The decline is not significant as it was mainly due to the timing of payments in July – mainly reduced sales tax payments due to the Accelerated Sales Tax (AST) program and one less deposit day for payroll withholding.

September collections will complete the first quarter of fiscal year 2016 and provide a clearer assessment of revenue growth. The first estimated payments from individuals, corporations and insurance companies are due in September.

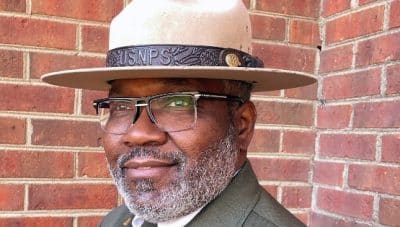

“Although August is not a significant month for revenue collections, the results do indicate that the Virginia economy has fundamentally improved from a year ago commensurate with our job creation efforts,” said Governor McAuliffe. “That is a good start, but we cannot claim victory yet. In just over two weeks, the federal government could shut down if Congress cannot enact a budget for the new federal fiscal year. Also, sequestration will go into effect on October 1 even if a budget agreement is reached, unless Congress takes explicit action to stop it.

“Diversifying our economy is the best way to continue our growth and mitigate the damage that federal dysfunction is doing to our Commonwealth. That is why I work so hard every day to build a new Virginia economy.”

The salient elements of August general fund revenue collections are as follows:

- Collections of payroll withholding taxes increased 5.6 percent,

- Collections of sales and use taxes, reflecting July sales, rose 0.1 percent,

- Recordation taxes from real estate transactions were up 2.2 percent.

On a year-to-date basis, collections of payroll withholding taxes – 64 percent of General Fund revenues — increased 0.7 percent, behind the annual forecast of 2.1 percent growth. Sales tax collections – 19 percent of General Fund revenues – fell 10.6 percent through August, behind the annual forecast calling for a 2.7 percent increase.

Adjusting for the Accelerated Sales Tax (AST) program, sales tax collections are up 4.8 percent compared to the economic based growth rate of 2.7 percent. Total revenues are up 0.4 percent through August adjusted for the AST program, ahead of the economic based forecast of 0.0 percent growth.

To view the full revenue report click here