Compare the Best 1 Hour Payday Loans No Credit Check – Top 10 Providers

In times of need, there might be a requirement for access to fast cash. Those without the means to meet short-term expenses, therefore, might be in search of a payday loan.

In this comparison guide, we review the 10 best 1 hour payday loans with no credit check.

List of the Best 1 Hour Payday Loans With No Credit Check

Those in need of quick funding might consider one of the providers outlined below – which highlights the 10 best 1 hour payday loans with no credit check.

- Viva Payday Loans – Overall Best Payday Loan With No Credit Check

- Low Credit Finance – Loans of up to $5,000 Within 60 Minutes

- Green Dollar Loans – Fast Loans With Terms of Between $100 and $5,000

- Big Buck Loans – Get Quick Funding Within 15 Minutes

- Credit Clock – Partnered With Lenders That Pay Loans Within 1 Hour

- RushIn Loans – Existing Customers Offered 1 Hour Funding

- Dollar Loan Club – Instant Funding Within 10 Seconds

- MoneyMutual – Find a Suitable Payday Lender Within Minutes

- Check Into Cash – Small Payday Loans From $50

- CashUSA – Fast Loans of up to $10,000

Just remember that payday loan regulations in the US are determined on a state-by-state basis. As such, borrowers will need to ensure that they are aware of what lending requirements are relevant in the state that they live.

Top 1 Hour Payday Loans – Full Provider Reviews

Research is crucial when searching for the best 1 hour payday loans with no credit check. Not only will borrowers need to assess what the lending requirements are for the respective provider, but the applicable terms and interest rates.

Below, we offer reviews of 10 providers in the US that currently offer fast payday loans.

1. Viva Payday Loans – Overall Best Payday Loan With No Credit Check

Viva Payday Loans is the first provider to consider. This lender offers payday loans online with a same day deposit from $100 up to a maximum of $5,000. Borrowers can choose a minimum and maximum repayment term of two and 24 months, respectively.

According to Viva Payday Loans, funding decisions are made in real-time, meaning that the borrower should receive confirmation within two minutes. With that said, Viva Payday Loans does not stipulate a specific funding timeframe, albeit, the lender claims that successful applications are funded fast nonetheless.

In terms of interest, the advertised APR stands at a minimum and maximum of 5.99% and 35.99%. Specific rates will depend on the personal circumstances of the borrower.

The representative example offered by Viva Payday Loans explains that a loan of $5,000 over a 48-month period would result in monthly repayments of $131.68. This includes an 8% arrangement fee at a representative APR of 18.23%. This would take the total repayment amount to $6,320.12.

Viva Payday Loans notes that all FICO scores are welcome. In terms of eligibility, borrowers will need to be aged 18 and above and receive a minimum monthly income of at least $1,000. Moreover, borrowers will need to have a permanent address and a valid checking/savings account with support for direct deposits.

| Max Loan | $5,000 |

| Funding Time | Same day |

| APR | 5.99%-35.99% |

| Repayment | 2-24 months |

| Representative Example | $5,000 loan over 48 months, APR of 18.23%. Monthly repayments are $131.68. Total repaid is $6,320.12. |

2. Low Credit Finance – Loans of up to $5,000 Within 60 Minutes

The next lender to consider on our list of the best 1 hour payday loans with no credit check is Low Credit Finance. This provider, in a similar nature to Viva Payday Loans, offers funding of between $100 and $5,000. Lending amounts will be determined by the borrower’s application.

According to Low Credit Finance, there is no required paperwork to make an application, nor are there any hidden fees. After making an application, Low Credit Finance will make a near-instant decision. Crucially, Low Credit Finance claims to send cash within 60 minutes of the loan being approved.

With that said, in some cases – at least for first-time customers, funding will be executed the next business day. When it comes to interest rates, this will vary from 5.99% to 35.99%. Only qualified applicants will have access to the best rates possible.

After applying, Low Credit Finance will send the application to its network of lenders. There is no fee charged directly by Low Credit Finance for this matching service. The representative APR example mirrors that of the previously discussed Viva Payday Loans.

| Max Loan | $5,000 |

| Funding Time | Within 60 minutes |

| APR | 5.99%-35.99% |

| Repayment | Flexible terms |

| Representative Example | $5,000 loan over 48 months, APR of 18.23%. Monthly repayments are $131.68. Total repaid is $6,320.12. |

3. Green Dollar Loans – Fast Loans With Terms of Between $100 and $5,000

Green Dollar Loans offers fast loans of between $100 and $5,000. The lender requires borrowers to fill out a quick application form to get the process underway, which typically takes two minutes. There are no upfront fees or costs to apply for a loan here, and terms range from three to 24 months.

Like many of the lenders that we discuss in this comparison guide, Green Dollar Loans accepts credit scores of all shapes and sizes. After applying for financing, Green Dollar Loans will match borrowers with its network of lenders.

It should, however, be noted that some lenders within its network conduct affordability checks. The APR range offered by this provider – through its network of lenders, is between 5.99% and 35.99%.

To offer some insight into how fees and repayments work, Green Dollar Loans offers various representative examples on its website. For instance, a loan of $1,000 with an APR of 24% over a 1-year period would require a fee of 3% – or $30. Moreover, the total repayment would amount to $1,134.72.

| Max Loan | $5,000 |

| Funding Time | Not stated |

| APR | 5.99%-35.99% |

| Repayment | 2-24 months |

| Representative Example | A loan of $1,000 with an APR of 24% over a 1-year period would require a fee of 3% – or $30. Moreover, the total repayment would amount to $1,134.72. |

4. Big Buck Loans – Get Quick Funding Within 15 Minutes

Big Bucks Loans is perhaps a top option from our list of the best 1 hour payday loans online with no credit check when taking into account funding times. The reason for this is that the provider claims to offer funds within 15 minutes of the application being accepted. Furthermore, all FICO credit scores are welcome at this provider.

The provider claims that by applying for a loan through its website, no footprint is left on the borrower’s credit file. When it comes to limits, Big Bucks Loans offers loans of between $100 and $5,000.

Interest rates will vary depending on the borrower’s circumstances, but will range between 5.99% and 35.99% nonetheless. Borrowers can choose their preferred term, from a minimum of three months and a maximum of two years.

Although Big Bucks Loans accepts applications from all credit scores, there are a number of eligibility requirements that the borrower must meet. This includes being aged 18 or above and employed with a minimum monthly income of $1,000. Moreover, the applicant must be a permanent US resident and have a valid checking or savings account.

| Max Loan | $5,000 |

| Funding Time | Within 15 minutes |

| APR | 5.99%-35.99% |

| Repayment | 3-24 months |

| Representative Example | $5,000 loan over 48 months, APR of 18.23%. Monthly repayments are $131.68. Total repaid is $6,320.12. |

5. Credit Clock – Partnered With Lenders That Pay Loans Within 1 Hour

Credit Clock is another provider on our list of the best 1 hour payday loans with no credit check that is part of a much broader network of lenders. This means that borrowers will need to fill out a form on the Credit Clock website, which will then be matched with suitable lenders based on the size and term of the loan.

Like many of the providers discussed today, Credit Clock enables borrowers to apply for a loan of between $100 and $5,000. Moreover, the lenders within the Credit Clock network offer APRs of between 5.99% and 35.99%. When it comes to terms, Credit Clock notes that most of the lenders within its network offer loans for up to six months.

This is less than the other providers discussed today – which typically offer repayment terms of up to two years. Nonetheless, in order to be eligible for a payday loan, borrowers will need to have a valid ID, be at least 18 years old, and have an active US-based bank account. For proof of income, borrowers will need to be earning at least $1,000 per month.

| Max Loan | $5,000 |

| Funding Time | Within 60 minutes |

| APR | 5.99%-35.99% |

| Repayment | 2-6 months |

| Representative Example | $5,000 loan over 48 months, APR of 18.23%. Monthly repayments are $131.68. Total repaid is $6,320.12. |

6. RushIn Loans – Existing Customers Offered 1 Hour Funding

RushInLoans claims to offer cash loans with a 1 hour funding time. However, this is typically offered to existing customers. First-time applicants will often receive a lending decision within 24-48 hours, once necessary checks have been undertaken. RushInLoans is not a direct financier, so applications are forwarded to its network of lenders.

Its terms and conditions state that the minimum loan available is $100, while the maximum is $5,000. Unlike the other providers discussed so far, RushInLoans does not state the minimum or maximum loan term when going through its website. It doesn’t offer an APR range either, nor a representative example.

| Max Loan | $5,000 |

| Funding Time | Within 60 minutes |

| APR | Not stated |

| Repayment | Not stated |

| Representative Example | Not stated |

7. Dollar Loan Club – Instant Funding Within 10 Seconds

Dollar Loan Club offers some of the fastest payday loans in this industry. Put simply, the provider claims that successful applications are often processed instantly, meaning that the borrower will receive the funds within 10 seconds. For this to be possible, Dollar Loan Club will deposit the funds onto the borrower’s debit card.

Dollar Loan Club is also known for its physical stores throughout Nevada and Utah. Those based within these states can therefore seek assistance in person. When it comes to limits, Dollar Loan Center offers funding of up to $5,000. However, the minimum loan size is not stated.

There are no application fees charged by this provider. However, interest rates are not specified until the borrower makes an application. When it comes to terms, this information is also missing from the Dollar Loan Club website. Those wishing to repay their payday loan early will be pleased to know that no early penalty fees are charged.

| Max Loan | $5,000 |

| Funding Time | Within 10 seconds |

| APR | Not stated |

| Repayment | Not stated |

| Representative Example | Not stated |

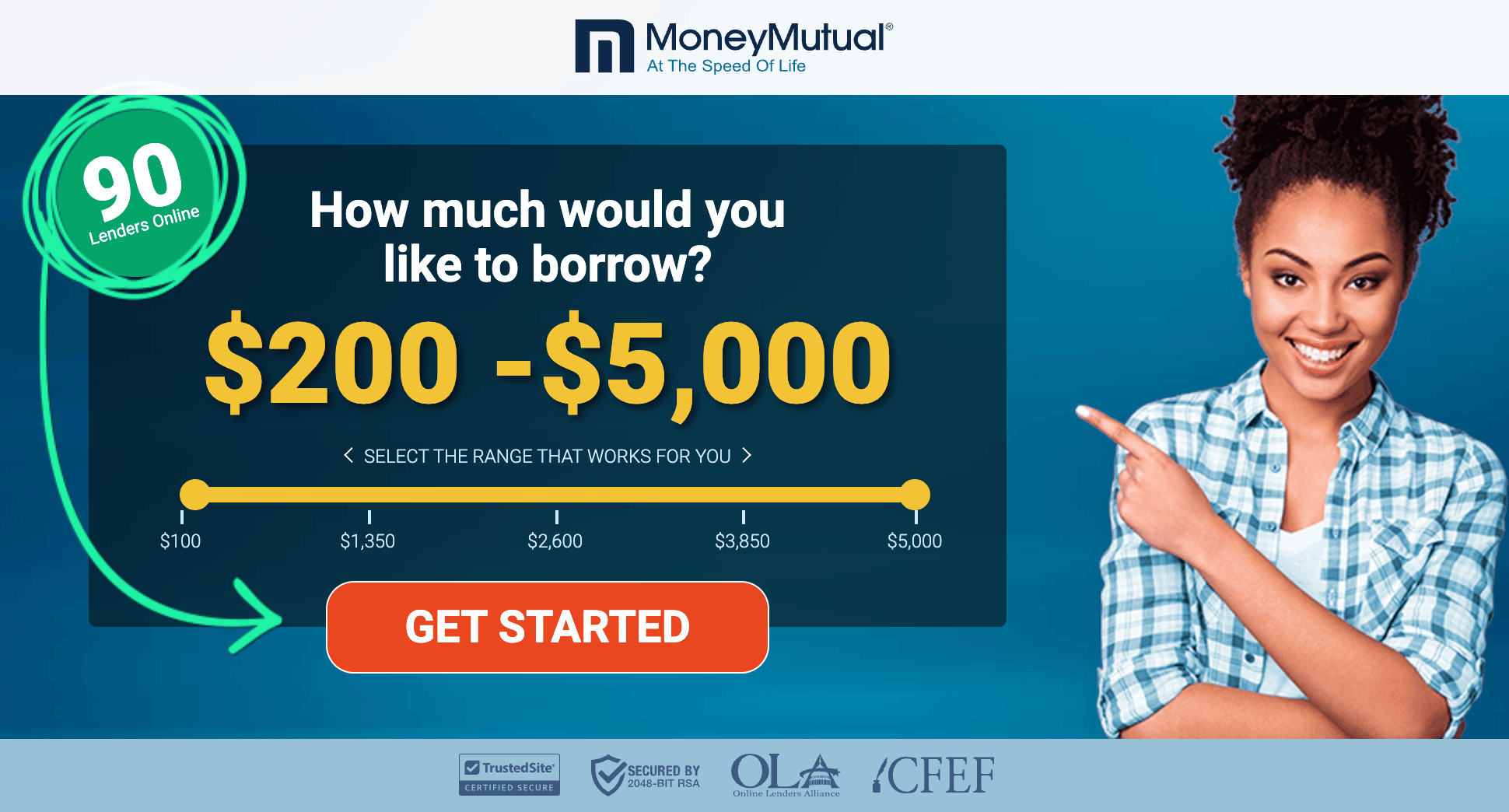

8. MoneyMutual – Find a Suitable Payday Lender Within Minutes

MoneyMutual claims to be partnered with an extensive network of lenders within the US. Those wishing to find a suitable loan with bad credit might consider MoneyMutual, as all FICO scores are considered. The minimum and maximum loan application supported by MoneyMutual is $200 and $5,000 respectively.

The application form itself is relatively basic and MoneyMutual claims to have been used by over 2 million customers. MoneyMutual does not charge any application fees, albeit, it likely collects a commission from any lenders that it partners the borrower with.

Payments, through its network of lenders, are typically made within 24 hours after the application is approved. MoneyMutual does not state what APRs or terms will come into play.

| Max Loan | $5,000 |

| Funding Time | Within 24 Hours |

| APR | Not stated |

| Repayment | Not stated |

| Representative Example | Not stated |

9. Check Into Cash – Small Payday Loans From $50

Those in the market for 1 hour payday loans with no credit check from a direct lender might consider Check Into Cash. This lender has more than 650 physical stores spread across more than 20 US states. However, those that prefer the speed and convenience of applying for a loan online can do so via the Check Into Cash website.

When applying for a payday loan here, the minimum and maximum amount that can be borrowed, respectively, is $50 and $1,500. This means that Check Into Cash might suit borrowers that require a very small short-term funding requirement. When it comes to loan terms and interest rates, this will vary on a state-by-state basis.

For example, those based in Nevada can borrow $50 at an APR of 651.79%Nonetheless, borrowers have the option of repaying a loan early with no financial penalties. Check Into Cash also offers title and installment loans, alongside lines of credit.

| Max Loan | $1,500 |

| Funding Time | Same day |

| APR | Depends on state |

| Repayment | Depends on state |

| Representative Example | Depends on state |

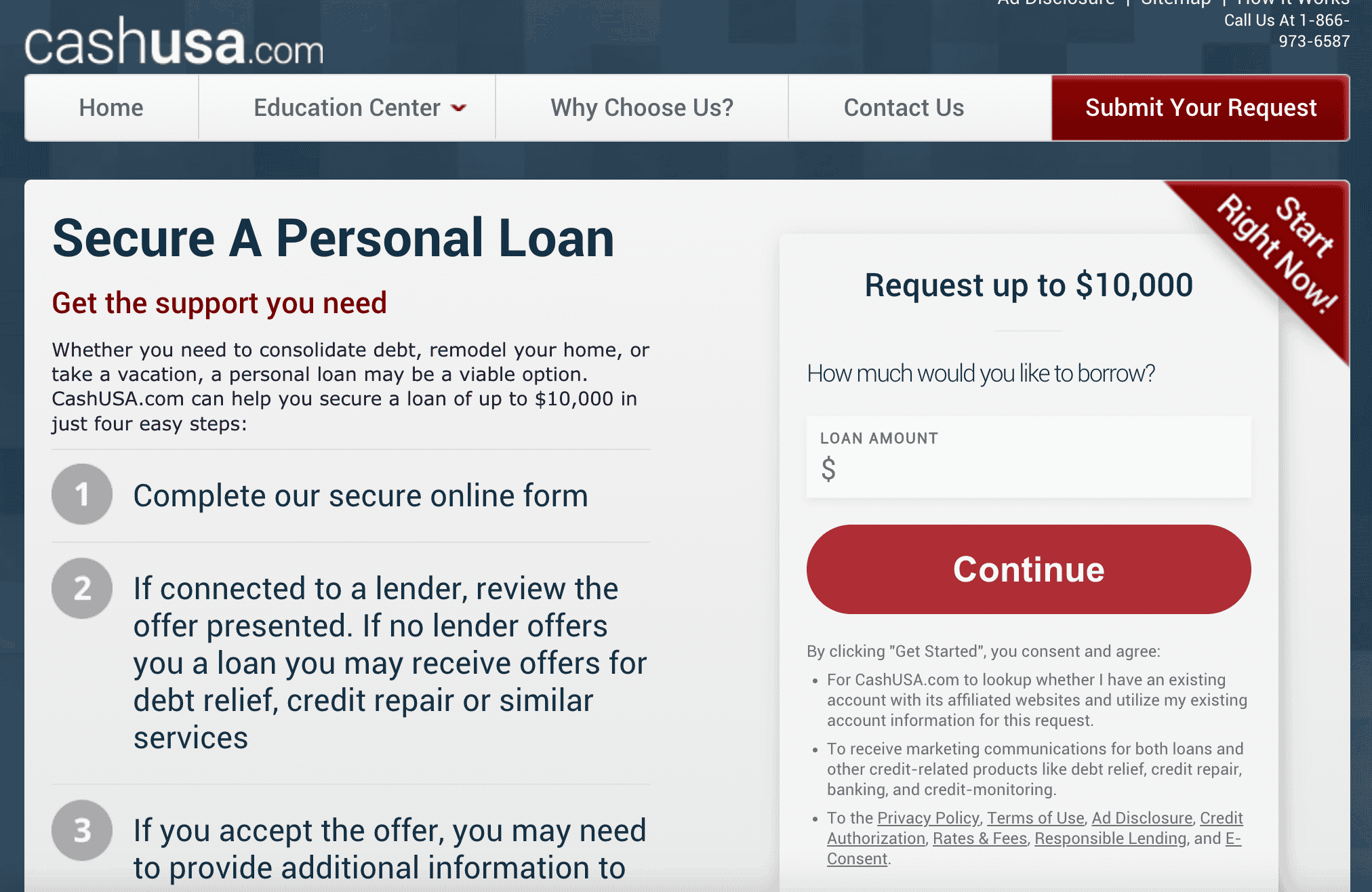

10. CashUSA – Fast Loans of up to $10,000

The final provider to consider is CashUSA. This provider will perhaps suit those that are looking for larger funding requirements, not least because CashUSA supports loan applications of up to $10,000. Loan terms range from 90 days up to a maximum of 72 months.

However, the loan term offered will ultimately depend on the circumstances of the borrower. CashUSA – which is not a direct lender, notes that its network offers a minimum APR of 5.99% up to a maximum of 35.99%.

Successful applications, according to CashUSA, can receive the loan funds in their account the next business day. To be eligible for a loan, borrowers must be at least 17 years old and be a US citizen or permanent resident.

The borrower must also have been employed for at least 90 days and have an active checking account. The representative example offered by CashUSA states that a loan of $1,500 over 24 months with an APR of 7.9% would require a monthly payment of $67.77 and a total repayment of $1,626.54

| Max Loan | $10,00 |

| Funding Time | Next business day |

| APR | 5.99%-35.99% |

| Repayment | 90 days-72 months |

| Representative Example | A loan of $1,500 over 24 months with an APR of 7.9% would require a monthly payment of $67.77 and a total repayment of $1,626.54 |

Comparison of the Best 1 Hour Payday Loans Without Credit Check

Refer to the table below for an overview of the best 1 hour payday loans without credit checks discussed in the sections above.

| Lender | Max Loan | Funding Time | APR | Repayment | Representative Example |

| Viva Payday Loans | $5,000 | Same day | 5.99%-35.99% | 2-24 months | $5,000 loan over 48 months, APR of 18.23%. Monthly repayments $131.68. Total repaid $6,320.12. |

| Low Credit Finance | $5,000 | Within 60 minutes | 5.99%-35.99% | Flexible terms | $5,000 loan over 48 months, APR of 18.23%. Monthly repayments $131.68. Total repaid $6,320.12. |

| Green Dollar Loans | $5,000 | Not stated | 5.99%-35.99% | 2-24 months |

A loan of $1,000 with an APR of 24% over a 1-year period would require a fee of 3% – or $30. Moreover, the total repayment would amount to $1,134.72.

|

| Big Buck Loans | $5,000 | Within 15 minutes | 5.99%-35.99% | 3-24 months |

$5,000 loan over 48 months, APR of 18.23%. Monthly repayments are $131.68. Total repaid is $6,320.12.

|

| Credit Clock | $5,000 | Within 60 minutes | 5.99%-35.99% | 2-6 months |

$5,000 loan over 48 months, APR of 18.23%. Monthly repayments are $131.68. Total repaid is $6,320.12.

|

| RushIn Loans | $5,000 | Within 60 minutes | Not stated | Not stated | Not stated |

| Dollar Loan Club | $5,000 | Within 10 seconds | Not stated | Not stated | Not stated |

| Money Mutual | $5,000 | Within 24 hours | Not stated | Not stated | Not stated |

| Check Into Cash | $1,500 | Same day | Not stated | Not stated | Not stated |

| CashUSA | $10,000 | Next business day | 5.99%-35.99% | 90 days-72 months |

A loan of $1,500 over 24 months with an APR of 7.9% would require a monthly payment of $67.77 and a total repayment of $1,626.54

|

1 Hour Loans – How do They Work?

As the name suggests, 1 hour loans enable borrowers in the US to seek financing – with the entire end-to-end process completed within 60 minutes. This includes the process of filling out the application form, having the loan approved, and the funds subsequently transferred to the borrower.

In most cases, the funds are deposited into a US checking or savings account. However, some of the providers discussed today can transfer funds directly onto a debit card. Lenders with physical stores in the US also offer the option of collecting cash in person.

- Either way, 1 hour loans are often applied for when borrowers require emergency funding.

- In other words, the borrower needs instant cash to settle a short-term expense that they cannot fund in any other way.

- And this point is crucial, not least because even the best 1 hour payday loans with no credit check come with huge APRs.

Fortunately, regulations on payday loans in the US are now a lot stricter than they used to be. Furthermore, terms surrounding interest rates, repayments, and minimum and maximum loan amounts are now determined on a state-by-state basis. Nonetheless, the average loan term offered by payday lenders is between two and 24 months.

Moreover, many of the payday lenders discussed today offer an average APR of between 5.99% and 35.99%. The APR and terms available will, however, vary from one lender and borrower to the next. We should also note that some payday loan providers are not direct lenders. Instead, they aim to match borrowers with a suitable lender based on the application made.

Is it Possible to Get a 1 Hour Loan with Bad Credit?

It goes without saying that many borrowers searching for 1 hour online payday loans are doing so because they have bad credit. Otherwise, the borrower would have access to more cost-effective lines of financing, such as a credit card or overdraft.

As a result, 1 hour payday loans are typically aimed at those with bad or no credit. This also means that some lenders are happy to accept applications without actually performing a credit check on the borrower.

However, this isn’t to say that the lender won’t have minimum eligibility requirements. In most cases, the borrower will at the very least need to be employed.

Eligibility Requirements to Get a 1 Hour Loan?

As noted above, even 1 hour loans offered to borrowers with bad credit will still come with a number of eligibility requirements.

This typically includes the following, but can vary from one lender to the next:

Age Requirements

At a minimum, the borrower will need to be aged at least 18 years old in order to get a payday loan in 1 hour. With that said, some states have stricter requirements, with the minimum age being set to 21.

Income

Although not always a requirement, many 1 hour payday lenders will only approve the loan if the borrower has an income of some sort.

This usually needs to be in the form of a full-time job over a minimum period of time. Furthermore, we found that many lenders require the borrower to earn at least $1,000 per month.

Active Checking Account

Another minimum requirement across the vast majority of 1 hour payday loan lenders is that the borrower should have an active checking account. If this isn’t the case, the lender might accept a savings account.

With that said, as noted above, some lenders can deposit the loan funds onto a US-issued debit card. However, the checking and/or savings account requirement will likely remain in place, as this is how repayments are made by the borrower.

Documents

Although many 1 hour payday loans can be obtained without a credit check, the lender is all-but-certain to ask for verification documents.

After all, the lender will need to know that the borrower is who they say they are. Moreover, if the payday loan is being issued on the basis of being employed, for example, then this will need to be validated through recent payslips.

Residency

All 1 hour payday loan companies will require the borrower to be either a US citizen or a permanent resident.

APR & Rates Charged by 1 Hour Payday Lenders

Once again, it is important to stress that the APR and other applicable charges will not only vary depending on the lender, but the state that the borrower is applying from.

Nonetheless, in this section of our guide, we will offer some insight into what fees to expect when taking out a 1 hour payday loan.

APR

All 1 hour payday loans will come with an APR (annual percentage rate)- just like any other financing agreement.

However, it goes without saying that payday loans – especially those funded within an hour, will come with a much higher APR than conventional lending methods.

Once again, there are caps in place in many US states, while some have no limits at all. From our research, we found that 1 hour payday loan lenders offer an APR of between 5.99% and 35.99%.

Additional Fees

Although prohibited in many US states, some 1 hour payday loan lenders will charge fees in addition to the APR. This might come in the form of an upfront fee that must be paid as part of the loan application.

These types of loans should be avoided, as the fee will need to be paid even if the financing application is rejected. Some 1 hour loans also come with a flat fee after approval has been given.

Just remember, borrowers are under no obligation to accept a loan once the terms have been offered. If the fees charged will result in the loan becoming unfavorable, borrowers should consider other financing options.

Early Repayments

Some of the 1 hour payday loan providers that we came across charge a penalty for repaying the loan early. This is often charged based on a minimum number of days worth of interest – as per the agreed APR.

How to Get a 1 Hour Loan

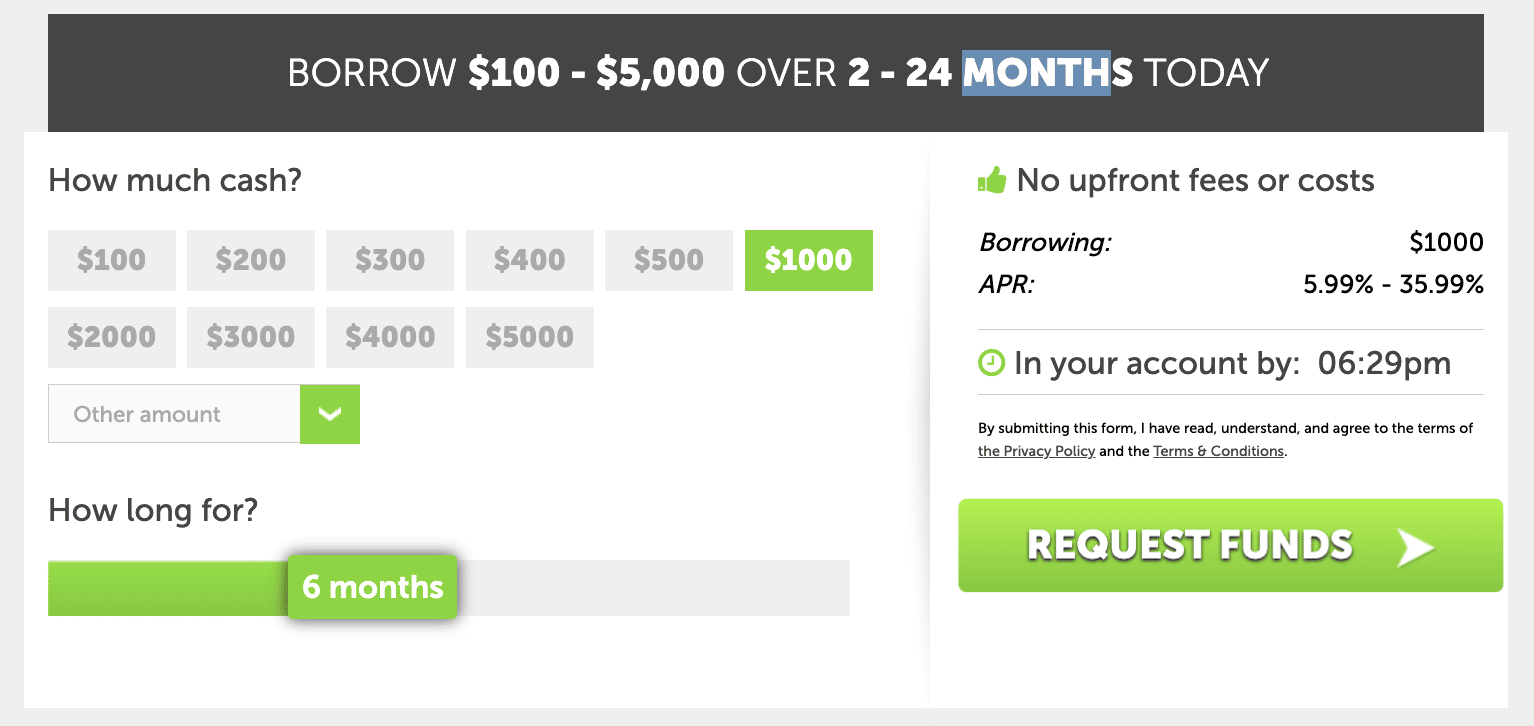

To conclude our guide, we will explain the steps required to get a 1 hour loan with Viva Payday Loans.

The process is, however, largely the same across all of the loan providers that we reviewed on this page.

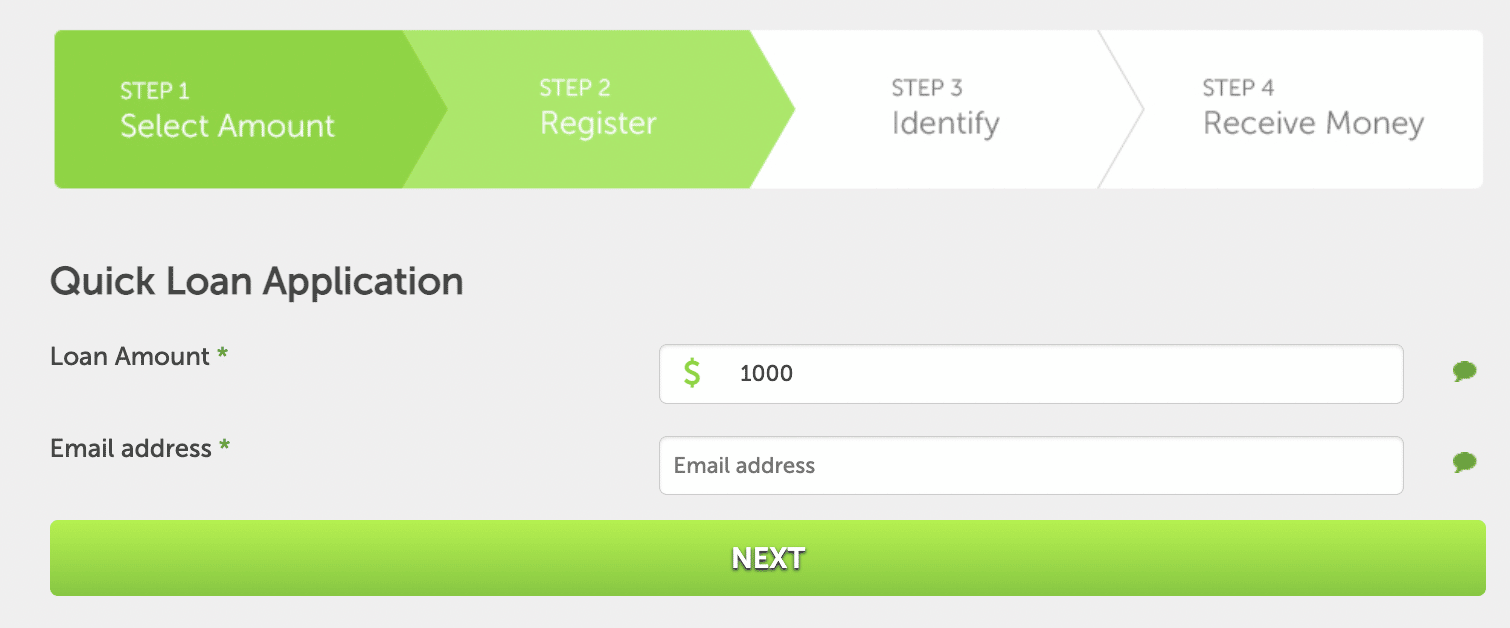

Step 1: Choose Loan Requirements

The first step is to visit the Viva Payday Loans website and use the tool on the homepage to enter the preferred loan terms.

This will initially require the user to select the amount of money that they wish to borrow. This can be any amount from $100 to $5,000. Click on the ‘Other Amount’ tab if the required amount isn’t displayed on the lending tool.

After that, use the slider to determine the length of the loan term. This starts from three months at Viva Payday Loans, up to a maximum of 24 months.

However, the slider on the homepage only permits a maximum of 12 months, albeit, this can be changed at the next stage of the application process.

To confirm, click on the ‘Request Funds’ button.

Step 2: Confirm Loan Amount and Enter Personal Information

Next, Viva Payday Loans will ask the borrower to re-confirm the size of the loan. Then, the borrower will need to type in their email address.

After that, a new form will appear – asking the borrower to provide some personal information.

This includes the borrower’s first and last name, date of birth, and primary phone number.

Step 3: Enter Additional Information

After entering some personal data, Viva Payday Loans will ask for additional information about the borrower.

This includes the borrower’s home address and residence status (homeowner or renting). The borrower also needs to enter the year that they moved to the stated address.

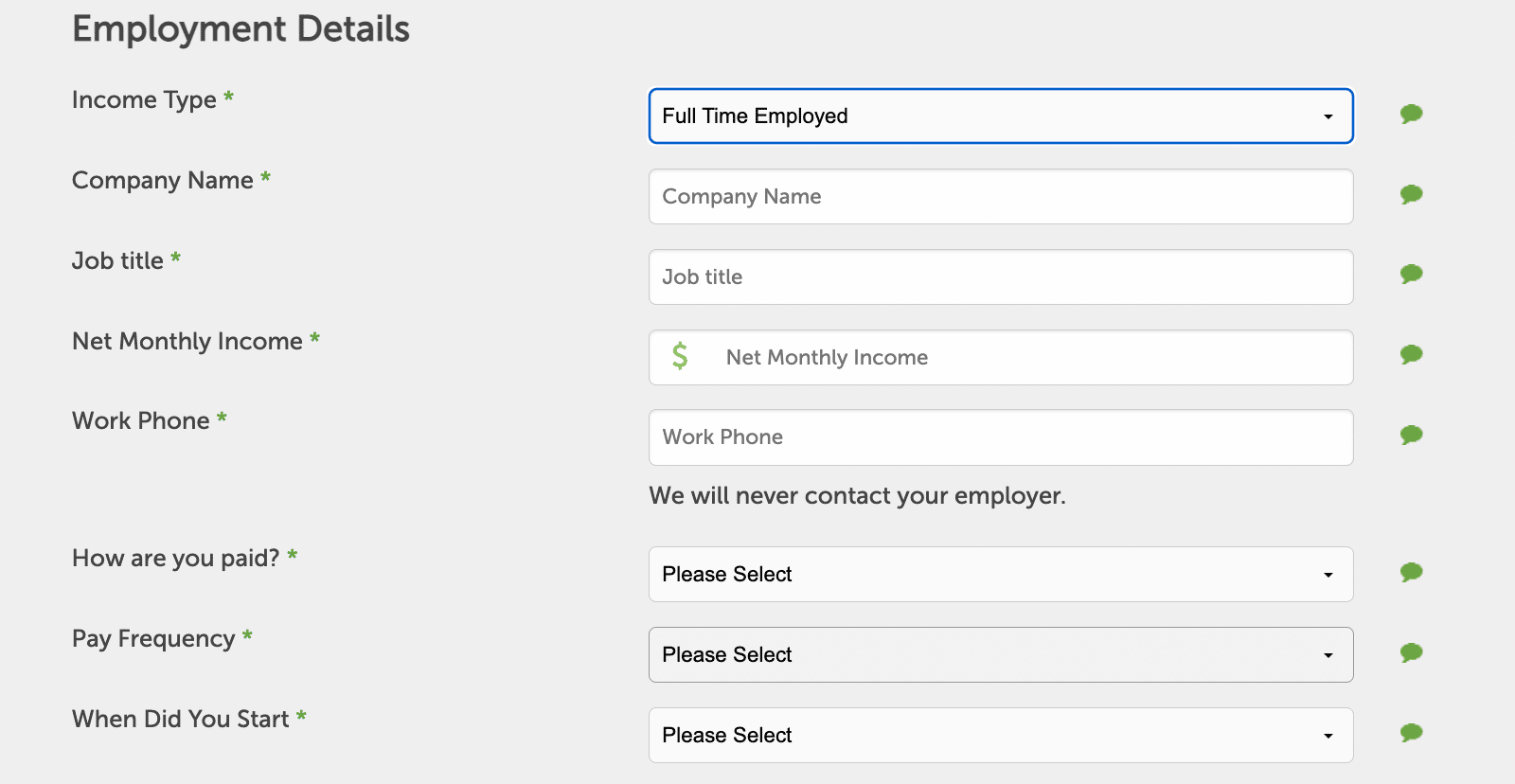

Step 4: Provide Income Details

The next stage of the application will require the borrower to enter some information about their income status.

This includes the employment status of the borrower, such as whether they are full-time. Viva Payday Loans will ask for the name of the employer, the borrower’s job title, net monthly income, and work telephone number.

The lender also needs to know how the borrower is paid (direct deposit or check), the pay frequency, and the length of time that the employment position has been in place.

Step 5: Get Matched With Lenders

After providing all of the personal information and contact details discussed above, Viva Payday Loans will then begin to match the borrower with lenders from within its network.

Once the search results load, this will present key information such as the:

- Name of the lender

- How much the lender is willing to loan to the borrower

- APR and other applicable fees

- Term of the loan

- How quickly the funds will be paid

It is then up to the borrower to research the offers they are presented with.

Step 6: Complete Loan Application With Lender

If Viva Payday Loans has matched the borrower with a suitable loan, the application will then need to be finalized directly with the lender.

In most cases, the lender will already have all of the information that the borrower entered as part of their application. As such, it’s just a case of confirming the information alongside the respective loan terms.

The final step will then be to sign the digital loan form.

Step 7: Receive Loan Funds and Make Repayments

After signing the loan agreement, it is then up to the lender to transfer the funds. This will usually be paid directly into the borrower’s checking account.

Borrowers are advised to be fully aware of the repayments terms and dates that were agreed to. Failure to meet a repayment on time can result in additional fees being charged by the lender.

Conclusion

This comparison guide has reviewed the 10 best 1 hour payday loans with no credit check. This form of financing should only be considered when no other options exist.

After all, payday loans often attract a high rate of interest and some US states have no limits in place.

Nonetheless, one of the top providers to consider in this industry is Viva Payday Loans – which offers financing to US residents irrespective of the borrower’s FICO score.

FAQs

How to get a payday loan in under 1 hour?

Which loans can I get without a credit check?

What is the easiest loan to get with bad credit?

Is there an app to borrow money instantly?

How quickly can I get a loan?

Sources:

https://www.consumerfinance.gov/payday-rule/

https://www.ncsl.org/research/financial-services-and-commerce/payday-lending-state-statutes.aspx

https://www.ftc.gov/news-events/topics/consumer-finance/payday-lending

Disclaimer:

The information on this page does not constitute financial advice. It is recommended to contact a financial advisor if you require financial assistance. You should do your own research before opening accounts with financial services providers. Research regulations regarding financial services and ensure a company is compliant before engaging. Ensure to borrow responsibly and never borrow more than you can reasonably pay back.