Best Online Payday Loans Virginia

If you’re looking to quickly borrow a few hundred dollars to get out of a financial emergency, payday loans are a much better option than traditional loans offered by banks and credit unions. In this guide, you’ll learn everything you need to know about the best online payday loans in Virginia, so you can submit your loan request in under five minutes and get cash into your account the same day.

The Top Online Payday Loan Providers in Virginia

When considering requesting a payday loan online, you need to make sure that you choose a trusted provider with a large network of reputable lenders. We’ve researched hundreds of online payday loan solutions and have put together a list of the most reputable ones.

Here are the ten best platforms that offer payday loans online for Virginia residents:

- Viva Payday Loans — Overall the Best Online Payday Loans in Virginia

- Low Credit Finance — Same-Day Loan Decisions and Cash Transfers Completed Within One Hour

- Green Dollar Loans — Quick Loan Approval Times and Flexible Terms

- Big Buck Loans — Online Payday Loans for Virginia Residents with All FICO Scores

- Credit Clock — Traditional Online Payday Loans and Tribal Loans

- RushIn Loans — Quick Online Payday Loans for People with Bad Credit Scores

- Dollar Loan Club — Payday Loans, Tribal Loans, and Alternative Loan Options

- Money Mutual — Fast Short-term Payday Loans and Cash Advances

- Check Into Cash — Large Fees and a $1,000 Loan Limit

- CashUSA — Best for More Substantial Loans up to $10,000

Best Virginia Payday Loans Online Reviewed

There are dozens of online payday loan providers with varying rates and repayment terms. While we understand that time is of the essence when you need a loan to get out of a financial emergency, you should still carefully weigh your options and choose the loan that offers the most favorable terms.

That doesn’t mean you have to spend hours or even days scouring the web and comparing all the different options. We did the heavy lifting for you! Here are in-depth reviews of the five most reputable online payday loan solution providers in Virginia, so you can make an informed decision.

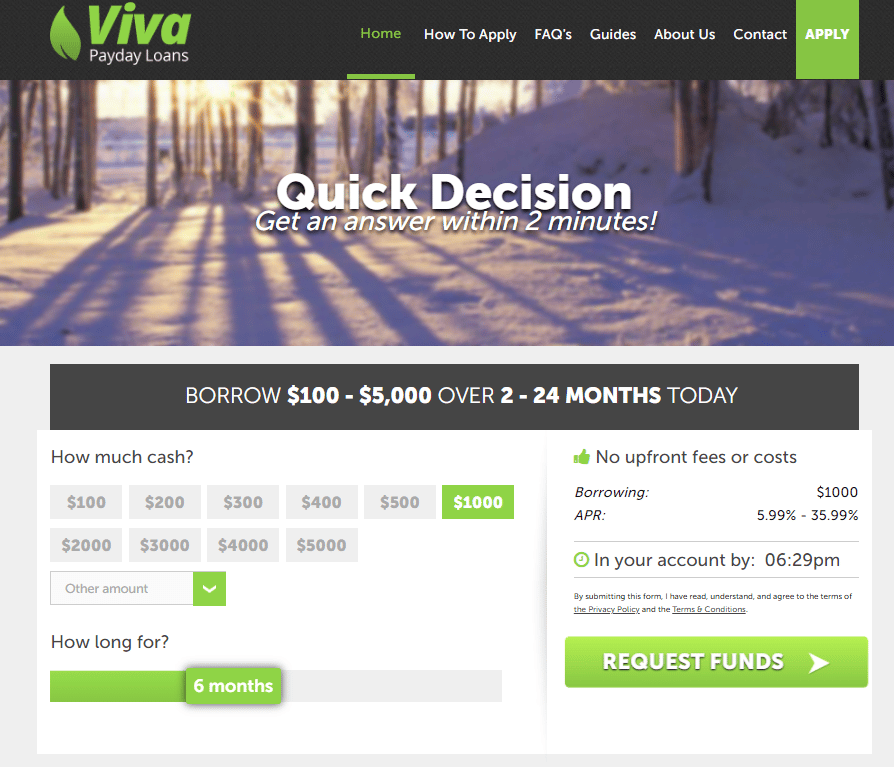

1. Viva Payday Loans — Overall the Best Online Payday Loans in Virginia

Viva Payday Loans ticks all of the boxes necessary to be called one of the best online payday loan providers. It provides loan decisions within two minutes, offers industry-standard rates, has high loan approval rates (over 90%), and features a large network of reliable, reputable lenders.

To request a loan on Viva, all you need to do is fill out a simple online application form. You don’t need to create an account, deal with any paperwork, or fax a loan agreement. All you need is a valid ID and proof of income of over $1,000/month, and you can request anywhere from $100 to $5,000 in seconds.

Once Viva’s algorithm matches you with a suitable lender in their vast network, you can negotiate the exact terms of the loan agreement directly with the lender. Depending on the sum of the loan, you’ll have the option of repaying it in monthly installments over 2 – 24 months.

After you agree to the terms of the loan, you’ll just have to digitally sign the document and email it back to the lender. Once you do, you can expect the cash to arrive in your bank account within 24 hours.

The best part about Viva is the fact that it offers online payday loans in Virginia with bad credit, as well as alternative loan options and loans to people who aren’t traditionally employed (e.g., veterans, freelancers, people with rental income, etc.).

Pros Cons

Arrangement fee: 8% ($400) Repayment period: 48 months Monthly payments: $131.67 Payback amount: $6320.12 Total cost: $1720.12 Representative APR: 18.23%

Max Loan Available

Quickest Transfer Time

APR rates

Repayment Options

Representative Example

$5,000

8 hours

5.99% – 35.99%

2- 24 months

Borrow: $5,000

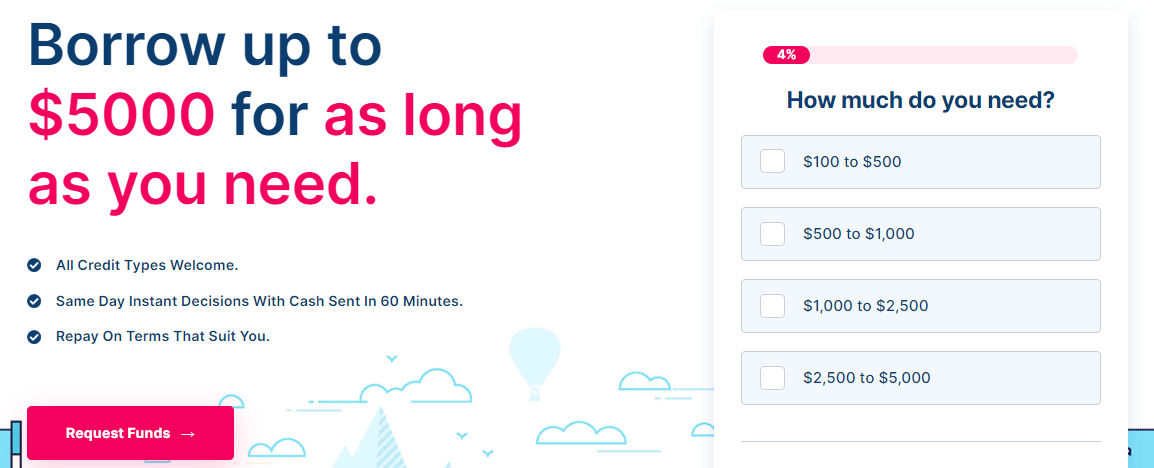

2. Low Credit Finance — Same-Day Loan Decisions and Cash Transfers Completed Within One Hour

Low Credit Finance is another excellent option for people looking for quick payday loans in Virginia online. The platform welcomes everyone regardless of their credit score, and the vast majority of lenders in Low Credit Finance’s network offer online payday loans in Virginia with no credit check.

The process of applying for a loan is simple and straightforward. Once you choose one of the four available loan tiers, you’ll be prompted to complete a simple six-step online form. The platform will then automatically connect you with a suitable lender, allowing you to negotiate the terms of the loan agreement in detail.

After the lender approves your request, they’ll transfer the funds within 60 minutes. The money will arrive in your bank account the same workday or, if you requested the transfer over the weekend, first thing Monday morning.

Low Credit Finance features an AI-powered loan matching software that finds cash loans or alternative loan solutions for 9/10 people who submit their requests on the platform. Even on the off-chance that your request is denied by a lender, you can always resubmit the form and connect to a different lender who might be more amicable.

Pros Cons

Arrangement fee: 8% ($400) Repayment period: 48 months Monthly payments: $131.67 Payback amount: $6320.12 Total cost: $1720.12 Representative APR: 18.23%

Max Loan Available

Quickest Transfer Time

APR rates

Repayment Options

Representative Example

$5,000

1 hour

5.99% – 35.99%

61 days minimum

Borrow: $5,000

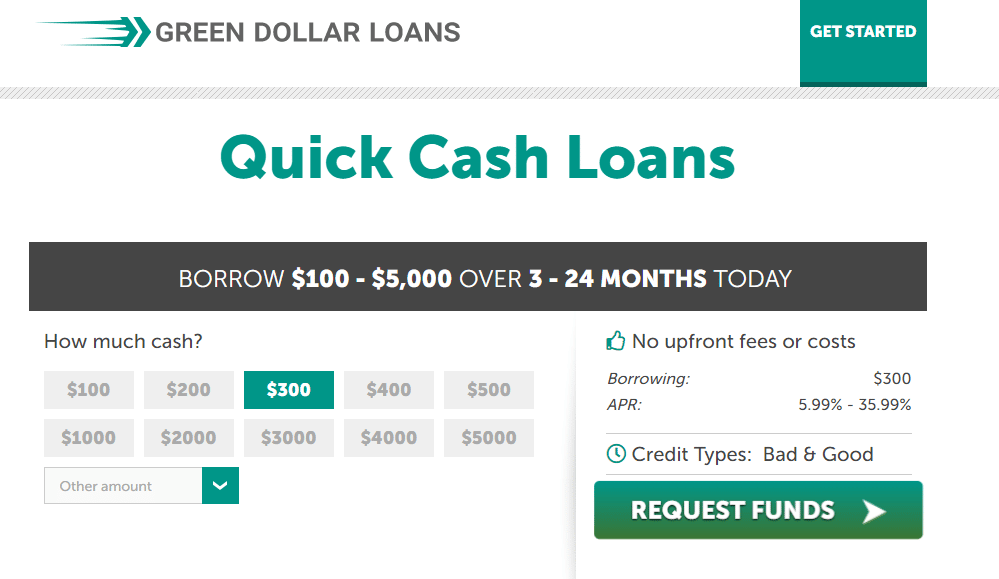

3. Green Dollar Loans — Quick Loan Approval Times and Flexible Terms

Green Dollar Loans offers direct online payday loans in Virginia with no hidden fees or extra costs. The website is funded by lenders and other marketers in the network, so you’ll only repay the agreed-upon sum stated on the loan agreement and not a penny more.

Once you select the amount you’d like to borrow, all you need to do is provide your email address, valid ID, and proof of income.

You’ll then be redirected to a lender’s landing page, where you’ll have the option to confirm loan terms and discuss rates and the repayment period. Most lenders will also include the option to repay the loan faster, so you’ll accrue less interest. This is an excellent option for anyone that needs a quick cash loan to cover them until the next paycheck.

The platform offers industry-standard annual percentage rates (APR), which range from 5.99% to 35.99%, depending on the sum you borrow and the repayment period — which ranges from 3 to 24 months.

Pros Cons

Arrangement fee: 8% ($400) Repayment period: 48 months Monthly payments: $131.67 Payback amount: $6320.12 Total cost: $1720.12 Representative APR: 18.23%

Max Loan Available

Quickest Transfer Time

APR rates

Repayment Options

Representative Example

$5,000

8 hours

5.99% – 35.99%

3 to 24 months

Borrow: $5,000

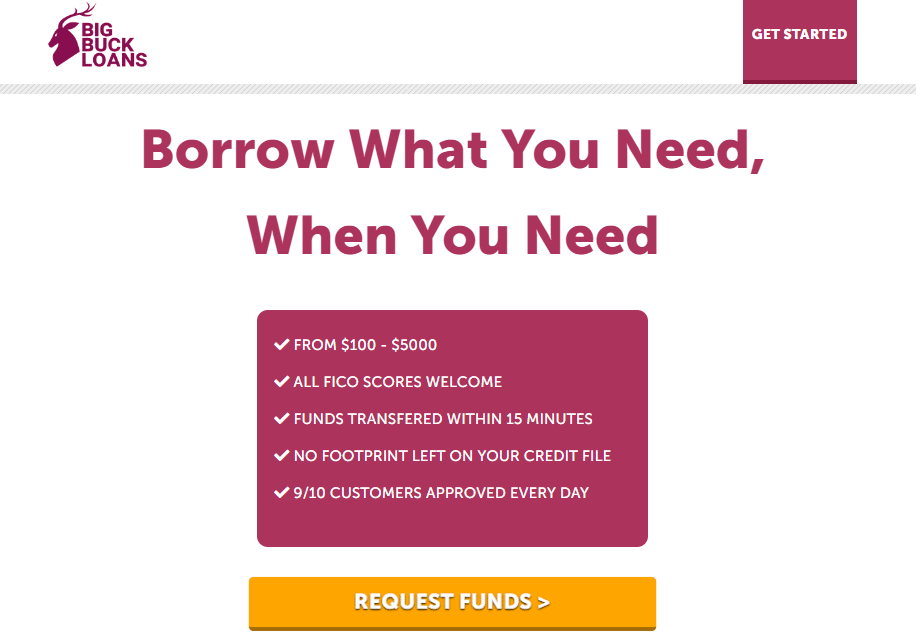

4. Big Buck Loans — Online Payday Loans for Virginia Residents with All FICO Scores

Big Buck Loans is the best option for online payday loans with same-day approval in Virginia. Its loan-matching platform will find a suitable lender to approve your loan regardless of your FICO score or credit history.

What’s best, there’s absolutely no paperwork involved, so the loan won’t leave a paper trail on your credit file. In other words, you can get cash in your account within the same day, all the while not hurting your credit score or having to deal with bureaucracy and faxing.

The available loan sums on Big Buck Loans range from $100 to $5,000, and the rates range from 5.99% to 35.99%, depending on the loan sum and repayment period.

Big Buck Loans has one of the fastest loan-matching platforms, so you can expect to receive a loan decision within two minutes. Once you’re approved for the loan, all you’ll need to do is finalize the loan contract with the lender. You can expect a cash payout within 15 minutes to an hour.

One thing to keep in mind is that the loans on Big Buck Loans are only available to legal U.S. citizens over 18 years of age, with a valid checking or savings account and proof of income of over $1,000/month.

Pros Cons

Arrangement fee: 8% ($400) Repayment period: 48 months Monthly payments: $131.67 Payback amount: $6320.12 Total cost: $1720.12 Representative APR: 18.23%

Max Loan Available

Quickest Transfer Time

APR rates

Repayment Options

Representative Example

$5,000

15 minutes

5.99% – 35.99%

3 – 24 months

Borrow: $5,000

5. Credit Clock — Traditional Online Payday Loans and Tribal Loans

If you’re having trouble getting your online payday loan approved on other platforms, Credit Clock might just be the solution you’re looking for. This loan-matching platform offers tribal loans, which are provided by companies owned by Indian tribes or Native Americans.

Tribal loans have much higher approval rates since the lenders are willing to take a bigger risk and offer large loans even to people with bad credit scores. The drawback is that tribal loans typically have astronomical interest rates, sometimes reaching up to 400%. We recommend tribal loans for smaller sums and only if you’re absolutely certain you can repay the full sum within the agreed-upon repayment period.

Apart from tribal loans, Credit Clock also offers traditional online payday loans with industry-standard rates and fast approval times. We strongly suggest applying for a standard payday loan first and only switching to a tribal loan if your request for an online payday loan gets repeatedly denied.

Pros Cons

Arrangement fee: 8% ($400) Repayment period: 48 months Monthly payments: $131.67 Payback amount: $6320.12 Total cost: $1720.12 Representative APR: 18.23%

Max Loan Available

Quickest Transfer Time

APR rates

Repayment Options

Representative Example

$5,000

1 hour

5.99% – 35.99%

3 – 24 months

Borrow: $5,000

Top Online Payday Loans in Virginia Compared

Payday Loan Solution

Max Loan Available

Quickest Transfer Time

APR rates

Repayment Options

Viva Payday Loans

$5,000

8 hours

5.99% – 35.99%

2- 24 months

Low Credit Finance

$5,000

1 hour

5.99% – 35.99%

61 days minimum

Green Dollar Loans

$5,000

8 hours

5.99% – 35.99%

3 to 24 months

Big Bucks Loans

$5,000

15 minutes

5.99% – 35.99%

3 – 24 months

Credit Clock

$5,000

1 hour

5.99% – 35.99%

3 – 24 months

RushIn Loans

$5,000

Within 24 hours

N/A

Not specified

Dollar Loan Club

$5,000

Within 24 hours

N/A

Not specified

Money Mutual

$5,000

Within 24 hours

N/A

Not specified

Check Into Cash

$1,000

Within 24 hours

Up to 399%

Not specified

CashUSA

$10,000

Within 24 hours

5.99% – 35.99%

3 to 72 months

How do Online Payday Loans Work?

There are many different types of loans that can help you recover from a financially difficult situation, but online payday loans are the fastest and the most convenient. The process of applying for and receiving an online payday loan in the U.S. is incredibly simple.

Once you choose a reputable loan-matching platform, like Viva Payday Loans, you’ll need to fill out an online loan application form. The eligibility requirements typically include a valid ID, a savings or checking account, and proof of income of over $1,000 as a guarantee you’ll be able to repay the loan.

After you submit all of the required information, you’ll be automatically matched with a suitable lender. Most online loan-matching platforms have large networks with hundreds of lenders, so you should have no problem matching with one that will fulfill your loan request.

You can negotiate the details of the loan directly with the lender. After reaching a mutually satisfactory decision regarding the APR, interest rates, and the repayment period, the lender will send you the loan agreement to your email address. You’ll be able to see the exact sum you’ll be expected to repay each month, as well as the starting date of the first installment.

We advise you to carefully read the document and familiarize yourself with the terms of the agreement before signing it since it’s legally binding. Once you send back the digitally signed loan agreement to the lender, they’ll transfer the funds to your bank account within 15 minutes to a couple of hours. The cash will typically arrive in your bank account within the same day, but the exact time depends on your bank.

Keep in mind that payday loans might function differently, depending on the particular country’s laws and regulations. Click here to learn how online payday loans work in different countries.

How Fast Can I Get an Online Payday Loan in Virginia?

All of the loan-matching platforms we reviewed in this guide offer same-day payouts. The online application forms are rather straightforward, so if you have all the required documents ready, it won’t take longer than 5 minutes.

The loan decisions on Viva Payday Loans, Low Credit Finance, and Big Buck Loans are near-instant, so you can expect to get your request approved within minutes.

Negotiating the terms of the loan with the lender can take anywhere from 15 minutes to half an hour, depending on how peculiar you are regarding the interest rates and the repayment options.

After signing the loan agreement and sending it back to the lender, they’ll typically transfer the funds to your bank account within an hour. You can expect the funds in your account the same day, usually within two to three hours.

Can I Get an Online Payday Loan in Virginia with Bad Credit?

It’s difficult, if not outright impossible to get a payday loan from a bank or other financial institution if you have a bad credit score. Online payday loan providers understand that most people who apply for loans online need a small amount of cash to get out of a financial emergency, so they offer loans to people with all FICO scores.

Viva Payday Loans, for example, offers both payday loans to people with bad credit, as well as alternative loan solutions.

One thing to understand when it comes to online payday loans is the fact that loan-matching platforms aren’t lenders. They simply match your request with the most suitable lender in their network. Regardless of which platform you opt for, the lenders themselves reserve the right to perform credit checks and might choose to deny your request.

That said, most lenders won’t even bother conducting credit checks for smaller amounts (up to $1,000), so you shouldn’t have any issues getting a quick online payday loan even if you have bad credit.

Keep in mind that you’ll still need proof of income, typically $1,000/month or more, as lenders need to ensure that you’re capable of repaying the loan within the agreed-upon timeline.

Direct Online Payday Loans in Virginia

All of the online payday loan solutions we reviewed in this guide offer direct payday loans to Virginia residents. In other words, the platforms connect you to a lender and allow you to discuss the terms of the loan with the lender directly.

After you agree on the rates and the repayment period, you’ll be required to sign the loan agreement document. The lender will then deposit the agreed-upon amount directly into the bank account you provided in the online application form.

Virginia Online Payday Loans APR & Rates

The rates of online payday loans vary depending on the amount you borrow, the loan’s repayment period (typically 3 to 24 months), and the individual lender. The industry standard APR for online payday loans ranges from 5.99% to 35.99% of the original sum.

The APR, interest rates, monthly payments, and full dollar amount you’ll be expected to repay should be clearly stated in the loan agreement. Make sure you carefully read the document before signing it. It’s also crucial to understand that there are situations in which you want to avoid taking a payday loan, so make sure you can comfortably repay the loan before you take the money.

Paying Back Online Loans in Virginia — Payment Plans Available

The best online payday loan solutions offer flexible repayment terms. Typically, you’ll have to start repaying the loan two to three months from the date you receive the cash and will have the option to repay it over the period of 3 to 24 months.

In most cases, the loan installments will be automatically deducted from your bank account each month. That said, for smaller amounts, you might agree with the lender to repay the loan weekly or fortnightly.

An interesting fact about online payday loans is that most lenders will also offer you the option to repay the full sum at once, making it possible to accrue less interest on the loan if you can cash out the full sum before the end of the repayment period.

How to Get a Payday Loan Online in Virginia

If you’ve gathered all the documents and are certain that an online payday loan is the best solution for your current situation, here’s a step-by-step guide to submitting a loan request on Viva Payday Loans:

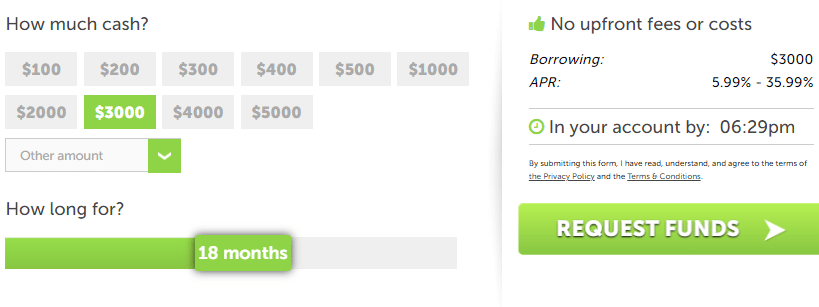

Step 1: Choose the Amount and Repayment Period

Visit the official Viva Payday Loans website and select the amount you’d like to borrow. Choose the repayment period and click on Request Funds to open the application form.

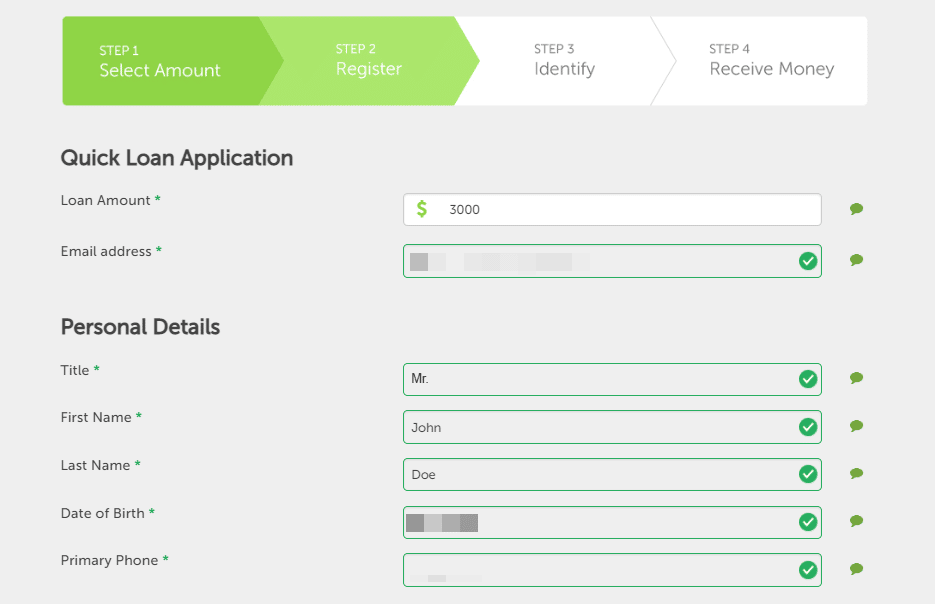

Step 2: Provide the Required Info

Fill out the online application, providing your name, address, email, valid ID, and proof of income.

Follow the instructions on your screen and double-check the information for accuracy.

Step 3: Negotiate Loan Terms With a Lender

Wait a couple of minutes for Viva’s loan-matching algorithm to connect you to a suitable lender. Negotiate the APR, interest rates, and repayment options with the lender, and sign the loan agreement once you’re satisfied with the terms.

After emailing back the signed agreement to the lender, you’ll receive the cash in your bank account within a few hours.

Conclusion

Online payday loans can be a great way to get out of a tough financial situation if all you need is a small amount of cash to make it to your next paycheck. At the same time, they can make a bad situation worse if you can’t really afford to make the monthly payments, as the interest rates will just keep piling up. Before signing the loan agreement, you should familiarize yourself with the pros and cons of online payday loans.

If you’re certain you can comfortably repay the loan amount, we recommend Viva Payday Loans as the go-to online payday loans solutions. This loan-matching platform offers flexible payday loans regardless of your credit score, as well as alternative loan solutions for people who aren’t traditionally employed.

You’ll get a loan decision within minutes and will receive the money the same day. The loan amounts and repayment options are quite flexible, and you can always negotiate the exact terms of the loan directly with the lender.

With a large network of reputable lenders, high loan approval rates, and flexible loan terms, Viva Payday Loans is the best choice for Virginia online payday loans.