Summer is here, and for many, the season is packed full of grilling, boating, driving and more. The State Corporation Commission Bureau of Insurance reminds Virginians to review insurance coverage ahead of any fun in the sun.

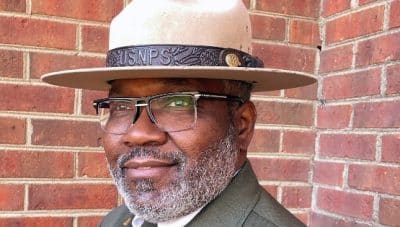

“Whether you’re grilling with friends, driving or boating, don’t let a lack of insurance coverage put a damper on your summer fun,” said Virginia Insurance Commissioner Scott A. White. “Anticipate summer hazards now to minimize their potential financial damage by ensuring your insurance coverage is adequate and up to date.”

Whatever you do over the summer months, it’s important for Virginians to protect themselves and their homes, vehicles and belongings against potential risks.

Insurance coverage to review

- Take the time to understand how much coverage your auto and homeowners’ insurance policies provide. Whether you’re the victim of theft, have a medical emergency, have a guest injured on your property, or your home or vehicle is damaged, you need to know the limits of your coverage and if you need additional insurance. It’s also important to understand your insurance deductibles and how to file a claim.

- Update your home inventory. When considering personal property, the Bureau encourages Virginians to review and update their home inventory, which will help them determine the proper amount of coverage for their belongings. Valuable items like jewelry, art or electronics may require separate coverage. Additionally, a home inventory can help with the claims process if damage or theft occurs.

- Consider flood insurance. When thinking about your home, you should consider that homeowners, renters and commercial insurance policies issued in Virginia typically do not cover damage to your home and belongings due to flooding, surface water or storm surge. Flood and flood-related insurance coverage are available through the federal government’s National Flood Insurance Program. For more information about the program, contact the NFIP at (800) 427-4661 or visit floodsmart.gov.

- Travel and health insurance. If you plan to travel, understand your health insurance coverage in case you need medical treatment at an urgent care facility or hospital – particularly if traveling long-distance or outside the United States. Keep insurance policy information and health insurance cards with you when you travel and make sure emergency contact information is current.

- Before hitting the road, review your auto insurance policy and make sure you have the coverage you need. Check your liability limits to ensure proper protection against personal injury or property damage because of an accident. It’s crucial that you keep a copy of your insurance card with you in your vehicle and know what to do if an accident occurs.