How to Buy Bitcoin UK – Step-by-Step Guide for Beginners

To buy Bitcoin in the UK, investors can complete the process with a regulated online broker that supports debit/credit card and bank transfer payments.

Although the investment process can be completed in just a few minutes from start to finish, buying Bitcoin for the first time can be a daunting task for beginners.

Therefore, the purpose of this step-by-step guide is to explain how to buy Bitcoin in the UK safely and cost-effectively.

How to Buy Bitcoin UK – Overview of the Step-by-Step Process

For a quick overview of how to buy Bitcoin in the UK, consider following the step-by-step walkthrough outlined below.

This highlights how to invest in Bitcoin via eToro – which is an FCA-regulated broker that offers low fees and small account minimums

- ✅ Step 1: Open an eToro Account – To get the ball rolling, visit the eToro website and elect to register a new account. eToro will ask for some basic information – such as the name, home address, and telephone number of the investor.

- 💳 Step 2: Deposit Funds – One of the best things about buying Bitcoin in the UK via eToro is that the broker supports debit/credit cards, e-wallets, and bank transfer payments. For UK residents, the minimum deposit is only $10 – or about £8.

- 🔎 Step 3: Search for Bitcoin – Look for the search box at the top of the eToro website and type in ‘Bitcoin’. Click on the ‘Trade’ button next to ‘BTC’ – which should be the first result at the top of the list that subsequently appears.

- 🛒 Step 4: Buy Bitcoin UK – Finally, the investor should now see an order box appear on the screen. In the ‘Amount’ box, specify how much to invest in Bitcoin – from $10 or more. To confirm, click ‘Open Trade’.

Unlike stocks and shares, Bitcoin trades 24 hours per day, 7 days per week. This means that as soon as the order is placed, eToro will add the Bitcoin tokens to the investor’s portfolio.

Read on for a more detailed step-by-step overview of how to buy Bitcoin in the UK with the best crypto exchanges UK.

Where to Buy Bitcoin in the UK – Top Crypto Exchanges and Brokers

When buying traditional stocks online, investors in the UK will need to open an account with a suitable broker. This is much the same as buying Bitcoin, as there are now a handful of FCA-regulated brokers that support crypto assets.

Exchanges are another option when deciding where to buy Bitcoin in the UK, albeit, it is important to assess whether or not the platform is regulated.

Choosing the best place to buy Bitcoin in the UK can be a time-confusing task, so below, we offer reviews of the most notable brokers and exchanges in this space.

1. eToro – Overall Best Place to Buy Bitcoin in the UK

eToro is also regulated by bodies in the US, Cyprus, and Australia. As a result, we found that eToro offers a safe and secure way to invest in Bitcoin in the UK. To open an account with eToro rarely takes more than five minutes and simply requires some basic personal information and contact details.

The minimum deposit requirement for those based in the UK is just $10. Payment options are plentiful at eToro and include UK bank transfers, debit/credit cards, and even e-wallets such as Skrill and Paypal. After making a deposit, UK residents can then proceed to search for Bitcoin and complete an instant purchase.

The minimum Bitcoin investment that can be made on the eToro is $10.

This means that UK residents will be purchasing a fraction of a token, albeit, the upside potential remains the same nonetheless. Once the Bitcoin purchase has been completed, there is nothing else to do until the investor decides to cash out. This is because eToro is responsible for safekeeping the Bitcoin and thus – the funds can be accessed via the user’s portfolio.

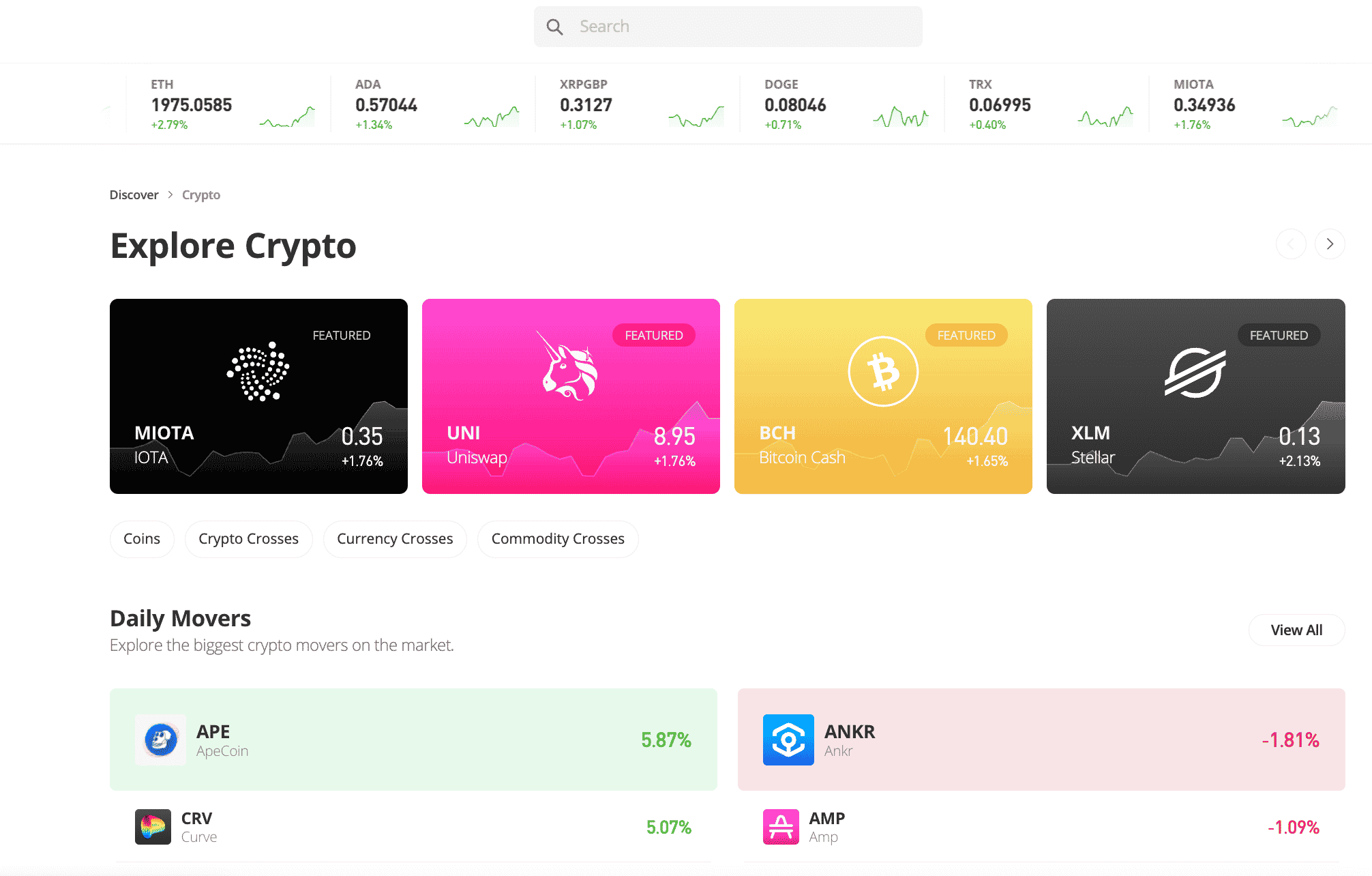

In addition to Bitcoin, eToro offers access to thousands of other markets. This includes more than 90 other cryptocurrencies, which include everything from Ethereum, Dogecoin, and Shiba Inu to XRP, Cardano, and NEO. eToro also supports metaverse coins such as Decentraland, Axie Infinity, My Neighbor Alice, and the Sandbox.

Those in the UK that wish to diversify into other asset classes will find more than 2,500 stocks and ETFs from the UK, US, Europe, and lots of other markets and exchanges. eToro also offers access to tradable markets that track indices, commodities like gold and oil, and even forex.

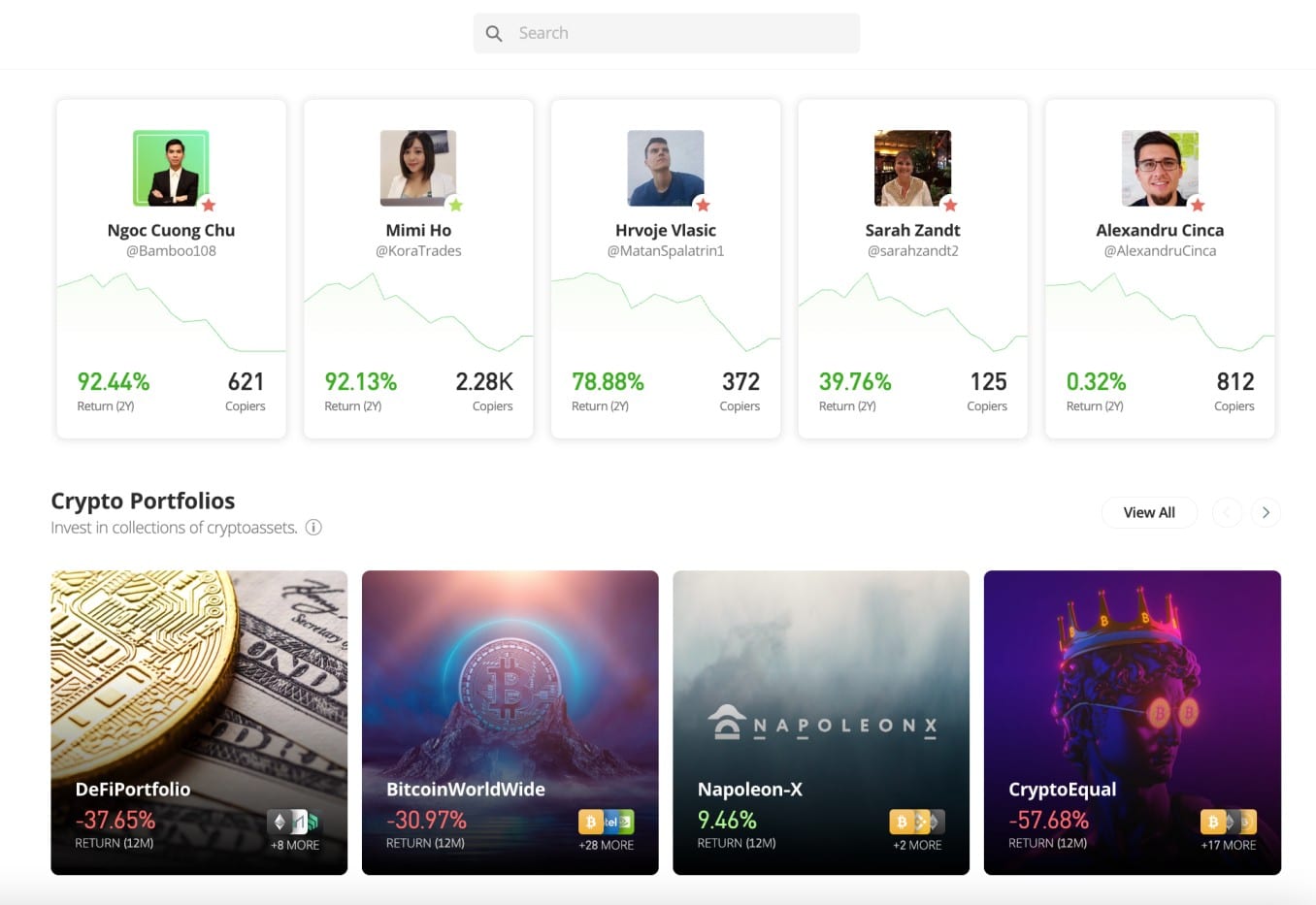

Another reason why eToro remains one of the best places to buy Bitcoin in the UK is that the broker offers passive investment tools. The first tool to consider is the Copy Trading feature which, as the name suggests, allows investors to ‘copy’ the positions of an experienced eToro trader.

For instance, if the trader buys Ethereum and Bitcoin, so will the respective investor using the Copy Trading tool. Another top-rated feature at eToro is its Smart Portfolios, which are professionally managed and come with no additional fees. There are several Smart Portfolios that track digital assets, which offers both a diversified and passive approach to crypto.

Those opening an account with eToro for the first time might also consider switching over to ‘Virtual Portfolio’ mode. This allows investors to buy and sell assets via live market conditions, but without risking any money. eToro also offers an iOS and Android crypto app, which is linked to the user’s main account.

What We Like About eToro:

- Regulated by the FCA

- Buy Bitcoin and 90+ other crypto assets

- Low fees and support for debit/credit cards and e-wallets

- Passive investment tools – including Copy Trading

- Very user-friendly platform and simple investment process

| Number of cryptocurrencies | 90+ |

| Debit card fee | 0.5% |

| Fee to buy Bitcoin in the UK | 1% |

| Minimum deposit | $10 (about £8) |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

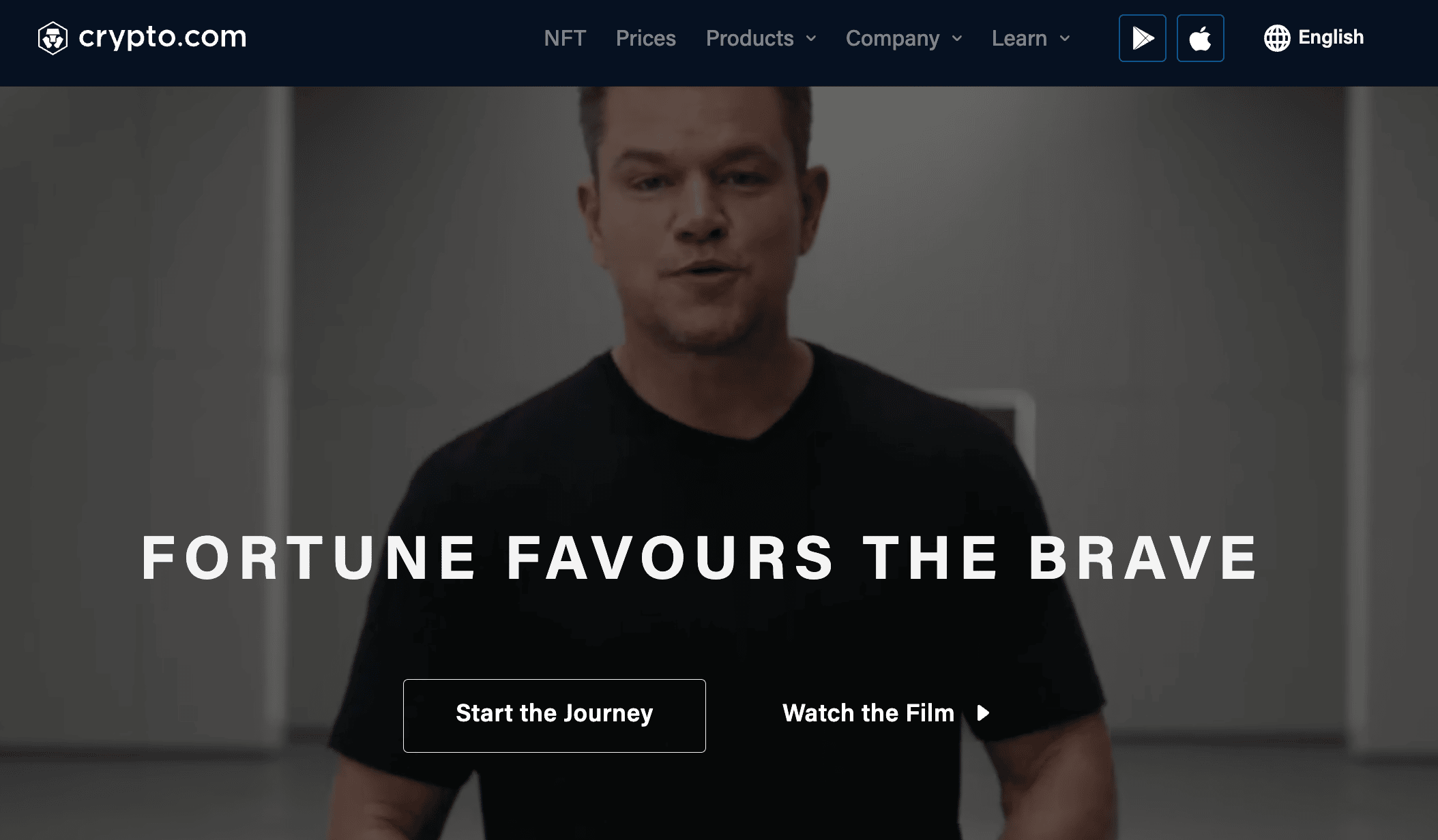

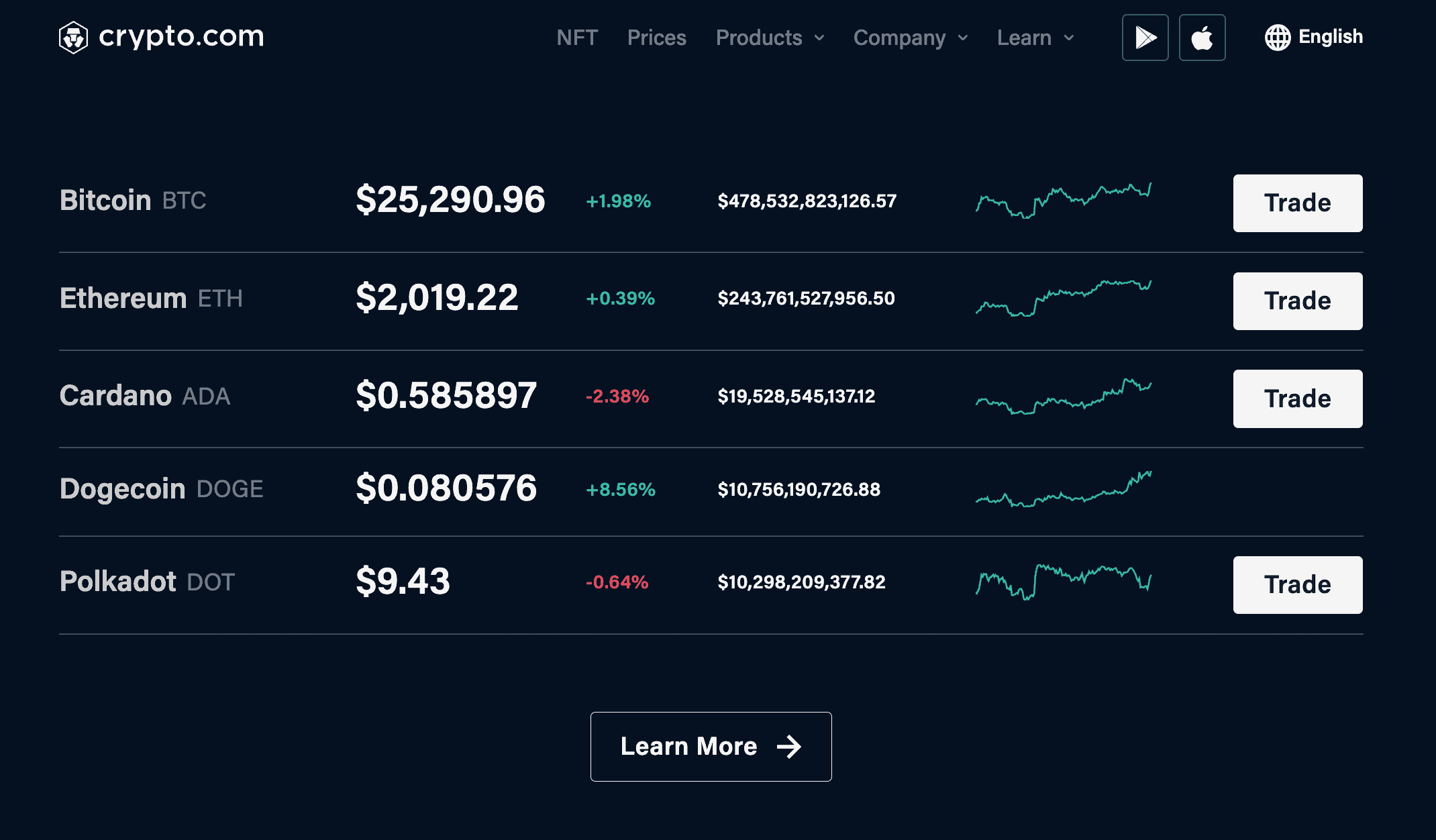

2. Crypto.com – Buy Bitcoin in the UK at a Commission of 0.4%

This means that in order to open a verified account, UK residents will need to upload a copy of their passport or driver’s license. After that, investors will be able to fund their Crpyto.com trading account via a UK bank transfer on a fee-free basis. Although Crypto.com states that this can take three working days to arrive, we found that this is normally within 24 hours.

Crypto.com also supports debit and credit card payments issued by Visa and MasterCard. This is an instant payment method but it does attract a fee of 2.99%. When compared to the 0.5% charged by eToro, this should be considered expensive. As such, if opting for Crypto.com, consider electing for a bank transfer deposit.

Either way, once the Crypto.com account has been funded with GBP, the investor will then be able to buy Bitcoin in the UK at a commission of just 0.40%. This means that for every £500 invested in Bitcoin, the commission will amount to just £2. Moreover, fees are reduced automatically when certain trading volume milestones are met.

After buying Bitcoin here, the tokens will be added to the Crypto.com portfolio – which can be accessed 24/7 simply by logging in. Alternatively, Crypto.com also offers a wallet app for iOS and Android smartphones. This option is best suited for experienced investors that understand how wallet security works.

Just like eToro, diversification is simply at Crypto.com. After all, this popular exchange offers access to more than 250 crypto assets across a wide range of projects. On the other hand, Crypto.com does not offer access to non-crypto assets like stocks and ETFs. Nonetheless, Crypto.com more than makes up for this with the variety of investment tools on offer.

For example, we like how Crypto.com offers interest accounts. This enables investors to buy Bitcoin in the UK and subsequently transfer the funds to an interest account that pays an attractive APR. Crypto.com also offers crypto loans, which enables investors to increase the size of their holdings by using Bitcoin as collateral.

Other features found on the Crypto.com website include a fully-fledged NFT marketplace, which offers fee-free trading for buyers. There is also a Crypto.com debit card, which enables investors to spend their digital assets in the real world. The card is backed by Visa so is compatible with in-store and online purchases, as well as ATMs.

What We Like About Crypto.com:

- Free GBP deposits via a UK bank transfer

- Buy Bitcoin with a debit card

- Mobile app supports instant debit/credit card payments

- More than 250 crypto assets supported

- Earn interest on Bitcoin deposits

| Number of cryptocurrencies | 250+ |

| Debit card fee | 2.99% |

| Fee to buy Bitcoin in the UK | 0.4% |

| Minimum deposit | $20 (about £16) |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

3. Binance – Popular Crypto Exchange That Charges Just 0.1% in Commission

First, the exchange has one of the lowest commission structures in the crypto space. In fact, even casual traders will never pay a commission of more than 0.1% per slide – so for every £500 invested, that’s a fee of just 50p. Moreover, in a similar nature to Crypto.com, Binance utilizes a pricing framework that rewards larger trading volumes with lower commissions.

When it comes to payments, available options at Binance can vary from time to time. The reason for this is that oftentimes, Binance is unable to offer a specific payment method due to regulatory restrictions. Nonetheless, at the time of writing, Binance supports instant debit/credit card payments at a fee of 1.8%.

Once again, this is more expensive than the 0.5% offered by eToro. With that said, Binance also supports UK bank transfers via faster payments. This fee-free option is the cheapest way to buy Bitcoin, albeit, the payment might be slower to process when compared to debit and credit cards.

In addition to offering low fees, Binance is also popular for its support for altcoins. Across more than 600 altcoins and 1,000 tradable markets, this offers UK investors the opportunity to create a highly diversified portfolio with low fees. Finally, Binance offers a mobile trading app for both iOS and Android, but this doesn’t come with all features found on the main website.

What We Like About Binance:

- Low trading commissions of just 0.1%

- More than 600 altcoins supported in addition to Bitcoin

| Number of cryptocurrencies | 600+ |

| Debit card fee | 1.8% |

| Fee to buy Bitcoin in the UK | 0.1% |

| Minimum deposit | £15 (debit/credit card payments) |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

4. Coinbase – User-Friendly Bitcoin Exchange Aimed at Beginners

Buying Bitcoin is as simple as opening an account, uploading some ID, and paying for the purchases with a UK debit or credit card. The key issue is that in using a debit/credit card, Coinbase users in the UK will be charged 3.99%. Furthermore, Coinbase no longer clearly advertises its deposit or withdrawal fee structure, which is a major drawback.

In addition to charging high payment fees to buy Bitcoin in the UK, Coinbase is also expensive when it comes to standard commissions. This stands at 1.49% per slide – so for every £500 traded, that’s a commission of £7.45. With that said, if buying Bitcoin with a debit/credit card, the 3.99% fee already includes the commission.

Coinbase offers a secure way to store Bitcoin, with various wallet options to choose from. The most common option is to keep the BTC tokens in the Coinbase web wallet, which is protected by two-factor authentication alongside IP address and device whitelisting. Those that prefer to retain full ownership of their private keys can download the Coinbase DeFi wallet.

Coinbase users will have access to dozens of other crypto assets in addition to Bitcoin and this covers everything from Ethereum and Decentraland to Shiba Inu and Dogecoin. The Coinbase app for iOS and Android is popular with investors in the UK that like to trade and keep tabs on their portfolio on the move.

What We Like About Coinbase:

- User-friendly platform will appeal to beginners

- Secure wallet for storing Bitcoin

| Number of cryptocurrencies | 100+ |

| Debit card fee | 3.99% |

| Fee to buy Bitcoin in the UK | 1.49% |

| Minimum deposit | No minimum stated |

Should I Buy Bitcoin in the UK? Our Thoughts

All investments irrespective of the asset class and market will come with an inherent level of risk. In other words, while there is every chance to see a profit when investing, losses can occur too.

With that being said, Bitcoin is considered to be an extremely volatile and risky asset - much of which is due to its speculative nature.

That is to say, while stock investors typically look for the fundamentals - such as the firm's ability to grow and its debt-to-income ratio, Bitcoin investors will focus almost exclusively on the price action of this digital asset.

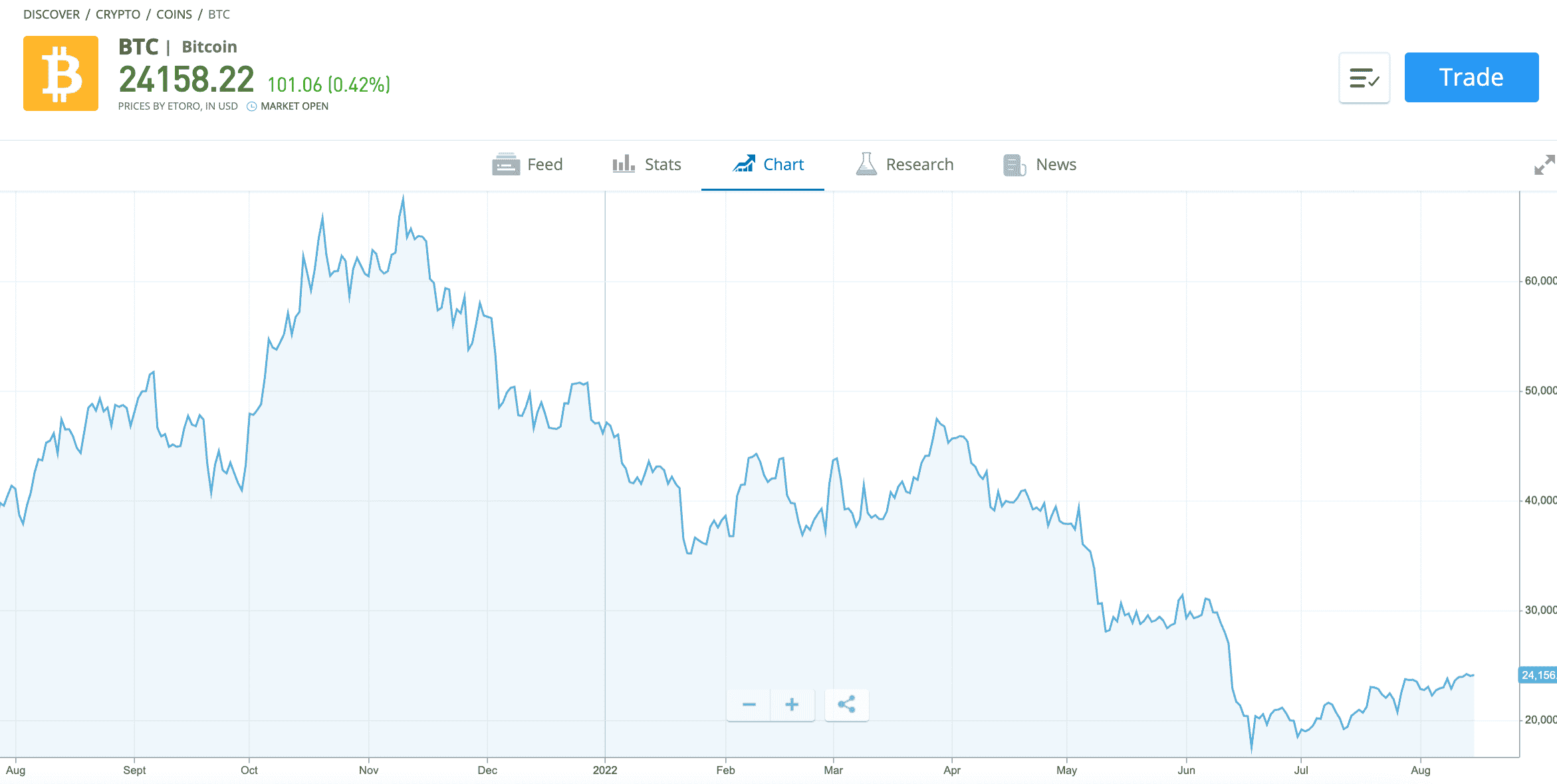

Nonetheless, as risky and speculative as Bitcoin is, it is important to note that this crypto asset has generated unprecedented growth since it was launched in 2009.

We cover the growth of Bitcoin in more detail shortly, but for a quick overview consider the following:

- In 2011 - more than two years after launching, Bitcoin was priced at $1 per token

- This means that an investment of $100 back in 2011 would have yielded 100 Bitcoin tokens

- Fast forward to late 2021 - which is when Bitcoin previously hit an all-time high, the token surpassed a value of $68,000

- This means that the same 100 Bitcoin tokens purchased back in 2011 would have been worth $6.8 million last year

However, Bitcoin has since entered a so-called bear market and 2022 lows have seen the digital asset priced at less than $20,000. This represents a decline of over 70%. Although traditional stock market index funds like the FTSE 100 will also experience bear cycles, a drop of this magnitude would be very unlikely - especially in the space of a few months.

On the other hand, Bitcoin has previously gone through several extended bear markets and so seasoned investors will view this as a good opportunity to invest in crypto at a discounted entry price.

The idea here is to buy Bitcoin in the UK while the price is low due to the broader bear market and enjoy favorable gains when the digital asset space eventually recovers. Crucially, however, there is no guarantee that Bitcoin will ever regain its previous all-time high - so investors in the UK should only consider investing what they can realistically afford to lose.

What are the Benefits of Buying Bitcoin in the UK?

This beginner's guide on how to buy Bitcoin will consider both the benefits and drawbacks of adding this speculative and volatile asset class to an investment portfolio.

Before covering the risks, let's start with the advantages that Bitcoin can offer to a long-term investment strategy.

Bitcoin is Still Considered a New Asset Class

Investors in the UK would no doubt like to turn the clock back and subsequently purchased shares in the likes of Microsoft and Apple in the 1980s, Amazon in the 1990s, and Tesla in 2010.

After all, at the time that the aforementioned stocks went public, they were considered growth companies with an unproven business model. But as we now know, early investors in these companies have since seen unprecedented growth of many thousands of percentage points.

This is relevant to the discussion of whether or not to buy BTC in the UK, not least because the digital asset is arguably in the same position that the previously mentioned growth stocks were when they first floated on an exchange.

And as a result, buying Bitcoin in 2022 allows investors to gain exposure to a growing asset class that is still in its infancy. Strong proponents of Bitcoin will argue that even at its $68,000 all-time high, this still represents just a tiny fraction of its true long-term potential.

Bitcoin is Decentralized

Bitcoin is a truly decentralized asset class, which means that the underlying framework is not controlled by any single person. This means that when transferring Bitcoin from one digital wallet to the next, the transaction does not require a third party.

This is in stark contrast to sending pounds and pence to another bank account, not least because the transaction is controlled by the respective financial institutions involved in the transfer.

In comparison, Bitcoin transactions can never be blocked when using a private wallet, as no person or authority has the ability to interject the transaction.

Bitcoin is Limited in Supply

Another major reason why more and more investors in the UK are looking at how to buy Bitcoin is that this digital asset is limited in supply. Every 10 minutes, a fixed number of tokens will enter circulation.

This will continue to be the case until approximately 2140, which is when Bitcoin is expected to reach its maximum supply of 21 million tokens. As the Bitcoin code is engraved in the underlying blockchain, its supply cannot be changed or manipulated.

As a result, Bitcoin is a deflationary asset that will never encounter the same fate as fiat currencies like the pound or dollar - which continue to be manipulated by central banks.

For example, every time the Bank of England prints more money, this increases the supply of the pound sterling, and thus - its value is reduced. This can never be the case with Bitcoin, so the digital asset is protected from inflationary policies.

Bitcoin Could be a Better Store of Value Than Gold

A store of value refers to an asset class that in theory, should continue to appreciate over the course of time. Leading examples include real estate, fine art, and of course - gold.

However, many would argue that when compared to gold, Bitcoin is more suited to function as a global store of value. First and foremost, gold needs to be stored and protected in specialist vaults with ample levels of insurance in place.

In comparison, Bitcoin can be safely stored in a private crypto wallet from the comfort of home. When it comes to transporting gold, this is a logistical nightmare considering its physical and valuable nature.

When transferring Bitcoin, this can be done digitally and each transaction will take just 10 minutes to arrive. Moreover, Bitcoin transactions are recorded on the blockchain ledger indefinitely, so ownership can be validated with ease.

Another issue with gold is that it is not a store of value that can easily be broken down into smaller units. Bitcoin, on the other, can be fractionized up to 8 decimal places - e.g (0.00000001 BTC).

This ensures that people of all budgets and financial circumstances have access to Bitcoin on a global scale.

And finally, when it comes to selling gold, this once again can be a challenging process - as physical bars and coins must be cashed at a specialist broker.

In comparison, Bitcoin can be sold for pounds and pence online in a matter of seconds by using a crypto exchange or broker.

Bitcoin has Generated More Returns Since 2009 Than any Other Asset

Much of the focus when learning how to buy Bitcoin in the UK will be on the potential gains on offer. In this regard, no other asset class in the global financial space has generated higher returns than Bitcoin.

After all, even excluding its price again prior to hitting $1 in 2011, Bitcoin has gone on to witness returns of over 6 million percent.

Over the same timeframe, the UK's primary stock market index - the FTSE 100, has generated returns of approximately 44%.

In more recent times, the FTSE 100 has increased in value by just over 2% over the past five years of trading. Bitcoin, on the other hand, has grown by over 470% over the same period.

Past performance should never be used solely as a reason to invest in Bitcoin - as future results are independent from historical price action.

Bitcoin is Available to Buy During the Crypto Dip

We mentioned just a moment ago that Bitcoin has gone through many market cycles since launching in 2009. From 2020 until late 2021, for example, Bitcoin witnessed an extended bull run that saw its value hit an all-time high of over $68,000.

Since then, however, Bitcoin has entered a bear market. In simple terms, this means that Bitcoin and the wider crypto market is now witnessing a downward pricing trend.

2022 lows, for instance, have dipped below $20,000 - which is 70% below the aforementioned all-time high. While nobody likes the see the value of their investments decline, Bitcoin has always recovered from previous bear markets to subsequently generate new highs.

Furthermore, seasoned investors will view a bear market as an opportunity rather than a negative. After all, when prices decline, this allows investors to buy Bitcoin in the UK at a discount.

For example, those buying Bitcoin at $20,000 would witness growth of 240% should the digital asset recover its previous high of $68,000 at some point in the future.

Just a Few Pounds is Required to Invest in Bitcoin

We noted earlier that Bitcoin can be fractionated into small units. From an investment and risk-management perspective, this means that it is now possible to buy Bitcoin in the UK with just a few pounds.

This is because there is no requirement to buy a Bitcoin in full when entering the market. At eToro, for example, a minimum deposit and investment of just $10 is required to invest in Bitcoin in the UK - which amounts to approximately £8.

What are the Risks of Buying Bitcoin in the UK?

After considering the benefits of buying Bitcoin, investors will also need to take into account the risks that this digital asset presents to a portfolio.

Bitcoin is Volatile and Speculative

Bitcoin is extremely volatile, especially in comparison to traditional asset classes. We mentioned earlier that since hitting highs of $68,000, Bitcoin has posted a decline of 70%.

Crucially, there is no guarantee that Bitcoin will ever recover its previous highs, so the risk of significant loss should be factored in.

Uncertain Regulation

Even though Bitcoin has since surpassed a market valuation of over a trillion dollars, Bitcoin is still loosely regulated in the UK. By this, we mean that there is no specific legislation in the UK that governs Bitcoin as an asset class.

As a result, if the UK government eventually decides to introduce Bitcoin-specific laws, it remains to be seen whether this will benefit or hinder the crypto industry.

Hacks and Theft

In most cases, when UK bank accounts and debit cards are used without the authorization of the owner, the respective financial institution will cover any subsequent losses that have resulted from the theft.

However, there are no such protections in place in the case of Bitcoin theft. For example, if holding Bitcoin in a private wallet that is subsequently hacked, the funds will be unrecoverable.

Similarly, if opting to store the Bitcoin at a third-party crypto exchange that has its servers compromised by a hacker, there is every chance that the funds will be unrecoverable.

Different Ways to Buy Bitcoin in the UK

Due to the rapid growth of the wider crypto markets, there are now many different ways to buy Bitcoin in the UK.

The most common methods are briefly discussed below:

Buy Bitcoin in the UK With a Credit or Debit Card

The most convenient way to gain exposure to crypto in the UK is to buy Bitcoin with a credit card or debit card.

- When using a regulated broker like eToro for this purpose, it is just a matter of opening an account and making an instant deposit with a Visa or MasterCard-issued card.

- The funds will then appear in the eToro account, so the investor can proceed to buy Bitcoin at the click of a button.

- When it comes to fees, eToro charges 0.5% to use a credit or debit card, while at Crypto.com and Coinbase this will cost 2.99% and 3.49% respectively.

As such, it pays to shop around when looking at where to buy Bitcoin in the UK with a credit or debit card.

Buy Bitcoin in the UK With PayPal

It is also possible to buy Bitcoin with PayPal in the UK. However, when compared to credit and debit cards, very few brokers and exchanges support this payment method.

eToro again comes out on top in this regard, as a fee of just 0.5% is applied when electing to buy Bitcoin with PayPal.

Buy Bitcoin in the UK With Neteller or Skrill

Similar to PayPal, very few platforms in the UK support Neteller or Skrill. eToro supports both of these e-wallets at a fee of 0.5%.

Buy Bitcoin in the UK With a Bank Transfer

The cheapest way to buy Bitcoin in the UK is often by making a bank transfer into a crypto exchange or broker. The process at Crypto.com, for example, can be completed without paying any deposit fees.

What is the Best Way to Buy Bitcoin?

In addition to choosing a suitable payment method to buy Bitcoin in the UK, investors will also need to consider the type of platform that they complete the process with.

Exchanges and Brokers

This guide on how to buy Bitcoin in the UK has frequently mentioned both crypto exchanges and brokers. Both enable investors to buy Bitcoin, albeit, the underlying framework differs between the two.

- When using an exchange, the buyer will need to have a seller at the other end of the transaction for the purchase to go through. This is why it is important to use an exchange that attracts sufficient levels of liquidity.

- Brokers, on the other hand, will have an allocation of Bitcoin that they can sell directly to investors in the UK. This option is not only more convenient, but brokers will need to carry a regulated status to sell Bitcoin in the UK.

As we mentioned earlier, FCA-regulated brokers like eToro offer a safe and burden-free way of buying Bitcoin in the UK.

Peer-to-Peer Exchanges

Peer-to-Peer (P2P) exchanges used to be the place to go for people to buy Bitcoin anonymously.

The reason for this is that P2P exchanges enable buyers to obtain Bitcoin directly from another seller. Unlike conventional exchanges, however, the transaction is conducted directly - without any funds going through the P2P platform.

- For instance, the buyer would be required to transfer funds into the seller's UK bank account.

- Then, the seller would transfer the Bitcoin to the buyer.

- Naturally, this type of exchange is risky, insofar that many sellers on P2P exchanges will attempt to scam buyers.

Moreover, it is no longer possible for P2P exchanges to support anonymous trades, as per anti-money laundering regulations.

Bitcoin ATMs

Prior to March 2022, there were more than 100 Bitcoin ATMs in the UK. This allowed investors to buy Bitcoin by inserting pound notes into the machine, and then the Bitcoin would be transferred digitally to a private wallet.

However, the FCA has since determined that Bitcoin ATMs are illegal in the UK, and thus - all operators have been told to shut down their terminals.

Once again, this demonstrates that the only way to legally and conveniently buy Bitcoin in the UK is through an online broker that is regulated by the FCA.

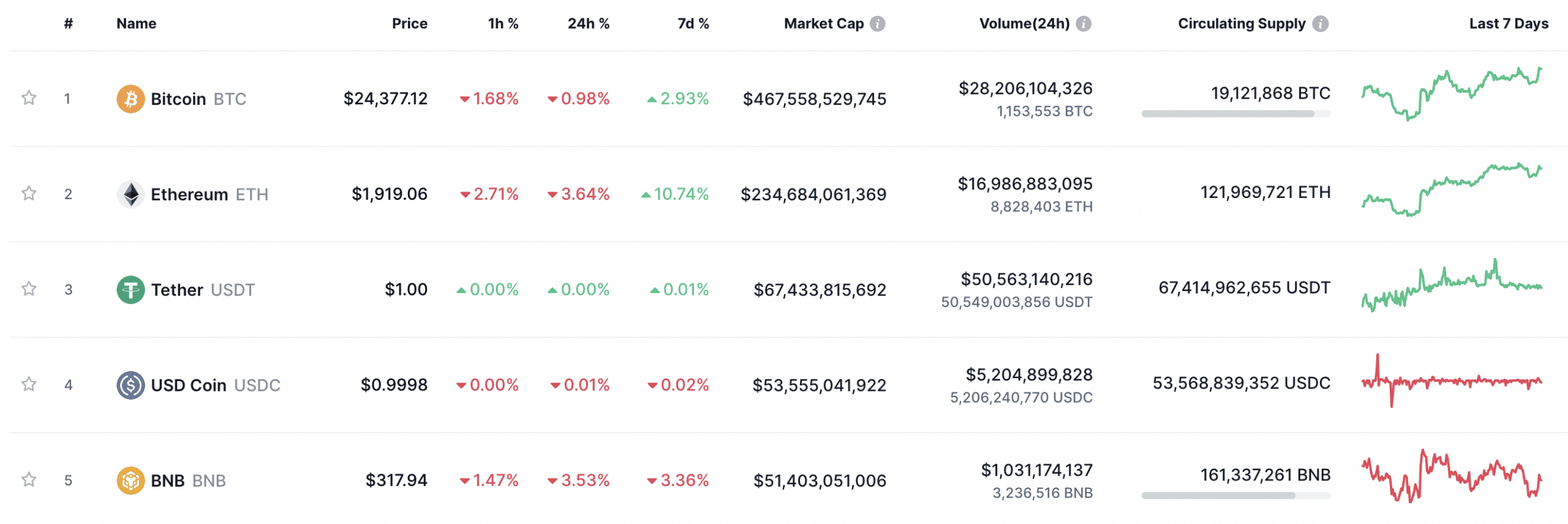

Bitcoin Price

This guide has discussed the historical price action of Bitcoin in US dollars as opposed to pounds and pence. The reason for this is that just like gold, oil, and many other global commodities, Bitcoin is commonly traded in US dollars.

As a result, this is the common standard when assessing and analyzing the price of Bitcoin. With that said, UK residents can still buy Bitcoin with pounds, albeit, the respective exchange or broker will likely make a conversion charge at the time of the trade.

Moreover, irrespective of whether dollars or pounds are being used to buy Bitcoin, the price of this digital asset is dictated by market forces. This means that demand and supply will determine whether the price of Bitcoin rises or falls.

Bitcoin Price Prediction

Bitcoin price predictions, in our view, are somewhat disingenuous. After all, there is little fundamental information to draw on when assessing the current and future value of Bitcoin.

This is in stark contrast with traditional stocks, as we have the ability to analyze the value of a company based on many metrics - such as its future growth potential, balance sheet, P/E ratio, dividend policy, and more.

As a result, it is best to view Bitcoin as a long-term investment, rather than relying on price predictions and forecasts. Don't forget that Bitcoin is speculative in nature, so any future growth is difficult to assess.

The unpredictability of Bitcoin increases the risks of making an investment too. This is why it is wise to explore the benefits of dollar-cost averaging and diversification.

How to Invest in Bitcoin Safely in the UK

Below, we offer some handy tips on how to buy Bitcoin in the UK safely.

Tip 1: Always use an FCA Regulated Broker

We have reiterated several times in this guide that UK investors should only consider buying Bitcoin from a brokerage firm that is regulated by the FCA.

This offers the best protection possible and will ensure that investors are using a credible provider.

Tip 2: Avoid Using a Credit Card to Buy Bitcoin

Credit cards - although supported by many FCA-regulated brokers in the UK, should not be used to buy Bitcoin.

After all, if buying Bitcoin on credit and the digital asset declines in value by a considerable amount, the repayments on the debt will still remain the same.

This means that credit card debt would be associated with negative equity. Instead, investors should only buy Bitcoin in the UK with amounts that they can realistically afford to lose.

Tip 3: Dollar-Cost Averaging With Sensible Amounts

The safest and most risk-averse way to buy Bitcoin in the UK is via dollar-cost averaging. This means investing a small amount at the end of each month consistently.

For example, the investor might consider injecting £15 into Bitcoin monthly. The amount to allocate to dollar-cost averaging will vary depending on the individual financial standing of the investor.

How to Buy Bitcoin in the UK - Detailed Step-by-Step Walkthrough

After exploring the ins and outs of Bitcoin - including both the risks and potential rewards that this digital asset offers, we will now conclude this guide with a step-by-step walkthrough on how to get started.

Below, we explain how to:

- Join eToro - which is an FCA-regulated broker offering low fees to buy Bitcoin in the UK

- Deposit funds with a debit/credit card or e-wallet

- Place an order to buy Bitcoin

- Sell Bitcoin back to pounds

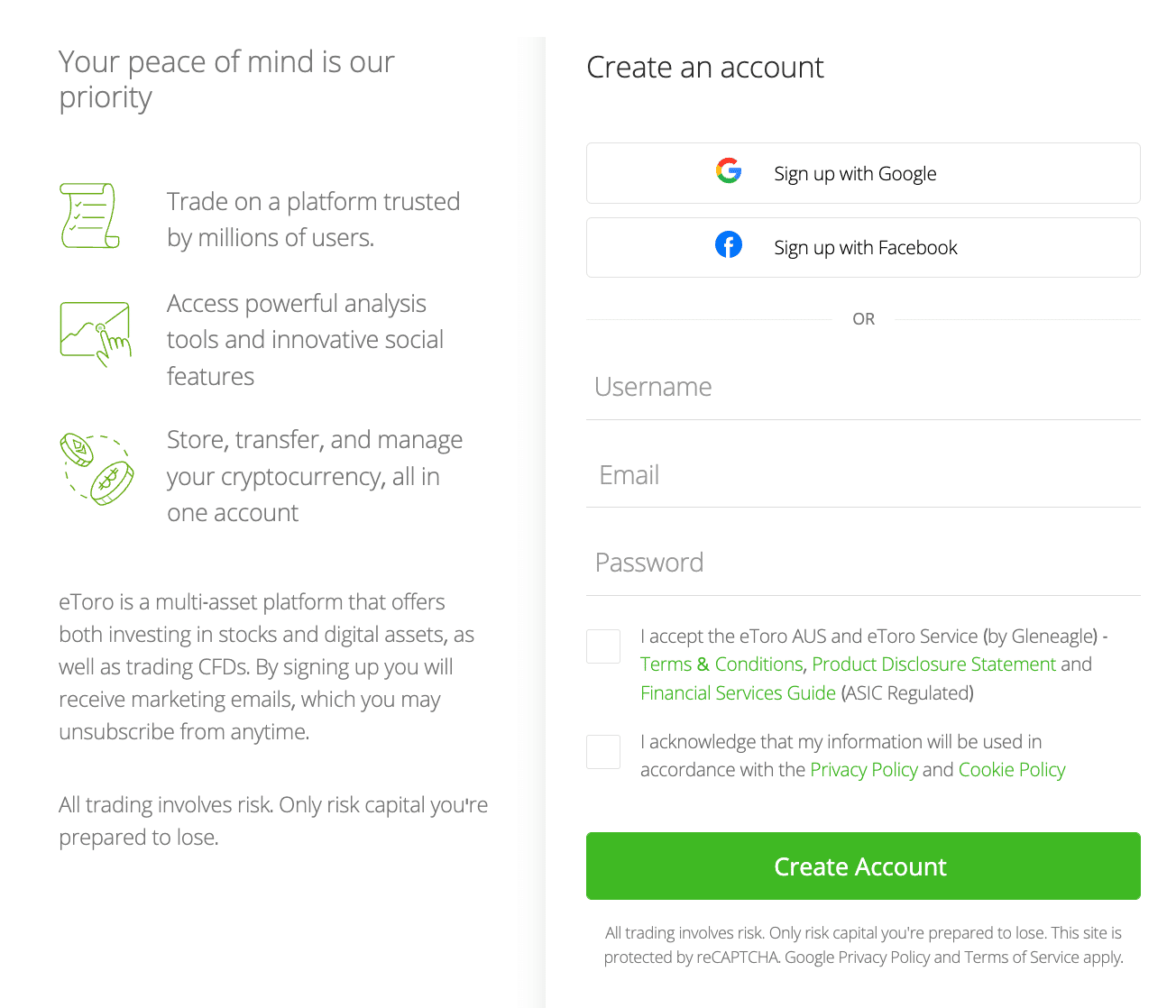

Step 1: Open an Account With eToro

Step 1 is to open an account with eToro. This will require some basic personal information and the process is no different from opening a stock brokerage account.

eToro will also ask for a copy of a government-issued ID - so a passport or driver's license will suffice.

With that said, European regulations - which are still enforced in the UK, will permit a first-time deposit of under €2,000 (about £1,700) without initially providing ID.

The eToro account will be restricted from making withdrawals though, so it is best to upload the ID straightaway.

Step 2: Deposit Funds

The next step is to meet a minimum deposit amount of $10 - or about £8.

Choose a payment method from the list of options outlined below:

- Paypal

- Skrill

- Neteller

- Debit card

- Credit card

- Bank transfer

Apart from a bank transfer - which can take a couple of days to process, all other payment methods accepted by eToro are instant.

Just remember that all supported methods attract a small foreign exchange fee (GBP to USD) of 0.5%.

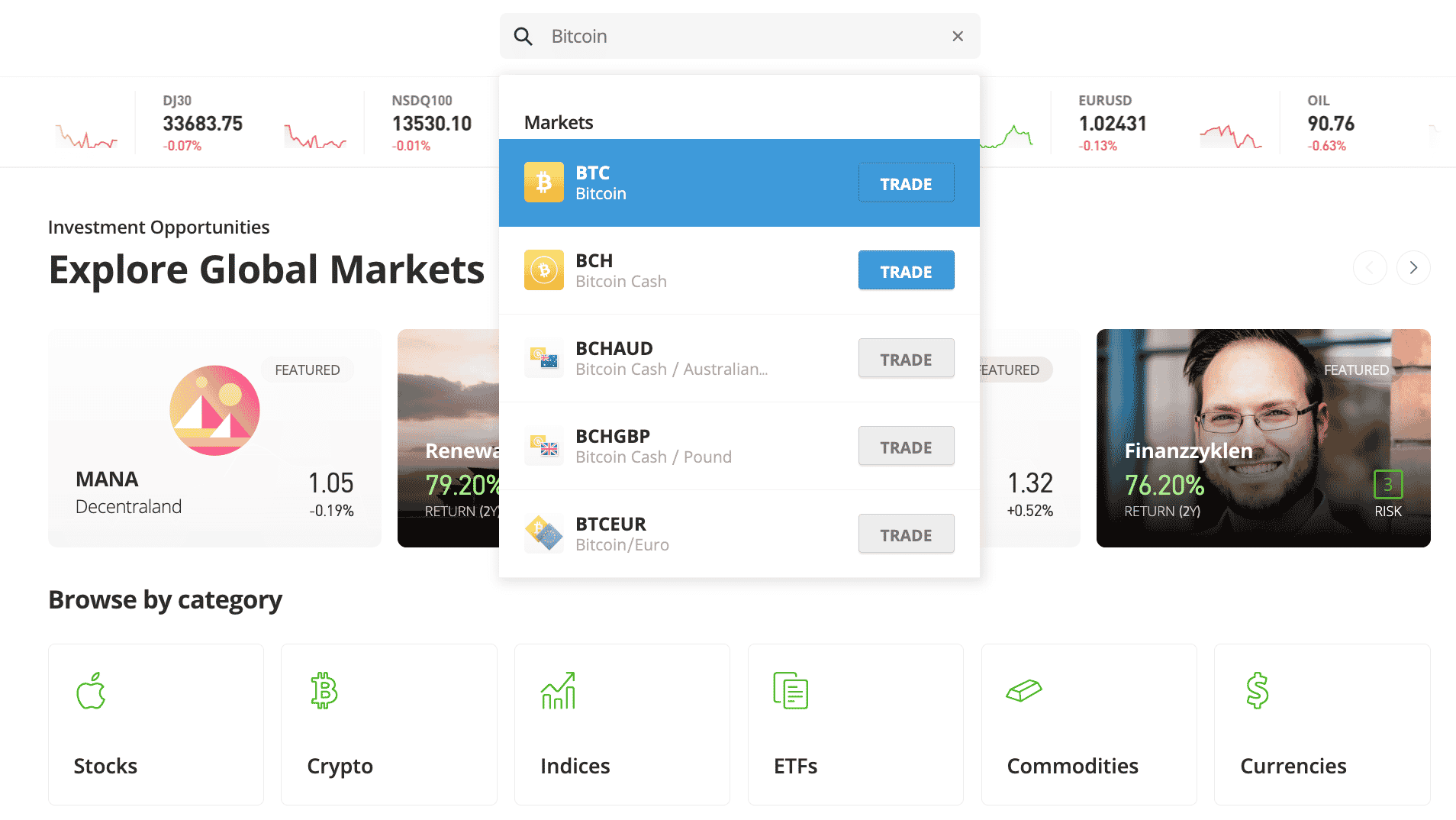

Step 3: Search for Bitcoin

The investor should now have a funded eToro account that is ready to buy Bitcoin in the UK.

At the top of the screen, type in 'Bitcoin' or 'BTC'. Then click on 'Trade' next to the result at the top of the list.

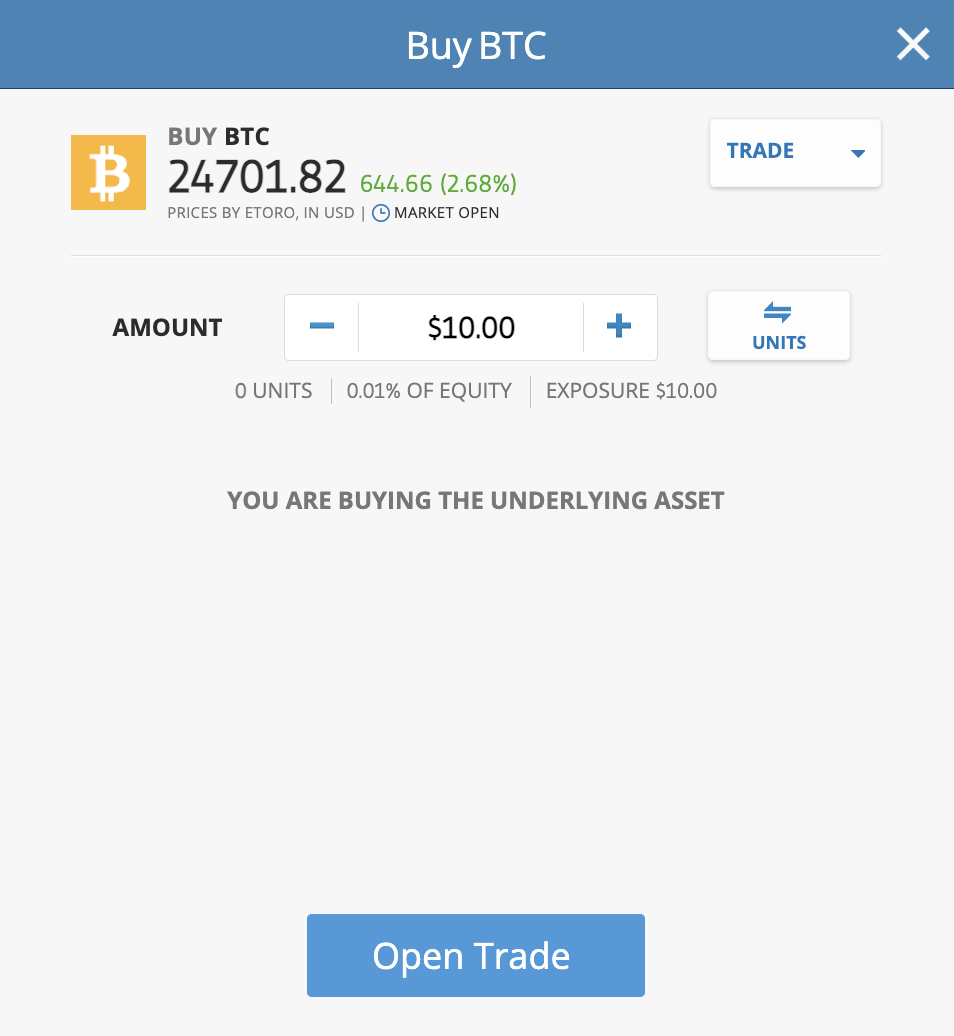

Step 4: Buy Bitcoin UK

The final part of this step-by-step walkthrough will require the investor to place a trading order.

While at first glance this might seem daunting for beginners, eToro only requires the investor to type in the total investment stake.

This will need to be stated in US dollars and once again - the minimum is $10.

To place the order and subsequently buy Bitcoin in the UK - click on the 'Open Trade' button.

Step 5: Sell Bitcoin UK

After buying Bitcoin via the step-by-step guide above, the tokens will be deposited into the investor's eToro portfolio.

This makes it convenient when the time eventually comes to sell Bitcoin in the UK.

The investor will simply need to log into the eToro account, head over to the portfolio section of the dashboard, and elect to cash out.

Once the sell order is placed, eToro will sell the BTC tokens at the current market rate and subsequently add the proceeds to the account balance.

It is then possible to make a withdrawal on the proviso that the ID verification process has already been completed.

Conclusion

This beginner's guide has not only explained how to buy Bitcoin in the UK - but how to do so safely.

In addition to covering the benefits of investing in the Bitcoin space, we have also explored the many risks that must be considered before proceeding.

To buy Bitcoin in the UK today, consider an FCA-regulated broker like eToro.

eToro supports easy and instantly processed deposits via a debit/credit card or e-wallet, and UK-based investors can buy Bitcoin with low fees and at a minimum outlay of just $10 - which is about £8.