Best Crypto Apps in the UK – Compare UK Crypto Trading Apps

Crypto apps enable UK investors to buy and sell digital currencies on the move. In choosing a crypto app, investors should look for regulated providers that offer low trading fees and plenty of supported markets.

In this comparison guide, we compare the best crypto apps in the UK right now.

List of the 10 Best Crypto Apps in the UK

The list below outlines the 10 best crypto apps in the UK right now:

- eToro – Overall Best Crypto App in the UK

- Crypto.com – Best App for Trading Cryptocurrency in the UK

- Binance – Low-Fee Crypto App for Active Traders

- Bitstamp – 0% Commissions When Trading Small Volumes

- Coinbase – User-Friendly Crypto App for Long-Term Investors

- Huobi – Trade 500+ Crypto Assets via an iOS or Android App

- Kraken – Advanced Trading App With 100+ Markets

- Coinjar – Buy and Sell Crypto From Just £10

- Luno – Access 8 Core Crypto Assets via a Simple Mobile App

- Gemini – Solid Crypto Trading App With High-Level Security

No two crypto apps are the same, so UK investors are advised to read our comprehensive reviews to choose a suitable provider.

Comprehensive Reviews of the Best UK Cryptocurrency Apps

Choosing the best crypto app for the purpose of trading digital currencies will require investors to explore core factors surrounding fees, user-friendliness, regulations, supported coins, and more.

To offer some insight into the best UK crypto app providers in the market today – below we offer comprehensive reviews of leading platforms in this space.

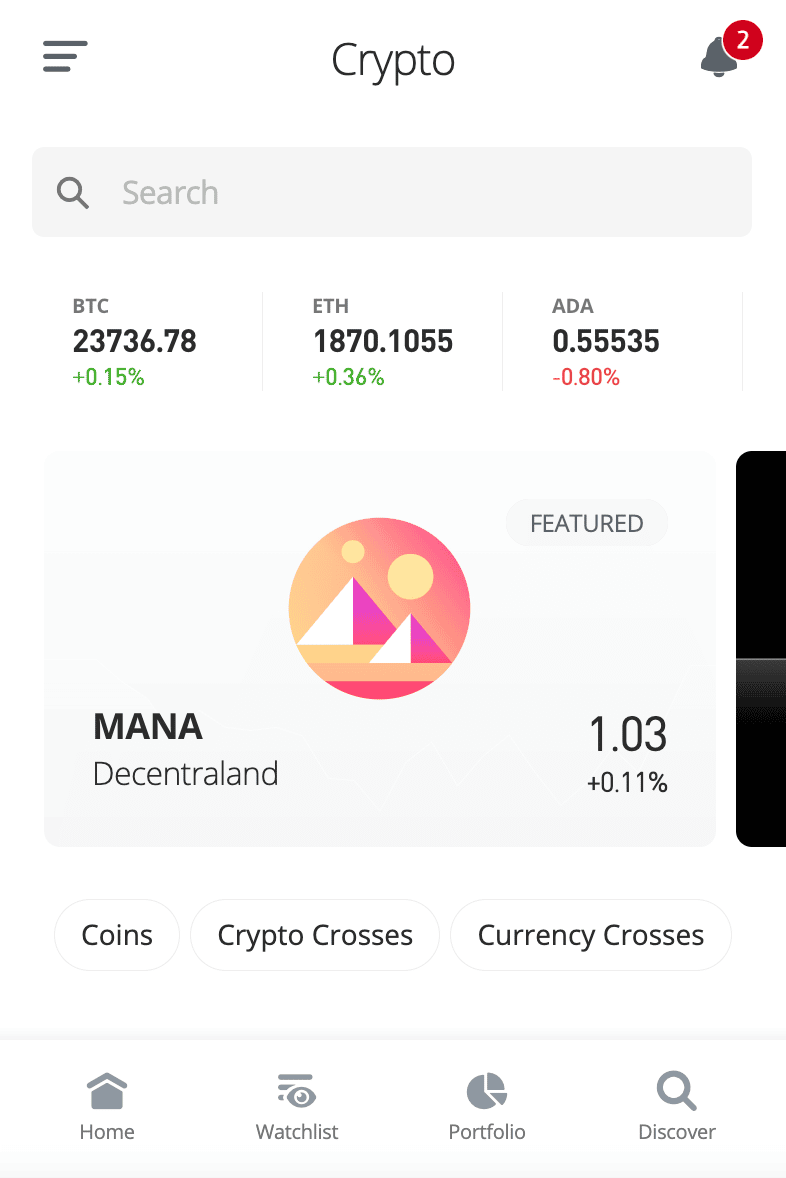

1. eToro – Overall Best Crypto App in the UK

In order to buy Bitcoin and other crypto on the eToro app, investors will first need to register an account and make a deposit. This rarely takes more than a few minutes from start to finish and the minimum first-time deposit for UK traders is just $10, or about £8. Moreover, instant deposits are supported via e-wallets and debit/credit cards.

The former includes Paypal, Skrill, and Neteller, and UK bank transfers are accepted too. Once the eToro app is funded, UK investors can then proceed to buy their chosen crypto asset. We like that eToro charges just 1% to buy and sell crypto, which is competitive. Furthermore, GBP deposits across all accepted payment methods are charged just 0.5%.

eToro offers a range of useful tools via its iOS and Android app that will appeal to investors that wish to trade passively. This includes the eToro Copy Trading tool. In a nutshell, UK investors can choose a successful eToro trader to copy and in doing so, all future investments will be mirrored automatically. The minimum Copy Trading investment is just $200, or about £160.

eToro Smart Portfolios are also worth considering. These are pre-built portfolios that are both managed and rebalanced by the eToro team. There are several Smart Portfolios to choose from that focus exclusively on digital currencies. The minimum Smart Portfolio investment is just $500, or about £400.

UK investors will also have access to more than 2,500 stocks and ETFs on the eToro app. This includes markets from the UK, the US, Europe, Canada, and more – all of which can be traded at 0% commission and from a minimum investment of just $10. By downloading the eToro app, UK investors can also trade indices, hard metals, energies, forex, and more.

Beginners might also appreciate the eToro demo account – which can be accessed at any given time. This comes preloaded with a paper trading balance of $100,000 and the demo platform mirrors live market conditions. The eToro app also comes with technical indicators and crypto news, alongside educational tools.

When it comes to safety, more than 25 million clients from around the world trust eToro. The broker is regulated by the FCA, as well as the SEC, CySEC, and ASIC. After buying crypto on the eToro app, the tokens will be added to the user’s portfolio. This means that eToro will be responsible for keeping the crypto tokens safe.

What We Like About eToro:

- Regulated by the FCA

- Buy Bitcoin and 90+ other crypto assets

- Low fees and support for debit/credit cards and e-wallets

- Passive investment tools – including Copy Trading

- Best app to buy crypto for beginners

| No. Cryptos | 90+ |

| Fee to Buy Crypto | 1% commission |

| Minimum Deposit | $10 (about £8) |

| Debit Card Fee | 0.5% |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

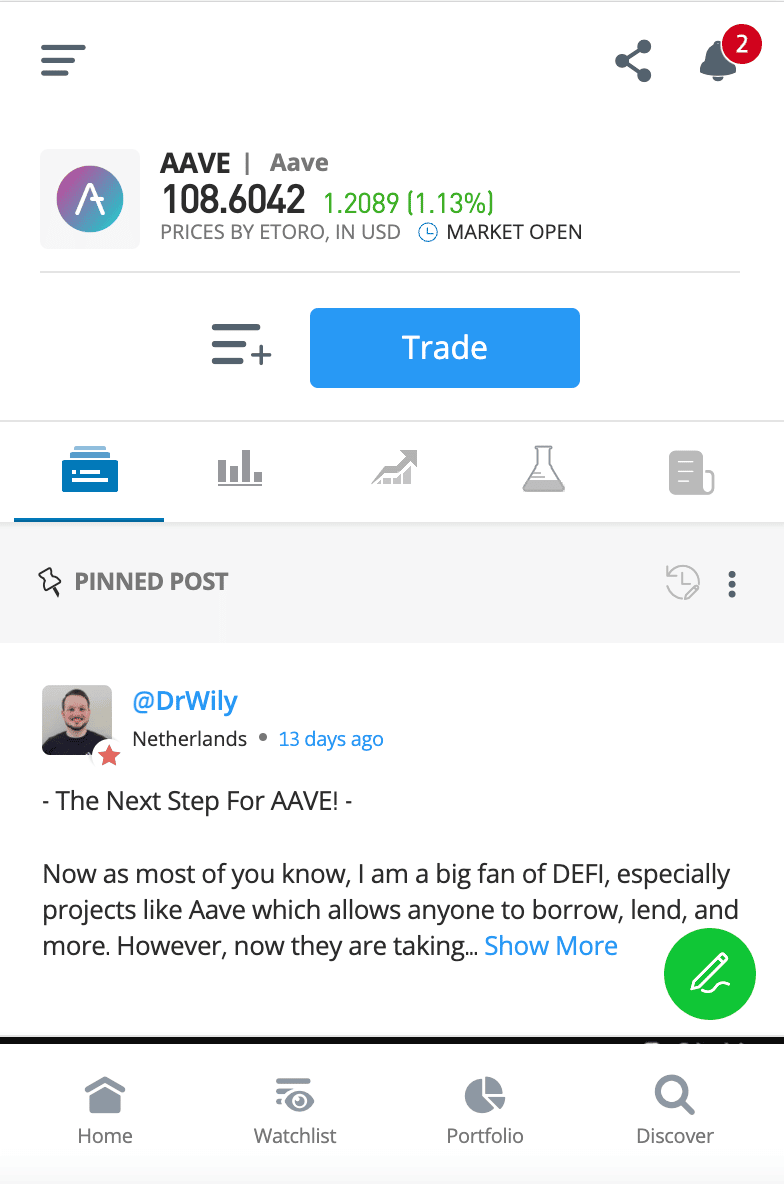

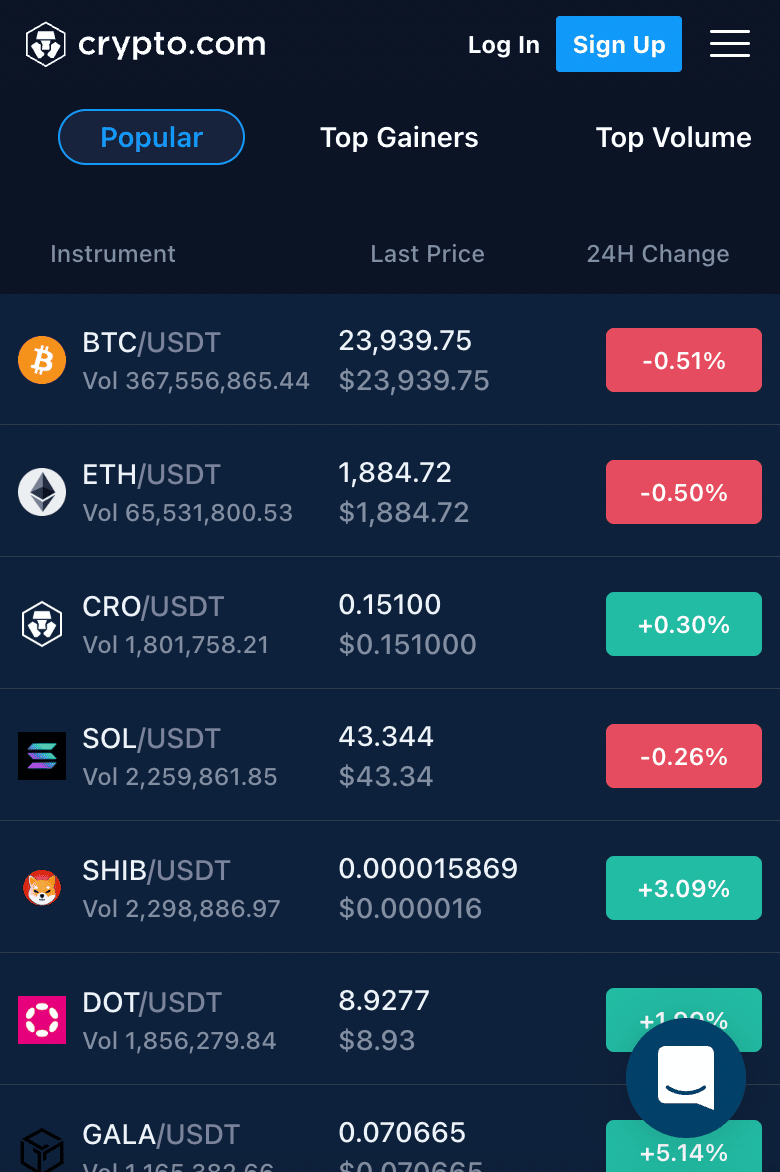

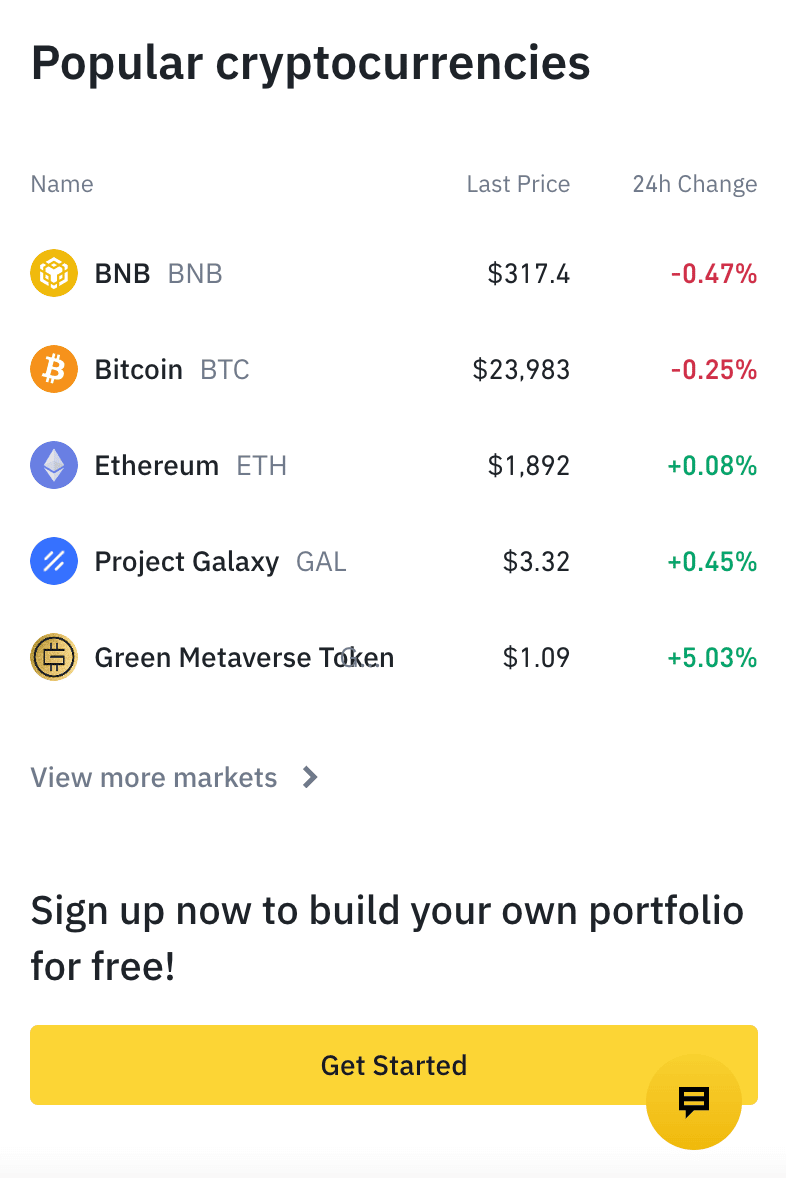

2. Crypto.com – Best App for Trading Cryptocurrency in the UK

Irrespective of the coin that the investor wishes to trade, when using the Crypto.com app, a commission of just 0.4% per slide will apply. In fact, when trading larger amounts throughout a 30-day period, Crypto.com will lower the commission. There are, however, additional fees applicable if the investor wishes to use a debit/credit card.

This deposit method will attract a fee of 2.99% of the transaction amount. With that said, budget-conscious investors in the UK can instead opt for a bank transfer, which doesn’t attract any fees at all. Just be aware that the deposit timeframe might take a couple of days.

Nonetheless, the Crypto.com app offers a range of security tools to ensure that investor funds are kept safe. At the forefront of this, is keeping 100% of all client digital assets offline in cold storage. This means that the funds are never connected to live servers and thus – the odds of a remote hack being successful are minute.

Investors in the UK also like Crypto.com for its interest-bearing tools. Put simply, investors can buy crypto and then transfer the tokens to a Crypto.com interest account that pays an APY of up to 14.5%. The best APYs are offered on three-month terms alongside the staking of CRO tokens.

With that said, Crypto.com also offers flexible and one-month interest accounts without any staking requirements. The former enables UK investors to withdraw their tokens from the interest account at any given time. Another useful feature offered by the Crypto.com app is its instant loan facility.

This is a secured loan backed by crypto and no credit checks or financial information is required. Instead, after putting a crypto asset up as collateral, the investor will have access to a 50% credit line. The Crypto.com app also offers an NFT marketplace, alongside the ability to apply for a Visa-backed debit card that permits the investor to spend crypto in the real world.

What We Like About Crypto.com:

- Free GBP deposits via a UK bank transfer

- Buy Bitcoin with a debit card

- Mobile app supports instant debit/credit card payments

- More than 250 crypto assets supported

- Best crypto trading app in the UK for low commissions

| No. Cryptos | 250+ |

| Fee to Buy Crypto | 0.4% commission |

| Minimum Deposit | $20 (about £16) |

| Debit Card Fee | 2.99% |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

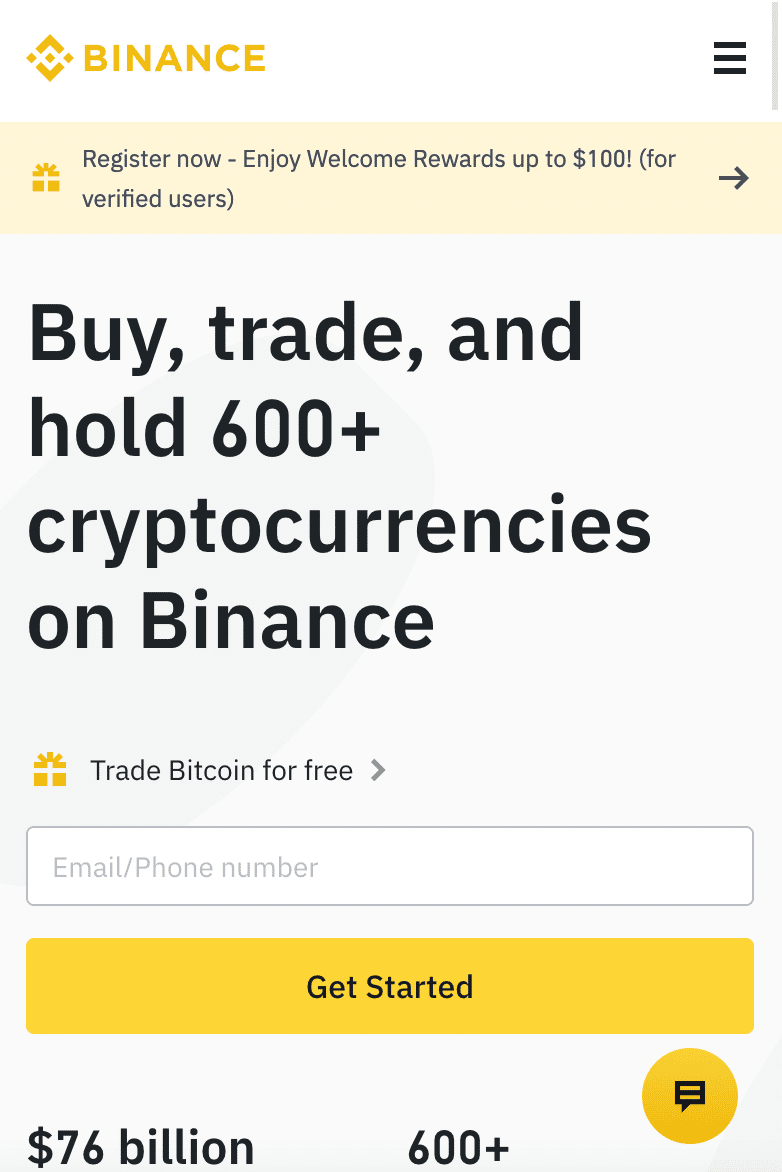

3. Binance – Low-Fee Crypto App for Active Traders

This includes the ability to make an instant debit or credit card payment via Visa or MasterCard at a fee of 1.8%. The other option is to conduct a UK bank transfer via faster payments, which attracts a small fee of just £1. Once the account is funded, UK investors will then have access to more than 600 coins and 1,000 markets.

Crucially, Binance is one of the best crypto apps in the UK for GBP-denominated markets. This means that UK investors can trade crypto assets against the pound sterling – so there is no requirement to utilize US dollars, as is the industry standard. Some of the most popular GBP markets supported by Binance include Bitcoin, Dogecoin, BNB, Cardano, Apecoin, and more.

In addition to offering GBP markets, Binance is also one of the best crypto apps in the UK for low trading fees. The app utilizes a conventional market maker/taker structure, albeit, for the purpose of simplicity – casual UK investors will pay just 0.10% per slide. This fee is reduced when trading volumes hit certain milestones.

Nonetheless, at 0.10% per slide, this is a very attractive commission rate. The Binance app comes with a wide variety of other crypto services which might be of interest to UK investors. This includes crypto interest accounts, staking, yield farming, and secured loans that are backed by collateral.

Moreover, the Binance app is considered secure for many reasons. First, the exchange has launched its Binance Authenticator application, which generates a unique code every time the investor wishes to log into their account. Binance keeps the vast majority of client digital assets offline, and it even has a Safe Asset Fund for Users (SAFU).

In a nutshell, SAFU builds a reserve pot on the back of trading fees collected by the Binance exchange. The purpose of this is to reimburse investors in the unfortunate event that Binance’s servers are hacked. With that said, although Binance has secured regulatory approval in several jurisdictions over the prior year, it is not licensed by the FCA.

What We Like About Binance:

- The best app to trade crypto via advanced charting tools

- More than 600 altcoins supported in addition to Bitcoin

| No. Cryptos | 600+ |

| Fee to Buy Crypto | 0.1% commission |

| Minimum Deposit | £15 (debit/credit cards) |

| Debit Card Fee | 1.8% |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

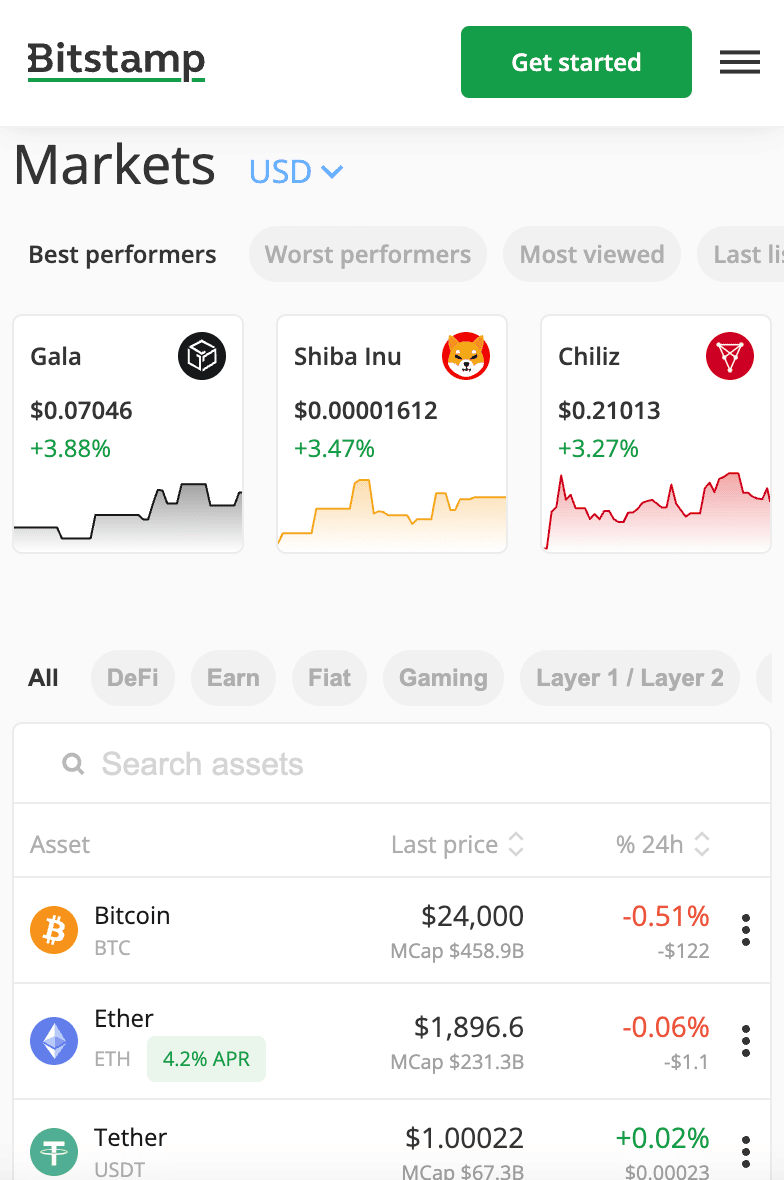

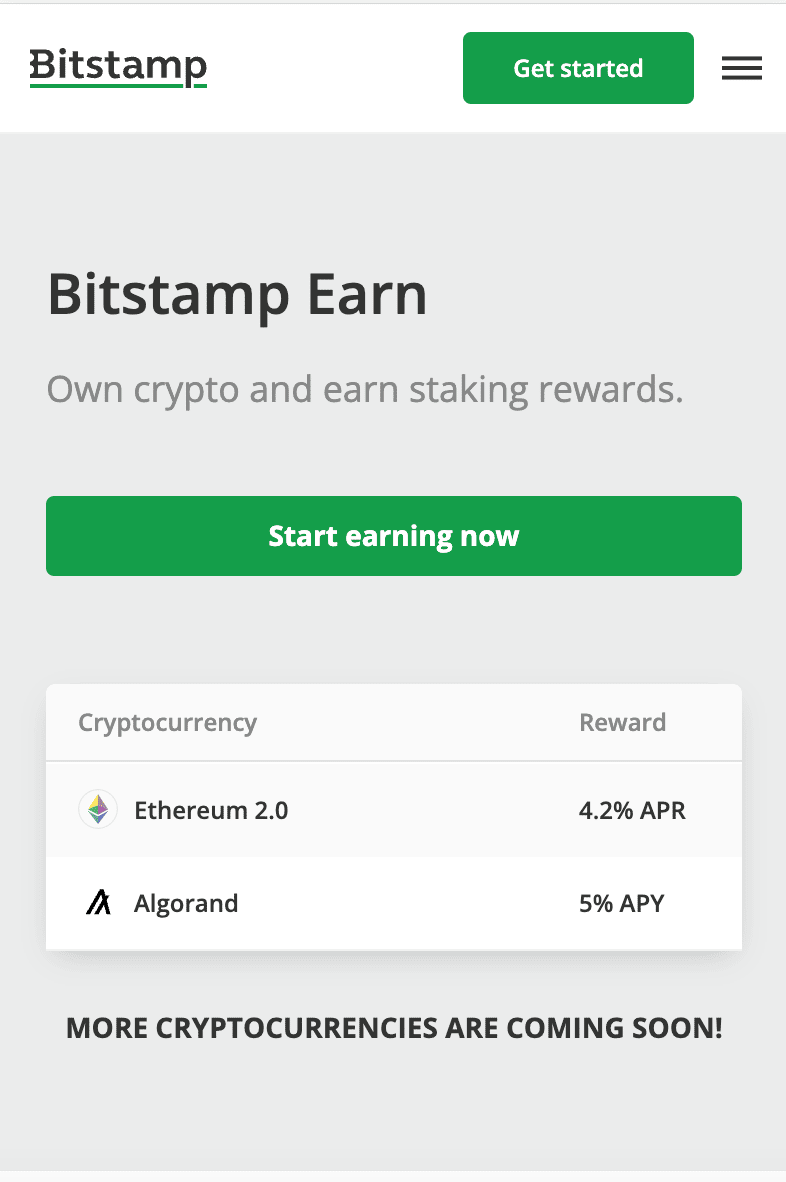

4. Bitstamp – 0% Commissions When Trading Small Volumes

Founded in 2011, Bitstamp was historically the go-to exchange for large-scale traders that sought high levels of liquidity and trading volumes. While this is still the case, Bitstamp has since adapted its business model to be more inclusive for casual traders.

At the forefront of this strategy is that as of August 2022 – Bitstamp revamped its pricing structure to offer 0% commission trading on 30-day volumes of under $1,000, or about £800. In other words, by buying and selling less than £800 worth of crypto assets throughout the month, UK investors will not pay any fees.

This is in addition to the tight spreads offered by Bitstamp, especially on major markets like BTC/USDT. Moreover, UK investors can elect to make a deposit via a bank transfer without paying any transaction fees. Those wishing to deposit funds instantly via a debit or credit card will, however, be charged a whopping 5% of the transaction size.

When it comes to supported markets, the Bitstamp app – which is compatible with both iOS and Android smartphones, offers access to more than 75 coins. This covers a good blend of large and mid-cap coins across various blockchain networks and token categories.

The Bitstamp app also offers access to TradingView, which is a leading third-party platform for the purpose of performing technical analysis. To access an investment portfolio, UK traders simply need to log into the Bitstamp app via fingerprint or face ID. This will display the value of the portfolio in real-time, alongside handy charts and analysis data.

The Bitstamp trading app also doubles up as a secure crypto wallet. This will give UK investors the option of transferring their crypto tokens to another location at the click of a button. In addition to this, Bitstamp recently launched a staking service for those seeking passive income.

However, at this moment in time, Bitstamp only offers staking for Algorand and Ethereum 2.0. Moreover, the platform takes a 15% cut of any staking rewards generated – which is somewhat excessive. Finally, considering that Bitstamp has been operational for more than a decade and that it keeps 98% of client digital assets in cold storage, the app is considered safe.

What We Like About Bitstamp:

- Established in 2011

- 98% of coins are kept in cold storage wallets

| No. Cryptos | 75+ |

| Fee to Buy Crypto | From 0% commission |

| Minimum Deposit | £10 (minimum trade size) |

| Debit Card Fee | 5% |

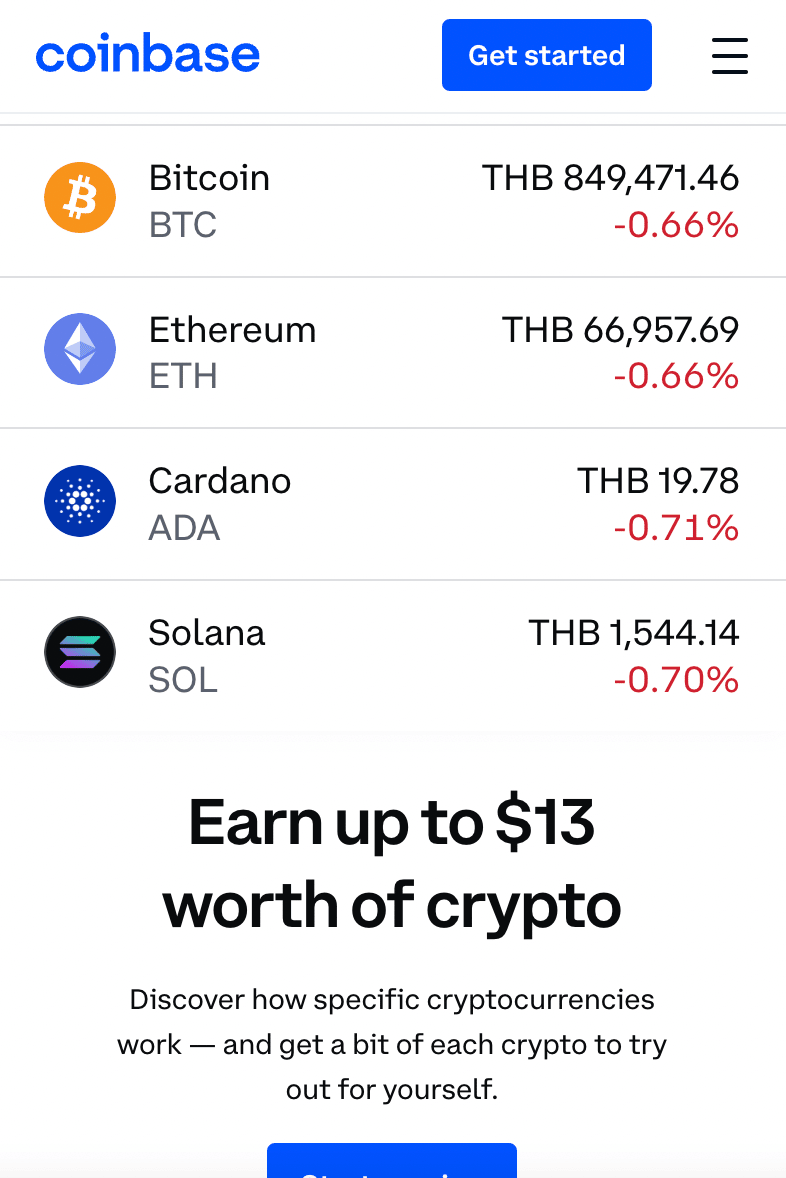

5. Coinbase – User-Friendly Crypto App for Long-Term Investors

UK investors might elect to deposit funds via a bank transfer, as no fees will apply. Although it can take 1-3 working days for Coinbase to credit the deposit, this is perhaps a better option than paying 3.99% on debit/credit card payments. The standard commission at Coinbase amounts to 1.49% per slide for orders of about $200.

A flat commission is charged on smaller trade values, with the specific amount depending on the size of the investment. Coinbase keeps the vast majority of client digital assets in cold storage and its mobile app is protected by two-factor authentication. Coinbase will also require an additional security step when logging into the app from a new IP address.

When it comes to trading tools, the Coinbase app is very simple in nature, so will appeal more to beginners. With that said, there is also the Coinbase Pro platform. Not only does this come with advanced trading tools and features, but lower commissions. Those wishing to upgrade to Coinbase Pro can do so without needing to open a new account.

Coinbase also offers a separate mobile app for iOS and Android that operates as a self-hosted wallet. This means that only the investor will have access to their private keys. Moreover, the self-hosted app also enables users to store NFTs as well as access dApps.

Another popular feature offered by Coinbase is its learn-to-earn concept. In a nutshell, this enables investors to earn free crypto simply for completing educational tasks. This consists of watching videos and subsequently completing crypto-related quizzes. There is no capital outlay requirement to use this tool, which is great for earning crypto in a risk-free manner.

What We Like About Coinbase:

- Best Bitcoin app in the UK for newbies willing to pay high fees

- Secure wallet for storing Bitcoin

| No. Cryptos | 100+ |

| Fee to Buy Crypto | 1.49% commission |

| Minimum Deposit | No minimum stated |

| Debit Card Fee | 3.99% |

Other UK Crypto Apps to Consider

Here's a quick overview of some of the other UK crypto apps that we came across.

- Huobi - The Huobi app is both a trading platform and a crypto wallet. UK investors will have access to more than 500 coins at a trading commission of 0.20% per slide.

- Kraken - Through its Kraken Pro mobile app, seasoned traders will have access to an advanced suite that offers technical indicators, drawing tools, and sophisticated charts. Commission start from 0.26% per slide.

- Coinjar - This crypto app provider offers a user-friendly and simple interface. UK traders can buy and sell crypto at a fee of 1%, while debit/credit card purchases cost 2%.

- Luno - Luno offers access to eight crypto assets at a trading commission of 1.5%. This app is perhaps more suited to those that wish to invest small amounts into the crypto market for the first time.

- Gemini - This exchange and trading app offers access to over 100 coins at a standard commission of 1.49% per slide. Gemini is renowned for its commitment to security and safety.

As always, investors will need to perform their own research when attempting to select the best crypto app in the UK for their requirements.

Comparison Table of the Best UK Crypto Apps

The table below compares the best cryptocurrency apps in the UK that we discussed in the sections above.

| Crypto Exchange | No. Cryptos | Min. Deposit | Debit Card Fee | Proprietary Wallet? | Fee to Buy Crypto | Top 3 Features |

| eToro | 90+ | $10 (about £8) | 0.50% | Yes | 1% | FCA-regulated, low fees, perfect for beginners |

| Crypto.com | 250+ | $20 (about £16) | 2.99% | Yes | 0.40% | Bitcoin interest accounts, 250+ markets, Low fees |

| Binance | 600+ | £15 (debit/credit card payments) | 1.80% | Yes | 0.10% | Free UK bank transfers, 0.1% commission, 600+ coins |

| Bitstamp | 75+ | £10 | 5% | Yes | From 0% | Established in 2011, 98% of coins are kept in cold storage, no commissions for 30-day volumes of under $1,000 |

| Coinbase | 100+ | No minimum stated | 3.99% | Yes | 1.49% | Newbie-friendly, top security, 100+ coins |

| Huobi | 500+ | £8 via bank transfer | Determined by Simplex | Yes | 0.20% | Free GBP bank transfers, 500+ coins, low commissions |

| Kraken | 100+ | £100 via bank transfer | N/A for UK traders | No | From 0.26% (Kraken Pro) | Great mobile app, 100+ coins, staking tools |

| Coinjar | 50+ | £10 | 2% | Yes | 1% | No fee to deposit GBP via a bank transfer, established in 2013, crypto bundles |

| Luno | 8 | No minimum stated | N/A for UK traders | Yes | 1.50% | Simple app for beginners, no GBP fees on bank payments, minimum order size just £1 |

| Gemini | 100+ | No minimum stated | 3.49% | Yes | 1.49% | Bank-grade security features, 100+ coins, pro-level trading tools |

How do UK Crypto Apps Work?

Crypto apps are essentially trading platforms that enable UK investors to buy and sell digital currencies on a smartphone. In the vast majority of cases, the best crypto apps in the UK are backed by an exchange or broker that primarily services clients through its website.

This means that by opening an account with a crypto exchange or broker, the investor will be able to trade online or via the app. In other words, both the online and mobile versions of the platform will be connected to the same trading account.

- We should note that even if the investor prefers to trade via a desktop computer or laptop, crypto apps can be invaluable.

- The reason for this is that the crypto markets are highly volatile and speculative and thus - it is crucial to have access to an account portfolio at all times.

- This might be to invest in a new crypto that is trending or perhaps to cash out a position that continues to decline in value.

Either way, it's just a case of opening the app and performing a trade. The best crypto apps in the UK also offer a variety of tools, such as real-time pricing charts, watchlists, alerts, and passive investment features like Copy Trading.

Selecting the Best Cryptocurrency App for UK Investors

Each crypto app that we discussed on this page will appeal to a certain type of investor.

For instance, some crypto apps are ideal for beginners or those on a budget. At the other end of the scale, some crypto apps will suit seasoned investors that seek high levels of liquidity and low fees.

This means that in order to choose the best crypto app in the UK, investors will need to consider their main priorities.

Below, we cover some of the most important factors to look for when selecting a UK crypto trading app.

Regulation

We mentioned just a moment ago that the best Bitcoin apps in the UK are backed by proprietary exchanges or brokers. As such, the first port of call for UK investors is to assess whether the provider in question is regulated.

eToro sets the standard in this regard, as the platform is regulated by the FCA alongside licensing bodies in other jurisdictions - such as the US and Australia.

Choosing a regulated crypto app will ensure that UK investors can buy and sell digital currencies in a safe environment.

With that said, unlike conventional stocks and funds, even if the provider is covered by the FSCS, this does not safeguard crypto investments.

User Experience

By using a crypto app, the overarching purpose is to buy, sell, and trade digital assets on a smartphone.

As smartphones offer a much smaller screen when compared to a desktop device or laptop, this means that the trading experience will often be less seamless.

Therefore, it is crucial to assess whether or not the chosen crypto app is user-friendly. It should be straightforward to search for crypto markets and subsequently enter buy and sell positions.

It should also be seamless to check the value of a portfolio and set up real-time alerts. One of the best ways to assess user experience of a crypto app is to opt for a provider that offers a free demo account.

Tradable Crypto Assets

We made it a point to explore how many crypto assets are listed by each of the providers reviewed on this page. The reason for this is that many UK investors will elect to create a diversified crypto portfolio that covers multiple coins.

If each coin isn't listed on the respective crypto app, then the investor will be forced to open an account with an alternative provider.

To offer some insight, Luno offers access to just eight crypto assets, while at eToro and Crypto.com, this stands at more than 90 and 250 respectively.

Fees

All of the crypto apps discussed today enable UK investors to open an account for free. However, most will charge a fee to deposit funds.

- Debit/credit cards attract the highest fee, with Bitstamp and Coinbase charging 5% and 3.99% respectively. eToro is a lot more competitive at 0.5%, as is Binance with its 1.8% charge.

- Crypto.com is the best crypto app in the UK for depositing funds via a bank transfer, as no charges are applied to the transaction.

- When it comes to trading fees, Crypto.com also stands out. The reason for this is that the app charges just 0.4% to buy and sell digital assets. This means that the investor will pay just 40p for every £100 traded.

- At Coinbase and Gemini, however, the commission stands at nearly 1.5% per slide, so this increases the fee to £1.50 for every £100 traded.

Some crypto apps will also charge withdrawal fees and this typically varies depending on the payment method. At eToro, all withdrawals cost $5, or about £4 - regardless of how much is being cashed out.

Trading Tools and Features

Investors should choose a crypto app that offers sufficient research tools - such as real-time pricing, advanced charts, and for experienced pros - technical indicators.

We should also mention the Copy Trading feature offered by the eToro app which, as we mentioned earlier, allows UK investors to trade passively.

For those seeking consistent passive income, Crypto.com offers interest accounts across dozens of coins with the top-tier APY standing at 14.5%.

Crucially, however, UK investors should consider whether or not the tools offered by a crypto app have been adequately optimized for smartphone usage. If not, this can result in a poor user and trading experience.

Deposit Methods

Deposit methods will vary from one crypto app to the next. It goes without saying that UK investors will likely prefer to use a provider that supports in-app deposits, rather than having to use the desktop website.

The eToro app enables instant payments via a debit or credit card, as well as e-wallets. The latter is inclusive of Paypal, Neteller, Skrill, and WebMoney.

Some crypto apps only support UK bank transfers. In this scenario, the investor will need to perform a manual transfer from their online banking app over to the crypto provider.

Another thing to assess is the minimum deposit requirement for the chosen payment method - and what fees apply.

Customer Support

The best crypto apps in the UK enable investors to seek assistance on their account via a live chat feature. This prevents the need to manually send an email.

Be sure to explore what the response time is when testing the live chat tool out. Ideally, investors should be connected to a live agent within two minutes.

Top Cryptocurrency Wallet Apps

For the most seamless and efficient investment process possible, UK residents should consider choosing a crypto app that doubles up as a trading platform and a wallet.

In doing so, not only will this enable UK investors to buy and sell crypto on the move, but safely store their tokens in a convenient manner.

There are two types of crypto wallet apps in this market - self-hosted and custodial.

Self-Hosted Crypto Wallet Apps

Otherwise referred to as a custodial wallet, self-hosted providers enable investors to take full control over their crypto investments. This means that the only person to have access to the private keys of the wallet is the investor themselves.

This comes with both benefits and drawbacks.

First, a self-hosted crypto wallet app will ensure that the investor retains 100% control over their tokens, and thus - access to the funds cannot be secured without knowing the respective private keys.

As a result, even if the respective crypto app provider ceased to exist, the investor would still have access to their crypto assets.

On the flip side, opting for a self-hosted crypto wallet app can be risky for those without prior experience in this space.

The reason for this is that if the investor forgets their wallet PIN or the device is lost or remotely hacked, the crypto assets might remain unrecoverable. The only way that the investor can get the funds back is through the backup passphrase of the wallet.

Custodial Crypto Wallet Apps

When opting for a custodial crypto wallet app, the funds will be safeguarded by the respective provider. Now, whether or not this is a suitable option will depend on the provider behind the crypto app.

At one end of the scale, the likes of eToro are fully regulated - which includes an FCA license. eToro custodial wallets are backed by institutional-grade security protocols, which includes cold storage.

Unfortunately, there are many crypto apps that are backed by unregulated exchanges, and thus - the risk of loss is far greater.

Billions of pounds worth of crypto have previously been stolen from unlicensed exchanges, so UK investors should only consider a custodial wallet app if it is backed by a regulated and trusted provider.

Cryptocurrency Price Alert Apps

One of the best features offered by leading crypto apps in the UK is the ability to set up price alerts. This feature is offered by eToro, Crypto.com, and several of the other apps that we reviewed today.

- Depending on the provider, the investor can set predefined parameters so that they are alerted the very second when a specific price is triggered.

- For example, the investor might wish to be notified when Ethereum surpasses $2,000 or Bitcoin drops by more than 5% in a 24-hour period.

Either way, when the parameter is triggered, the crypto alert app will ping a notification alert to the investor's smartphone. This will enable the investor to act on the pricing alert should they wish.

Get Started With a UK Crypto Trading App Today - Step-by-Step Tutorial

The process of getting started with a UK crypto trading app is relatively simple. It's just a case of opening an account with the provider and making a deposit, before placing an order to invest in the chosen crypto asset.

First-timers might appreciate the step-by-step guide outlined below, where we explain how to get started with the eToro crypto app in less than five minutes.

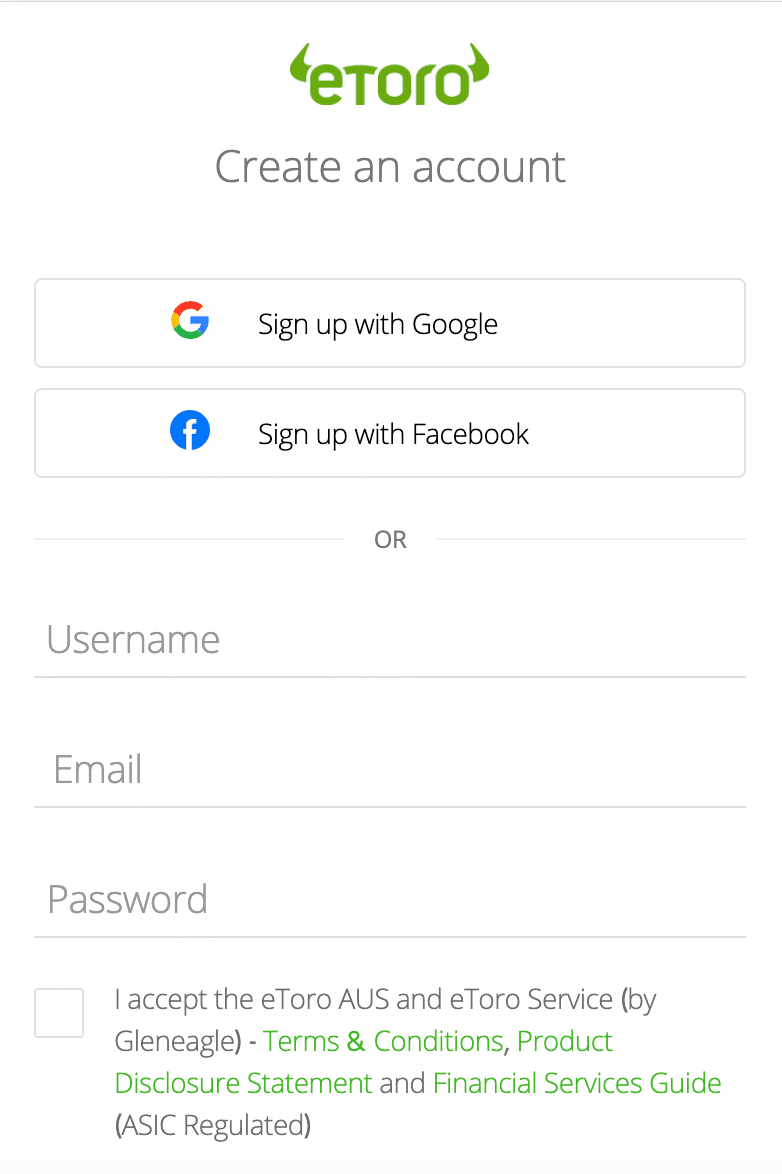

Step 1: Open an Account With eToro

Before downloading the app, UK investors will need to visit the eToro website to open an account. This will initially require the investor to choose a username and password, and enter an email address.

Next, eToro will collect some personal information such as a full name, date of birth, and national insurance number.

Step 2: Download the eToro App

Now that the account has been opened, the investor can proceed to download the eToro directly from the provider's website. The app is compatible with both iOS and Android.

Once the app is installed, the investor will need to log in via the username and password selected in the previous step.

Step 3: Verify Account

Upon logging into the app, eToro will ask the investor to verify their account. This is best achieved via the app, as the investor can use their smartphone camera to take a picture of their government-issued ID.

This can either be a passport or driver's license, albeit, ensure that the quality of the image is sufficient to pass the eToro KYC tool. If it isn't, eToro will ask the investor to re-upload the document.

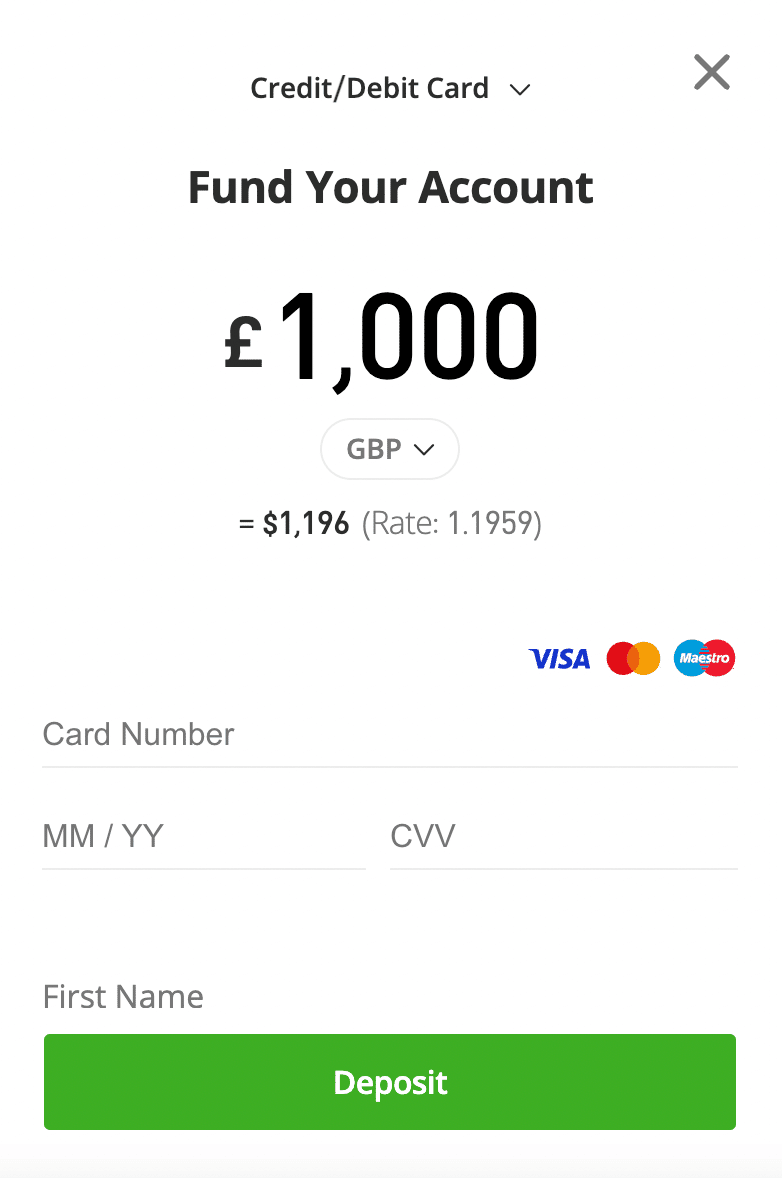

Step 4: Deposit Funds

Making a deposit via the eToro app is both seamless and instant when opting for a debit/credit card or e-wallet.

The minimum deposit is $10 and the entire process can be completed via the app. The only exception here is if the investor elects to deposit funds via a bank transfer - which will need to be completed manually outside of the app.

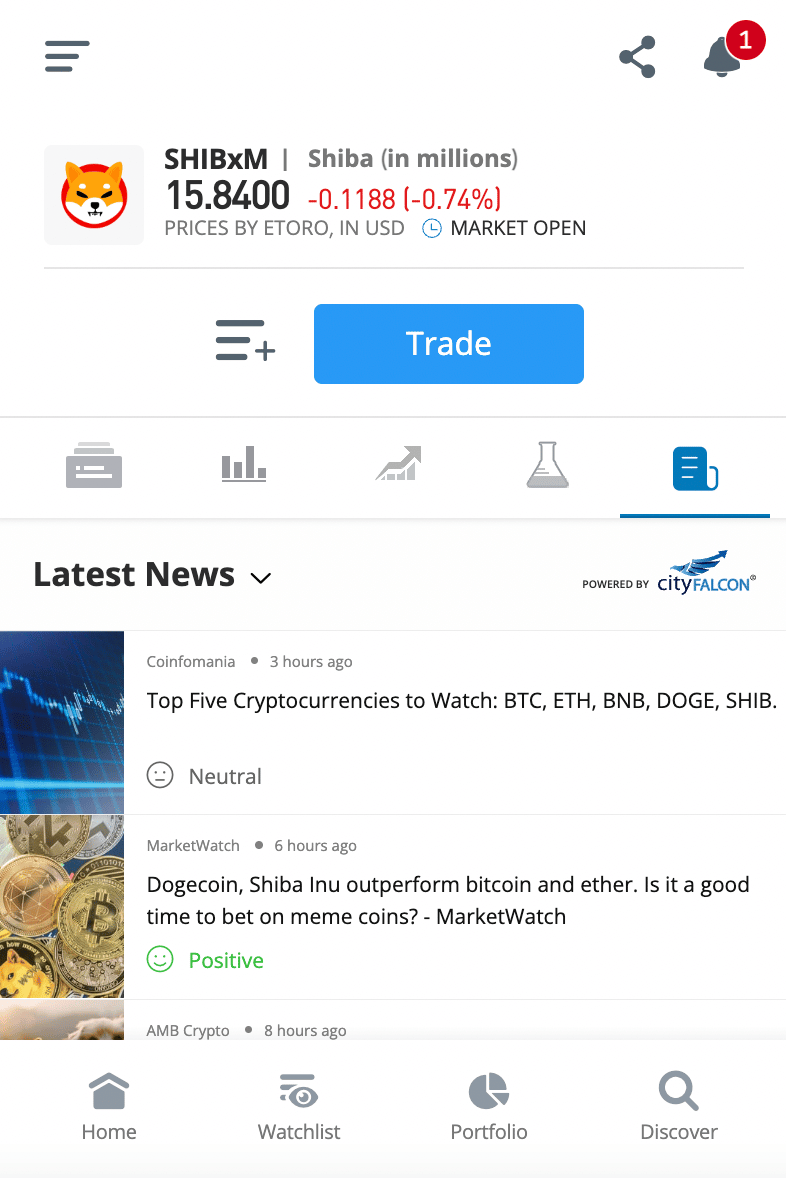

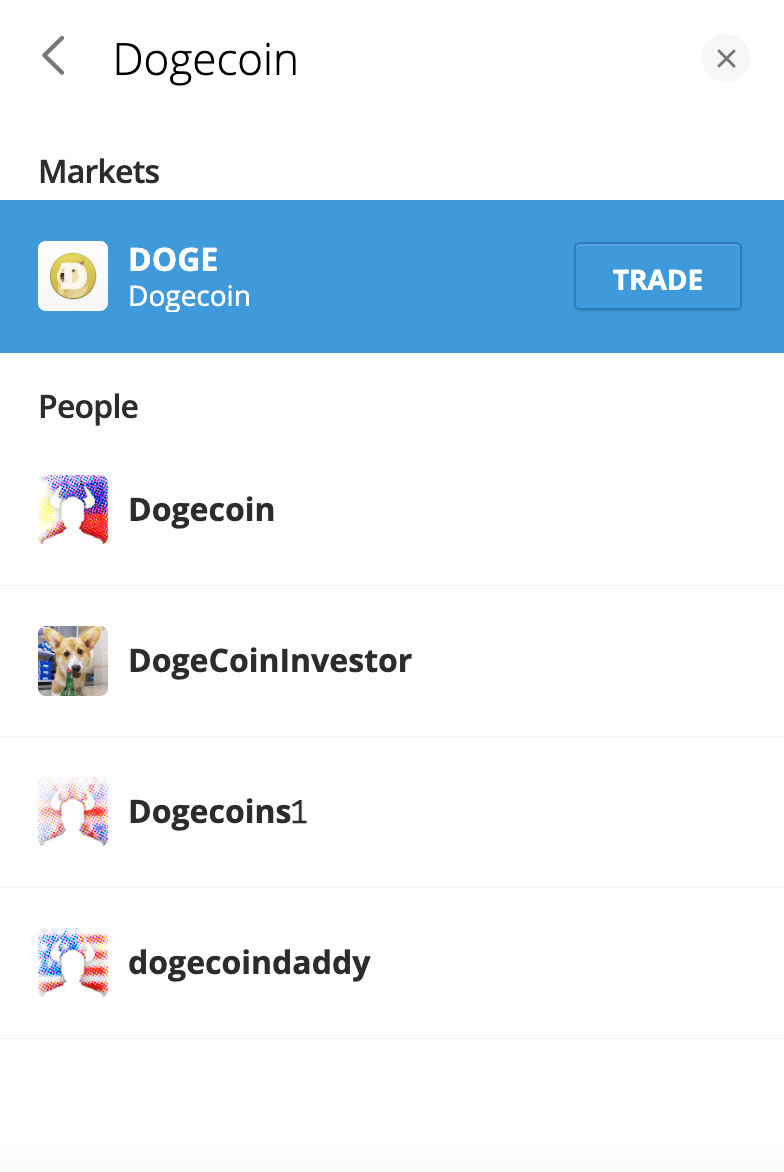

Step 5: Search for Crypto Market

At this stage, the investor will have funds in their eToro account, so it's just a case of using the app's search function to find a suitable market to trade.

As per the image above, we are searching for Dogecoin. To proceed, click on the 'Trade' button next to the respective crypto asset.

Step 6: Buy Crypto

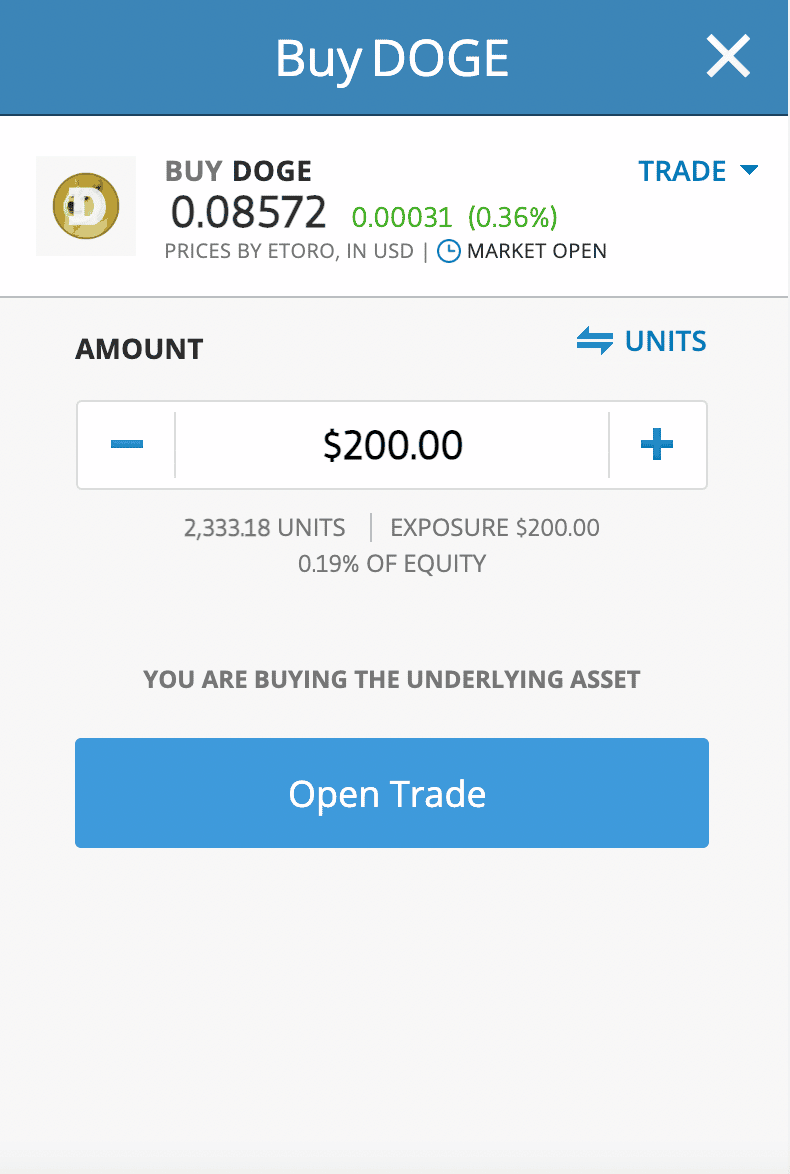

After hitting the 'Trade' button, the eToro app will then ask the investor to create an order.

In the 'Amount' field, type in the total investment amount ($10 minimum). In our example above, we are trading $200 worth of Dogecoin.

By clicking on the 'Open Trade' button, the eToro app will automatically execute the buy order. This means that within a few seconds, the crypto tokens will appear in the investor's eToro portfolio.

Step 7: Sell Crypto

At any stage, the investor can use the eToro app to sell their crypto holdings. This can be executed via the portfolio area of the app.

Once the investor sells their crypto, eToro will add the funds to the account balance. The investor can then use the funds to invest in other markets or elect to request a withdrawal.

Conclusion

Crypto apps allow UK investors to trade digital assets via a smartphone. The best crypto apps in the UK that we have reviewed today offer a seamless trading experience alongside competitive fees and support for instant payment methods.

eToro is a great option to consider for its FCA-regulated status and low-fee structure. Moreover, the eToro app is suitable for beginners - owing to its user-friendly interface and small minimum deposit requirements.