Best Crypto Wallet in the UK – Top Bitcoin Accounts for UK Residents

A crypto wallet is essential when investing in digital currencies like Bitcoin.

The reason for this is that – unlike traditional money and bank accounts, digital assets are stored on the blockchain, and thus – a wallet gives the investor access to their crypto tokens.

In this comparison guide, we explore the best crypto wallets in the UK for security, convenience, features, fees, and more.

List of the 10 Best Crypto Wallets in the UK

We consider the following list of providers to offer the best crypto wallets in the UK.

- eToro – Overall Best Crypto Wallet in the UK

- Modeapp – Top Crypto Wallet App for Buying and Storing Bitcoin

- Coinbase – User-Friendly Wallet That Connects to an Online Crypto Account

- Binance – Great Crypto Wallet for Active Traders

- Huobi – iOS and Mobile Trading App That Doubles up as a Wallet

- Luno – Buy, Sell, and Store 8 Crypto Assets

- CEX – All-in-One UK Crypto App for Trading and Storing Tokens

- Coinjar – Invest From £10 Into Crypto via a Simple Wallet App

- Exodus – Leading Crypto Wallet for Desktop Users

- Electrum – Bitcoin Wallet for Windows and Mac Devices

There are many types of crypto wallets across desktop, mobile, and web applications – and each category will come with its own strengths and weaknesses.

Therefore, in order to select the best Bitcoin wallet in the UK, investors will need to consider what level of security and convenience they require.

Comprehensive Reviews of the Best UK Crypto Wallets

Investors will need to search long and hard when selecting the best crypto wallet in the UK for their unique requirements.

Not only in terms of the device that the wallet will be stored on – but which crypto assets it supports and what security features are offered.

To help clear the mist, the sections below offer comprehensive reviews of the best crypto wallets in the UK right now.

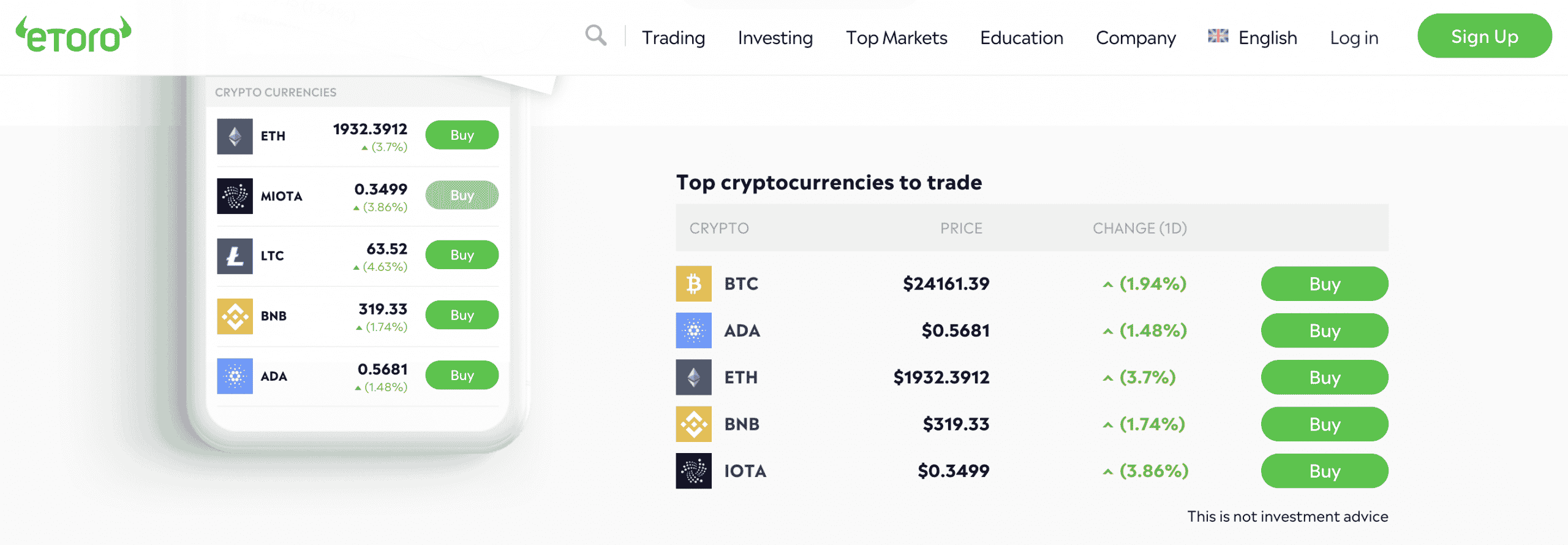

1. eToro – Overall Best Crypto Wallet in the UK

eToro actually offers two different crypto wallets to UK investors. First, there is the eToro web wallet, which can be accessed simply by logging into the Bitcoin account. After buying crypto on the platform, this is where the tokens will be stored by default.

As a custodial web wallet, eToro is responsible for keeping the tokens safe. It does this through a range of institutional-grade security practices, including storing the vast bulk of client digital assets in cold wallets. This option will suit investors with little to no experience in wallet security controls. Moreover, the web wallet makes it a seamless task to cash a crypto position out.

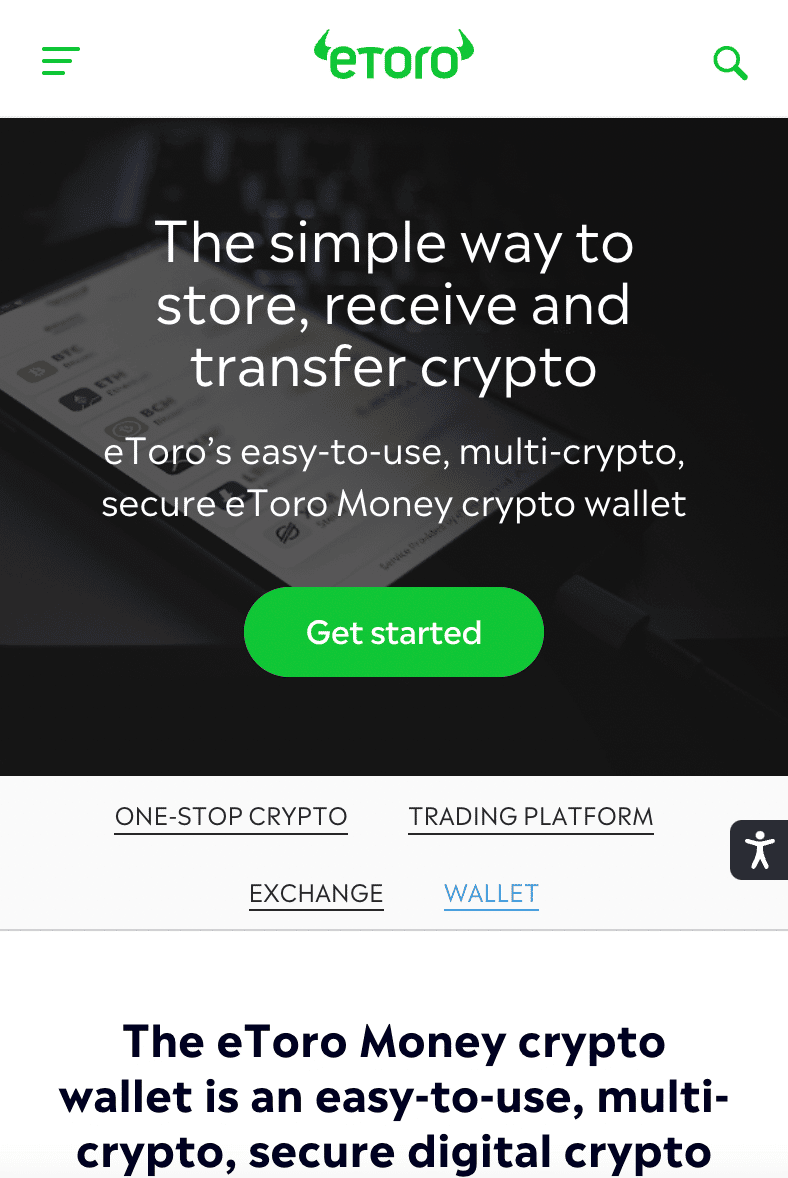

This is because the investor can simply head over to their eToro portfolio to create a sell order – and the funds will be added to the user’s account balance. The other option to consider is the eToro Money crypto wallet. This offers more control over the purchased crypto tokens, as the wallet comes in the form of a mobile app.

Moreover, unlike the web wallet, this option enables investors to transfer tokens to an external address. The eToro Money crypto wallet also allows traders to swap one token for another without leaving the app. This feature is supported for more than 500 crypto pairs.

Another feature that comes with the eToro Money crypto wallet is the unlosable private key service. In a nutshell, the team at eToro will help the investor recover their private key in the event it is lost. Both the web and mobile wallet offered by eToro are user-friendly and will suit beginners and seasoned crypto traders alike.

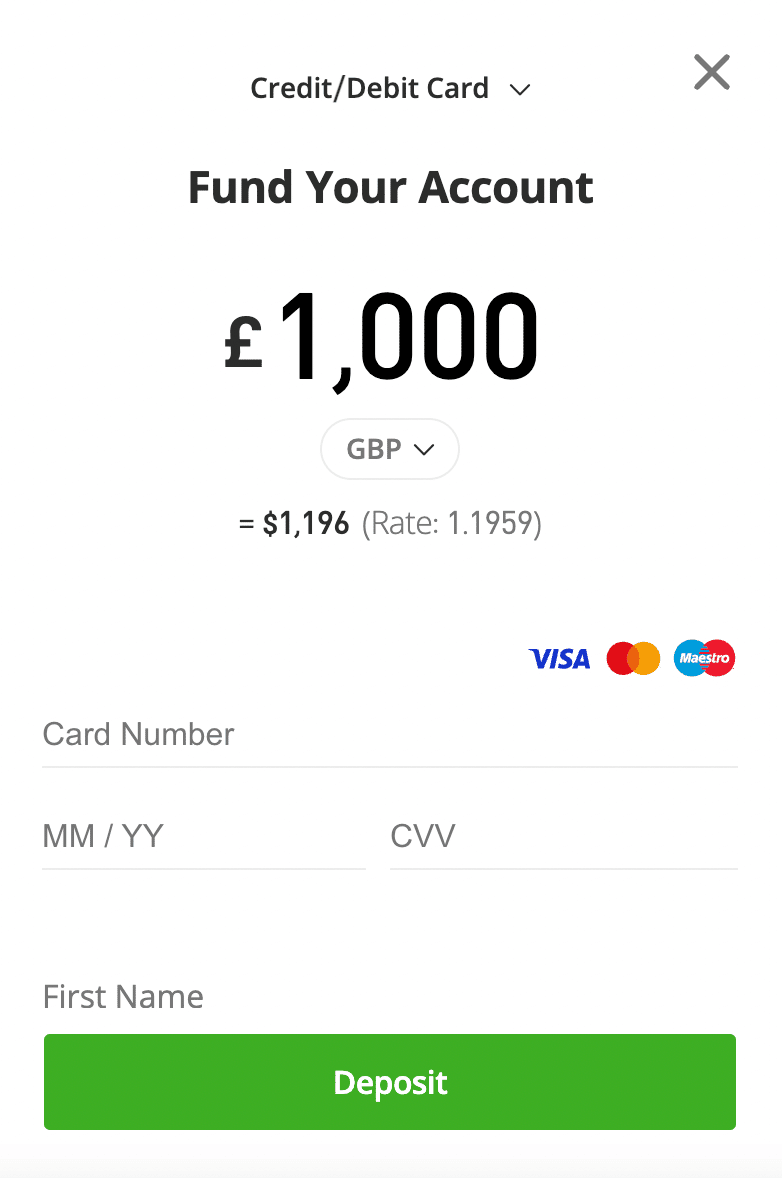

Perhaps one of the main benefits of choosing eToro is that the platform is ideal for buying and selling crypto assets in addition to storing them. For example, eToro requires a minimum deposit and trading order of $10 – which amounts to about £8. Furthermore, UK investors can instantly deposit funds with an e-wallet or debit/credit card at a fee of just 0.5%.

With that said, when making a deposit via the eToro Money crypto app in GBP, the 0.5% FX fee is waivered. Trading fees when buying and selling crypto at eToro amount to 1%. UK investors can also access Smart Portfolios and Copy Trading tools – both of which enable eToro users to invest in the crypto markets passively.

Finally, and perhaps most importantly – eToro is one of the most trusted crypto providers in the UK. As noted above, not only is it FCA-regulated, but eToro is licensed by the SEC, ASIC, and CySEC. Furthermore, the eToro Money crypto wallet itself is regulated by the GFSC. This is one of the many reasons that eToro is now used by more than 25 million clients worldwide.

What We Like About eToro:

- Brokerage platform is regulated by the FCA

- eToro Money crypto wallet is licensed by the GFSC

- Buy and sell Bitcoin and 90+ other crypto assets

- Low fees and support for debit/credit cards and e-wallets

- Passive investment tools – including Copy Trading

- Very user-friendly platform and simple investment process

| No. Cryptos | 90+ |

| Fee Structure | 1% commission, 0.5% deposit fee, 0.1% crypto-to-crypto swap |

| Fee for Sending Bitcoin | Blockchain fee only |

| Mobile App? | Yes, for iOS and Android |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

2. Modeapp – Top Crypto Wallet App for Buying and Storing Bitcoin

Nonetheless, Modeapp is adequately regulated in the UK for investor safety. In downloading the Modeapp application, investors will first need to register an account and pass a quick KYC process. After that, investors will have the option of depositing Bitcoin into their Modeapp wallet address.

We found that in some cases, it can take more than 10 minutes for Bitcoin tokens to arrive. Alternatively, Modeapp is a suitable option for investors that wish to buy Bitcoin in the UK. The app supports deposits via a UK bank transfer which, in most cases, will arrive in the account in less than a minute.

There are no fees to deposit or withdraw funds at Modeapp, which is great. However, UK investors will be charged a commission of 0.99% should they wish to buy Bitcoin. This fee is also charged when selling Bitcoin. Moreover, when withdrawing Bitcoin from Modeapp over to another wallet, this will be charged at 0.0005 BTC.

In terms of core features, Modeapp enables UK investors to buy items online and receive cashback. More than 250+ UK stores support this feature and the cashback rate will vary depending on the purchase. Modeapp also offers a Bitcoin academy, which teaches the ins and outs of crypto and blockchain technology.

What We Like About Modeapp:

- Registered with the FCA

- Best Bitcoin wallet in the UK for free GBP bank transfers

- Transparent fees

| No. Cryptos | 1 |

| Fee Structure | 0.99% commission, free GBP bank transfers |

| Fee for Sending Bitcoin | 0.0005 BTC |

| Mobile App? | Yes, for iOS and Android |

3. Coinbase – User-Friendly Wallet That Connects to an Online Crypto Account

This can be accessed by logging into the Coinbase account via the website or mobile app. In choosing this option, investors will benefit from a full range of security protocols. This includes two-factor authentication, which means that all login attempts require the investor to input a code that is sent to their mobile phone.

Furthermore, if the investor logs into their Coinbase account from a new location or device, a further security step is required. In addition to this, Coinbase claims to keep 98% of client-owned digital assets in cold storage. This means that the funds remain offline at all times – which is a major security safeguard.

The Coinbase web wallet connects to the main investment account, so this makes it seamless to buy and sell digital assets. However, UK investors should be aware of the fees charged by Coinbase – which are high when compared to the industry average. For example, there is a standard commission of 1.49% charged on all buy and sell orders.

Moreover, in order to deposit funds with a UK debit or credit card, an instant buy fee of 3.99% is charged. If this does not put investors off, then Coinbase account holders will have access to more than 100 coins. The platform also supports staking services alongside a marketplace to buy and sell NFTs.

Coinbase also offers a decentralized wallet in addition to its main storage service. This is a self-hosted option, otherwise referred to as custodial. This means that upon setting the wallet up, only the Coinbase user will have access to the private keys. This results in a crypto wallet that is 100% owned and controlled by the investor.

What We Like About Coinbase:

- Best Bitcoin wallet in the UK for self-hosted keys

- Ideal for beginners with no experience in crypto trading

| No. Cryptos | 100+ |

| Fee Structure | 1.49% commission, 3.49% debit/credit card fee |

| Fee for Sending Bitcoin | Blockchain fee only |

| Mobile App? | Yes, for iOS and Android |

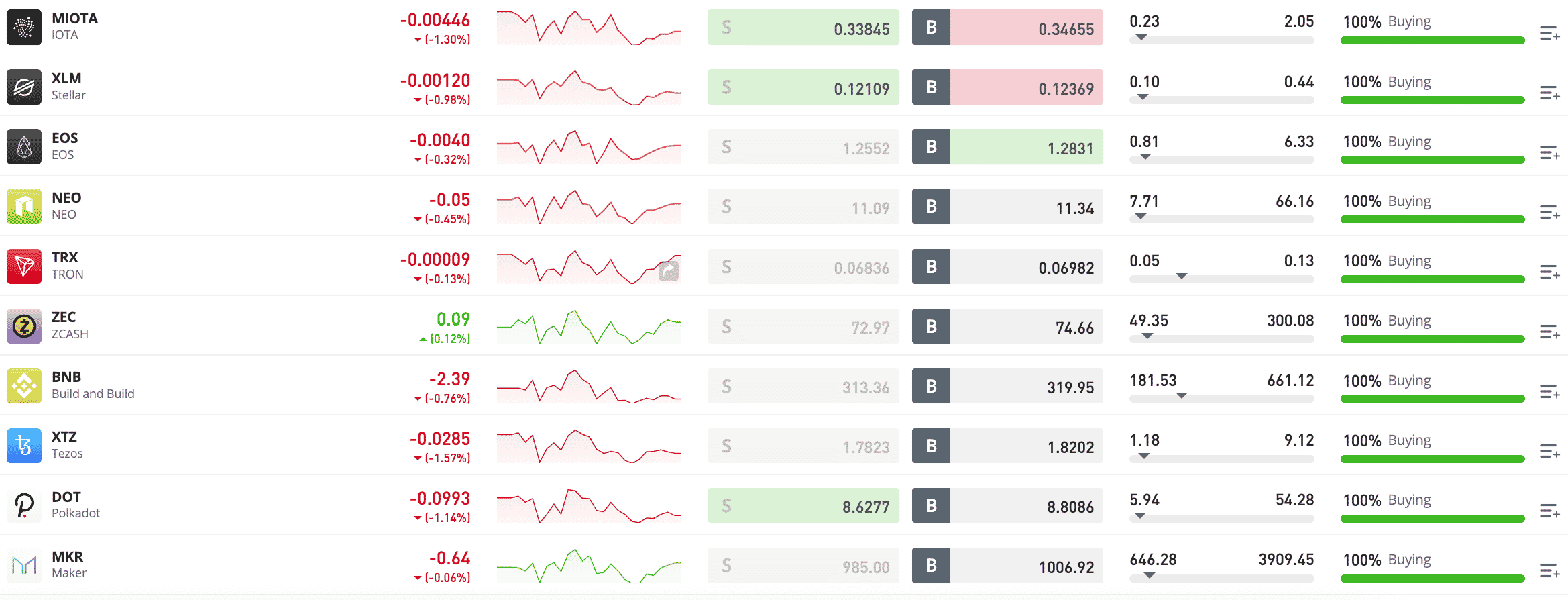

4. Binance – Great Crypto Wallet for Active Traders

For example, we mentioned earlier that Coinbase charges a trading fee of 1.49% on all buy and sell orders. In comparison, Binance charges just 0.10% per slide – and even less when paying fees in the platform’s native token – BNB. Furthermore, Binance charges 1.8% on UK debit/credit card deposits, albeit, this is more expensive than the 0.5% available at eToro.

Nonetheless, Binance is a great wallet provider to consider for market diversity, not least because it hosts more than 600 coins. Binance also comes with ample tools and features to perform technical analysis. In terms of storage options, some Binance investors in the UK will opt for the standard web wallet.

This is protected by two-factor authentication and email/mobile notifications when transactions are conducted. Binance also claims to keep the majority of client assets in cold storage. There is also the SAFU (Safe Asset Fund for Users). This is funded by trading commissions collected by Binance and utilized in the event of an exchange hack.

Investors can access their Binance web wallet by logging into their account online or via the mobile app for iOS and Android. The other option is to download Trust Wallet – which is backed by Binance. This is a decentralized wallet that offers full control over private keys and the subsequent crypto tokens.

More than 25 million use Trust Wallet for its secure and simple interface, and it supports thousands of tokens across multiple blockchain networks. Trust Wallet also connects to decentralized apps like PancakeSwap and Curve. Although Trust Wallet has integrated a debit/credit card purchase feature, this is provided by a third party and thus – expect to pay between 3-5%.

What We Like About Binance:

- Low trading commissions of just 0.1%

- Choose a secure web or DeFi wallet

| No. Cryptos | 600+ |

| Fee Structure | 0.1% commission, 1.8% debit/credit card fee |

| Fee for Sending Bitcoin | 0.0002 BTC |

| Mobile App? | Yes, for iOS and Android |

5. Huobi – iOS and Mobile Trading App That Doubles up as a Wallet

Those planning to use Huobi can store their digital assets via the web wallet or mobile app. Both are connected to the same account and are custodial wallets. This means that Huobi will take full responsibility for the funds. Investors in the UK will appreciate that Huobi has a reserve pot worth 20,000 BTC in the event that the exchange is hacked.

At the time of writing, this amounts to nearly £400 million. Furthermore, Huobi accounts can be secured through two-factor authentication, which can be set up by downloading the Google Authenticator app. When it comes to fees, Huobi charges a standard trading commission of 0.20% to buy and sell crypto assets on its exchange.

UK investors can deposit money via a bank transfer without paying any fees and the minimum funding requirement is just £8. Debit/credit cards are supported too but this is facilitated by Simplex. This third-party provider is known to charge fees of up to 5%, so bank transfers remain the more viable option.

Additional features offered by this exchange and wallet provider include access to DeFi services. This is inclusive of interest accounts and staking, alongside crypto loans that require no credit check. The Huobi platform supports more than 75 coins, most of which are considered large-cap projects.

What We Like About Huobi:

- More than 500+ coins supported

- Custodial wallet backed by 20,000 BTC reserve fund

| No. Cryptos | 500+ |

| Fee Structure | 0.2% commission, debit/credit card fee determined by Simplex |

| Fee for Sending Bitcoin | Not stated |

| Mobile App? | Yes, for iOS and Android |

Other UK Crypto Wallets to Consider

In addition to the five providers reviewed above, UK residents might also consider the following crypto wallets:

- Luno - This simple but popular wallet app enables investors to buy, sell, and store eight different crypto assets. Fees are on the high side, with Luno charging a commission of 1% on all trading orders.

- CEX - This crypto exchange and wallet provider offers one of the best Bitcoin apps in the UK for iOS and Android. Plenty of markets are supported, albeit, the CEX website can be clunky at times.

- Coinjar - This provider offers UK investors the ability to buy crypto from just £10. The digital assets will then be stored in the Coinjar wallet - which is accessible online and via a mobile app.

- Exodus - This wallet supports more than 230 crypto assets and NFT. It comes in the form of both desktop software and a mobile app, alongside integration with the Trezor hardware wallet.

- Electrum - This is one of the oldest Bitcoin wallets in the space - with Electrum first launching in 2011. Electrum is a desktop wallet that is compatible with both Windows and Mac devices.

Comparison Table of the 5 Best UK Crypto Wallets

The table below compares the five best crypto wallets in the UK.

| Crypto Wallet | No. Cryptos | Fee Structure | Fee to Sending Bitcoin | Mobile App? |

| eToro | 90+ | 1% commission, 0.5% deposit fee, 0.1% crypto-to-crypto swap | Blockchain fee only | Yes, for iOS and Android |

| Modeapp | 1 | 0.99% commission, free GBP bank transfers | 0.0005 BTC | Yes, for iOS and Android |

| Coinbase | 100+ | 1.49% commission, 3.49% debit/credit card fee | Blockchain fee only | Yes, for iOS and Android |

| Binance | 600+ | 0.1% commission, 1.8% debit/credit card fee | 0.0002 BTC | Yes, for iOS and Android |

| Huobi | 500+ | 0.2% commission, debit/credit card fee determined by Simplex | Not stated | Yes, for iOS and Android |

When choosing the best Bitcoin wallet in the UK, investors should independently verify the information listed above.

What is a Crypto Wallet? - Overview

The conventional way to store money is in a bank account. The account holder will then have the option of sending and receiving funds and making ATM withdrawals as they see fit. In comparison, crypto assets like Bitcoin and Ethereum are stored in wallets.

The specific wallet will connect to the blockchain network, which enables transfers at the click of a button. The vast majority of crypto wallets are software-based and come in the form of a mobile app or desktop software. Web wallets exist too and these are controlled by a third party - such as a crypto broker or exchange.

There are also crypto hardware wallets that store the digital assets on a physical device that appears somewhat similar to a USB stick. Irrespective of which crypto wallet is chosen, it is important that investors in the UK understand the difference between custodial and non-custodial storage.

Although we explain this in more detail shortly, custodial wallets are controlled by third parties which means that the investor will need to trust that their funds are being kept safe. In comparison, non-custodial wallets are controlled by the investor and this ensures that the individual has access to their private keys.

Private keys are essentially a password that proves ownership of a crypto wallet. Anyone who has knowledge of the private keys can therefore access the wallet in question. This is why investors must have a firm grasp of security controls when opting for a non-custodial wallet.

Another thing to note about crypto wallets is that they generate public addresses. This is not too dissimilar to a bank account number and sort code. The reason for this is that the public address enables the wallet to receive funds. Unlike a private key, public addresses do not give access to the wallet.

How do Crypto Wallets Work?

UK residents venturing into the crypto space for the first time should have a firm grasp of how wallets work. This will ensure that a suitable option is selected when deciding on the best crypto wallets in the UK.

Wallet Address

All crypto wallets have a public address attached to them. As we briefly mentioned above, a wallet address is similar to a UK bank account number and sort code - as is required when receiving funds.

For instance, if the investor wishes to send Bitcoin from a crypto exchange over to a private wallet, they would be required to input the destination address.

Here is an example of what a crypto wallet address looks like:

3FZbgi29cpjq2GjdwV8eyHuJJnkLtktZc5

Now, unlike a bank account number and sort code, crypto wallet addresses are public information. This is because of the blockchain ledger, which is accessible by all.

This means that while nobody can access a wallet simply by having the public address, information concerning the funds being stored is readily available.

For example, by inputting the above address into a website like Blockchain.com - we can see that the wallet currently contains $360 worth of crypto tokens.

With this in mind, those seeking to keep their crypto investments private should refrain from handing out their wallet address unless absolutely necessary.

Private Keys

We also mentioned earlier that all crypto wallets come with private keys. Whether or not the investor has access to the private keys will ultimately depend on whether they opt for a custodial or non-custodial wallet - which we explain in more detail shortly.

Nonetheless, whoever knows the private key will have access to the wallet no matter where they are located. As a result, investors should never share their private keys with anyone.

For illustrative purposes, a private key could look like the following:

E9873D79C6D87DC0FB6A5778633389_SAMPLE_PRIVATE_KEY_DO_NOT_IMPORT_F4453213303DA61F20BD67FC233AA33262

The good news is that there is no longer a requirement to write down the private key of a wallet, as most providers in this space offer a backup passphrase. As we cover shortly, this offers a more user-friendly way to keep crypto wallets safe.

Wallet Password

All wallets will come with a password of some sort and this can be represented in many different ways. For example, if using a web wallet via an exchange or broker, access is only granted by logging into the account with a username and password.

If opting for a mobile wallet, the investor can often log in by typing in a PIN or through fingerprint/face ID. Either way, this ensures that access to the wallet is protected, albeit, investors in the UK should ensure that a strong password is chosen.

Backup Passphrase

We mentioned above that a backup passphrase is a more user-friendly representation of a private key. When setting up a crypto wallet, most providers will display the backup passphrase via a string of words.

This is often 12 words but can be longer depending on the wallet provider. Either way, if the investor forgets their password or loses the device that the wallet is stored on, access can be recovered remotely through the backup passphrase.

Once again, as the backup passphrase is essentially the private key, investors must never share this with anyone. In fact, the backup passphrase should be written down on a piece of paper and stored somewhere safe.

Receiving Funds

Once the wallet has been set up, the investor will need to fund it with crypto tokens. As we mentioned earlier, the funds will need to be sent to the public address that is associated with the wallet.

An unlimited number of addresses can be created by the investor and each one can be accessed from the same wallet. In terms of how long it takes for the fund to arrive, this varies depending on the underlying blockchain network.

For example, Bitcoin transactions usually take 10 minutes to arrive, while in the case of Ethereum, this typically takes less than 60 seconds.

Either way, once the transaction is validated by the blockchain, the crypto assets will appear in the wallet.

Sending Funds

In order the send crypto assets to another wallet, the process is largely the same as receiving funds - but in reverse. The investor simply needs to paste the destination address into the wallet before confirming the transfer.

Blockchain Fees

Another important factor to understand when searching for the best crypto wallet in the UK is that transactions are confirmed by 'miners'.

Put simply, anyone can become a miner and by contributing their excess computing power, rewards are paid in the crypto token that backs the respective blockchain network.

This is relevant to the discussion of crypto wallets as when sending funds to another location, this will attract a fee. The size of the transaction fee will depend on various factors - such as the underlying blockchain and how busy the network is.

There are no fees payable when receiving funds in a crypto wallet.

Do You Need a Wallet When Investing in Crypto?

On the one hand, the only way to send, receive, and store crypto assets is by having access to a wallet. This is because the wallet will form the crucial bridge between users and the blockchain network.

However, whether or not UK residents actually need a crypto wallet will depend on the individual requirements and objectives of the investor.

- For example, if the investor is simply looking to buy crypto assets like Bitcoin or Ethereum, they can do so at an FCA-regulated broker like eToro without needing a wallet.

- This is because upon completing the purchase, the crypto assets will be safeguarded by eToro on behalf of the investor.

- This means that the investor can access their crypto assets simply by logging into their eToro account.

- Furthermore, when it comes to cashing out the crypto assets back to GBP, this can be achieved at the click of a button via the account portfolio.

On the other hand, some will invest in crypto assets because they want to retain full control over their personal wealth. In this scenario, a web wallet managed by a crypto exchange or broker will not suffice.

On the contrary, the investor will need to consider downloading a non-custodial wallet that offers full control over the funds and private keys.

Another thing to mention is that investors choosing to use an unregulated exchange to purchase a specific crypto asset will also likely want to withdraw the tokens out of the platform and into a private wallet.

This will avoid the need to trust a crypto exchange that does not take regulation seriously.

Different Crypto Wallets - Compare Bitcoin Account Options

Now that we have discussed the ins and outs of how crypto wallets work, we can explore the many different options available in this marketplace.

Let's start with software wallets.

Software Crypto Wallets

The most commonly used crypto wallet comes in the shape of a software application.

This covers the three main wallet types -

- Mobile App - Those in the hunt for the ideal balance between safety and convenience might consider a mobile crypto wallet. This will come in the form of a mobile app that is protected by a PIN, albeit, some providers support fingerprint and face ID too. By opening the app, the user will be able to send and receive, crypto at the click of a button.

- Desktop Software - A small number of crypto wallets come in the form of desktop software. This option is, however, more suited to developers that need direct access to the blockchain ledger.

- Web Wallet - When storing crypto assets at an exchange or broker, the investor will be using a web wallet. Access is granted simply for logging into the respective account. However, the exchange or broker will retain ownership of the wallet's private keys.

Hardware Crypto Wallets

The safest way to store crypto assets in the long term is via a Bitcoin hardware wallet. The two leading providers in this space are Ledger Nano and Trezor - both of which offer a physical wallet that stores the private keys on the device itself.

The hardware wallet will come with a public address, which is how the investor will receive their funds. However, in order to send funds out of the wallet, the investor will need to physically enter their chosen PIN onto the device.

This means that without having direct access to the device, the investor will not be able to send funds. Hardware wallets also come with a backup passphrase, which will be required in the event the device is lost, stolen, or damaged.

From pretty much any software wallet, the investor would be able to recover their funds via the backup passphrase.

As is evident, the best crypto hardware wallets are suitable for long-term investors that do not plan on sending or receiving funds on a regular basis.

Paper Crypto Wallets

Paper crypto wallets offer a rock-solid way to securely store digital assets in the long run. Just like hardware wallets, this option will not be suitable for those that wish to regularly send and receive funds.

The reason for this is that paper wallets remain offline at all times. In most cases, the backup passphrase or a QR code of the private keys will be printed on a sheet of paper and then stored somewhere safe.

If the investor wishes to access the funds, they will need to import the backup passphrase or private keys onto a software wallet.

Top Tips on Selecting the Best Cryptocurrency Wallet in the UK

To ensure that investors in the UK select the right wallet for their personal requirements and objectives, it is important that plenty of independent research is undertaken.

We found that when searching for the best crypto wallet in the UK, the following factors should be taken into consideration:

Custodial or Non-Custodial

The most important decision that crypto investors in the UK will need to make is whether to opt for a custodial or non-custodial wallet.

As noted earlier, a custodial wallet will mean that the respective crypto assets are managed and safeguarded by a third party. This option should only be selected if the custodial provider meets some core minimum requirements.

- For example, as is the case with eToro, the custodial wallet provider should be regulated - preferably by the FCA.

- Moreover, the provider should keep the vast majority of client funds in cold storage wallets and offer security tools like two-factor authentication.

Those wishing to retain full control over their private keys will instead need to opt for a non-custodial wallet.

But, just remember, in the event that the private keys are lost or compromised - there will be no way to regain access to the wallet - or any of the crypto assets stored within it.

Device to Store the Wallet

Another key decision that investors will need to make when choosing the best crypto wallet in the UK is the specific device that it will be stored on.

As we noted earlier, mobile wallets are convenient in this regard, as the crypto assets can be accessed simply by loading up the app. The mobile app will be protected by a PIN or fingerprint/face ID.

Other options include a hardware or desktop wallet. Alternatively, investors might consider a web wallet offered by a regulated broker like eToro.

Supported Coins

Each crypto wallet will support one or more blockchain networks. For instance, Modeapp only supports Bitcoin, meaning that those investing in other crypto assets like Ethereum or Dogecoin will need to use another wallet.

This is why it is best to choose a multi-currency wallet that supports lots of different blockchains.

User Experience

The best crypto wallets in the UK offer a superb user experience. Investors of all skill levels should be able to access the wallet seamlessly, as well as send and receive funds without needing any prior knowledge of how crypto works.

Using a crypto wallet that offers a sub-par user experience can result in costly mistakes being made.

Fees

Unless buying a hardware device like Ledger Nano or Trezor, software wallets are typically free to download and maintain. The only fee that should come into play is the cost of sending funds.

Some wallet providers - such as eToro and Coinbase, only charge the respective blockchain fee at the time of the transfer. This means that the providers do not add a mark-up.

On the other hand, providers like Modeapp and Binance charge a fixed fee to send funds - irrespective of how busy the respective blockchain network is. This stands at 0.0002 BTC and 0.0005 BTC, respectively.

Exchange Tools

The best crypto wallets in the UK offer more than just a storage service. On the contrary, providers like eToro and Modeapp enable investors to buy and sell crypto directly.

Moreover, eToro goes one step further by offering support for instant token swaps across 500 different crypto pairs. This would enable the investor to swap Bitcoin for Ethereum, for instance, at the click of a button.

Just remember, if the chosen wallet supports crypto purchases in GBP, then the investor will need to go through a KYC process by uploading some ID.

How to Get a Crypto Wallet in the UK

Setting up a Bitcoin account via a UK crypto wallet is relatively simple, albeit, the process will vary depending on the provider.

To offer some insight into how the process works, the sections below explain how to get set up with the eToro Money crypto wallet in under five minutes.

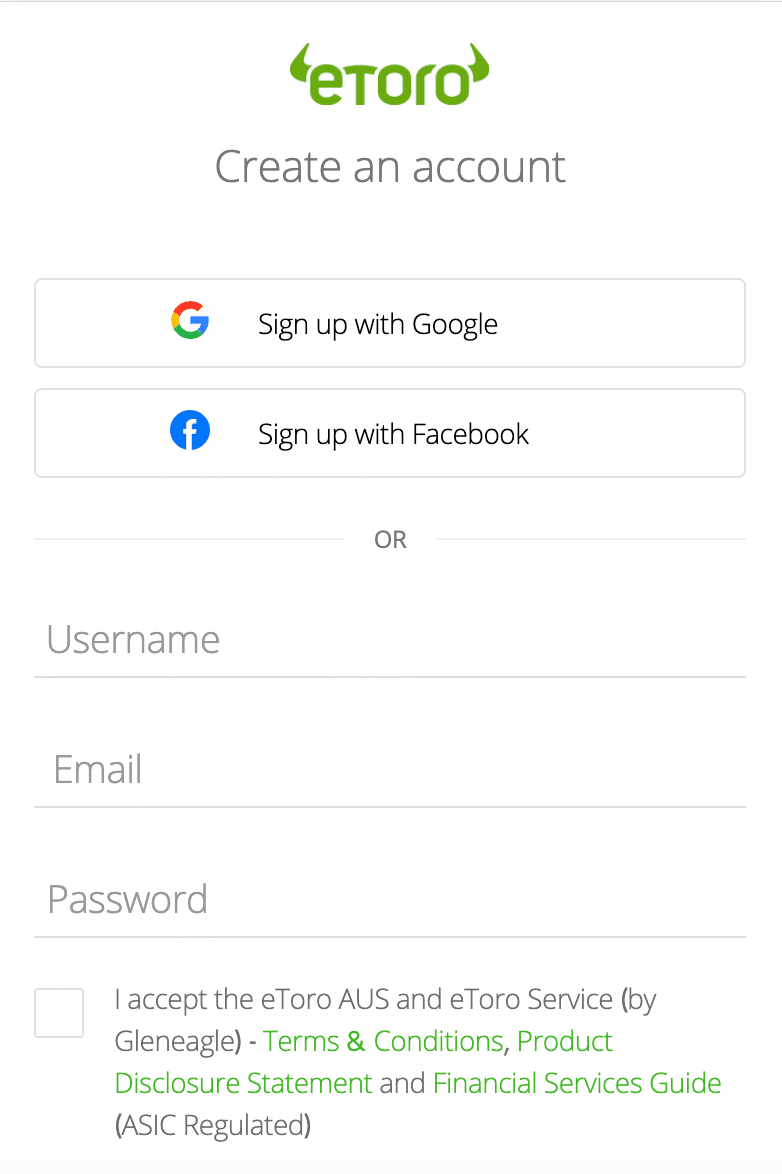

Step 1: Open an Account With eToro

eToro is a regulated broker with an FCA license, so all wallet users must register an account with the platform.

This can be achieved in a matter of minutes by visiting the eToro website and entering an email address and a preferred username and password.

As per KYC regulations, the investor will need to provide eToro with some personal information and contact details. Moreover, eToro will also require a copy of the investor's driving license or passport - which will be validated instantly.

Step 2: Download the eToro Money Crypto Wallet App

After opening a verified account with eToro, the investor will now have unfettered access to all wallet and trading services.

As such, the next step is to download the eToro Money crypto app.

The app is compatible with iOS and Android smartphones and is free to download and install.

Step 3: Deposit Funds Into the eToro Money Crypto Wallet

By installing the eToro Money crypto wallet app for the first time, the Bitcoin account balance will be empty. In order to fund the wallet, the investor has two options:

Deposit Crypto

if the investor already owns digital assets in another location, they can transfer the funds over to the eToro Money crypto wallet.

- First, copy the wallet address that is associated with the respective crypto asset. In other words, if the investor wishes to deposit BTC tokens, they will need to copy their online Bitcoin wallet address.

- Next, head over to the location (e.g. external wallet or exchange) where the crypto assets are located. Elect to make a transfer by specifying the amount and pasting the eToro Money crypto wallet address.

- Confirm the transfer, and wait for the funds to arrive in the eToro wallet.

Deposit GBP and Buy Crypto

Those without any digital assets to transfer can deposit GBP into the eToro Money crypto wallet and subsequently make a purchase across 90+ different coins:

- Choose a suitable payment method from the list of options. Debit/credit cards and e-wallets are preferred by eToro investors, as the payment will be processed instantly.

- The minimum deposit is $10 (about £8) and when using the eToro Money crypto wallet app, no fees are charged on GBP payments

- After making a deposit, choose the crypto to buy and confirm the amount

Step 4: Send Funds From the eToro Money Crypto Wallet

Should the investor wish to transfer funds from the eToro app into another wallet, the process can be completed as follows:

- Open the eToro Money crypto wallet and under the 'Crypto' tab, click on the digital asset to send.

- Next, click on the 'Send' button and paste in the destination wallet address.

- eToro will send an SMS code to the investor's registered mobile number.

- After confirming the code, eToro will execute the transfer.

As noted above, eToro only charges the respective blockchain fee when making transfers out of its wallet.

Conclusion

Crypto wallets form the crucial bridge between investors and the blockchain network. At a minimum, crypto wallets enable investors to store, send, and receive digital assets.

However, top crypto wallets in the UK offer additional features and benefits - such as being able to buy, sell, and swap digital assets at the click of a button.

We found that the overall best option to consider today for both security and convenience is the eToro Money crypto app.

Put simply, the app enables UK investors to safely store digital assets while at the same time - having access to exchange and trading services. Plus, GBP deposits made into the eToro Money crypto app are processed fee-free.