Best Crypto Exchange in the UK – Compare Top Bitcoin Exchanges

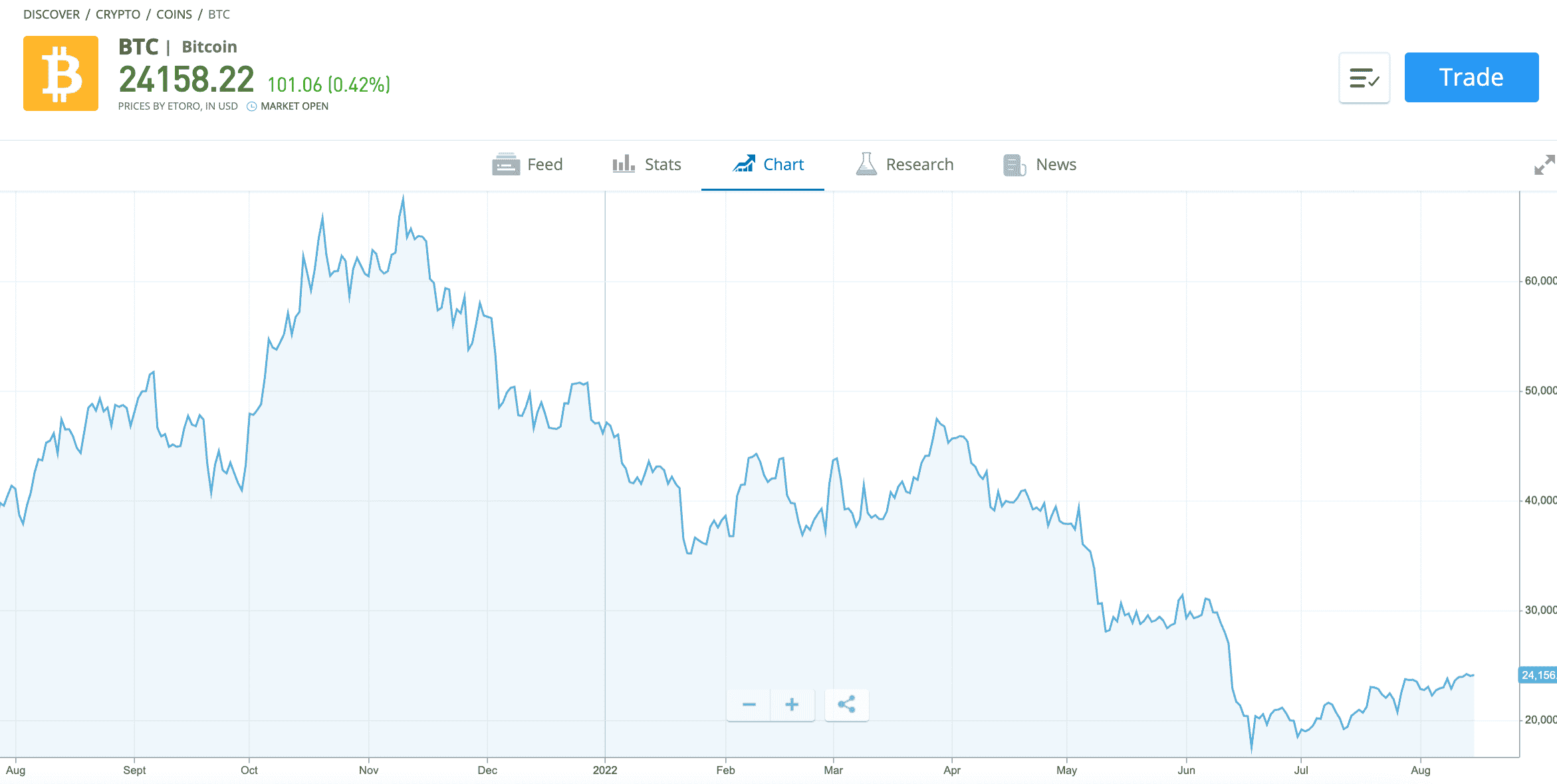

The Bitcoin and wider cryptocurrency scene continue to grow traction in the UK market. Those wishing to invest in digital currencies for the first time will need to do so via an online exchange.

The purpose of this guide is to compare the best crypto exchanges in the UK market today. In order to do this, we compare key metrics surrounding regulation, fees, supported coins, usability, and more.

List of the Best Crypto Exchanges in the UK

The results of our findings are highlighted below – where we list the 10 best crypto exchanges in the UK.

- eToro – Overall Best Crypto Exchange in the UK

- Crypto.com – Great Crypto Exchange for GBP Bank Payments

- Binance – Low-Commission Crypto Exchange With 600+ Coins

- Bitstamp – Established Crypto Exchange With Low Fees for Casual Traders

- Coinbase – User-Friendly Crypto Exchange

- Huobi – Crypto Exchange That Supports More Than 500+ Coins

- Kraken – Advanced Trading Tools and Solid Mobile App

- Coinjar – Start Buying Crypto in Minutes With Just £10

- Luno – One of the Best Crypto Exchange Apps

- Gemini – Secure Crypto Exchange With a Range of Products and Services

To select the best crypto exchange in the UK, investors are advised to read our in-depth reviews.

Comprehensive Reviews of the 10 Best Bitcoin Exchanges in the UK

The reviews outlined below showcase the 10 best crypto exchanges in the UK.

We discuss important factors surrounding listed crypto markets and fees, safety, customer service, trading tools, and more.

1. eToro – Overall Best Crypto Exchange in the UK

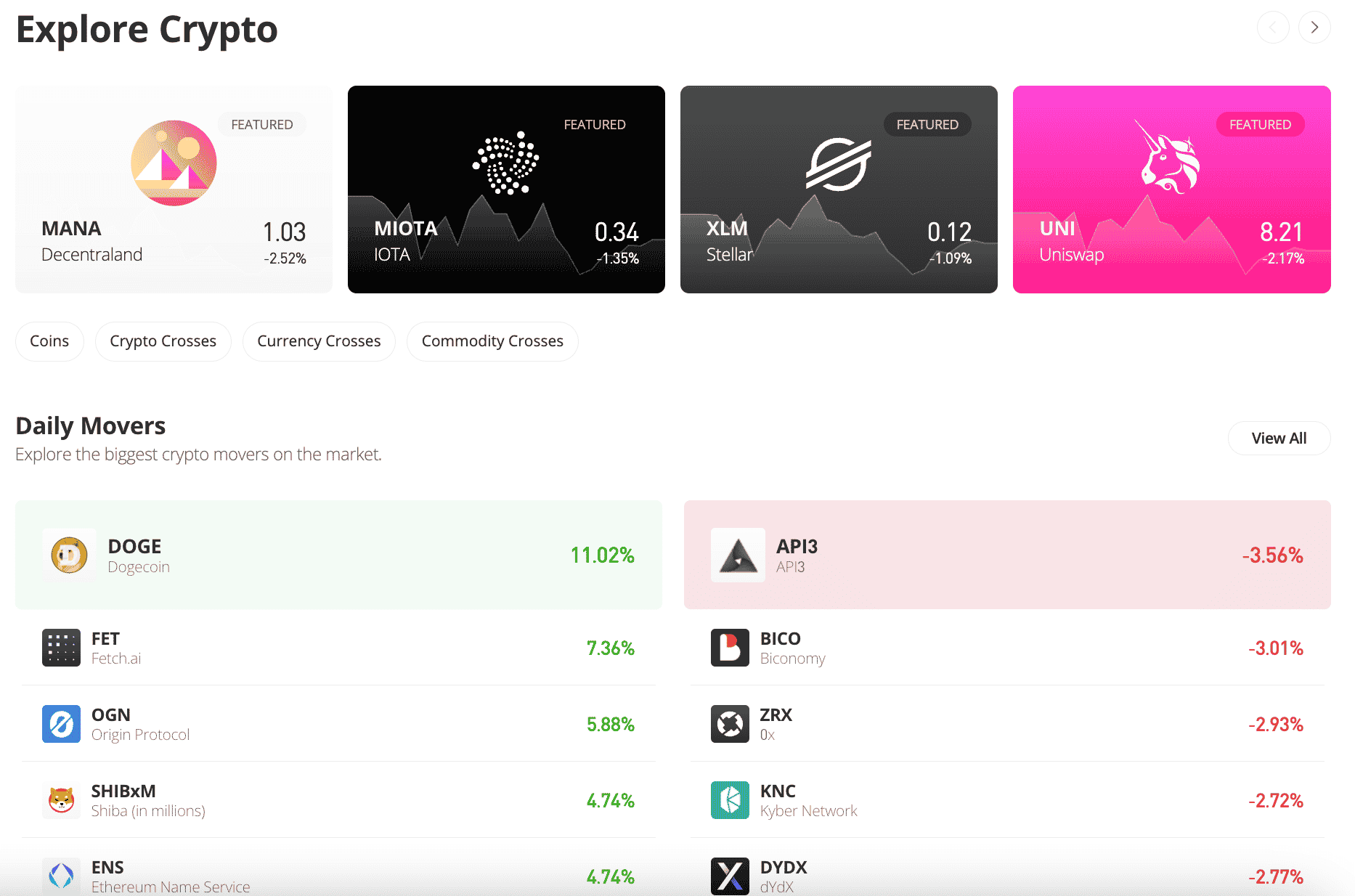

Metaverse projects like the Sandbox, My Neighbor Alice, and Decentraland are supported too, alongside DEX tokens such as Uniswap and SushiSwap. When buying and selling crypto assets on the eToro platform, UK investors will pay a standard fee of 1% – irrespective of the token.

Moreover, investors in the UK can easily make a deposit into their eToro account. Accepted payment methods include everything from Paypal and Skrill to debit/credit cards and UK bank transfers. The minimum first-time deposit for UK investors is just $10 (about £8).

The minimum crypto trade requirement also stands at $10 – which will suit those on a budget that wish to invest in high-value tokens such as Bitcoin, Ethereum, and Yearn.Finance. eToro also offers a free crypto wallet that comes packed with institutional-grade security tools. This is a web wallet, so access is granted simply by logging into the eToro account.

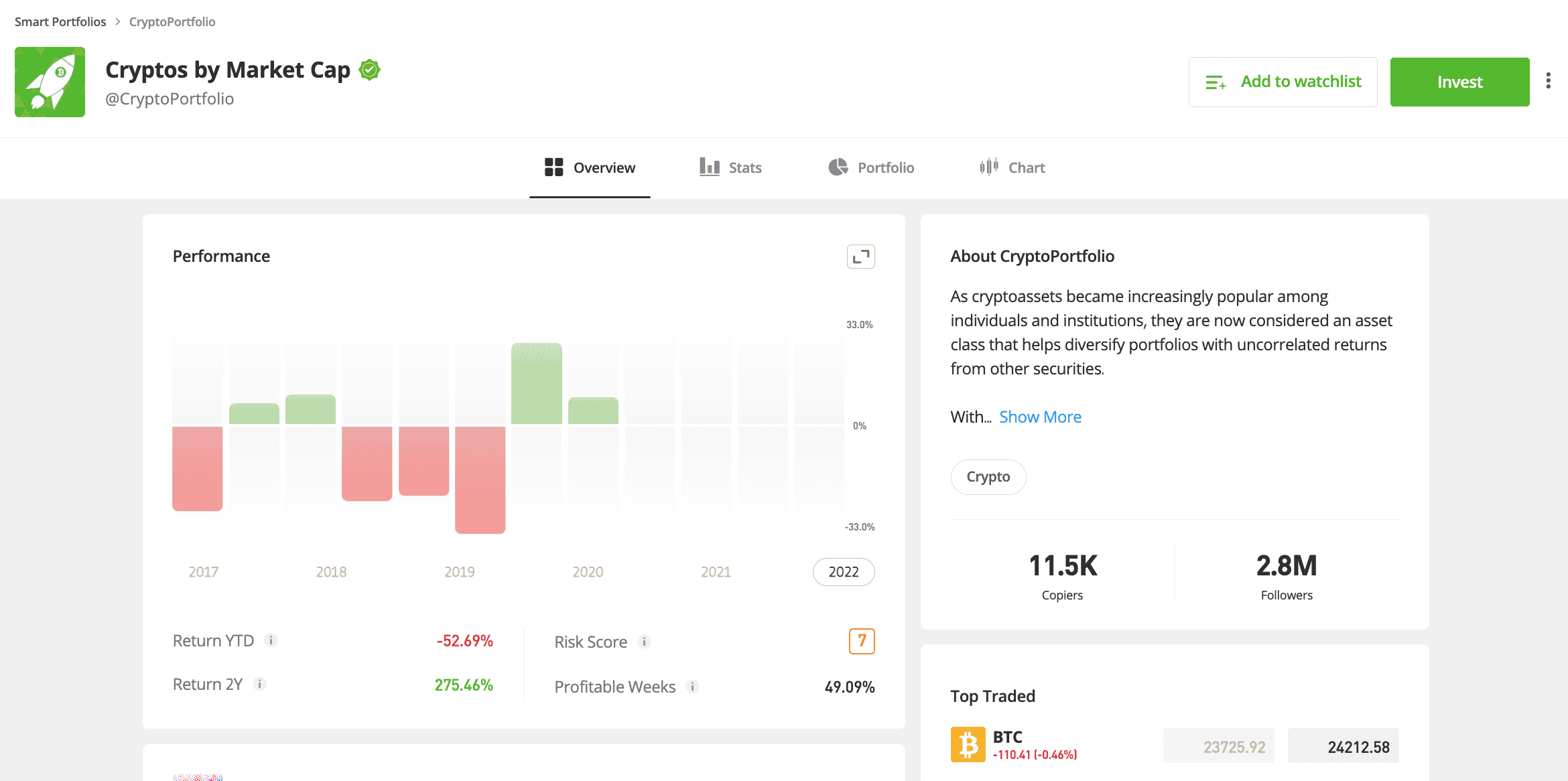

Alternatively, eToro also offers a crypto wallet for iOS and Android devices via a user-friendly crypto app. In addition to storing crypto, this wallet enables users to swap one token for another at the click of a button. Another interesting feature that we came across at eToro is its Smart Portfolios.

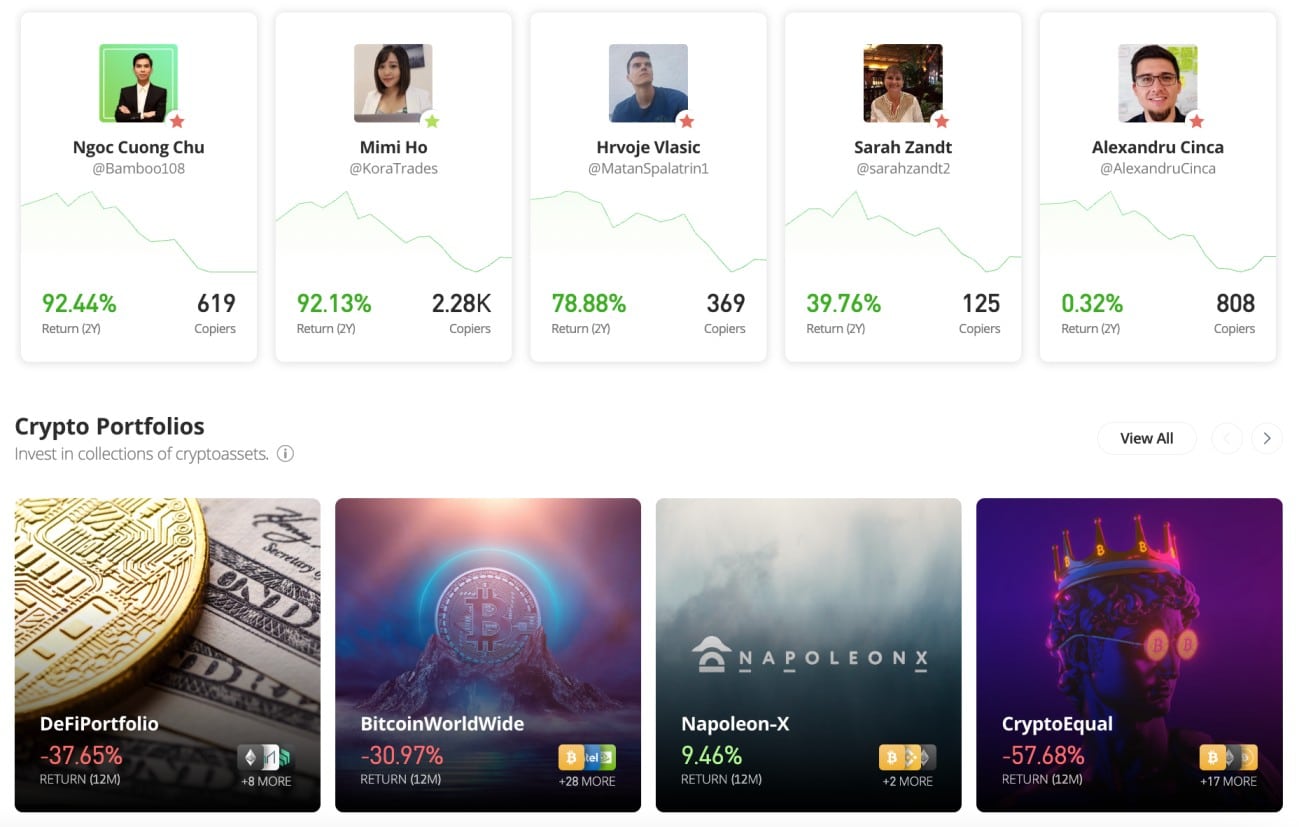

This enables UK investors to gain exposure to a wide basket of crypto assets through a single trade. The respective basket will be rebalanced by eToro regularly to align with the objectives of the Smart Portfolio. Those wishing to actively trade crypto passively can consider the Copy Trading tool.

As the name implies, this allows eToro users to select a seasoned investor to copy, and all future investments will be mirrored automatically. We should also note that in addition to crypto, eToro offers access to thousands of stocks and ETFs. This includes more than a dozen stock exchanges – both in the UK and internationally.

eToro also offers forex, commodities, and indices. Traders in the UK will be pleased to know that eToro is authorized and regulated by the Financial Conduct Authority (FCA). Additional regulation comes from licensing bodies located in the US, Cyprus, and Australia. eToro is now used by more than 25 million clients globally.

What We Like About eToro:

- Regulated by the FCA, CySEC, and ASIC

- One of the best Bitcoin brokers UK with low fees

- Buy Bitcoin and 90+ other crypto assets

- Low fees and support for debit/credit cards and e-wallets

- Passive investment tools – including Copy Trading

- Very user-friendly platform and simple investment process

| No. Cryptos | 90+ |

| Fee to Buy Crypto | 1% commission, 0.5% deposit fee |

| Proprietary Wallet? | Yes |

| Top 3 Features | FCA-regulated, low fees, perfect for beginners |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

2. Crypto.com – Great Crypto Exchange for GBP Bank Payments

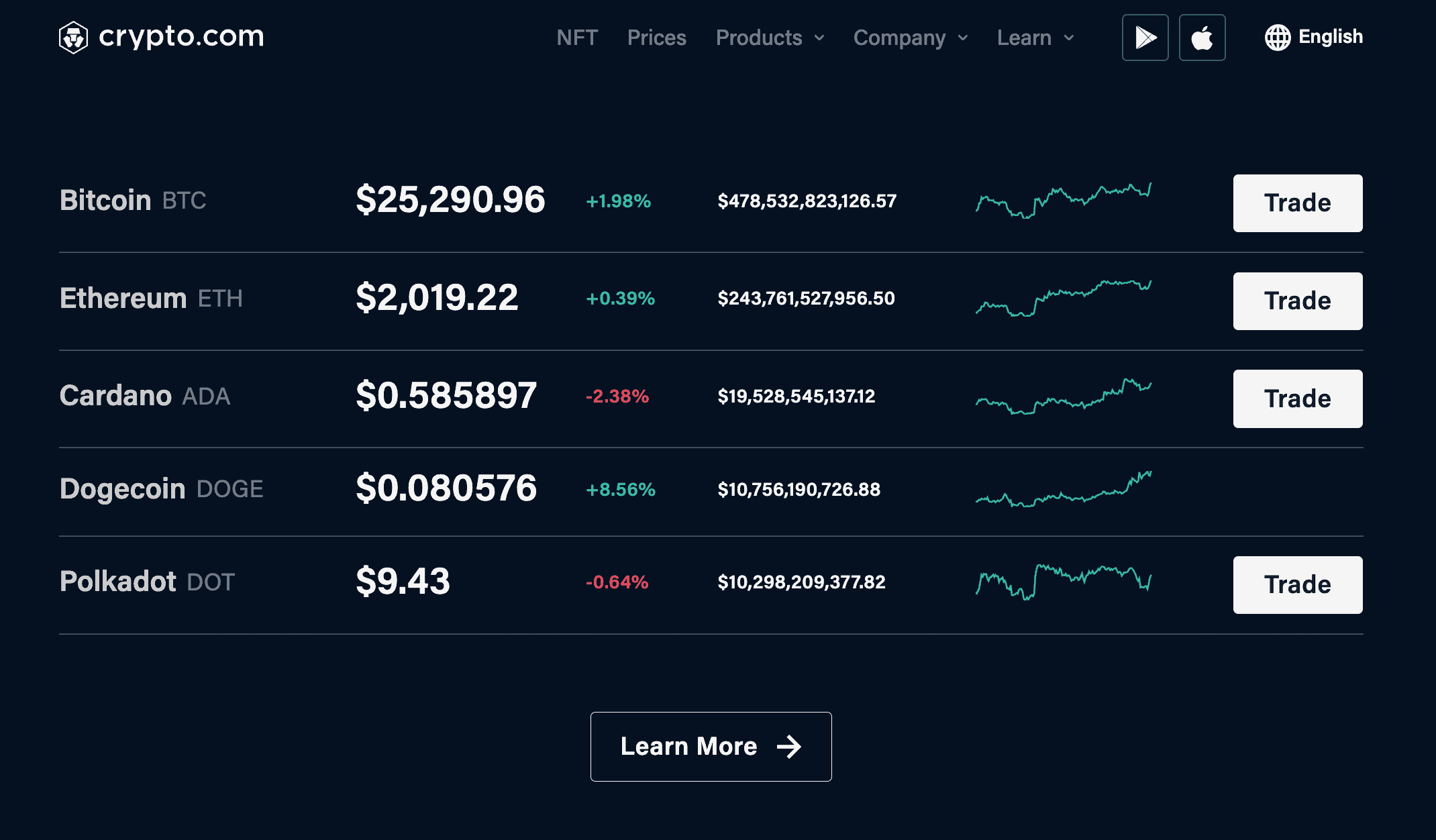

However, do note that when using a debit card at Crypto.com a fee of 2.99% is applied to the transaction. Instead, a much more cost-effective option is to transfer funds from a UK bank account. In doing so, no fees will be charged on the deposit.

Once the Crypto.com account has been funded with pounds and pence, UK investors can then proceed to buy digital assets at a fee of just 0.40% per slide. On a purchase of £1,000, for example, this would amount to a commission of just £4. For larger investments, Crypto.com offers reduced pricing.

One of the best features offered by Crypto.com is its support for interest accounts. Across dozens of digital assets, UK investors can earn interest simply by HODLing. The maximum APY on offer is 14.5%, albeit, this will vary depending on several factors. For instance, the highest APYs are offered when investors opt for a three-month lock-up term.

However, one-month and flexible terms are available nonetheless. Furthermore, in order to get the best APY on offer, investors will need to stake CRO. This is the native digital asset of the Crypto.com ecosystem. Another option to consider when trading on this exchange is the Crypto.com credit facility.

In a nutshell, this offers long-term holders the opportunity to receive an instant credit line worth 50% of the collateral put forward. Another top-rated feature offered by Crypto.com is its Visa-backed debit cards. By owning a Crypto.com card, investors in the UK can make purchases with digital assets – but in the real world.

This even includes the ability to withdraw cash from an ATM. Many investors in the UK will opt for the Crypto.com app when buying and selling digital assets. The app – which is compatible with both Android and iOS, offers 24/7 access to the crypto markets. Moreover, in order to use a debit/credit card to buy digital assets, this needs to be processed via the app.

What We Like About Crypto.com:

- Free GBP deposits via a UK bank transfer

- Buy Bitcoin with a debit card

- Mobile app supports instant debit/credit card payments

- More than 250 crypto assets supported

- Earn interest on Bitcoin deposits

| No. Cryptos | 250+ |

| Fee to Buy Crypto | 0.4% commission, 2.99% debit card fee |

| Proprietary Wallet? | Yes |

| Top 3 Features | Bitcoin interest accounts, 250+ markets, Low fees |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

3. Binance – Low-Commission Crypto Exchange With 600+ Coins

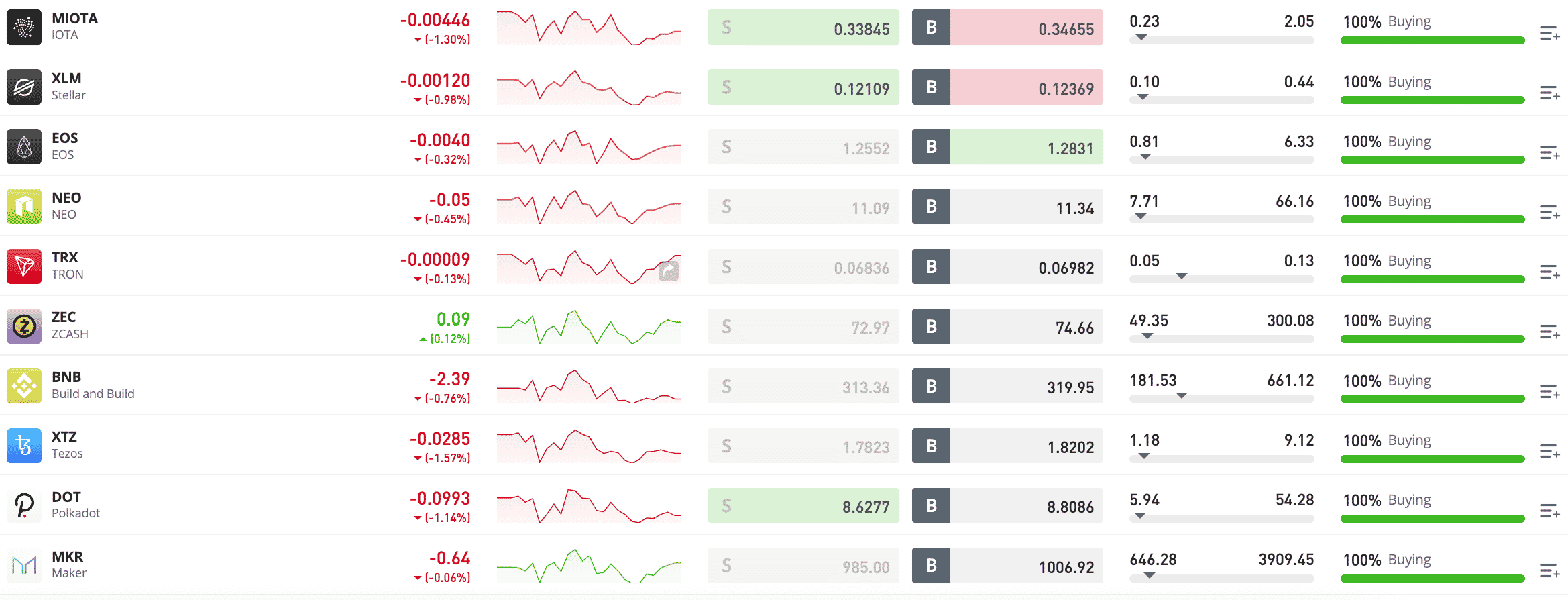

As a result, it is often the go-to place for day traders that seek active markets. By opening an account with Binance, investors in the UK will have access to no less than 600+ crypto assets. This covers both crypto-fiat (e.g. BTC/GBP) and crypto-cross pairs (e.g XRP/BNB) – so traders have access to a wide variety of markets.

Moreover, Binance is often considered one of the cheapest crypto exchanges in the UK, not least because the maximum commission charged is just 0.10%. This would result in a commission of just £1 for every £1,000 traded. Binance is able to offer such low commissions because of the sheer amount of volume that it attracts each and every day.

Moving on to payments, UK investors have the option of making a deposit via a standard debit or credit card at a fee of 1.8%. The minimum card payment at Binance is £15. The other option is to transfer funds from a UK bank account. This can be achieved on a near-fee-free basis, as bank deposits cost just £1.

Binance offers plenty of trading tools to keep seasoned investors interested. This includes integration with TradingView, meaning access to dozens of economic indicators and chart drawing tools. Binance also offers a range of DeFi services, such as staking and yield farming, in addition to crypto interest accounts.

Mobile traders are also catered for through the Binance app for iOS and Android. Although it must be said, the app does not offer anywhere near the same number of products as the main Binance website. Nonetheless, having access to the Binance app at the click of a button will ensure that investors never miss a market opportunity.

What We Like About Binance:

- Low trading commissions of just 0.1%

- More than 600 altcoins supported in addition to Bitcoin

| No. Cryptos | 600+ |

| Fee to Buy Crypto | 0.1% commission, 1.8% debit card fee |

| Proprietary Wallet? | Yes |

| Top 3 Features | Free UK bank transfers, 0.1% commission, 600+ coins |

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

4. Bitstamp – Established Crypto Exchange With Low Fees for Casual Traders

Anything above this figure, within the respective 30-day period, will attract a commission of 0.30%. At just £3 for every £1,000 traded, this is still competitive. Moreover, as trading volumes increase, commissions are reduced. With that said, Bitstamp is expensive when it comes to making a deposit with a debit or credit card.

Put simply, UK investors will pay a 5% transaction charge on Visa and MasterCard payments. That’s £50 for every £1,000 deposited. Fortunately, Bitstamp has since begun offering fee-free deposits via UK bank transfers. Oftentimes, the transfer will be credited to the Bitstamp account on the same working day.

The minimum deposit at Bitstamp is just £10, and bank withdrawals are charged a flat fee of £2. In addition to offering a low commission structure, Bitstamp is also popular for its support of more than 75 crypto assets. Taking into account its £10 minimum trade size, a deposit of £100 would permit diversification into 10 different projects.

In terms of safety, although Bitstamp is not regulated by the FCA, it does have a solid reputation that now spans more than a decade. Moreover, the exchange keeps 98% of client digital assets offline in cold. Finally, Bitstamp – just like Binance, might appeal more to experienced investors. Its trading suite offers plenty of technical indicators, reliable order execution, and support for APIs.

What We Like About Bitstamp:

- Established in 2011

- 98% of coins are kept in cold storage wallets

| No. Cryptos | 75+ |

| Fee to Buy Crypto | From 0% commission, 5% debit card fee |

| Proprietary Wallet? | Yes |

| Top 3 Features | Established in 2011, 98% of coins are kept in cold storage, no commissions for 30-day volumes of under $1,000 |

5. Coinbase – User-Friendly Crypto Exchange

Moreover, when buying crypto on the Coinbase website, the funds are protected by a variety of security tools. This includes mandatory two-factor authentication, 98% of client digital funds being held in cold storage, and device whitelisting. The latter requires an extra security step in the event that account holders attempt to log in from a new laptop or phone.

In addition to offering top-level security, Coinbase is home to more than 100+ crypto assets. Unfortunately, however, trading crypto assets at Coinbase is far from cheap. For orders above $200 (about £160), a commission of 1.49% is charged. For orders below $200, a flat rate kicks in – depending on the specific transaction size.

Another issue with Coinbase is that debit and credit card transactions attract a fee of 3.99%. UK bank transfers are supported fee-free, albeit, expect to wait 1-3 days for the money to clear in the Coinbase account. Paypal payments are supported too but again – this will be charged at 3.99%.

Nevertheless, Coinbase offers a decentralized app that doubles up as a crypto wallet. This means that users can retain full control over the crypto assets and the subsequent private keys. There is also the ability to stake crypto at Coinbase, in addition to applying for a crypto-backed Visa debit card.

What We Like About Coinbase:

- One of the best crypto exchanges for beginners

- Secure wallet for storing Bitcoin

| No. Cryptos | 100+ |

| Fee to Buy Crypto | 1.49% commission, 3.99% debit card fee |

| Proprietary Wallet? | Yes |

| Top 3 Features | Newbie-friendly, top security, 100+ coins |

6. Huobi – Crypto Exchange That Supports More Than 500+ Coins

And the latter – Huobi lists more than 500 coins across both fiat-crypto and crypto-cross pairs. The exchange supports lots in the way of charting tools and technical indicators, which includes integration with TradingView. Investors can also access DeFi tools at the click of a button – such as staking and interest accounts.

Huobi enables UK investors to open an account in less than five minutes and after uploading some ID, deposits can be made with a debit or credit card. However, this will be processed by Simplex – a third-party provider that charges up to 5% of the transaction. Instead, UK investors might consider making a bank transfer on a fee-free basis.

The minimum deposit when opting for a bank transfer is just £8. Investors will appreciate that Huobi has a reserve fund of 20,000 BTC to cover the impact of a potential hack. This is a responsible move, as some of the largest exchanges globally have witnessed at least one remote hacking attempt that has resulted in clients losing funds.

What We Like About Huobi:

- More than 500+ coins supported

- Lots of trading features and analysis tools

| No. Cryptos | 500+ |

| Fee to Buy Crypto | 0.2% |

| Proprietary Wallet? | Yes |

| Top 3 Features | Free GBP bank transfers, 500+ coins, low commissions |

7. Kraken – Advanced Trading Tools and Solid Mobile App

This can be facilitated by making a bank transfer, as UK clients are not permitted to make debit/credit card payments. Kraken charges a deposit and withdrawal fee of £1.95 on bank transfers. In terms of commissions, Kraken Pro offers the most competitive rates – which start at just 0.26%.

On the other hand, if opting for the instant buy feature on the main Kraken exchange, the commission stands at 1.5% per slide. Kraken offers access to a wide suite of digital assets, with investors having more than 100+ coins to choose from. Unfortunately, Kraken does not offer a proprietary wallet.

As such, after buying crypto on this exchange, users are advised to withdraw the tokens to a private wallet – such as MetaMask or Trust. Kraken does, however, offer a good selection of advanced trading tools. This includes plenty of technical indicators to help predict the future price movements of the crypto markets. The Kraken app is also a top option for mobile traders.

What We Like About Kraken:

- Trusted reputation in the global Bitcoin industry

- Top-rated mobile app

| No. Cryptos | 100+ |

| Fee to Buy Crypto | From 0.26% commission (Kraken Pro), £1.95 bank transfer fee |

| Proprietary Wallet? | No |

| Top 3 Features | Great mobile app, 100+ coins, staking tools |

8. Coinjar – Start Buying Crypto in Minutes With Just £10

In most cases, UK investors can open a Coinjar account in less than five minutes from start to finish. A variety of deposit methods are supported – including debit/credit cards, bank transfers, and Google/Apple Pay. Fees will depend on the payment method being used.

For example, UK bank transfers are fee-free, but traders will need to pay a 1% commission to buy or sell their chosen crypto asset. Using a debit/credit card or Google/Apple Pay to buy crypto instantly will incur an all-in fee of 2%. Coinbase is considered by many to be a safe exchange and thus – the platform is registered with the FCA.

The minimum deposit to get started is just £10. Another popular feature offered by Coinjar is its crypto bundles. This offers access to a hand-picked basket of crypto assets through a single investment. For example, the ERC-20 bundle contains a selection of tokens that operate on the Ethereum blockchain. There is also a green bundle, which focuses on low-carbon tokens.

What We Like About Coinjar:

- Established in 2013 and registered with the FCA

- Crypto bundles make diversification easy

| No. Cryptos | 50+ |

| Fee to Buy Crypto | 1% commission, 2% debit card fee |

| Proprietary Wallet? | Yes |

| Top 3 Features | No fee to deposit GBP via a bank transfer, established in 2013, crypto bundles |

9. Luno – One of the Best Crypto Exchange Apps

UK investors can then proceed to deposit funds into their newly created Luno account via a bank transfer. This is processed free of charge. After the funds arrive, investors can buy and sell crypto at a fee of 1.50% – which is considered expensive. The minimum trade value per crypto order is just £1, which will suit those on a budget.

Although Luno offers a user-friendly interface, it should be noted that the app supports just eight crypto markets. This includes Bitcoin, Ethereum, USD Coin, Bitcoin Cash, Chainlink, Litecoin, and Ripple. Finally, the Luno mobile app doubles up as a handy crypto wallet.

What We Like About Luno:

- Simple trading app to buy and sell crypto

- No fees when depositing funds via a UK bank transfer

| No. Cryptos | 8 |

| Fee to Buy Crypto | 1.50% commission |

| Proprietary Wallet? | Yes |

| Top 3 Features | Simple app for beginners, no GBP fees on bank payments, minimum order size just £1 |

10. Gemini – Secure Crypto Exchange With a Range of Products and Services

On the flip side, Gemini is also known for charging fees above and beyond the market average. For example, its web trading commission of orders above $200 amounts to 1.49% of the position size. A flat fee is charged for orders below $200, albeit, this works out at even more in percentage terms.

In addition to this, Gemini charges 3.49% on debit and credit card transactions. While slightly more competitive than Coinbase and Bitstamp, this is expensive when compared to the 0.5% charged by eToro. In total, Gemini offers more than 100+ coins on its exchange platform, as well as its mobile app for iOS and Android.

What We Like About Gemini:

- Heavily regulated crypto exchange

- More than 100+ coins supported

| No. Cryptos | 100+ |

| Fee to Buy Crypto | 1.49% commission |

| Proprietary Wallet? | Yes |

| Top 3 Features | Bank-grade security features, 100+ coins, pro-level trading tools |

Comparison Table of the Best UK Crypto Exchanges

Our reviews of the best crypto exchanges in the UK are summarized in the comparison table below:

| Crypto Exchange | No. Cryptos | Min. Deposit | Debit Card Fee | Proprietary Wallet? | Fee to Buy Crypto | Top 3 Features |

| eToro | 90+ | $10 (about £8) | 0.50% | Yes | 1% | FCA-regulated, low fees, perfect for beginners |

| Crypto.com | 250+ | $20 (about £16) | 2.99% | Yes | 0.40% | Bitcoin interest accounts, 250+ markets, Low fees |

| Binance | 600+ | £15 (debit/credit card payments) | 1.80% | Yes | 0.10% | Free UK bank transfers, 0.1% commission, 600+ coins |

| Bitstamp | 75+ | £10 | 5% | Yes | From 0% | Established in 2011, 98% of coins are kept in cold storage, no commissions for 30-day volumes of under $1,000 |

| Coinbase | 100+ | No minimum stated | 3.99% | Yes | 1.49% | Newbie-friendly, top security, 100+ coins |

| Huobi | 500+ | £8 via bank transfer | Determined by Simplex | Yes | 0.20% | Free GBP bank transfers, 500+ coins, low commissions |

| Kraken | 100+ | £100 via bank transfer | N/A for UK traders | No | From 0.26% (Kraken Pro) | Great mobile app, 100+ coins, staking tools |

| Coinjar | 50+ | £10 | 2% | Yes | 1% | No fee to deposit GBP via a bank transfer, established in 2013, crypto bundles |

| Luno | 8 | No minimum stated | N/A for UK traders | Yes | 1.50% | Simple app for beginners, no GBP fees on bank payments, minimum order size just £1 |

| Gemini | 100+ | No minimum stated | 3.49% | Yes | 1.49% | Bank-grade security features, 100+ coins, pro-level trading tools |

What is a Bitcoin Exchange?

A crypto exchange is an online platform that sits between buyers and sellers for the purpose of trading digital assets like Bitcoin. This means that ordinarily, the exchange is an intermediary. As a result, when buying crypto via an exchange, the purchase is matched with a seller at the other end of the transaction.

Exchanges operate traditional order books, which means that orders can only be matched if there are sufficient levels of liquidity available at the requested price. This is why the best crypto exchanges in the UK discussed today attract huge volumes of liquidity, as this ensures a functioning trading marketplace.

In return for matching buy and sell orders, crypto exchanges charge commissions. This will vary from one exchange to the next. Moreover, exchanges can also make money by charging deposit and withdrawal fees. As such, in order to select the best crypto exchange in the UK, it is important that investors spend some time exploring the platform's fee policy.

It is important to note that some of the crypto exchanges discussed on this page are actually brokers. This means that the platform does not require a seller at the other end of the trade. On the contrary, investors in the UK can buy Bitcoin and other digital assets directly from the broker itself.

How do Crypto Exchanges Work?

Although there are dozens of crypto exchanges serving UK clients, the underlying framework of how these platforms work is largely the same.

For instance, the first step for investors to take is to open an account with the exchange. Assuming that the chosen exchange is regulated, then the investor will need to enter some personal information and contact details. Moreover, should the investor wish to buy crypto with fiat money (e.g. pounds), they will be required to upload some ID.

After the account is funded, the investor can proceed to buy their chosen crypto. This requires the investor to create a buy order, which means entering the desired stake.

- If the investor opts for a 'market' position, then the crypto exchange will execute the order at the next best available price.

- Otherwise, if the investor elects to place a 'limit' order, this will only be executed once the requested price is triggered by the market.

Either way, an executed order will complete the process of buying crypto and the exchange will add the tokens to the investor's portfolio.

At this stage, the investor can keep the tokens in the wallet provided by the exchange. Or, they can request to withdraw the tokens to a private wallet.

With that said, some exchanges in this space - such as Crypto.com, offer an alternative option when it comes to storage. That is to say, investors can transfer their crypto tokens into an interest account for the purpose of earning an APY.

Tips to Select the Best Crypto Exchange in the UK

This page has reviewed the 10 best crypto exchanges in the UK right now, as per our independent research. With that said, investors in the UK are advised to perform their own research and analysis in order to choose a suitable platform.

Below, we explain the main considerations to make when browsing through UK Bitcoin trading platforms.

Regulation and Security

Regulation is the most important consideration to factor in when searching for the best Bitcoin exchange in the UK.

eToro came out top in this department, as the platform is not only regulated by the FCA - but ASIC (Australia), CySEC (Cyprus), and the SEC (the US) too.

This ensures that eToro traders enjoy regulatory oversight across multiple financial bodies. Some crypto exchanges are 'registered' with the FCA, but this does not offer the same level of oversight when compared to brokers that have a regulated status.

Crucially, however, UK investors should go one step further when choosing an exchange. For example, the best crypto exchanges in the UK will store the vast majority of client funds in cold wallets.

Moreover, additional tools such as two-factor authentication and IP address whitelisting will add an extra layer of security to the account.

Supported Crypto Assets

There will be a disparity in the number and type of crypto assets supported by UK exchanges in this space.

For example, Luno is home to only eight crypto assets - so this does not offer investors a suitable number of options when it comes to diversification.

In comparison, UK investors can access more than 250 assets at Crypto.com. Ultimately, the more assets on offer the better.

After all, if the investor wishes to invest in a digital asset but it isn't supported, they will need to open an account with a new exchange in order to buy it.

Fees

Investors will need to take into account both non-trading and trading fees when searching for the best crypto exchange in the UK.

- Regarding the former, most crypto exchanges charge fees on deposits. In particular, debit and credit card transactions attract an average fee of 3-5%.

- Our research found that the most competitive exchange for debit/credit card payments is eToro at 0.5%.

- The most costly exchanges were Bitstamp and Coinbase at 5% and 3.99% respectively.

Another way to reduce deposit fees is to opt for a UK bank transfer. Many of the exchanges discussed today support this payment method on a fee-free basis.

In terms of trading fees, this comes in the form of a commission. Low-cost options in this regard include Crypto.com and Binance, which charge 0.4% and 0.2% respectively.

Wallet

All of the exchanges discussed today offer an in-built web wallet. This means that the investor simply needs to log into their exchange account in order to access the funds.

Security protocols and controls will vary considerably from one Bitcoin exchange to the next. At a minimum, UK investors should expect the exchange to keep the vast majority of digital assets offline in cold storage wallets.

This means that the funds are never connected to live servers. Moreover, as noted earlier, we prefer crypto exchanges that offer two-factor authentication.

Another thing to bear in mind is that all of the crypto exchanges discussed on this page - apart from Kraken, offer a proprietary wallet app for both iOS and Android.

In some cases, this will be a decentralized wallet, which means that investors will have full control over their private keys.

Tools and Features

Some crypto exchanges offer a simple service that only includes the ability to buy and sell digital assets. On the other hand, the best crypto exchanges in the UK offer a variety of tools and features.

For instance, Crypto.com offers interest accounts that generate passive income. All the investor is required to do is deposit their idle crypto tokens into the interest account and they will start earning a yield.

Another popular feature that we came across is the eToro Copy Trading tool. This allows investors to copy the investments of a successful eToro trader. This will likely appeal to investors that wish to regularly trade crypto but have little to no experience in doing so.

In addition to the above, other notable tools and features offered by the best UK crypto exchanges include:

- Demo accounts - This enables traders to buy and sell crypto in a risk-free manner. Instead of using real money, the investor will trade with paper funds.

- Charting tools - Seasoned investors will appreciate having access to chart drawing tools and technical indicators.

- News and market insights - It is also notable when UK crypto exchanges offer news updates about specific digital assets as well as the broader market.

Investors in the UK can assess what tools and features are offered by an exchange by browsing the provider's website.

Payment Methods

Bank transfers can often be made into a crypto exchange account on a fee-free basis. However, do bear in mind that transfers can take anywhere from 1 to 7 working days, depending on the provider.

This is why the best crypto exchanges in the UK support debit and credit cards, as the payment will be processed in real-time. Just be aware of the deposit fees involved when choosing a payment type.

Customer Service

We prefer UK crypto exchanges that offer customer service on a 24/7 basis. The exchange gets extra points when it offers support via live chat alongside fast response times.

Mobile App

The crypto markets are volatile and thus - can move at a rapid pace at a moment's notice. Therefore, the best UK crypto trading platforms in the UK will offer a mobile app.

At the click of a button, this enables UK investors to buy or sell a digital currency regardless of where they are - as long as an internet connection is available.

The best crypto trading apps not only support buy and sell orders, but pricing alerts. This will send a notification to the investor's phone in real-time when a pre-selected crypto asset experiences a notable price movement.

Step-by-Step Walkthrough on How to Use a UK Crypto Exchange

This guide has discussed the importance of choosing the right crypto exchange when buying digital assets for the first time.

For those who are completely new to crypto exchanges, consider following the step-by-step guide below to get started with the FCA-regulated platform eToro in less than five minutes.

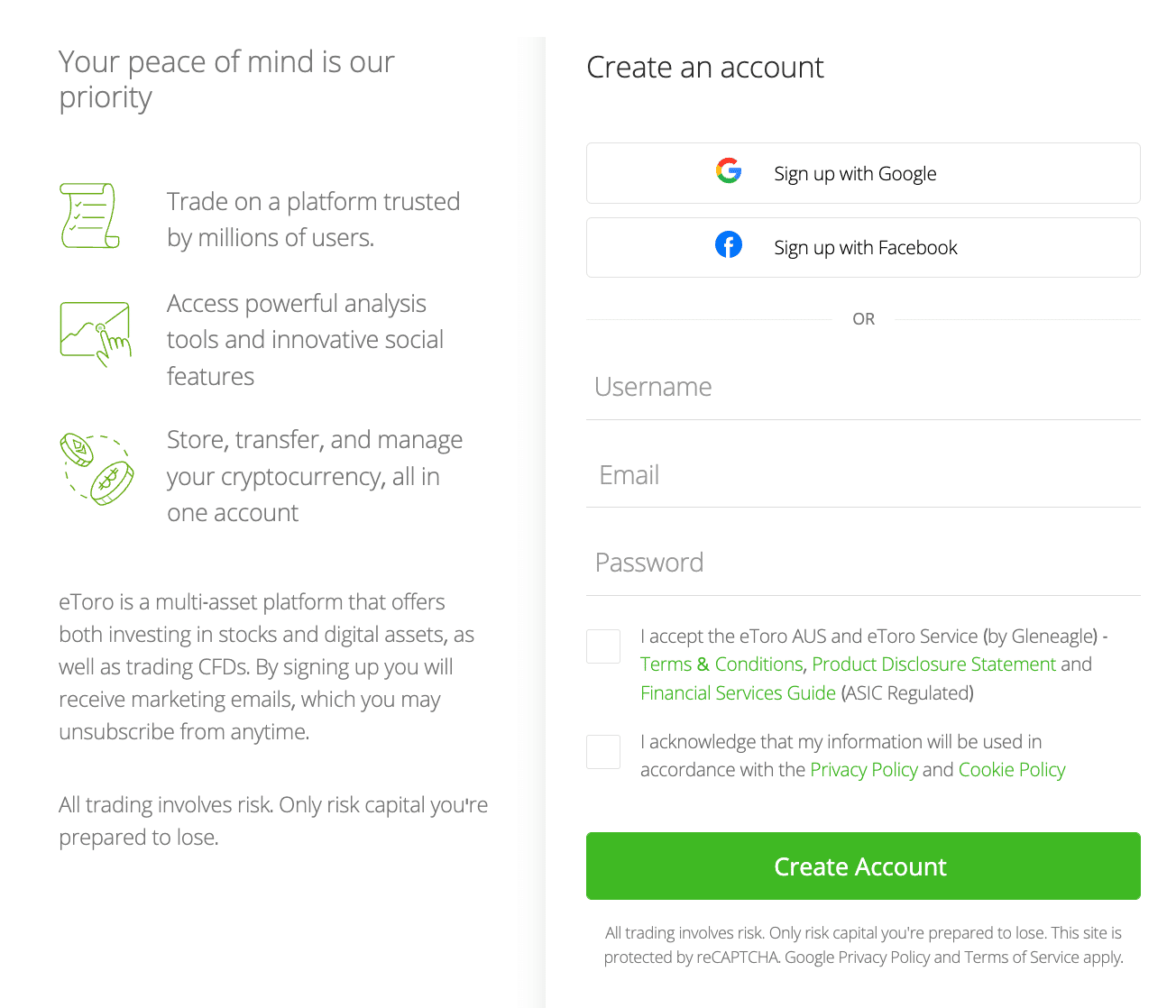

Step 1: Open an Account With eToro

To open an account with eToro, the investor will need to provide their full name, address, date of birth, and other personal information.

The investor will also need to choose a username and a strong password.

eToro - as an FCA-regulated broker, is also mandated to verify the identity of all new account holders. This requires the investor to provide a copy of a driver's license or passport.

The document will be verified in real-time.

Step 2: Deposit Funds

Verified account holders can then proceed to deposit some money. eToro requires a very small minimum deposit of $10 - which amounts to approximately £8.

Investors in the UK can choose from a bank transfer, debit/credit card, or a supported e-wallet.

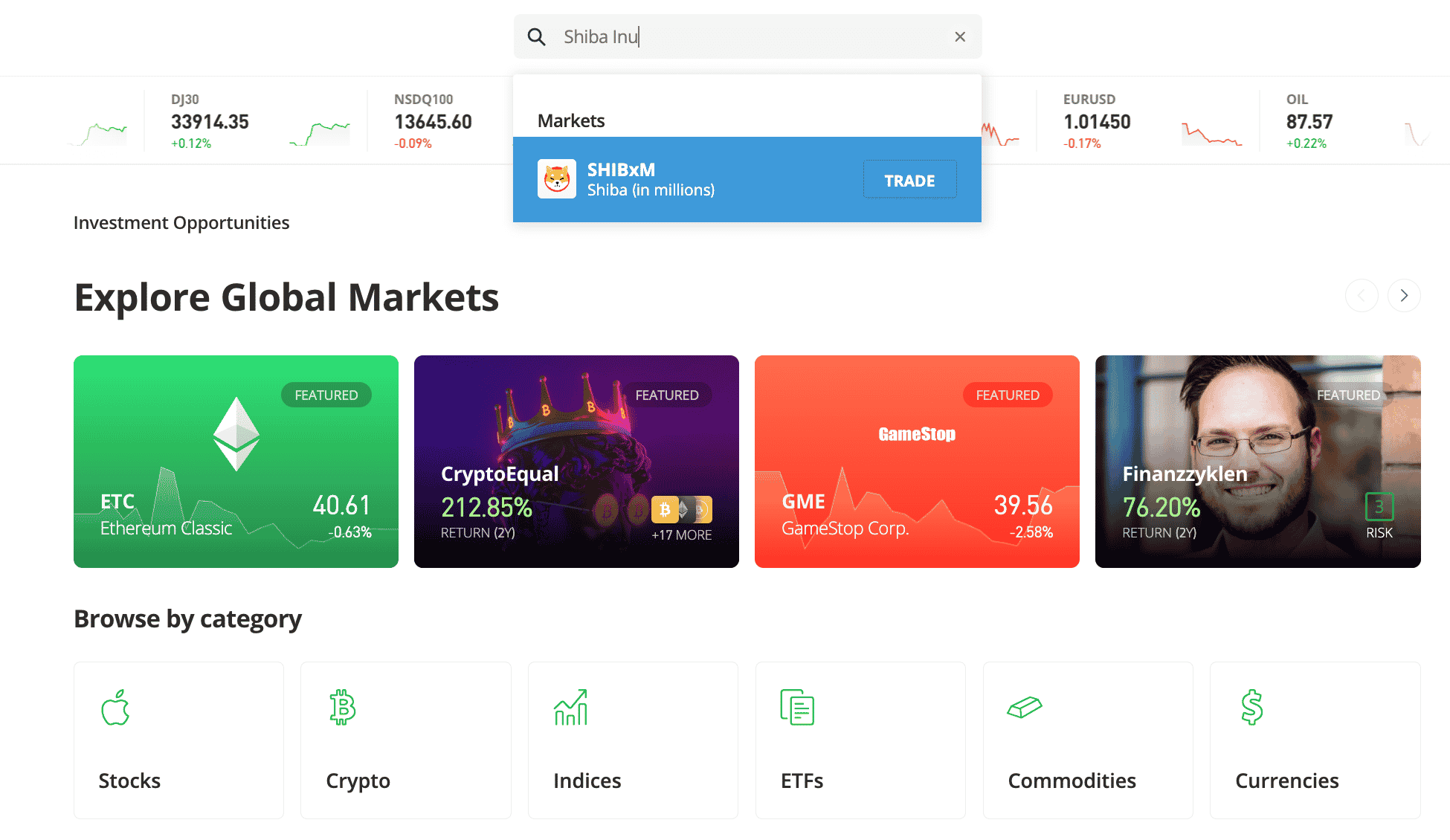

Step 3: Search for Crypto

The next step is to search for a suitable crypto asset to buy. Click on the 'Discover' button followed by 'Crypto'. This then offers a full breakdown of the 90+ crypto assets supported by eToro.

eToro also offers handy lists, such as the best-performing crypto assets in the prior 24 hours.

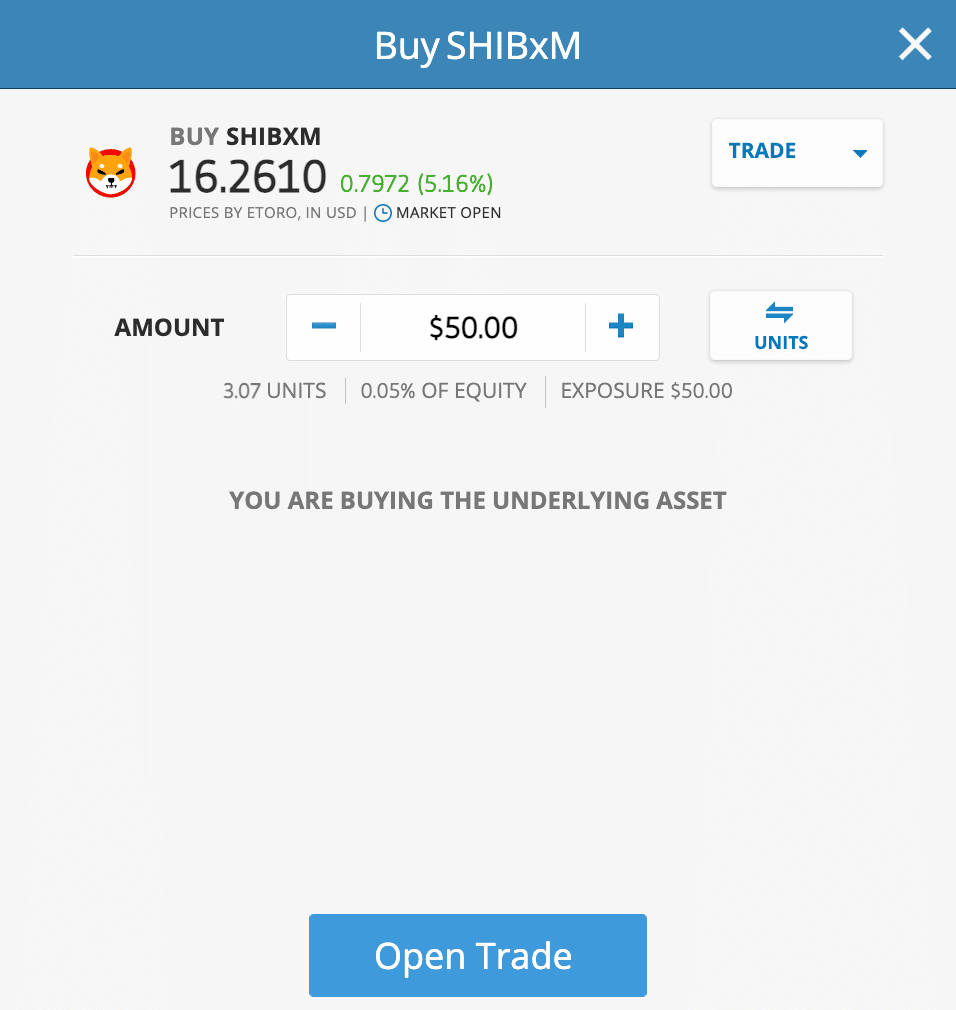

The other option is to use the search bar at the top of the screen. In our example above, we are searching for 'Shiba Inu'.

Step 4: Buy Crypto

After finding a crypto asset to buy, the investor will need to click on the 'Trade' button to populate an order form.

Next, in the 'Amount' field, type in the investment stake. The minimum is $10 when buying crypto, albeit, in our example below, we are looking to purchase $50 worth of Shiba Inu tokens.

After checking that everything is in order - confirm the investment by clicking on 'Open Trade'.

Step 5: Sell Crypto

Depending on the chosen strategy, the investor might decide to hold on to their crypto assets in the long or short term. Either way, it takes less than 30 seconds to sell a crypto investment back to cash when using eToro.

Simply head over to the eToro portfolio and look for the crypto asset to cash out. After confirming the sell order, proceeds from the sale will be made available for withdrawal.

Conclusion

Choosing the best crypto trading platform in the UK for the investor's personal requirements is an important process.

As this guide has discussed in great detail, some of the most crucial aspects to task into account when choosing a provider should surround regulation, fees, user-friendliness, customer service, and supported markets.

Across these core metrics and more, we found that eToro is the overall best crypto exchange in the UK.

This FCA-regulated platform offers a safe, low-cost, and beginner-friendly way to buy and sell crypto from the comfort of home.