10+ Best Crypto to Buy on the Dip – Top Crypto Crash Coins

With the crypto trading markets now in a bearish cycle, now is a great time to buy a collection of top-rated digital assets at a discount. For instance, why pay nearly $5,000 to invest in Ethereum, when the token has since hit lows of $1,000?

In this guide, we analyze the 10 best crypto to buy during the crash to benefit from declining asset prices.

List of the 10+ Best Crypto to Buy During This Dip

We found that the best crypto to buy during the crash are the 10+ projects listed below:

- Wall Street Memes (WSM) – Overall Best Crypto to Buy During Crash

- Launchpad XYZ (LPX) – Web 3 Crypto to Buy During this Dip

- Evil Pepe Coin (EVILPEPE) – Memecoin to Buy During this Dip

- BTC20 (BTC20) – Ethereum-based Bitcoin to Buy During Crash

- Chimpzee (CHMPZ) – Green Crypto with Major Upsides

- Ethereum – Leading Blockchain for Smart Contracts and Metaverse Projects

- Bitcoin – Store of Value to Hold Long-Term

- Decentraland – Best Metaverse Crypto Coin to Buy

- Stellar – Top-Quality Crypto Project That Permits Cheap and Fast Cross-Border Transactions

- XRP – Interbank Payment Solutions via Blockchain Transactions

- BNB – Native Token of the Binance Smart Chain and Exchange

Read on to find out why we like the above crypto projects.

Full Analysis of the Best Cryptos to Buy on the Dip

While the vast majority of cryptocurrencies are currently witnessing a major decline in value, there are more than 20,000 tradable tokens in this market.

And as such, investors will need to carefully select the best long-term crypto investments when building a diversified portfolio.

In the sections below, we provide a full evaluation of the 10 best crypto to buy during this dip.

1. Wall Street Memes (WSM) – Overall Best Crypto to Buy During Crash

Bitcoin’s inability to stay above the $30k mark has opened the market for cryptos with the potential to go viral. What started as a memecoin mania of 2023 has rippled into memecoin offerings that are available as a presale, allowing investors to take advantage of the virality without being subjected to the market’s volatility.

Inspired by the viral movement created by Wall Street Bets, Wall Street Memes aims to turn memecoins into profit-generating assets the same way that Wall Street Bets did for Gamestop. The memecoin project follows the same ideology that pushed Gamestop’s value high to mobilize the community to pump the value of its memecoin – WSM – and help the community make massive gains.

While bearing little utility, Wall Street Memes focuses on the power that memes bring to the table. The combination of humour, trolling, and financial independence incites people to invest in memes “just because” is making Wall Street Memes a viable investment for short-term seekers.

However, Wall Street Memes has also given an insight into its long-term goals of creating a gated community that will have additional perks, exclusive deals and new ways to interact with the crypto economy.

2. Launchpad XYZ (LPX) – Web 3 Crypto to Buy During This Dip

Launchpad XYZ is a crypto project that covers everything that Web 3 has to offer but wraps them inside an inclusive interface that has a human touch. Created to make it easier for people to find suitable blockchain projects to get behind, Launchpad XYZ’s main vision is to launch people’s Web 3 investment dreams properly.

Helping it realize this vision is a large number of tools. With Trading Edge, novices can train in the ways of crypto trading while earning profits. Beginners can use the same tool to develop complex strategies to trade the way they want.

Beyond, Launchpad XYZ provides assessment tools for every element in the Web 3 space. NFT seekers can use the tool to search through the marketplace and find the best assets that are in the most demand. Many NFTs will be tied to real-world properties through fractionalized assets, which will allow Launchpad XYZ to provide users with real estate, car, and other investment opportunities.

Coming back to assessment tools, Launchpad XYZ will provide analysis for utility tokens, presales, metaverse experiences, and play-to-earn hubs. These projects will be given an LQ score – Launchpad Quotient, which is a unique metric created by pooling 400 different data points consisting of financial, technical and sentimental indicators.

Underpinning these features is Apollo, Launchpad XYZ’s own AI – Artificial Intelligence. Leveraging matching learning and multiple language models, this AI tool will make it easy for users to find their next Web 3 investment.

People look for assets with huge potential during a crash, and Launchpad XYZ has it. Available as a presale which has already raised more than $1 million, Launchpad XYZ is a good crypto to buy during the dip.

3. Evil Pepe Coin (EVILPEPE) – Memecoin to Buy During This Dip

Pepe Coin brought memecoin mania, which led to the launch of similar meme-based tokens with little utility. Many of these assets made massive gains within short time frames, but most of them turned out to be rug pulls, disappearing within a day after going up by 5 digits.

But that did not stop investors from putting their money into these assets, hoping that one investment would turn out right. Evil Pepe Coin represents that drive. The desire to invest in projects that people know might turn out to be rug pulls is what is pushing the memecoin economy right now.

“There is a bit of evilness in it”, Evil Pepe says, and thus it offers a unique community-centric token that focuses on the audacious aspects of the memecoin community.

It doesn’t exposit that it has a use case; it also doesn’t say that the memecoins are good investments. What it does say, however, is that “embracing the darker side of crypto” can prove profitable in the long run.

With the goal of reaching a $100 million market capitalization in record time, Evil Pepe Coin has recently launched as a presale. With its Pepe Coin imagery and a low-price point, this token has the potential to pump once it goes live on DEXs, making it a good crypto to buy during the crash.

4. BTC20 (BTC20) – Ethereum-based Bitcoin to Buy During Crash

Bitcoin came at a time when not many people believed in its offerings. But those that could mint massive gains during the bull run of 2021. Even now, when BTC’s price comes closer to the $30k mark, those who invested in the token more than a decade ago when it was priced at $1, have made a lot of money.

The same idea lies behind BTC20. A Bitcoin for the Ethereum blockchain, BTC20, is taking the same steps as the original Bitcoin did in 2011 by offering the initial 6.05 million tokens in a two-phased presale where the price of one token is $1.

The remaining 14.95 million will be kept locked inside a liquidity contract. Similar to how Bitcoin releases tokens per block to the miners, BTC20 will release per block for the stakers. By mirroring Bitcoin’s mining rewards using staking, BTC20 ensures that beginners can participate in Bitcoins without being burdened by massive hardware and financial requirements.

BTC20 has already raised more than $1.4 million in the first phase of its presale. With its low value and the fact that it is still in the presale, BTC20 is a good asset to invest in during the crash.

5. Chimpzee (CHMPZ) – Green Crypto with Major Upsides

Environmental concerns have increased the value of green crypto assets, which was the main reason that proof-of-stake cryptos have prospered this year. But merely adopting an ERC-20 standard is not enough. Blockchain projects can be geared towards protecting the environment and combating climate change, and Chimpzee intends to do the same.

A green cryptocurrency project that focuses on NFTs, merchandising, and gamification, Chimpzee is driven by the community’s desire to do good for the environment. And it does so by incentivizing making environment-saving moves using three earning mechanics.

- Shop to Earn – This mechanic is driven by Chimpzee Shop, a place that sells Chimpzee merchandise and Chimpzee gear. Buying products from this shop will reward investors with CHMPZ tokens. The project will also share a portion of the profits with organizations focusing on environmental protection.

- Trade to Earn – Chimpzee’s NFT marketplace is home to this particular earning mechanic. Interacting with the marketplace – buying and selling NFTs – will reward users with a share of profits generated by the marketplace.

- Play to Earn – Chimpzee pioneers a “zero tolerance game”. While the details of the type of game it is are not known, it is clear that users who complete milestones within this game are rewarded with CHMPZ tokens.

These triple-earning mechanics make Chimpzee a good crypto to buy during the crash.

6. Ethereum – Leading Blockchain for Smart Contracts and Metaverse Projects

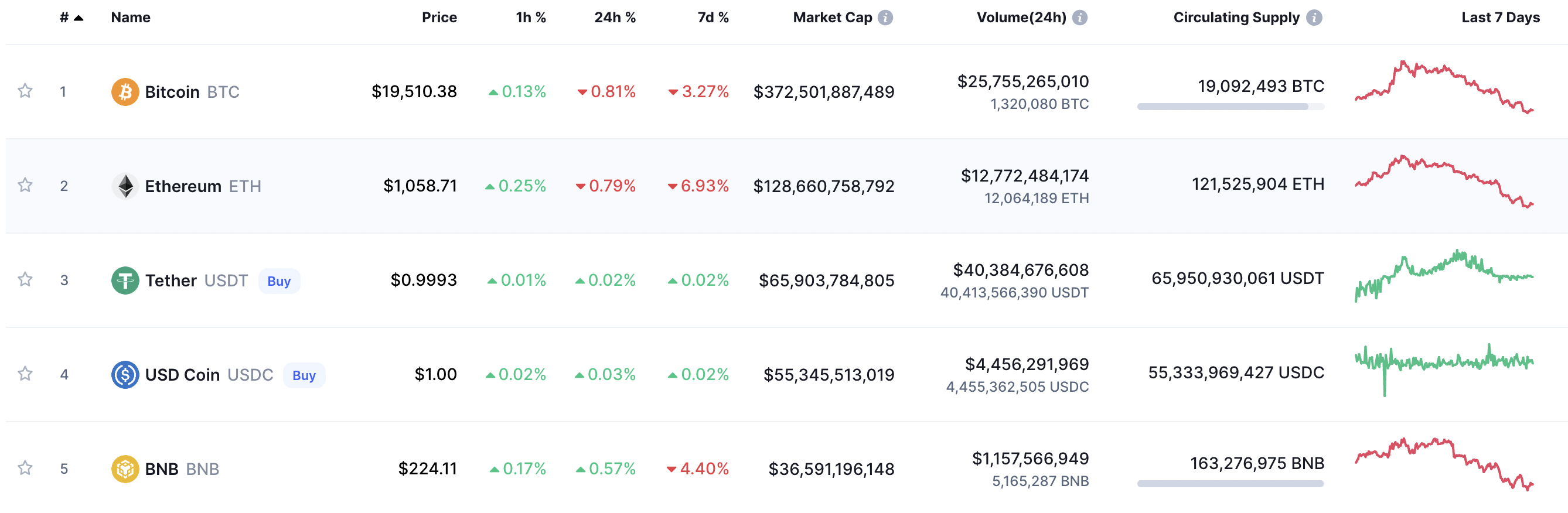

Ethereum, the best altcoin to buy, is a large-cap cryptocurrency that all investors should consider adding to their portfolio for long-term value. It was launched in 2015 and behind Bitcoin, carries the second-largest valuation in this industry. Ethereum is best known for its smart contract capabilities, which allow developers to build decentralized apps that function autonomously.

Crucially, the Ethereum blockchain not only supports thousands of ERC-20 tokens, but plenty of metaverse projects. This includes the likes of Decentraland, which is a metaverse platform that allows users to invest in virtual real estate. As such, metaverse projects using the Ethereum blockchain are required to execute smart contracts, which subsequently require GAS.

In a nutshell, GAS refers to the transaction fee that smart contracts require when they are executed. Moreover, and perhaps most importantly, GAS is paid for in Ethereum. Therefore, this gives Ethereum a real-world use case. Another reason why Ethereum is one of the best crypto to buy during this dip is that it will soon migrate to proof-of-stake (PoS).

By migrating to PoS, this will improve the capabilities of the Ethereum blockchain significantly. Not only in terms of lower fees and faster transactions, but scalability. In fact, it is expected that PoS will take Ethereum from 16 transactions per second up to 100,000. This will make the Ethereum blockchain much more conducive for metaverse and NFT projects.

The final icing on the cake with Ethereum is that much like the broader crypto space, its token is trading at considerable lows when compared to its nearly $5,000 all-time high that it achieved in late 2021. Since the crypto winter came to fruition, Ethereum investors can now gain exposure to this token at around the $1,000 level.

Cryptoassets are highly volatile investment products. Your capital is at risk.

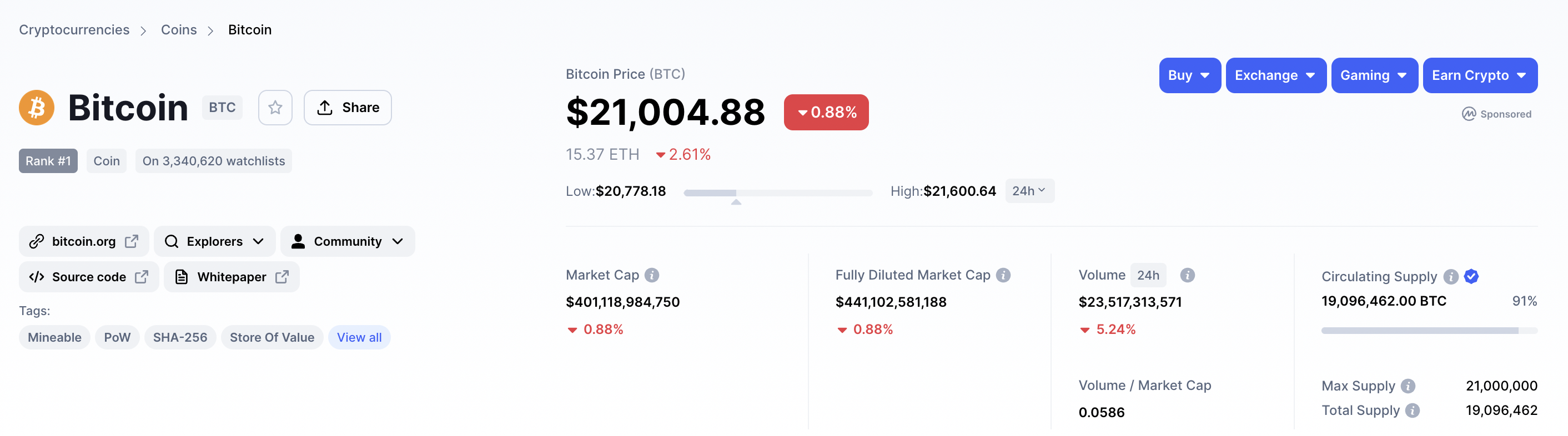

7. Bitcoin – Store of Value to Hold Long-Term

Bitcoin is the most popular crypto to buy, as it is held by the majority of investors that have exposure to this industry. It is the largest crypto by market capitalization. At its peak in late 2021 – when Bitcoin surpassed a value of over $68,000, the project hit a valuation of over $1 trillion. This made Bitcoin more valuable than most blue-chip stocks.

Nonetheless, Bitcoin has since declined in value as per the broader crypto winter. As of writing, Bitcoin seems to have entered a consolidation period of around the $20,000 level. This means that first-time investors can buy Bitcoin at a discount of over 70%, based on its prior peak.

Bitcoin is best viewed as a long-term investment due to its de-facto status as a store of value. There will only ever be 21 million Bitcoin in circulation, which is expected to happen in 2140. Moreover, Bitcoin is truly decentralized and its network cannot be controlled by any single person or authority.

Unlike a central bank, the supply of Bitcoin cannot be manipulated either, so this alleviates the risk of inflation. In fact, new Bitcoin tokens enter circulation every 10 minutes, as per its underlying code that cannot be amended. While Bitcoin still trades for many thousands of dollars, the token can be split into micro units. As such, it is possible to invest in Bitcoin with just a few dollars.

Cryptoassets are highly volatile investment products. Your capital is at risk.

8. Decentraland – Best Metaverse Crypto Coin to Buy

We mentioned earlier that Ethereum is the leading blockchain network for the most successful metaverse projects in this space. However, Ethereum merely provides the smart contract technology for metaverse platforms. Therefore, those looking for the best metaverse crypto coin to buy during the market dip might consider an individual project like Decentraland.

This project offers a virtual world that can be accessed by users from all over the world. After connecting a wallet to Decentraland and choosing a personalized avatar, the user can then move around the virtual world and even communicate with other players.

Furthermore, and perhaps most interestingly, Decentraland allows users to buy virtual land. Only one person can purchase a specific piece of land, which is represented by an NFT to prove ownership. The land can then be used to build a virtual real estate project, such as a casino or hotel.

Each plot of land or real estate project – via an NFT, can then be sold in the open marketplace. Some transactions have attracted a sale price of several millions of dollars – all of which are conducted in the Decentraland token – MANA. This token is one of the best-performing cryptocurrencies in recent years, with gains of over 23,000% since launching in 2017.

However, due to the wider crypto winter, those with an interest in Decentraland can buy MANA tokens at a huge discount. As of writing, MANA can be bought at pricing levels that are nearly 85% lower than their late 2021 peak.

Cryptoassets are highly volatile investment products. Your capital is at risk.

9. Stellar – Top-Quality Crypto Project That Permits Cheap and Fast Cross-Border Transactions

Stellar is a blockchain project that was first launched in 2014 by Ripple co-founder Jed McCaleb. The project allows the un-banked to transfer funds on a cross-border basis at super-low fees and fast processing times. Regarding the latter, Stellar transactions amount to a fee of just 0.00001 XLM – which, as of writing, equates to just $0.000001.

This is the case regardless of where the sender and receiver are based, or the size of the transaction. Regarding processing times, Stellar transactions typically require just five seconds before the funds are confirmed. This superior technology – which is built on its own proprietary blockchain network, has resulted in Stellar forming some highly notable partnerships.

At the forefront of this is IBM, which uses the Stellar network as part of its Universal Payment Solution program. In addition to IBM, Stellar is also used by MoneyGram. This enables the money transfer company to offer fast transactions to its customers. Stellar also has its own native crypto token – Lumens.

This digital currency trades at dozens of exchanges and subsequently can be purchased with ease. Crucially, for the purpose of this market insight on the best crypto to invest in during the crash, Lumens is now trading at a huge discount. For instance, while Stella was trading at $0.27 at the start of 2022, it has since dropped below the $0.10 level.

Cryptoassets are highly volatile investment products. Your capital is at risk.

10. XRP – Interbank Payment Solutions via Blockchain Transactions

The underlying blockchain code of XRP is very similar to that of the previously discussed Stellar. For instance, both blockchains offer transaction times of around five seconds regardless of where the sender and receiver are based, and fees amount to a tiny fraction of a cent.

Moreover, both XRP and Stellar can handle approximately 1,500 transactions each and every second. However, while Stellar targets the consumer and private business sectors, XRP provides a global payments network for large banks and financial institutions.

To date, XRP is used by more than 200 partners, which includes Santander, the Bank of America, and Standard Chartered Bank. One of the most appealing aspects of the Ripple blockchain is that it permits interbank transactions in a speedy and low-cost manner irrespective of which fiat currencies are being used.

Ordinarily, institutions from the third world would be required to go through a correspondent bank in order to transact in emerging currencies. This would result in high fees, slow transaction times, and lots of regulatory red tape. However, by using XRP via the Ripple blockchain, this type of transaction can be conducted in a matter of seconds.

Cryptoassets are highly volatile investment products. Your capital is at risk.

11. BNB – Native Token of the Binance Smart Chain and Exchange

BNB is the native crypto token of the Binance ecosystem, which is inclusive of the world’s largest exchange in terms of registered users and trading volume. When BNB is used on the Binance exchange, it offers a discount of 25% on commissions. BNB can also be used to engage in staking, yield farming, and other DeFi services.

Perhaps even more notable for this token is that BNB backs the Binance Smart Chain. This blockchain network is used by thousands of projects. When users wish to buy a token listed on the Binance Smart Chain, fees are paid in BNB.

Furthermore, tokens on the Binance Smart Chain are paired with BNB, so this ensures that the digital asset remains in high demand. We also like BNB for its burning program, which is initiated by Binance. This means that periodically, Binance buys an allocation of BNB and subsequently removes the tokens from circulation.

This operates in a similar way to a traditional share buyback program executed by blue-chip firms like Apple. BNB has generated some sizable returns since it was launched in 2017 and it is now one of the largest digital assets globally in terms of market capitalization. However, BNB has since dropped in value by over 70% when compared to its prior all-time high.

Cryptoassets are highly volatile investment products. Your capital is at risk.

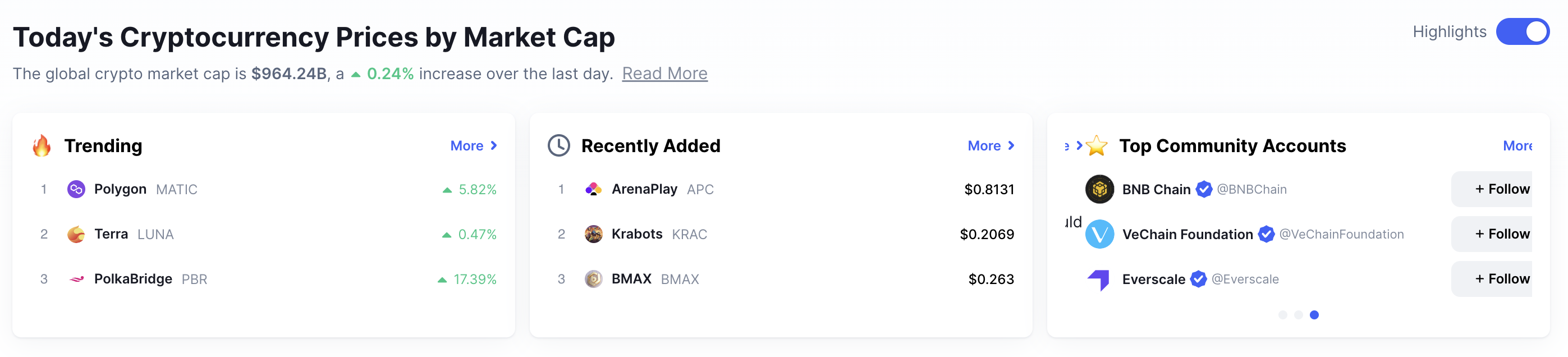

Why are Crypto Prices Crashing? Overview of the Crypto Winter

Collectively, the crypto markets witnessed a prolonged upward trajectory between April 2020 and November 2021. Bitcoin, for example, went from lows of nearly $5,000 to a new all-time high of $69,000. Other cryptocurrencies in this space – such as Shiba Inu, saw gains in the millions of percentage points.

In other words, during the aforementioned period, the crypto industry was in a bull market. This simply means that investor sentiment is strong and thus – the broader markets experience increased asset valuations. However, the vast majority of tokens in this marketplace peaked in late 2021.

Since then, crypto prices have continued to fall. As such, we are now in a crypto bear market. Crucially, however, prices are declining irrespective of the fundamentals of each individual project. Therefore, just like a stock bear market, this allows investors to buy solid crypto tokens with strong fundamentals at a major discount.

In terms of how long the current bear market will last, this remains to be seen. We can, however, look at the previous bear market, which began in December 2017 and lasted for three years. This is because it wasn’t until December 2020 that Bitcoin regained its previous all-time high of $20,000.

Is it Wise to Invest in Crypto Crash Coins During a Bear Market?

The simple answer here is yes – investing in crypto during a bear market is arguably the best time to gain exposure to this industry. After all, when the broader market is crashing, this enables investors to buy digital assets at a much lower price, when compared to previous highs.

- For example, those that invested in Bitcoin in November 2021 would have paid in the region of $68,000.

- Since then, Bitcoin has hit lows of $20,000.

- As such, those buying Bitcoin at the $20,000 level are doing so at a discount of 70% from its peak.

- Similarly, Ethereum was previously trading at nearly $5,000 in late 2021 but has since dropped below $1,000.

Buying digital assets during a crypto winter is therefore no different from investing in solid, high-grade stocks during a bear market. In fact, it is often said that seasoned investors crave bear markets, as this offers a superb way to build a diversified portfolio at highly attractive entry prices.

On the other hand, when during a bear market, many crypto tokens will never recover. As a prime example, when investors lost confidence in the Terra Luna project, its token crashed overnight – subsequently losing 99.9% of its value. The same project also saws its stablecoin – Terra USD, not only de-peg from the dollar, but become virtually worthless.

With this in mind, investors should ensure that they tread carefully when searching for the best crypto to buy during the crash. It is best to stick with solid projects with strong fundamentals, that have every chance of recovering their prior all-time highs once the broader markets once again become bullish.

Tips on How to Find the Best Crypto to Buy During the Crash

As we discussed in the section above, buying crypto tokens during a bear market can be a smart move considering the heavily discounted prices on offer.

However, not all cryptocurrencies will recover once the bear market concludes, which is why investors are required to perform their own research before proceeding.

Below, we explain what to look for when searching for the best crypto to buy during this dip.

Fundamentals

We mentioned above that picking the best crypto to buy during the crash is all about selecting projects with strong fundamentals. This simply means that investors should consider cryptocurrencies that have a solid business model alongside proprietary technology.

For example, Bitcoin is the de-facto crypto token in terms of a long-term store of value. As such, it is more of a probability than a possibility that once the broader markets recover – however long that takes, Bitcoin will eventually regain its prior highs. The same could be said for Ethereum, as well as many of the other projects we have discussed on this page.

On the other hand, it is best to stay away from so-called meme coins, which offer nothing proprietary and most definitely do not solve any real-world problems. In our view, this would include meme dog cryptos like Shiba Inu and Dogecoin, but not the likes of Wall Street Memes which offer a massive community to investors.

Consider Presales for Instant Token Discounts

Although we are in a bear market, it is still wise to explore solid projects that are yet to launch on public exchanges. A prime example here is Launchpad XYZ, which is arguably one of the best crypto to buy during this dip.

This metaverse, NFT, and trading project – which is also building several Web 3 ecosystems, is a great buy.

Look for Sizable Discounts

Buying crypto during a bear market is all about finding discounts that may never be available again. For example, those that bought Bitcoin in the midst of the COVID-19 pandemic in April 2020 would have had access to an entry price of $5,000.

- While there are no guarantees in this space, the general consensus is that Bitcoin will likely never again drop these pricing levels.

- In the current market landscape, Bitcoin has since dropped by more than 70% when compared to its previous high of $68,000.

In the case of Decentraland, the project has declined by more than 85% from its lows, with other projects dropping by over 90%.

Build a Diversified Portfolio

Seasoned investors will look to mitigate the risk of loss by building a highly diversified portfolio of crypto tokens. This means that rather than focusing on one or two projects, it is best to gain exposure to at least 10 – perhaps more.

Each crypto token should come from a different niche, which, again, will mitigate the risk of investing in a project that subsequently fails.

This is why our list of the best crypto to buy during the crash contained a full range of different projects.

Consider Where the Market Will be in Five Years

The most successful investors in the crypto space are long-term holders. By holding onto a token for at least five years, this will enable the investor to ride out inevitable bear markets, which we are currently in.

With this in mind, it is wise to consider where the crypto arena will be in five years – in terms of trends and emerging markets.

- For example, there is an expectation that in the coming years, the metaverse will reach the masses.

- And one of the best metaverse projects we came across is Launchpad XYZ, which combines all the elements of Web 3.

Another area that is expected to grow substantially in the coming years is decentralized finance – or DeFi. DeFi Coin – which also made our list of the best crypto to buy on the dip, is the native token of DeFi Swap.

As we noted earlier, DeFi Swap is a growing decentralized exchange that offers everything from staking and yield farming to token exchanges.

The Verdict?

Bear markets allow investors to buy crypto tokens at a major discount, when compared to their previous all-time highs. We have ranked the 10 best crypto to buy during the crash – based on the underlying fundamentals of each project.

Overall, our market research found that Wall Street Memes is the best crypto to consider right now. It offers a fun community and an engaging ecosystem.

Launchpad XYZ is another to consider. Encompassing all Web 3 elements, this project has huge upsides.