Best Long Term Cryptocurrency Investments in 2024

Long term crypto investors will engage in a process dubbed ‘HODLing’. This simply means that investors will buy a cryptocurrency and hold on to the token for several years, with the view of maximizing potential returns.

In this guide, we reveal the 10+ best long term crypto investments for 2024.

List of the Best Long Term Crypto Investments for 2024

A list of the best long term crypto investments for 2024 can be found below:

- Wall Street Memes – Overall Best Long Term Crypto Investment of 2024

- Launchpad XYZ – Long Term Crypto for Web 3 Enthusiasts

- Evil Pepe Coin – Memecoin with Possible Long Term Implications

- BTC20 – Ethereum-based Long Term Crypto With Bitcoin’s Fundamentals

- Chimpzee – Long-Term Green Crypto of 2024

- Bitcoin – Store of Value for Long Term Crypto Investors

- Ethereum – Solid Smart Contract Blockchain With Huge Market Capitalization

- Solana – Top-Performing Blockchain Network That is Highly Scalable

- Polygon – Quality Side-Blockchain for Ethereum Transactional Activity

- XRP – Long-Term Investment Into the Future of Interbank Transactions

- Decentraland – Invest in the Metaverse Today via MANA Tokens

- BNB – Invest in the Continued Growth of the Binance Ecosystem

We analyze each of the above crypto assets in full in the following sections of this guide.

Best Crypto for Long Term Investments – Detailed Analysis

Investors wondering how to make money with cryptocurrency may turn to long term investments. The most successful crypto investors are those that ‘HODL’ over an extended period of time. This ensures that investors give themselves the best chance possible of riding out volatile market waves.

Moreover, long term investors will look to capitalize on bear markets – such as the one we are currently in, by purchasing crypto at discounted prices. Other investors prefer to trade cryptos for immediate gains, selecting one or two cryptos to trade and capitalize on the market swings.

Taking all of this into account, below we offer a detailed analysis of the 10 best long term crypto investments for 2024.

1. Wall Street Memes – Overall Best Long Term Crypto Investment of 2024

Inspired by Wall Street Bets, Wall Street Memes is a surprising addition to this list because of all intents and purposes, it is a memecoin through and through. Memecoins have not been assets that people choose for long-term gains. But Wall Street Memes does many things that set it apart as a long-term crypto asset.

The first thing is its community, which is over 1 million strong. Next comes its social media posts that have a humorous take on the current financial situation through memes. These memes have gotten the attention of Elon Musk. The Dogecoin hypeman has engaged with the community on three separate occasions.

These two factors combine to form a community that is capable of mobilizing memecoins in the same way that Wall Street Bets did for Gamestop. This memecoin project puts profitability at the forefront and is eyeing a $1 billion market capitalization in the price charts.

The tokens’ long-term aspects come from their potential to go volatile when it finally lands on listing exchanges. Like the best memecoins in the market, Wall Street Memes would likely follow an erratic path on the price charts, but that would potentially help users seeking volatile gains to interact with this ecosystem.

Now available as a presale, Wall Street Memes has already raised more than $17.5 million. The hard cap is $20 million, with many say will be reached soon.

2. Launchpad XYZ – Long Term Crypto for Web 3 Enthusiasts

Utility cryptos with the potential to increase the blockchain adoption rate will always hold value as long-term assets in the crypto space. And with Launchpad XYZ, investors have access to an asset that has made the Web 3 ecosystem more inclusive while providing users with new ways to interact with the blockchain ecosystem.

To start, Launchpad XYZ has designed a trading terminal that doubles as a training module for beginner-level investors. It offers them tutorials and other simple-to-use tools to help them not feel lost when trading cryptos. The same terminal can be used by veteran traders who can leverage sentimental and technical indicators and other features to customize their crypto trading abilities.

The other unique aspect is the asset assessment tool. Launchpad XYZ has created an interface that assets every blockchain asset, ranging from presale cryptos, utility tokens, and NFTs to metaverse experiences and P2E hubs. The Web 3 ecosystem scores them using a metric that combines 400 different data points. That metric is known as Launchpad Quotient.

Other than these features, Launchpad XYZ aims to provide a launchpad for developers to develop and launch Dapps and crypto assets. With its fractionalized asset utility, Launchpad XYZ can tie NFTs with real-world properties.

Underpinning these features is the clever implementation of artificial intelligence. The native AI of Launchpad XYZ is Apollo. Modelled with multiple languages, this AI bot offers a unique search engine to users, allowing them to find the best Web 3 investment they seek.

Powering this ecosystem is the native crypto LPX. An ERC-20 asset, LPX can be used to stake to earn APY rewards, get discounts on NFTs in the NFT marketplace, and access other facilities that Launchpad has to offer.

LPX is currently available as a presale which has already raised more than $1.1 million. Those interested can visit the official website to participate in this presale.

3. Evil Pepe Coin – Memecoin with Possible Long Term Implications

Another memecoin that we believe could have positive long-term implications is Evil Pepe Coin. Inspired by Pepe Coin, the token that started the meme mania, Evil Pepe Coin is getting traction in the crypto market not through its utilities but through what it represents.

It symbolizes the drive that makes investors put their money into tokens that show short-term benefits but are likely rug-pulls. The token focuses on FOMO, the major aspect that drives the crypto market and leads to many memecoins making parabolic games.

States in its official whitepaper that embracing a little “evil” is what it takes to make it big in memecoin, Evil Pepe Coin pivots away from memecoins of the past that used the Doge imagery to market themselves and peddled utilities that they couldn’t fulfil.

Evil Pepe Coin fully embraces what it is – a memecoin that seeks to create profit for its community. It promotes embracing the uncertainty of the crypto space while providing a community to those who seek to make gains in the current market’s volatility.

Evil Pepe Coin is currently available as a presale in which it has already raised more than $750k. With the hard cap set to $1.99 million, it is likely that the presale will be over soon.

4. BTC20 – Ethereum-based Long Term Crypto With Bitcoin’s Fundamentals

BTC20 plays on combining the words BTC and ERC-20, presenting a unique crypto, a unique form of Bitcoin that fits right in with the Ethereum blockchain.

With the vision to provide users with a Bitcoin-like investment opportunity, albeit in a more comfortable manner, BTC20 takes a different approach to standard tokens. It has a limited supply similar to Bitcoin, 21 million and intends to use a stake-to-earn mechanic that releases rewards similar to how the Bitcoin blockchain releases tokens to crypto miners.

Out of the 21 million supply, BTC20 intends to give away the first 6.05 million tokens at the price of $1 in a two-phased presale. It is giving away 3 million in the first phase and 3.05 million in the second. The remaining 14.95 million will remain locked in the liquidity contract, released in predetermined amounts upon the execution of blocks to those who stake their BTC20.

Since a limited number of tokens will be released, the scarcity of the tokens will increase, which can potentially boost BTC20’s price. The network aims to release all the tokens in an estimated time of 120 years.

Further in the roadmap, BTC20 is also planning to expand the utility of the token within decentralized applications.

With a long-term token release window that will last 120 years and a limited supply, BTC20 has a chance to go high as a long-term asset. And by leveraging the proof-of-stake mechanism, it is providing a green option to those who wanted to invest in Bitcoin but stayed away due to high requirements.

5. Chimpzee – Long Term Green Crypto of 2024

Chimpzee is a green crypto that established its long-term value by providing an ecosystem where users can earn tokens and work to protect the environment at the same time. While this approach has been one that has been in the crypto space for a very long time, Chimpzee’s main USP is that it doesn’t provide one but three ways to earn.

That means investors will earn triple the amount of tokens they would have if they chose any other green ecosystem. These three mechanics aren’t only accessible but introduce new concepts to the blockchain space.

The first mechanic is Trade-to-Earn, the world’s first NFT-powered earning system where investors will be given a share of profits made by the NFT marketplace. Chimpzee’s NFT marketplace will feature Chimpzee NFTs. Regularly interacting with the marketplace will reward users with a share or profits. These profits can be increased by owning the Chimpzee NFT passport, a key to accessing other features of this green ecosystem.

The second mechanic is Shop-to-Earn, which comes from Chimpzee Shop. The Chimpzee shop will feature a slew of merchandise based on the Chimpzee characters and other physical and digital assets. Interacting with the shop will reward users with CHMPZ tokens. Also, a portion of the profits will be shared with eco-focused organizations.

The final earning mechanic is Play-to-Earn. It comes from a hybrid game named “Zero Tolerance Game” that will reward players for reaching certain milestones. While the nature of the game is yet to be revealed, initial speculation is that it is a hybrid game where users will be rewarded for recycling and partaking in other eco-friendly measures.

These factors will give Chimpzee a long-term appeal in the eco-friendly crypto niche.

6. Bitcoin – Store of Value for Long Term Crypto Investors

It will likely come as no surprise to see Bitcoin on our list of the best long term crypto investments for 2024. Bitcoin is the first and still de-facto cryptocurrency in this marketplace. Launched in 2009, Bitcoin was originally created as a medium of exchange to compete with the traditional financial system.

However, Bitcoin transfers take 10 minutes to confirm and are limited to just 7 transactions per second. As a result, Bitcoin is now viewed as a store of value – in a similar nature to gold. There will only ever be 21 million Bitcoin in supply and new tokens enter circulation every 10 minutes.

Furthermore, and perhaps most pertinently, the supply of Bitcoin cannot be manipulated like fiat currencies. This means that Bitcoin can never witness the same fate as the US dollar, euro, British pound, and other currencies in terms of inflationary practices. In addition, no single person or authority has control over the Bitcoin network.

Taking all of this into account, Bitcoin is one of the best long term crypto investments for 2024. Crucially, the broader crypto markets have been in freefall since the turn of 2022 – which means that Bitcoin can be purchased at a much lower price than its previous all-time high of November 2021.

Back then, Bitcoin peaked at nearly $69,000 after going on a prolonged bullish run. Since then, Bitcoin has dropped to lows of just under $20,000. Therefore, when compared to its previous high, Bitcoin can be purchased at a discount of over 70%. At these pricing levels, if and when Bitcoin eventually recovers to its previous high, this would require an upside of nearly 250%.

Note: Although Bitcoin trades for over $20,000 per token, budget-friendly brokers like eToro allow minimum investments of just $10.

Cryptoassets are highly volatile investment products. Your capital is at risk.

7. Ethereum – Solid Smart Contract Blockchain With Huge Market Capitalization

Seasoned crypto investors will often focus on just two tokens – Bitcoin and Ethereum. Regarding the latter, Ethereum is positioned just behind Bitcoin in the market capitalization rankings. Since it was launched in 2015, Ethereum has not only gone on to become one of the most valuable digital currencies – but the most trusted.

This decentralized project runs in conjunction with the Ethereum Foundation, which is a non-profit organization that aims to develop the blockchain protocol throughout the course of time. One of the main aspects that sets Ethereum apart from Bitcoin is that it facilitates smart contract agreements.

In their most basic form, smart contracts allow people to enter into trustless agreements. The terms of each agreement are built into the smart contract code and thus – cannot be amended or manipulated. Some of the best altcoins to buy right now – including the likes of Decentraland and Polygon, operate on top of the Ethereum blockchain.

In fact, there are thousands of projects that utilize the Ethereum network for their own ecosystem – which are otherwise referred to as ERC-20 tokens. Just like Bitcoin, Ethereum is one of the best long term crypto investors to consider right now due to its discounted price. As of writing, Ethereum is trading at a discount of nearly 70% from its 2021 highs.

Cryptoassets are highly volatile investment products. Your capital is at risk.

8. Solana – Top-Performing Blockchain Network That is Highly Scalable

Although we would argue that Ethereum is one of the best long term crypto investments that all traders should consider, we also like Solana. This project is often dubbed an Ethereum Killer, not least because it also offers decentralized smart contracts – but in a much more efficient and cost-effective way.

For example, Ethereum can only handle up to 16 transactions per second. Although Ethereum 2.0 will eventually take this figure to an expected 100,000 per second, when this happens remains to be seen. In comparison, Solana can reportedly handle up to 50,000 transactions per second and at a much cheaper rate than Ethereum.

For instance, the average transaction fee on Solana is just $0.00025, while in the case of Ethereum, this typically sits between $0.50 and $1 when the network isn’t overloaded. When Ethereum experiences a network overload, this can increase to several dollars.

Nonetheless, the smart contract market is large enough for more than one blockchain network to stake a claim. As a result, both Ethereum and Solana potentially represent two of the best long term crypto investments for 2024. In terms of pricing, Solana is, as of writing, trading at a discount of nearly 85% when compared to its previous all-time high.

Cryptoassets are highly volatile investment products. Your capital is at risk.

9. Polygon – Quality Side-Blockchain for Ethereum Transactional Activity

We mentioned just a moment ago that Ethereum, which is still the de-facto blockchain of choice, is very limited when it comes to scalability and is expensive in terms of transaction fees. This is where Polygon comes in, which most definitely makes our list of the best long term crypto investments for 2024.

In a nutshell, Polygon operates a side-chain network for the Ethereum blockchain. This means that developers get the best of both worlds. That is to say, developers can build decentralized applications that run in conjunction with the Ethereum network, meaning that security and legitimacy remain in place.

However, through the Polygon side-chain, developers and end users benefit from significantly lower fees and more scalable transactions throughout. Backing the Polygon ecosystem is the MATIC token. When MATIC was launched in 2019, CoinMarketCap notes that it was priced at just $0.0035.

In late 2021, MATIC hit an all-time high of $2.92. This means that early investors witnessed gains of over 83,000%. Based on prices at the time of writing, MATIC can be purchased at a discount of over 70% from its prior all-time high. As such, never before has there been a better time to invest in the Polygon ecosystem.

Cryptoassets are highly volatile investment products. Your capital is at risk.

10. XRP – Long-Term Investment Into the Future of Interbank Transactions

Next up on our list of the best crypto for long term investment is XRP. This is the native digital currency of the Ripple company, which is involved in payments solutions. In fact, Ripple has built an innovative payments network that allows big banks and financial institutions to transact on a cross-border basis.

While several legacy systems already serve this function, performing interbank transactions via the Ripple network is both cheaper and faster. For instance, if a bank in Africa wishes to transfer funds to an institution in Australia, this would typically need to go through a third party like SWIFT.

The SWIFT network – which was dominated the interbank sector since the 1970s, is expensive and oftentimes incredibly slow. Ripple, however, enables banks to transact internationally at a fee of just 0.00001 XRP. As of writing, this amounts to just $0.0000036 per transaction – irrespective of the size of the transfer.

Furthermore, Ripple transactions take just a few seconds before they are validated. Not only can Ripple handle up to 1,500 transactions per second, but XRP ensures that cross-currency transfers have sufficient levels of liquidity. The main drawback with XRP is that its token valuation is yet to regain its prior all-time high of over $3.30 – which it hit in early 2018.

Nonetheless, taking into account the current bear market, there is still plenty of upside potential. For instance, as of writing, XRP is trading at a discount of nearly 75% when compared to its 52-week high of $1.41. If XRP were able to regain this previous high, this would require an upside of nearly 300%.

Cryptoassets are highly volatile investment products. Your capital is at risk.

11. Decentraland – Invest in the Metaverse Today via MANA Tokens

One of the best long term crypto investments for 2024 is the metaverse. This concept is currently being developed by a number of leading projects, which is inclusive of Decentraland. In a nutshell, Decentraland offers a virtual world that enables users to create their own digital avatar.

This avatar is essentially the virtual version of an individual user, it can be fully customized, and is represented via a unique NFT. Users can then explore the Decentraland virtual world, which is limitless in terms of its potentialities. For example, plots of land within the Decentraland ecosystem can be purchased by users.

In order to do this, users must connect their wallet to Decentraland and pay for their purchase with MANA tokens. To date, many plots of land have been purchased for significant sums – some of which have surpassed $1 million. Moreover, plots of land can be used to build virtual projects – such as hotels, apartments, or casinos.

Either way, some market commentators see virtual real estate in the Decentraland world as a long-term investment. The theory is that as Decentraland and the broader metaverse become more mainstream, land valuations will increase. The value of the MANA token itself has performed exceptionally well since it launched in 2018 – with peak gains of over 20,000%. For the best metaverse cryptos read our detailed article now.

Cryptoassets are highly volatile investment products. Your capital is at risk.

12. BNB – Invest in the Continued Growth of the Binance Ecosystem

Binance is the largest private entity that operates in the cryptocurrency and blockchain sector. While the current crypto bear market is resulting in a wave of exchanges facing liquidity issues, Binance faces no such problem. In fact, Binance has stated that it has the financial resources to purchase struggling crypto firms should the right opportunities present themselves.

And as such, BNB, which is the native digital asset of the Binance ecosystem, is perhaps one of the best crypto to invest in the long term. Before we get to the price action of this token, let’s explore the fundamentals of BNB. First and foremost, the token was originally created with one sole purpose – to offer Binance exchange traders a discounted commission rate.

While this benefit still exists, BNB now offers a much wider range of use cases. At the forefront of this is the Binance Smart Chain. This is a decentralized network that supports thousands of crypto tokens – many of which are brand new start-ups. When traders elect to buy a token listed on this network, fees must be paid in BNB.

Furthermore, tokens launched on the Binance Smart Chain are paired with BNB. This means that liquidity is facilitated in BNB and thus – demand for this crypto token continues to grow. However, in line with the wider crypto winter, BNB has since seen its value decline. This does, however, mean that when compared to its previous high, BNB is available at a discount of 70%.

Cryptoassets are highly volatile investment products. Your capital is at risk.

The Basics of Long Term Crypto Investing

In a nutshell, long term crypto investing is defined as holding onto a digital asset for at least one year. However, in the volatile world of crypto, long term investors should consider holding for several years – especially when gaining exposure to solid projects with strong fundamentals.

After all, one only needs to look at the previous pricing cycles of Bitcoin and the broader crypto markets to understand that long term investors will always do better than short term speculators.

- For example, in 2017, Bitcoin went on a prolonged bull run, going from $1,000 at the start of the year to close at $20,000.

- After hitting its then all-time high of $20,000, Bitcoin entered an extended bear market.

- In fact, just one year later, Bitcoin hit lows of approximately $3,500.

- On the one hand, this means that those buying at the peak of $20,000 and selling at $3,500 would have been looking at losses of over 80%.

- However, those that held on until November 2021 would have been able to cash out at nearly $69,000 – which represents gains of almost 245%.

In another example, in January 2018, Ethereum hit highs of $1,400, only to breach lows of nearly $100 just one year later. However, fast forward to November 2021 and Ethereum hit new all-time highs of almost $5,000.

The key point here is that by refraining from panic selling during a broader bear market, long term investors stand the best chance possible of not only recovering losses – but creating far greater gains.

This is, however, on the proviso that investors are holding solid cryptocurrencies with strong fundamentals. After all, many crypto tokens from the 2018/19 bear market have never recovered. On the contrary, lots of projects have since become insolvent.

Should I HODL my Crypto?

Knowing whether to HODL or cash out an investment during a crypto bear market is no easy feat. After all, not only is there no guarantee that the respective token will recover – but the broader crypto market itself.

As such, investors should carefully consider how to proceed. Below, we explore some of the key considerations that should be made when making an investment decision during bearish periods.

Fundamentals of the Crypto Project

First and foremost, investors should look at the fundamentals of a project when deciding whether or not to HODL. For example, in our view, the likes of Bitcoin and Ethereum are solid, established cryptocurrencies that will always be around.

Both of these digital assets – and many others, have not only survived prior bear markets but continue to generate attractive gains for long term investors.

In order to determine the long term viability of a crypto investment – consider the following key points:

- How long has the crypto project been in existence?

- Does the crypto project have a strong, active community of investors?

- What exchanges is the crypto token listed on and does it attract sufficient levels of liquidity?

- How big or small is the market capitalization of the crypto project?

- Is the respective team of developers working on the crypto project behind the scenes?

- What notable partnerships has the crypto project formed?

Being able to evaluate the above questions will help investors determine how strong the fundamentals of the project are and ultimately – pay less attention to short term volatility.

This is no different from holding high-grade stocks during a recession.

Performance of the Crypto Since the Previous Bear Market

The next metric to consider is how the crypto token has performed since the prior bear market. By this, we mean exploring the previous all-time high of the project and whether or not it has gone on to smash through this figure since.

For example, we mentioned earlier that Bitcoin hit an all-time of $20,000 in late 2017. Although it took three years for Bitcoin to once again hit a price of $20,000, the digital currency has since gone on to breach new highs of over $68,000.

At the other end of the spectrum, many crypto projects have failed to recover former highs from several years prior. As such, this should be viewed as a major red flag.

Discounted Prices Means a Lower Average Cost Price

Rather than panic selling, seasoned investors will often look to increase their exposure to long term holdings during a crypto winter.

The best crypto to buy during the market crash are those that offer solid fundamentals but at a hugely discounted price. This will enable investors to reduce the average cost price of any tokens being held during a market dip.

- For example, let’s suppose that an investor allocated $10,000 into Bitcoin when the digital asset hit $68,000

- The investor then allocates a further $10,000 into Bitcoin when it hit $40,000, and again at $20,000

- This takes the total investment into Bitcoin to $30,000

- However, the average cost price has subsequently been reduced from $68,000 per BTC to just over $42,000

- This means that if and when Bitcoin eventually recovers to $68,000, the investor will be looking at gains of 61%, rather than breaking even

Once again, long term cryptocurrency predictions are never an indicator of future results, meaning that there are no guarantees that prices will ever recover. As such, traders should never invest more than they can realistically afford to lose.

Step-by-Step Guide on How to Invest in Long Term Crypto on eToro

IBAT is yet to hit a public exchange, as the crypto token is in the midst of its presale campaign. Most of the other tokens on our list of the best crypto for HODLing can be found on eToro.

In a nutshell, eToro is a regulated broker that supports small crypto investments from $10 alongside competitive fees. Plus, it’s easy to open an account and subsequently deposit funds with a debit/credit card, bank wire, or e-wallet.

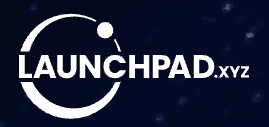

Step 1: Open an eToro Account

First, create an eToro account by clicking ‘Sign Up’ and choosing a suitable username and password. Next, follow the on-screen instructions by entering some basic personal information, alongside an email address and cell phone number.

To finalize the account opening process, upload a copy of a government-issued ID – such as a driver’s license or passport.

Cryptoassets are a highly volatile unregulated investment product.

Step 2: Deposit Funds

The minimum deposit for US/UK clients at eToro is $10, and $50 elsewhere. No fees apply on USD deposits across all supported payment types.

The fastest and most convenient way to deposit funds at eToro is via a debit/credit card or an e-wallet like Paypal. Bank wires are supported too.

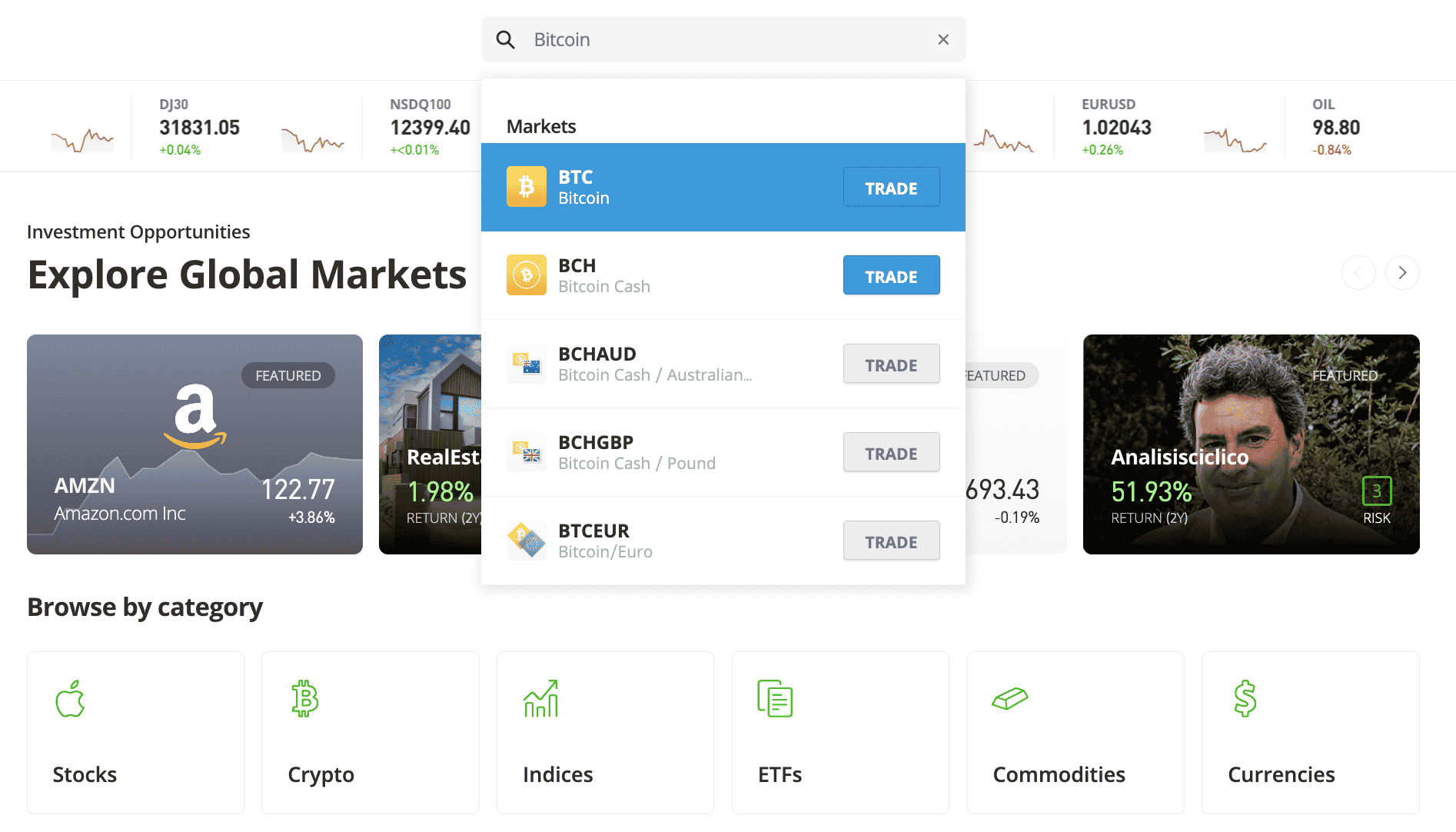

Step 3: Search for Long Term Crypto

By clicking on the ‘Discover’ button, investors can browse the many crypto tokens that are available to buy on eToro.

eToro users can also use the search bar – like we have done in the example image above.

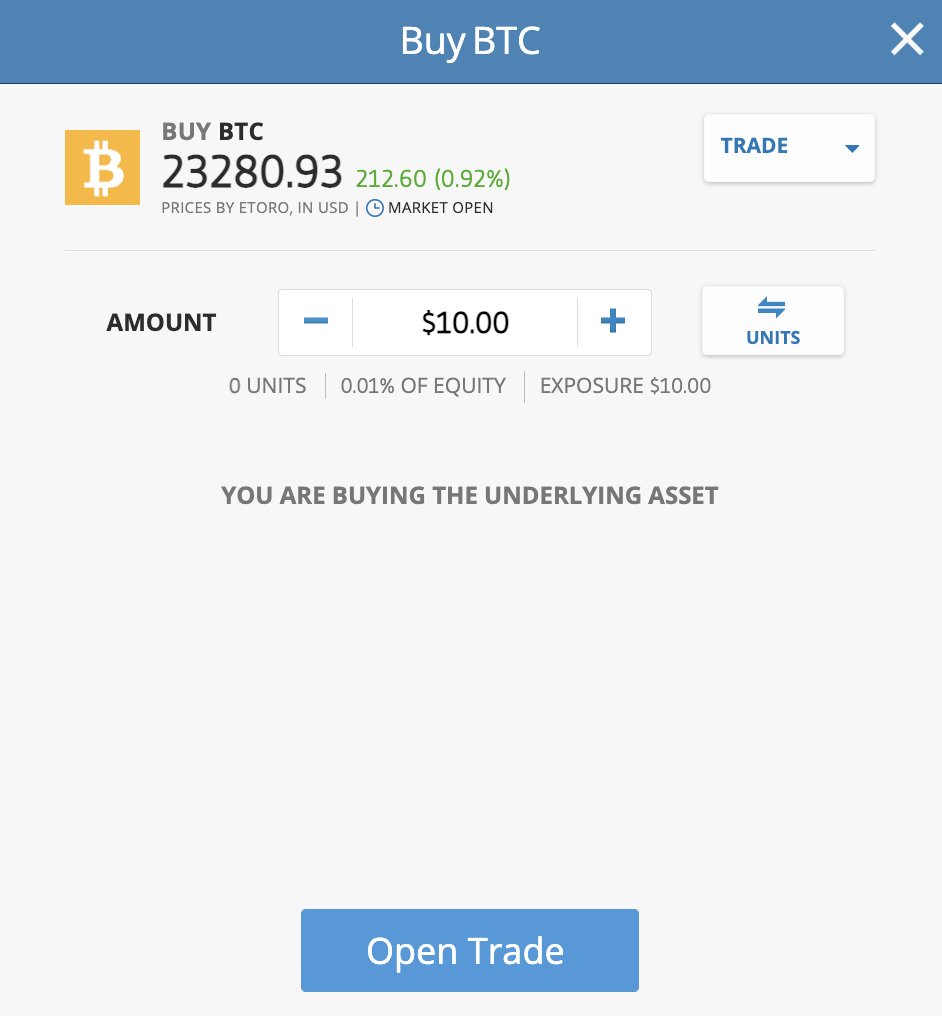

Step 4: Buy Long Term Crypto

The eToro user will now need to click on the ‘Trade’ button next to the crypto they wish to buy. This will subsequently launch an order box.

Next, type in the total investment amount – from $10. Finally, to complete the investment process, click “Open Trade’.

Conclusion

Although the wider crypto sector is currently in the midst of a bear market, this offers a great opportunity to enter some long-term positions.

Many of the tokens on our list of the best cryptocurrency to invest in 2024 for long-term growth have previously witnessed bearish conditions – but have since gone on to generate new all-time highs.

Wall Street Memes is our top pick as a long-term investment. Even though a memecoin, Wall Street Memes is supported by a strong community that aims to mobilize memecoin into a wealth-generating asset.

Our other top pick is Launchpad XYZ, a Web 3 ecosystem making the blockchain tech more palatable using inclusive means.