Whether the bond is issued by a company, state or locality, one of the key considerations for bond investments is the rating given to a bond by a nationally recognized bond rating company. While these bond ratings can be useful when evaluating possible investments, the State Corporation Commission’s Division of Securities and Retail Franchising encourages Virginians to consider factors other than the rating when determining whether to invest in a particular bond or bond fund portfolio.

Companies, states, localities and the U.S. government issue bonds to raise money. When investing in a bond, you’re loaning a sum of money to the bond issuer for a specified period of time. In exchange, the issuer promises to make regular interest payments to you at a predetermined rate until the bond comes due, and then repay your principal upon maturity.

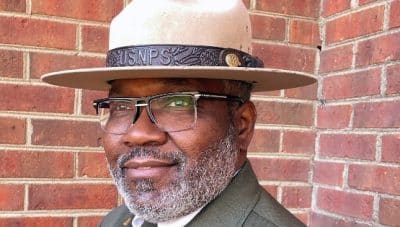

Although bonds are generally considered to carry less risk than stocks, they are not risk-free. Just as individuals have their own credit report and rating issued by credit bureaus, bond issuers are evaluated by their own set of ratings agencies to assess their financial health and creditworthiness. “Bond ratings can give you an indication of the riskiness of various kinds of debt and which bond issuers are most and least likely to fail to meet their obligations,” said Ron Thomas, director of the SCC’s Division of Securities and Retail Franchising. He cautions investors, however, that: “Bond ratings aren’t perfect and can’t predict the financial health of a bond issuer or whether your investment will go up or down in value.”

Investors are encouraged to understand the basics of bond ratings before investing. Bonds are rated at the time they are issued and can be upgraded or downgraded before they mature. The rating affects the interest rate that companies and government agencies pay on their bonds and drive bond pricing. Typically, the higher a bond’s rating, the safer an investment it is. However, highly rated bonds may also offer lower interest rates than bonds with lower ratings.

As with any investment, Thomas encourages Virginians to protect themselves financially by defining their objectives when investing, balancing risk versus reward, researching details about an investment, understanding all costs associated with buying and selling that investment, and regularly monitoring your investments. “Use caution when considering higher yields offered by bonds with lower credit ratings. Remember: higher yield equals higher risk,” he said.

When buying individual bonds, Thomas recommends finding a firm and broker specializing in bonds and checking their credentials and disciplinary history. In Virginia, you can do this by contacting the SCC Division of Securities and Retail Franchising at 804-371-9051 or toll-free (in Virginia) at 1-800-552-7945 or visiting its website. To learn more, visit the North American Securities Administrators Association’s website.