Most Volatile Cryptocurrency to Invest in 2024

The crypto markets are now firmly in a bearish cycle – meaning that prices are even more volatile than ever. This does, however, present an opportunity to buy popular crypto assets at an attractive price.

In this guide, we discuss the 10 most volatile crypto to invest in right now.

List of the 10 Most Volatile Crypto to Invest in 2023

In terms of investment opportunities as per the current bear market, the 10 most volatile crypto to buy right now are listed below:

- Tamadoge (TAMA) – Exciting P2E Game With NFTs and Battles

- Battle Infinity (IBAT) – Metaverse Project With a Focus on Play to Earn Fantasy Sports Games

- Lucky Block (LBLOCK) – NFT Competitions and Rewards on the Blockchain

- Bitcoin (BTC) – Most Popular Crypto That Still Remains Volatile

- DeFi Con (DEFC)– Potentially the Next DeFi Project to Explode

- Shiba Inu (SHIB) – Volatile Meme Coin With an Impending Metaverse Launch

- BNB (BNB) – Top-Rated Crypto Backing the Binance Ecosystem

- Ethereum (ETH) – Large-Cap Crypto Asset With Regular Volatile Swings

- Dogecoin (DOGE) – De-Facto Meme Coin That is Now Accepted by Tesla

- Ethereum Classic (ETC) – Most Volatile Crypto Asset This Year

Detailed Analysis of the Most Volatile Crypto to Invest In 2023

Irrespective of whether the digital asset scene is considered to be in a bull or bear market, cryptocurrencies are volatile investment products – at least in comparison to the traditional financial markets.

This means that even the best long-term crypto investments – such as Bitcoin and Ethereum, witness rapid price swings in both directions.

Fortunately, when the broader markets are down, this offers an excellent opportunity to take advantage of volatility. Below, we explore the most volatile crypto to buy right now.

1. Tamadoge (TAMA) – Exciting P2E Game With NFTs and Battles

Many crypto investors may not have heard of Tamadoge (TAMA), not least because the project is yet to be listed on a public exchange. The reason for this is that Tamadoge is a brand new crypto project that is currently engaged in its presale launch. This means that investors can buy its digital token – TAMA, at the best price possible.

Tamadoge is building an entire ecosystem that focuses on a pet-themed play to earn game. Players will be able to mint their very own virtual pet and subsequently take care of it. This might include training the pet or even feeding it. Either way, each Tamadoge pet is not only unique from the next but represented by an NFT.

This means that each NFT will have its own traits, both good and bad. The theory is that the rarer the pet – the more value it carries within the ‘Tamaverse’. The traits of each NFT are randomly generated by a smart contract, so all Tamadoge players have access to a fair playing field.

In addition to being a fun and engaging game, the P2E element of Tamadoge ensures that players are incentivized through rewards. This means that by playing Tamadoge, players can win TAMA tokens. There are many ways to build a stash of TAMA, one of which is to enter a virtual pet into battle with another player.

There is also a leaderboard that awards top-performing pets and players each month. Further down its roadmap objectives, Tamadoge will release a mobile app for both Android and iOS. This will not only enable players to keep tabs on their Tamadoge pets while on the move, but experience augmented reality.

In its most basic form, this will require players to explore the ‘real-world’ looking for TAMA tokens. While looking at their smartphone screen, players will be able to see augmented visualizations – such as in-game hints and assets. This will, potentially, result in Tamadoge becoming the best NFT game of all time.

When it comes to the tokenomics of this project, Tamadoge recently sold out its beta launch – which raised in the region of $1.6 million. This offered early investors the chance to buy Tamadoge at a rate of 100 TAMA per 1 USDT. Now that the project has moved onto its presale, the price has increased slightly to 80 TAMA per 1 USDT.

Nonetheless, this still offers a highly attractive entry price for early investors, not least because it is yet to launch on public exchanges. In order to buy TAMA via its presale, investors can head over to the Tamadoge website and connect their wallets. After that, investors will need to either swap USDT or ETH for TAMA, at a minimum of $15.

Read More: Does Tamadoge have what it comes to become the best P2E game of the year?

| Min Investment | 1,000 TAMA (∼$10 + gas fee) |

| Max Investment | None |

| Purchase Methods | ETH, USDT, Debit / Credit Card (via Transak) |

| Chain | Ethereum |

| Presale Ends | Q4 2022 |

2. Battle Infinity (IBAT) – Metaverse Project With a Focus on Play to Earn Fantasy Sports Games

Battle Infinity (IBAT) is the next project that we will discuss. In a similar nature to Tamadoge, Battle Infinity is only just launching its project to the public. In just 24 days, the Battle Infinity presale raised its entire hard cap total of 16,500 BNB – or about $5 million.

Now that the presale has sold out, there is a lot of speculation that IBAT could be the cheapest cryptocurrency to buy on PancakeSwap – with its listing imminent. About the project – Battle Infinity is primarily building a fantasy sports ecosystem that enables players to earn real-world rewards in the form of digital assets.

After picking a team of players from a sport – such as football or basketball, Battle Infinity users will earn points based on the real-world performance of each individual athlete. For example, let’s suppose that the user has built a fantasy soccer team and one of their chosen players scored two goals in the previous match.

This would result in the Battle Infinity user accumulating points. While equally, if the user picked a player that received a red card in the most recent match, this would result in a points deduction. Either way, the more points that a player gets via the Battle Infinity fantasy sports game, the more rewards they will earn.

All rewards within this project are distributed in IBAT tokens. Upon earning IBAT, players have a number of options. Long-term investors might consider transferring the tokens to the IBAT staking tool, with the view of earning interest in a passive manner. Alternatively, players can sell their IBAT for a large-cap coin like BNB via the Battle Infinity DEX.

The Battle Infinity whitepaper notes that the project will expand into many other gaming niches and genres. Therefore, this up-and-coming project aims to sit alongside the best crypto games in the market. Crucially, we should also mention that the project’s gaming ecosystem will run alongside the metaverse and NFTs.

Not only will this ensure that players have the opportunity to enjoy immersive experiences, but any in-game assets earned will be owned by the respective user via an NFT that is stored on the Binance Smart Chain. Those that like the sound of Battle Infinity should know that although its presale has concluded – investors can buy IBAT at an attractive price on PancakeSwap. It will be listed on PancakeSwap on 17 August 2022.

Read More: Join the Battle Infinity Telegram to get real-time information on the PancakeSwap launch alongside any other important project developments.

3. Lucky Block (LBLOCK) – NFT Competitions and Rewards on the Blockchain

Although Lucky Block (LBLOCK) is behind one of the best crypto presales of 2023, it is still one of the most volatile crypto to buy. Regarding its presale, LBLOCK tokens were purchased by early-bird investors at $0.00015. After the presale reached its hard cap total of over $5 million, it was then listed on PancakeSwap.

What followed was LBLOCK reaching a market capitalization of $1 billion faster than any other post-sale crypto project. Moreover, LBLOCK generated gains of over 60x in just a month of trading. Due to extreme volatile conditions as per the 2022 bear market, LBLOCK is, at the time of writing, trading at just over $0.001.

As a result, this volatile crypto project can be accessed at a discount of 85% when compared to its prior peak of $0.009. Those new to the Lucky Block project might wish to read the whitepaper. Nonetheless, in a nutshell, Lucky Block is building an NFT competition platform that offers ongoing draws and crypto rewards.

Those wishing to enter a competition will need to purchase an NFT. Examples of competitions being run in the coming weeks and months include a Lamborghini, a luxury vacation package, and even $1 million worth of BTC. As a result, some Lucky Block competitions offer life-changing prizes.

Moreover, those buying an NFT to subsequently enter a competition can still generate gains on their initial purchase, not least because holders will receive ongoing rewards that are paid in LBLOCK tokens. This is a great incentivization tool to attract new players to the Lucky Block ecosystem – which is built on top of the blockchain protocol.

Therefore, players can feel comfortable knowing that all Lucky Block NFT competitions are drawn fairly and randomly as per the underlying smart contract. In order to buy LBLOCK, investors will first need to decide whether they wish to purchase the V1 (Binance Smart Chain) or V2 (Ethereum) version of the token.

4. Bitcoin (BTC) – Most Popular Crypto That Still Remains Volatile

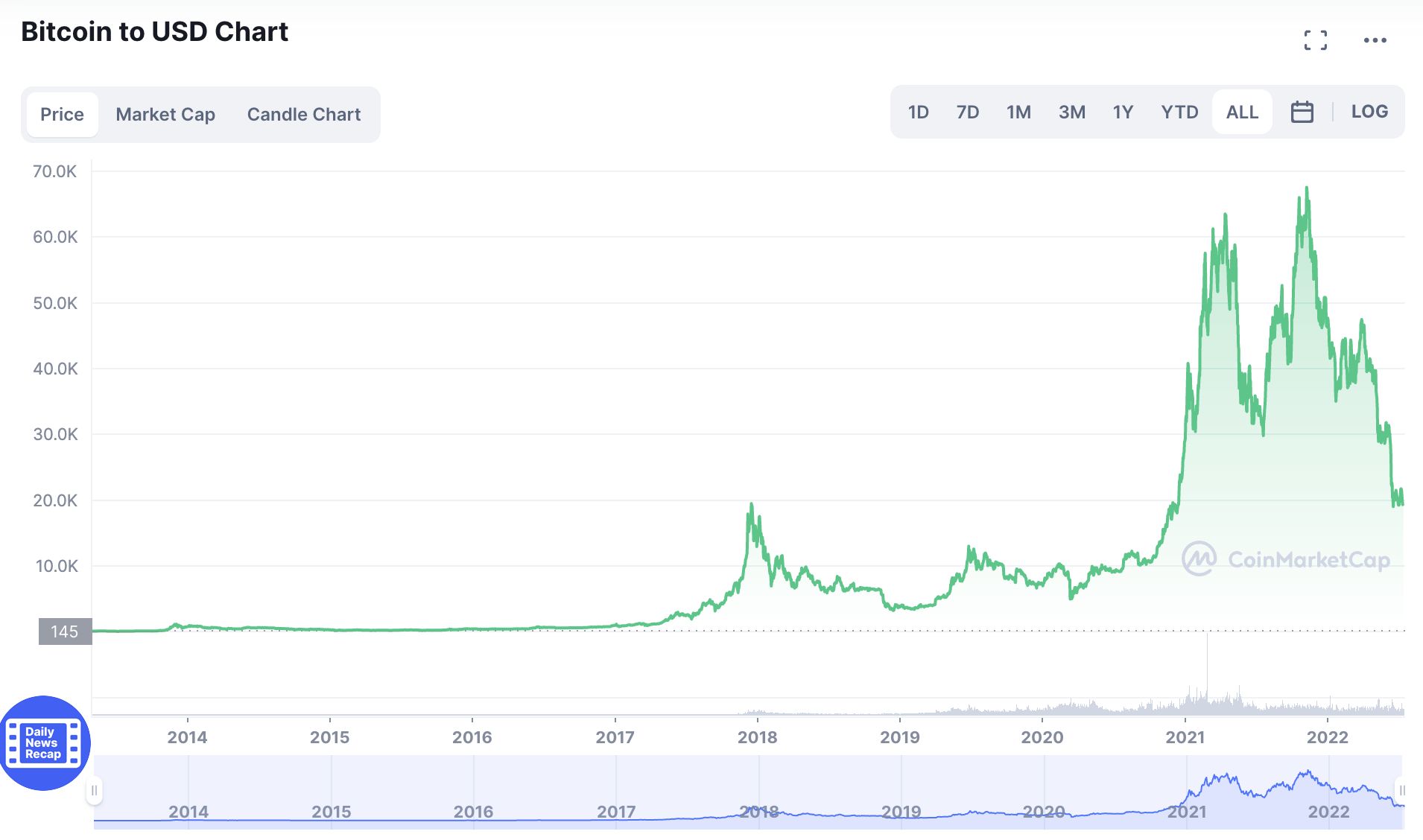

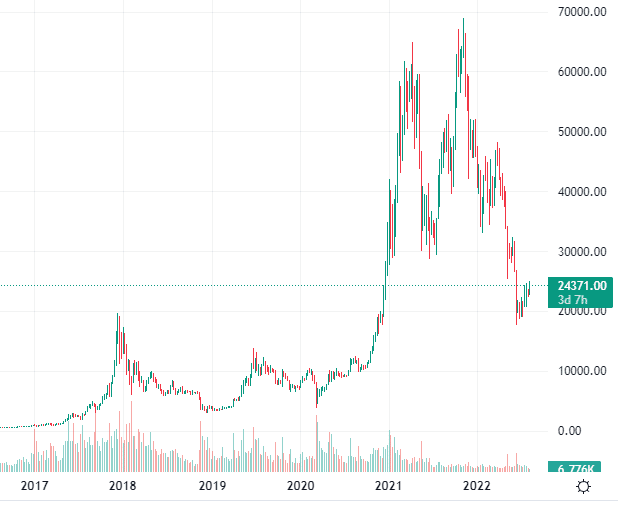

Although Bitcoin (BTC) is by far the largest cryptocurrency for market capitalization and perceived value, it is still a volatile digital asset nonetheless. Once again, this offers speculative investors the opportunity to buy Bitcoin at an attractive entry price, not least because its value has declined considerably since hitting its prior all-time high of over $69,000.

Before reaching $69,000, it is important to remember that in the midst of the COVID pandemic, Bitcoin hit lows of $5,000. Therefore, its overly extended bull run resulted in gains of over 1,200% for those taking advantage of the dip. As per the current bear market, investors once again have a chance to invest in Bitcoin at a huge discount.

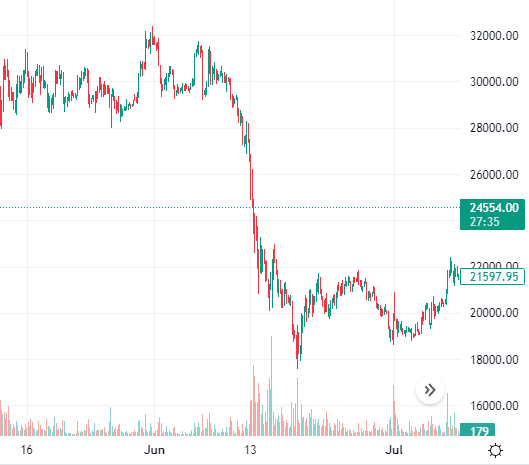

After all, Bitcoin has since dropped to lows of $20,000 – meaning an attractive discount of 70% when compared to its former peak. Due to its volatility, one of the best ways to approach the current market is to dollar-cost average. This will require the investor to stick to consistent purchases – such as $100 per week.

In doing so, this will allow the investor to gain exposure to Bitcoin in sensible intervals, while still taking advantage of its reduced value. Based on its 52-week low of just under $20,000, this would require an upside trajectory of 240% to get back to the $69,000 level.

Cryptoassets are highly volatile investment products. Your capital is at risk.

5. DeFi Con (DEFC) – Potentially the Next DeFi Project to Explode

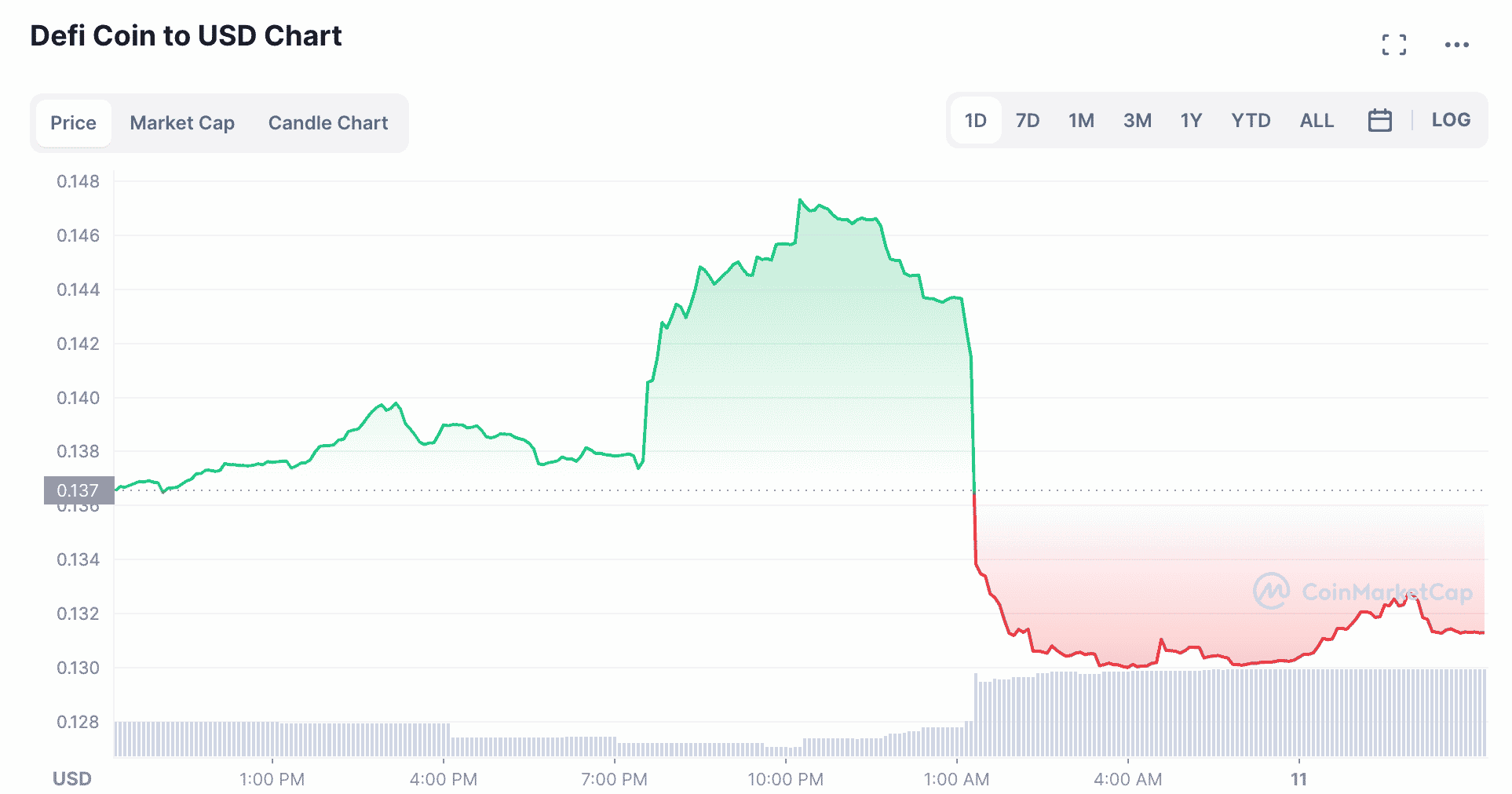

Seasoned investors looking for a bargain cryptocurrency to purchase during the bear market might consider DeFi Coin (DEFC). This BSc token remains one of the most volatile crypto to invest in, albeit, it offers an attractive long-term proposition, especially at current pricing levels.

DeFi Coin is the native token of the DeFi Swap DEX. At this moment in time, the developers behind the project are still working on the beta launch. This is to ensure that investors and traders have access to a highly secure DEX that is able to operate in an autonomous manner. Therefore, while the DEX is still being built, this offers investors the chance to get in early.

Some of the most sought-after products on the DeFi Swap DEX include yield farming and staking. Both of these tools enable investors to earn a passive income on any idle tokens they hold in their wallet. The latter will suit those that prefer a fixed rate of interest, meaning that they know exactly how much they will earn.

On the other hand, the yield farming tool at DeFi Swap will suit investors that wish to target higher gains and are prepared to take on additional risk to get there. The DeFi Swap exchange will also allow traders from all over the world to swap one digital asset for another in an anonymous manner – without needing to go through a centralized party.

Further down the line, as per the DeFi Coin roadmap, the DEX will host the best new NFT projects, mobile app, an education center, and more. In terms of its pricing action, the DeFi Coin presale offered the token at just $0.07. Within a couple of weeks of launching on PancakewSwap, the token hit highs of over $3. However, as of writing, investors will pay $0.13 per token.

6 – Shiba Inu (SHIB) – Volatile Meme Coin With an Impending Metaverse Launch

Shiba Inu (SHIB) is a crypto project that was launched in 2020 with the view of challenging Dogecoin as the de-facto meme coin. Although at the time of its launch, Shiba Inu offered little in the way of utility, the digital asset went on to record significant gains for early adopters of its token.

Estimates vary due to the project’s initial launch on a decentralized exchange, albeit, gains subsequently ran into the millions of percentage points. As a result, Shiba Inu has since solidified itself as a top-20 cryptocurrency for market capitalization. However, Shiba Inu is also one of the most volatile cryptocurrencies in 2023.

At its peak in 2021, Shiba Inu surpassed a value of over $0.00008. As of writing, Shiba Inu is trading at just $0.00001. Compared to its aforementioned high, this means that Shiba Inu can be purchased at a discount of over 85%.

Perhaps one of the main reasons that this could be a crypto asset worth considering at current prices, is that Shiba Inu is looking to add more utility for token holders. At the forefront of this is the metaverse project that Shiba Inu developers are working on. This will enable token holders to browse immersive experiences and even purchase plots of land.

The latter follows a similar concept to Decentraland and the Sandbox, where virtual land within the metaverse is viewed by many as a long-term crypto investment opportunity. In the case of the Shiba Inu metaverse, just 100,000 plots will be created. A percentage of this figure will be made available for purchase at various stages of development.

Cryptoassets are a highly volatile unregulated investment product.

7. BNB – (BNB) – Top-Rated Crypto Backing the Binance Ecosystem

BNB is also one of the most volatile cryptos to buy right now – with investors having access to a huge discount when compared to its pre-bear market valuation. BNB is the native digital asset owned and backed by the Binance ecosystem. Not only is Binance the largest crypto exchange, but it offers a variety of products and services that increase the demand for BNB.

For example, those wishing to earn a passive income on Binance can do so by depositing BNB into a staking or yield farming pool. Moreover, BNB can be used to access leveraged derivatives on Binance, as well as to buy NFTs via its online marketplace. Those wishing to benefit from reduced trading fees on Binance can get a 25% discount by holding BNB.

Another use case for BNB – and perhaps with the most potential, is that it is the native currency of the Binance Smart Chain. Considering that this blockchain network now supports thousands of tokens – most of which are paired against BNB, this ensures that the digital asset remains relevant in the long run.

BNB has generated sizable gains since it was launched in late 2017. The digital currency peaked in 2021 at over $669 per token, albeit, its value has taken a major hit since the bear market came to fruition. At the time of writing, BNB investors can enjoy a discount of over 50% when entering the market at current pricing levels.

Cryptoassets are highly volatile investment products. Your capital is at risk.

8. Ethereum (ETH) – Large-Cap Crypto Asset With Regular Volatile Swings

Ethereum is the second-largest digital asset in this space, behind Bitcoin. It is behind the most popular blockchain network in terms of clients, not least because thousands of tokens are built on top of the Ethereum framework. This includes several tokens discussed on this page, such as Tamadoge, Shiba Inu, and Lucky Block (V2).

The reason that many crypto projects prefer Ethereum is that its underlying blockchain offers rock-solid security, alongside fast transactions and support for smart contract agreements. For instance, some of the best metaverse projects in this space – such as the Sandbox, Axie Infinity, and Decentraland have opted to launch their ecosystem on the Ethereum chain.

Crucially, this means that the project’s underlying token – ETH, remains in huge demand across the market. The reason for this is that each and every token built on top of the Ethereum network is still required to pay transaction fees in ETH. Many from within the crypto market expect Ethereum to reach new heights when its migration to proof-of-stake is finalized.

After all, this will enable the blockchain network to process transfers with much cheaper fees and scale up to 100,000 transactions per second. As a result, this could make so-called ‘Ethereum Killers’ like NEO and Solana somewhat irrelevant. As of writing, Ethereum is trading on public exchanges at a discount of 60% when compared to its 2021 all-time high.

Cryptoassets are highly volatile investment products. Your capital is at risk.

9 – Dogecoin (DOGE) – De-Facto Meme Coin That is Now Accepted by Tesla

Dogecoin is one of the most volatile cryptos to invest in right now and considered by some as one of the best shitcoins – especially since the bear market came to light. When this meme coin was created as a joke in 2013, it remained on the sidelines for many years to follow.

Perhaps its only use case was a means to tip top-rated comments on social media and became the best crypto to buy on Reddit.

However, since Tesla CEO Elon Musk announced in early 2021 that he personally owned Dogecoin, this resulted in the meme project entering a rapid upward trajectory that generated gains of several thousand percentage points. In fact, at the close of 2020, Dogecoin was priced at $0.004, only to hit highs of $0.74 just five months later.

However, the extreme volatility of Dogecoin has seen the digital currency hit lows of just $0.03. Whether or not this huge decline is justified remains to be seen. Although the use case of this crypto asset is still questionable, it is important to remember that Tesla – the largest car market globally, not only accepts DOGE, but it holds it on its balance sheet.

Moreover, although Tesla announced in its most recent earnings report that it sold 75% of its Bitcoin holdings to raise cash, it left its Dogecoin untouched. Another core factor going for Dogecoin is that it has a huge meme following in the crypto space. As of writing, Dogecoin is trading at 90% less than its former all-time high.

Cryptoassets are highly volatile investment products. Your capital is at risk.

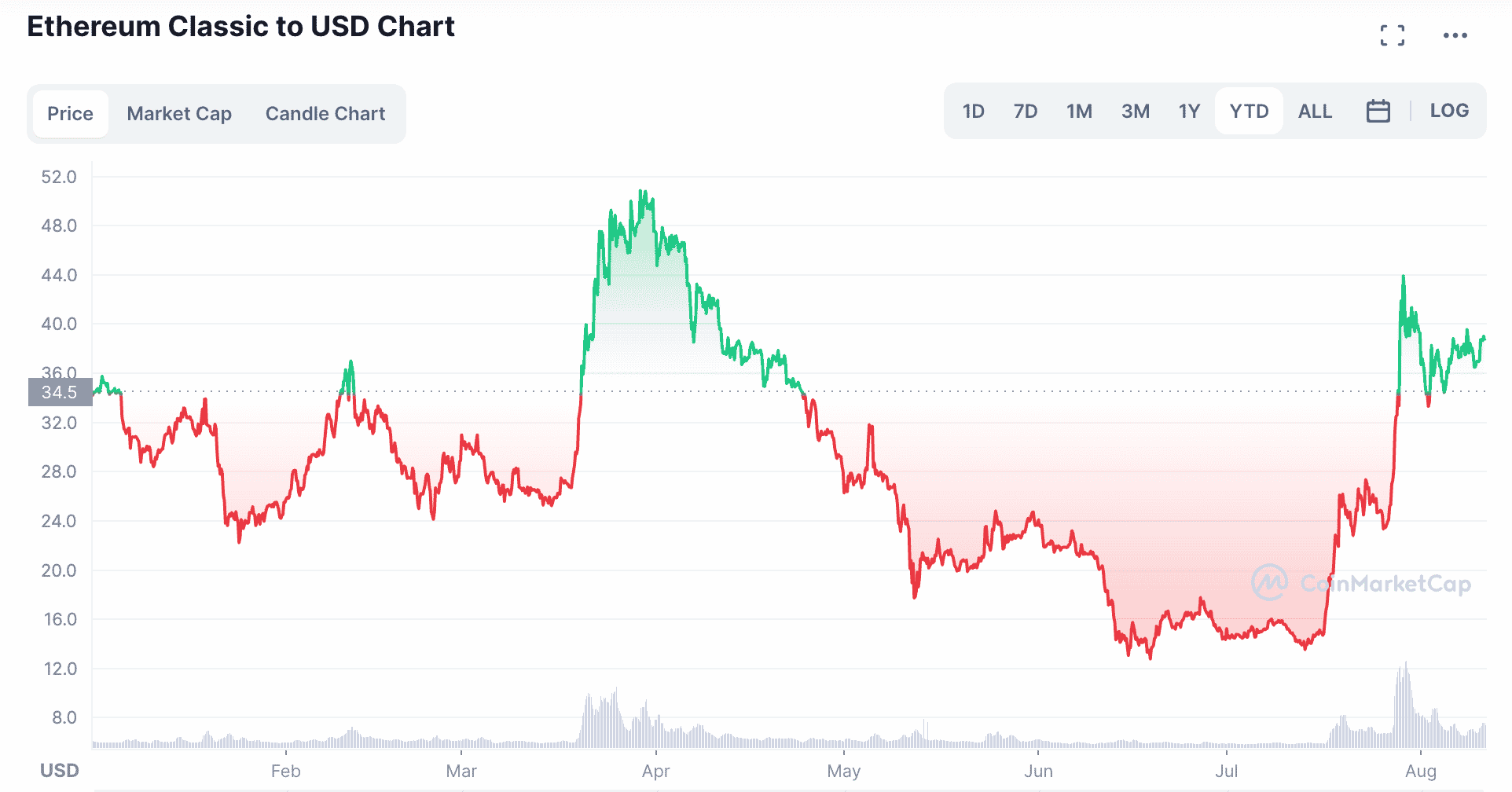

10 – Ethereum Classic (ETC) – Most Volatile Crypto Asset This Year

Ethereum Classic is quite possibly the most volatile crypto to invest in for 2023. According to CoinMarketCap, Ethereum Classic was trading at just over $34 at the start of the year. Just four months later, Ethereum Classic went on to hit a year-to-date high of $51.

This means that although the broader crypto market was in the midst of a bearish cycle, Ethereum generated gains of over 50%. Extremely volatile market conditions meant that by July, Ethereum Classic hit lows of just under $13.

However, further volatility meant that by the end of July, Ethereum Classic hit $44 – which translates into gains of over 235% from the aforementioned bottom. Short-term speculators might therefore decide to trade this highly volatile crypto asset, as its pricing movements remain a lot more unpredictable than the broader market.

Cryptoassets are highly volatile investment products. Your capital is at risk.

How to Locate the Most Volatile Crypto Assets

On the one hand, some crypto assets are more volatile than others. However, it should be remembered that the broader crypto industry itself is considered volatile, especially when compared to traditional blue-chip stocks.

As a prime example, in 2021, the total market capitalization of the entire crypto industry stood at just over $1.9 trillion.

As of writing, it stands at $1.1 trillion, which represents a decline of over 40%. During the same period, the S&P 500 index declined by less than 6%.

Nonetheless, in order to find the most volatile crypto to buy in today’s bear market – consider the following:

All-Time High to Current Price

The first metric to consider when searching for crypto with the highest volatility is the token’s prior all-time high. The vast majority of digital currencies witnessed their most recent all-time high towards the end of 2021.

For example, Bitcoin and Ethereum hit an all-time of $69,000 and $4,900 respectively in November 2021. After assessing the previous all-time high, the next step is to check the token’s current price.

For example, as of writing, Bitcoin and Ethereum are trading at approximately $24,000 and $1,900 respectively. Therefore, when compared to their prior all-time high, Bitcoin and Ethereum are trading 65% and 60% lower, respectively.

In comparison, the are many other digital assets that have lost a much larger chunk of their former valuation. The two largest meme coins in this space – Dogecoin and Shiba Inu, are trading 90% and 85% lower than their prior all-time highs.

Look at 1-Month Highs and Lows

Another way to find the most volatile cryptos is to explore the highs and lows of the token over the prior month of trading.

This information can be extracted directly from CoinMarketCap.

For example:

- Over the prior month, DeFi Coin has hit highs of $0.14

- During the same timeframe, DeFi Coin has hit lows of $0.08

- The difference between the one-month high and low of DeFi Coin is therefore 54%

Let’s compare this to Bitcoin:

- Over the prior month, Bitcoin has hit highs of $24,572

- During the same timeframe, Bitcoin has hit lows of $18,999

- The difference between the one-month high and low of Bitcoin is therefore 25%

As per the above examples, the smaller a crypto asset is in terms of its market capitalization, the more volatile it generally is.

Note: Investors can also assess the most volatile cryptocurrency for daily volume.

Explore Crypto Presales and New Listings

One of the best ways to trade the most volatile cryptos is to look for the best presale cryptos and the subsequent exchange listing that follows.

For example, we briefly mentioned that in just 24 days, the Battle Infinity presale raised its hard cap target of 16,500 BNB – or about $5 million based on current prices.

Within the next few days, the IBAT token will begin trading on PancakeSwap. As is often the case with newly listed tokens, it is expected that there will be extreme volatility in the hours and days that follow.

When do Cryptocurrencies Experience the Most Volatility?

Once again, it is important to stress that when compared to traditional investment products, the broader crypto markets are considered volatile throughout the year.

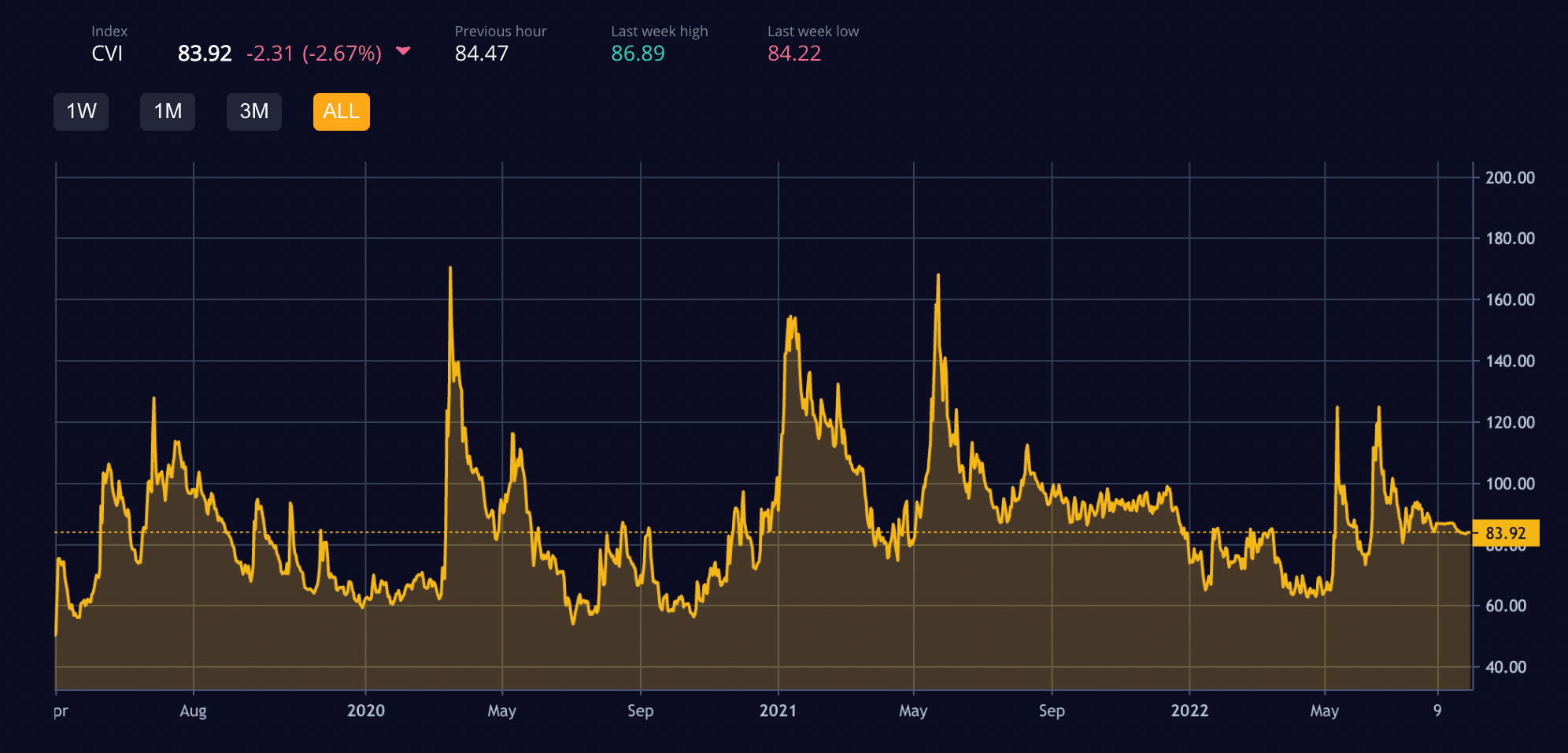

However, during certain time periods, volatility levels increase. One of the best ways to track volatility levels across the wider market is via the Crypto Volatility Index (CVI). In a nutshell, this index tracks the overall crypto market to assess how volatile it is from one day to the next.

As per the chart above, in May 2021, the CVI index experienced its most volatility since its inception in 2019. At the other end of the scale, the index experienced its lowest levels of volatility in March 2022. (fragster.com) This is when Bitcoin remained in a tight trading range between the $35,000 and $38,000 levels.

In terms of what motivates volatility, this is largely due to wider sentiment in the market. For example, when Bitcoin went from $40,000 in September 2021 to $69,000 in November of the same year, the markets were extremely bullish on the digital asset. As such, the markets were overly volatile during this period.

There was also extreme volatility in the month to follow, where market sentiment on Bitcoin dropped significantly – with the digital asset dropping to lows of $46,000 from its prior all-time high.

Should I Buy Volatile Crypto Assets?

Put simply, anyone buying a crypto asset is subsequently investing in a volatile market. With that said, some crypto investments are a lot more volatile than others.

In comparison to the broader market, large-cap cryptocurrencies like Bitcoin and Ethereum are less volatile. At the other end of the scale, newly launched projects with a small market capitalization such as Tamadoge will typically possess the greatest volatility levels.

Whether or not investors should explore the most volatile cryptos to buy will ultimately depend on the risk appetite of the individual.

On the one hand, investing in volatile cryptocurrencies can yield attractive gains. However, when things don’t go to plan, the most volatile cryptocurrencies typically generate much larger losses.

This is why crypto investors should consider creating a diversified portfolio alongside a dollar-cost averaging strategy.

Conclusion

Anyone looking to invest in crypto assets should remember that this industry is both volatile and speculative. Nonetheless, some of the most volatile cryptos in this space do offer the chance to target attractive gains, albeit, the risk of loss remains high.

Overall, for the purpose of this guide, we like the look of Tamadoge – a newly launched metaverse and P2E game that allows players to mint, train, and battle virtual pets.

TAMA tokens can be purchased via the Tamadoge presale until the hard cap target is reached – which is expected to happen in the coming days.