The crypto market looks like it is starting to come out of the wilderness as conditions seem like they are picking up again. Bitcoin’s price is once again recovering and as we know that tends to signify market conditions will be improving. This means it is the perfect time to start investing again.

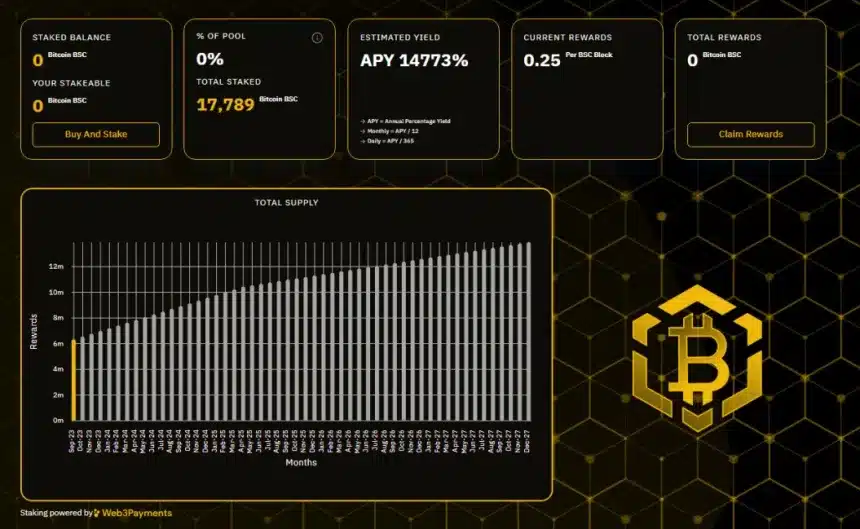

We trawled through the presale market and tried to find the next coin that looks like it could be huge and we think we found it in Bitcoin BSC (BTCBSC). There are many reasons for this but something that stands out is the inclusion of a staking system.

The crypto market loves a good trend. Once a project finds something that works you will see other clever projects adapt it into their ecosystem. Staking is the latest trend that is working for new projects so of course Bitcoin BSC is using it to great effect.

This isn’t the only reason why we think it is the best investment opportunity but it certainly helps. Coins like Dogecoin (DOGE) and Chainlink (LINK) dominate more headlines but they are overvalued and don’t offer as much as Bitcoin BSC does.

Let’s get into everything this new Bitcoin-inspired token can bring to investors.

Bitcoin BSC- Already over halfway through its presale

We can never fully correlate the pace of a presale with how successful the coin will be long-term but in general, if it is successful it normally bodes well for the project. Bitcoin BSC (BTCBSC) has already raised over $2.9 million and is therefore past the halfway point of the presale despite it only beginning a matter of weeks ago.

As we mentioned above, staking is definitely a factor in this, and the project is likely aided by the recent success of a similar coin. BTC20 (BTC20) is also a Bitcoin-inspired token and it also allowed its investors to stake their tokens before the listings began. Over 2/3rds of the purchased tokens were staked and this helped BTC20 pump once listings started.

It looks like something similar is in store for Bitcoin BSC. Staking has already been enabled and over 1 million tokens have been staked by investors. With an estimated APY of 254%, this number will likely go way up as investors see the potential passive earning opportunity.

Of course, staking brings more benefits than just this. Bitcoin has come under fire because of its mining process and how much energy is needed for this. As we likely head toward mass regulation in the future a coin like Bitcoin Bsc, which is proof-of-stake and does not require mining, will become even more popular.

There is also the added benefit of a more secure project as staked tokens are less likely to be dumped once listings begin. So, we have seen the huge benefits that staking will bring to Bitcoin BSC but let’s also look at what sets it out from the competition that also uses staking.

Some readers may be wondering what the BSC stands for in Bitcoin BSC. Well, it stands for Binance Smart Chain which is the chain the coin is built on. This is where its advantage lies as the BSC has smaller gas fees. This allows for not only cheaper transactions but faster ones too when compared to rival coins.

As the chain shares the same code as Ethereum investors also need not worry about security or smart contract capabilities. Most other ‘inspiration’ coins are built on the Ethereum network which is also fine but lacks the speed and cheapness the BSC has.

The last factor that makes Bitcoin BSC a smarter choice is just some clever marketing they have employed that shows they know the crypto audience. The price per token is $0.99 which is the price Bitcoin was just before it took off back in 2011.

By setting it at this price they allow investors to get the feeling of what it would have been like to invest in Bitcoin before most people even knew what the crypto market was. So we think we have shown why it is a better option than Dogecoin or Chainlink at the moment but let’s look at what is happening with each respective project.

Don’t bite too soon on Chainlink and Doegcoin

If there is one thing that investors should have learned from the last bearish period it is not to bite too early on good news coming from the outside of a crypto ecosystem. Ethereum looked like it was about to pump once ETFs were filed for a spot Ethereum exchange by many different firms but it never came.

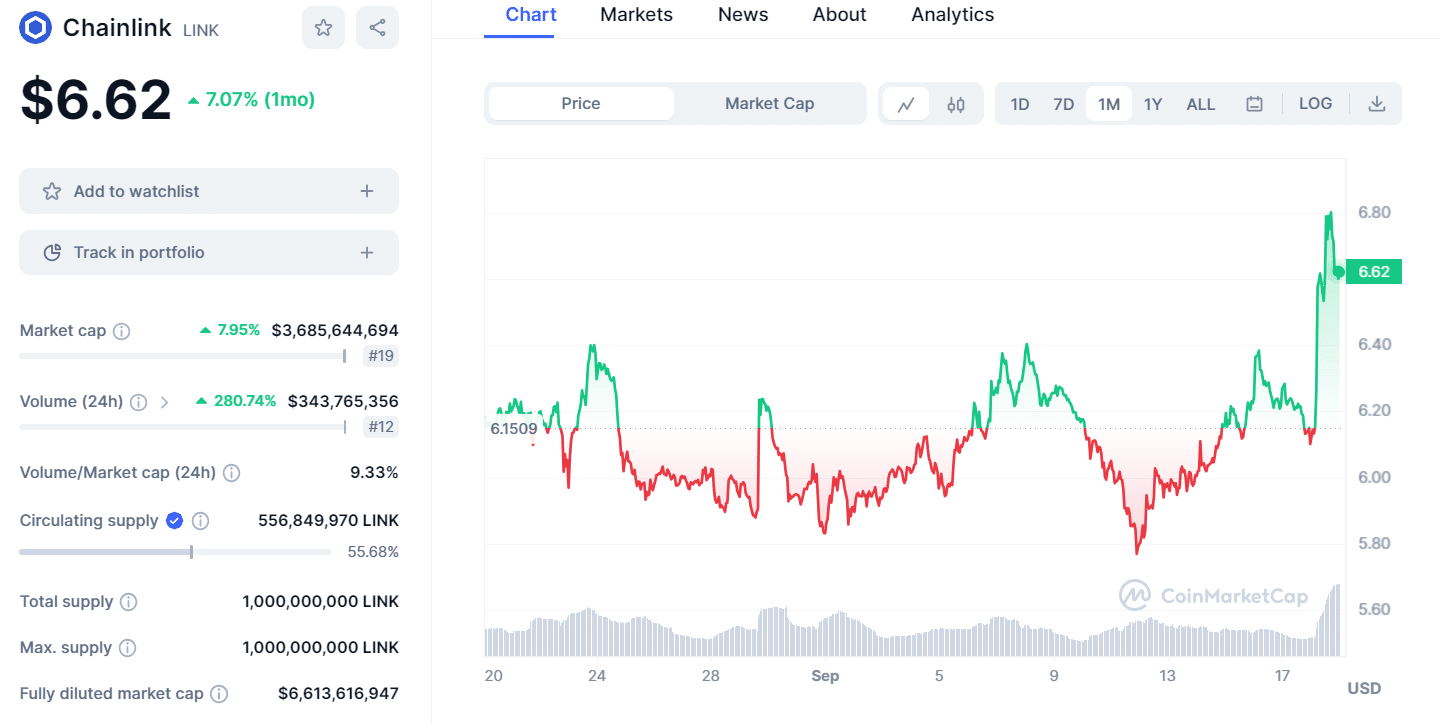

Below we can see the 30-day price movement for Chainlink (LINK). The upturn at the end likely comes after news that ANZ, one of the biggest banks in Australia, is advancing towards greater adoption of tokenized assets, after successfully completing a test transaction in collaboration with Web3 services platform Chainlink.

This seems like great news but investors should be wary after what happened with Ethereum. These spots of good news normally lead to quick pumps before the price collapses again. This may or may not happen with Chainlink we are just advising some caution.

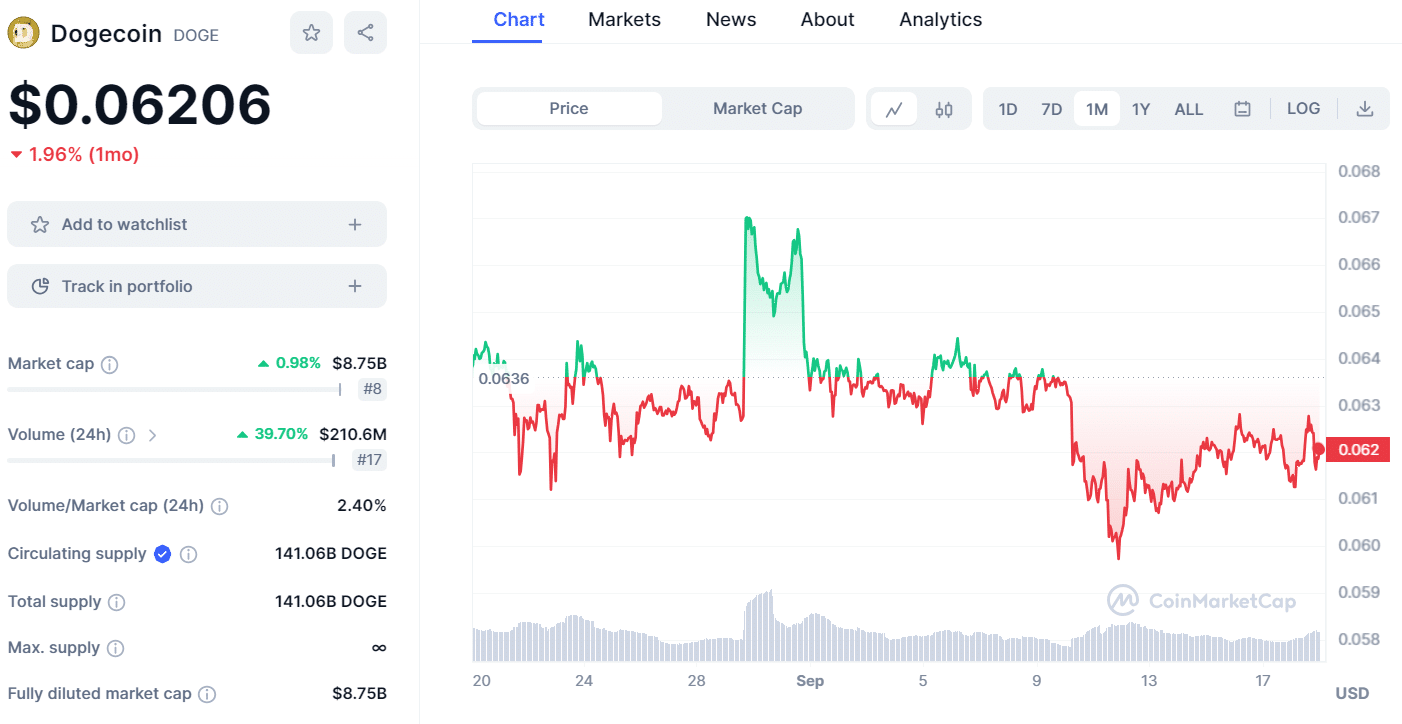

The 30-day price movement chart for Dogecoin (DOGE) does not make for great viewing for investors. The price collapsed in the middle of August and has not made much progress in getting out of that hole since.

Cointelegraph notes that we could be at a crucial crossroads for DOGE right now. The meme coin is trading between its 20-day EMA and the solid support at $0.06. It is now up to buyers to see which way this goes. If support comes in it may dig itself out of the hole but if not it could continue to plummet all the way down to $0.055.

It has not been a great 2023 for the market’s number-one meme coin. Unlike most major cryptos it is down from its starting point on the 1st of January. This is likely due to increased competition and we may not see dogecoin at the top of the meme coin ladder for much longer.

Conclusion

So although Chainlink may seem like a good buy right now we would advise you to be cautious if investing. Dogecoin on the other hand looks like a stay away altogether. That leaves Bitcoin BSC which looks like the perfect investment choice right now. Its staking system will give it a strong foundation that should see it pump once listings begin.