Altindex.com Review 2023: Advanced Investment Tools in the Age of AI

AltIndex is a trading analysis platform that allows users to implement data-driven trading easily and more profitably.

The platform generates high-quality insights through big data analytics. Its stock-picking algorithms have a win rate of 75% according to tests done within 6 months.

Users not only receive stock recommendations but can also use the platform to track specific stocks. In this review, you will learn the facts about AltIndex and how you can use it for trading success.

What is AltIndex?

AltIndex is an investment platform that offers signals on stocks, Exchange Traded Funds (ETFs), and crypto.

The platform uses powerful AI algorithms to analyse alternative data for insights. Amazingly, it claims to deliver over 100k signals daily on popular stocks such as Google, Facebook, Amazon, NVIDIA, Disney and Alphabet.

It also claims to deliver quality signals on popular ETFs such as Vanguard S&P 500, iShares Core S&P 500, and SPDR S&P 500. Traders are required to register on the official AltIndex website to access these signals.

As we will see later in this review, this platform offers free, starter, pro, and enterprise packages. Its packages are low-priced when compared to what its competitors charge.

How AltIndex trades the Reddit Buzz

Social media platforms such as Reddit are quite popular with investors and traders. Some social media communities are so powerful that they can cause booms and crashes on individual stocks.

For instance, a Reddit community known as WallStreetBets led to a massive rally of the GameStop stock in 2021 in what is known as the GameStop Short squeeze.

The subreddit rallied its 14+ million members to short the stock after a renowned hedge fund predicted that the stock would decline. According to the New York Times, GameStop gained by 1700% following the short squeeze.

This case illustrates the power of social media on stock volatility. AltIndex uses AI to analyse investors’ social media posts and recommend trades based on their sentiments.

Its sentiment analysis algorithm is driven by Machine Learning (ML) and Natural Language Processing (NLP). These two subsets of AI are the backbone of the best AI-powered signal providers.

Sentiment analysis is also quite useful in crypto trading given the sensitivity of the crypto markets to social media comments. The crypto rally of 2021 was mostly driven by celebrity sentiments.

AltIndex algorithms track the social media pages of renowned celebrities such as Elon Musk and generate signals from their crypto-related comments.

Which assets does AltIndex trade?

As mentioned above, AltIndex provides signals on stock, ETFs, and cryptocurrencies. However, it’s more popular with stock trading.

Its users receive signals on hundreds of popular stocks and ETFs listed on NYSE and NASDAQ. Unfortunately, the platform doesn’t provide signals on stocks and ETFs listed outside the US.

On crypto, AltIndex provides signals on BTC, ETH and trending altcoins such as BNB, DOGE, and Uniswap.

How AltIndex executes data-driven trading

In this age of information, only a data-driven trader can expect success. Data-driven trading involves a constant analysis of market data for insights.

The bigger the dataset analysed the more accurate the trading signals. Moreover, the data must be analysed quickly given its dynamism. Data can be analysed manually or through algorithms coded into computer programs.

However, it’s impossible to maintain accuracy and speed when analysing big data manually. This explains the fast growth of Artificial Intelligence (AI) driven computer programs in trading and investment.

AltIndex is a powerful investment analysis tool that leverages AI algorithms to generate insights from big data. As we will see below, the platform is unique given that it generates its signals from alternative data.

Traditional and alternative data sources

Most signal providers generate trading insights from price data and news only. Popular trading platforms such as the MT4 only provide tools for price and news trading.

Price trend analysis involves a study of historical price behaviour to predict future price direction. The price trend strategy is anchored on the assumption that asset prices move in waves.

On the other hand, the news trading technique is based on market expectations before and after the news.

AltIndex generates signals from traditional and alternative data. The platform uses sophisticated algorithms to generate insights from non-traditional sources such as social media, web traffic, and reviews from consumers, employees, and experts.

The AltIndex algorithms can filter through the noise to only build signals from relevant and accurate data.

Other alternative data sources

AltIndex AI algorithms also generate signals from specific stocks’ web traffic data. Web traffic data is a great source of insights for companies that offer a product or a service online.

An increase in web traffic indicates a demand for specific products or services while a decline in web traffic signifies a declining business. The AltIndex algorithms can predict the short-term volatility of a stock by analysing the web traffic of the associated company.

Some of the NYSE and NASDAQ e-commerce stocks traded through this platform include Alibaba, Sea, Revolve, Jumia, Walmart, Shopify, eBay, and Global E Online. The platform also takes into account data such as mobile app downloads for companies that provide a service through an app.

AltIndex also relies on employee feedback as shared through review sites such as Glassdoor. Employee satisfaction has a strong positive correlation with shareholder returns and hence stock gains.

AltIndex Features

AltIndex’s popularity is as a result of its superior features. Most of these features are not available on competing platforms. Find listed below the top 5 features of AltIndex AI.

- AI Stock picks

- AI Ranking Score

- Stocks screener

- Trending Stocks

- Stocks Alert

Experts conclude that AltIndex offers the best features in the market. We will discuss each of the above features in detail below.

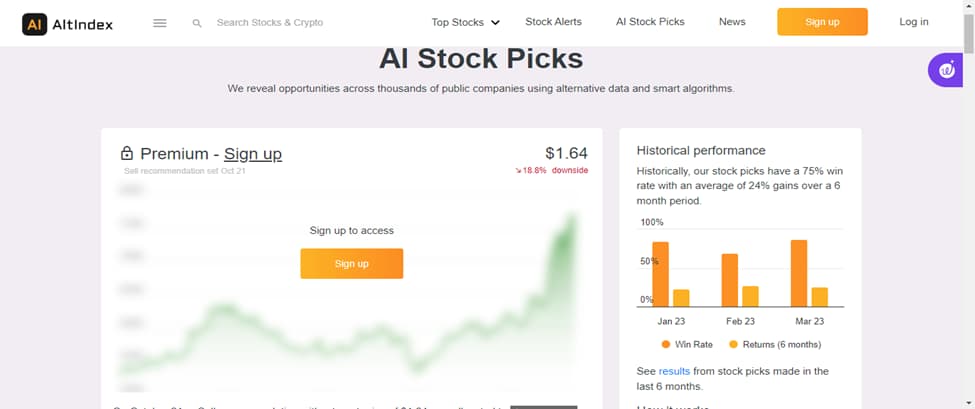

AI Stock picks

The AltIndex AI algorithm analyses hundreds of stocks and recommends the most promising ones. As stated earlier, this platform only analyses stocks listed on NYSE and NASDAQ.

Its algorithms are driven by subsets of AI known as Machine Learning (ML) and Natural Language Processing (NLP). These subsets of AI enable it to analyse both qualitative and quantitative data.

As explained earlier, the platform derives trading insights from alternative data. Its AI algorithms crawl through troves of social media and web data for insights. These algorithms can analyse many stocks simultaneously and generate tens of signals within a minute.

The signals are ranked according to their potential with the most promising ones appearing on top. Risk has a strong positive correlation with reward and therefore the most promising signals also carry the biggest risk.

Amazingly, experts’ tests show that AltIndex has the highest win rate in its category. An analysis of its historical data for the last six months indicates that it has a win rate of 75%. We couldn’t confirm the accuracy of the study.

AI ranking score

The AltIndex AI ranking score system analyses big data to rate each stock on a scale of 1 to 100. A higher score means that the stock is likely to outperform the markets in the next six months.

AltIndex determines the score by analysing price trends, news, and alternative data. Only stocks that demonstrate a steady price gain and have positive fundamentals receive a score of above 60.

The fundamentals mostly include social media following, web visits, app downloads, and employee reviews. As mentioned above, AltIndex mostly generates insights from alternative data.

Each stock recommended by the AltIndex system has an AI ranking score. Some stocks may have a lower AI ranking score but still rank high for volatility trading.

The AI ranking score is an asset for volatility traders as well as medium-term investors.

Stock Screener

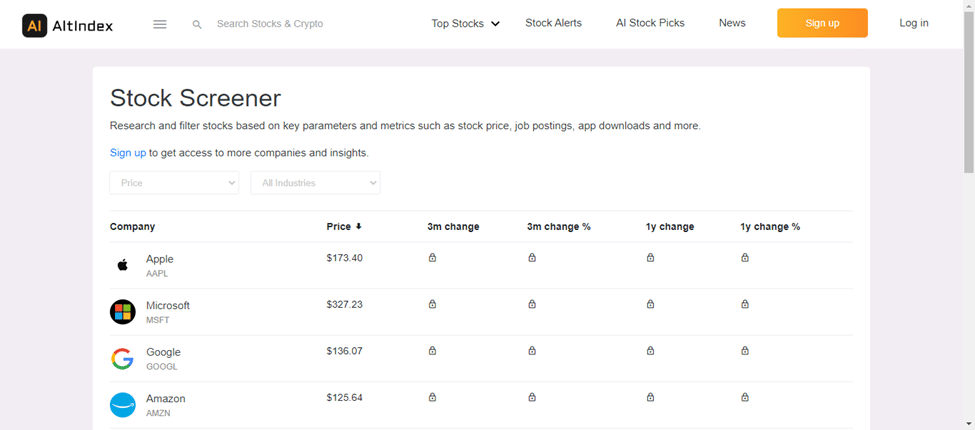

The AltIndex stock screener allows users to filter stocks based on key parameters and metrics.

For instance, they can search for stocks based on stock price, app downloads, job postings, web traffic, Reddit mentions, social media followers or patents. These parameters can be used to accurately predict whether a stock will gain or fall.

A stock with many positive Reddit mentions and a growing social media following indicates growing investor confidence. AltIndex is, therefore, likely to recommend it as a strong buy.

The stock screener allows users to filter stocks on up to 7 parameters. Stocks that score high on most of the parameters are ranked top. This feature also allows users to sort stocks based on their industries.

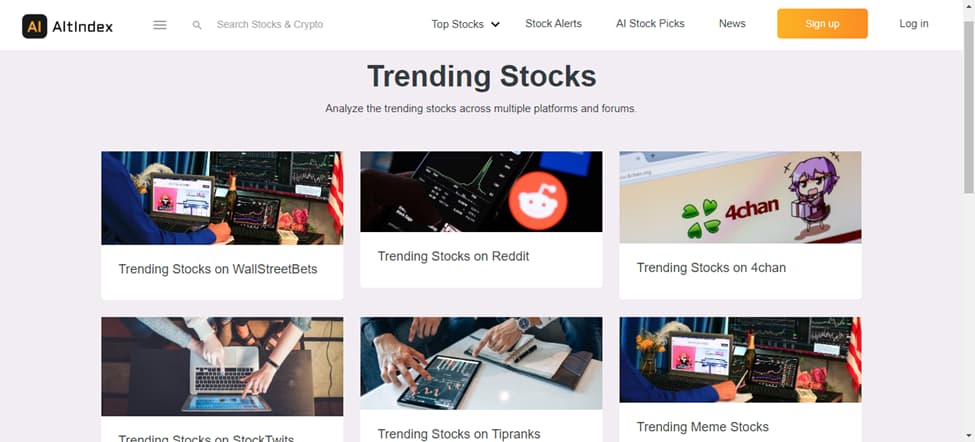

Trending stocks

Traders can use AltIndex to identify trending stocks and generate signals from them. The trending stocks feature presents stocks that are trending on WallStreetBets and related subreddits.

AltIndex uses an NLP algorithm to crawl popular social media platforms for stock mentions. The algorithm analyses the mentions to determine if they are positive or negative.

Positive mentions indicate that investors are confident in the stock and it’s therefore likely a strong buy. A stock with generally negative social media comments is likely to decline and is therefore best for short selling.

Stock Alert

The stock alert feature allows the trader to track individual stocks based on the metrics discussed earlier.

Traders can track up to 20 stocks simultaneously. Moreover, they can track each stock on up to 10 parameters and metrics. This ensures that only high-quality signals are generated.

Examples of metrics included in the stock alert report include Job posts, social media followers, web traffic, employees’ ratings, Google trends, Google Adspend, Lobbying Costs, and Patents.

Getting started with AltIndex

AltIndex is recommended for newbies as well as experienced traders. Many reviewers praise it for being highly intuitive.

Traders are required to register on the official AltIndex website to access its features. The platform provides four packages as discussed below.

The free package

This package gives the newbie trader a real feel of the platform without depositing any money.

The package only offers access to signals on 2 stocks within the trader’s portfolio and 1 stock recommendation. They can also access the AltIndex stock screener even though with limited data.

The free package only allows 20 dashboard visits every month. This package is only recommended for traders who want to test the waters.

Starter plan – $29/month

This package provides insights on up to 20 stocks. It also allows unlimited dashboard visits and provides a comprehensive stock screener report.

Traders on the starter plan also receive up to 10 AI stock recommendations and up to 10 alerts per month.

Pro Plan – $99/month

This package provides all the features with unlimited dashboard visits and signals on up to 50 NYSE and NASDAQ stocks.

Users can also receive alerts on up to 50 stocks per month. They can also access 25+ stock recommendations every month.

Enterprise plan

This plan is for professional and institutional traders. Traders must contact them to receive a fee guide for this package.

Is AltIndex a Scam? Final word

AltIndex is genuine and transparent. Most experts conclude that it’s among the best stock signals providers in 2023.

Moreover, thousands of stock traders report profitability when trading with it. The experts who have tested it conclude that it has a 75% win rate. AltIndex generates most of its signals from alternative data, mostly social media sentiments.

This makes it the best bet for speculating on highly volatile stocks and crypto. High-volatility stocks are quite sensitive to social media sentiments. AltIndex uses AI-driven algorithms to build insights from big data.