According to the Government Finance Officers Association, 37 percent of households in Virginia received an average deduction of $11,288 in their taxes from the state and local tax (SALT) deduction that the Republican proposal eliminates. Virginia is one of the states hit hardest by the elimination of this deduction in the Republican plan. The SALT tax was put in place as a foundational aspect to the modern American tax code to protect families from double taxation based on local laws in various states. More than 50 percent of SALT deductions go to American households making less than $200,000.

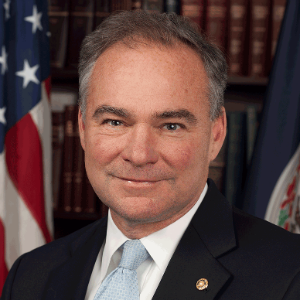

“The Republican tax plan leaves behind hardworking Virginia families who depend on this deduction to help them pay the bills and afford necessities like groceries,” Kaine said. “I’m concerned how a family in the Valley or Southwest Virginia is going to get by when they are potentially slammed with an additional $7,000 of their income being taxed. If my colleagues will drop their efforts to once again jam through a one-party proposal, I’d gladly work with them on bipartisan reforms that help families, create jobs, and make our businesses more competitive.”

Kaine supports bipartisan efforts to make the tax code fairer and simpler to help Virginia families. He has raised concerns that the current proposal cuts taxes for the wealthy at the expense of the middle class. Senate Republicans have indicated they will attempt to pass tax reform through the reconciliation process, which would only require fifty votes, instead of a bipartisan process that could take the best ideas from both sides of the aisle.

Below is a breakdown of the average SALT deduction by congressional district in Virginia:

1st Congressional District:

- 41% percent of households in the 1st congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $8,987.

2nd Congressional District:

- 32% percent of households in the 2nd congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $8,313.

3rd Congressional District:

- 31% percent of households in the 3rd congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $8,352.

4th Congressional District:

- 38% percent of households in the 4th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $7,839.

5th Congressional District:

- 28% percent of households in the 5th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $9,500.

6th Congressional District:

- 27% percent of households in the 6th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $7,303.

7th Congressional District:

- 39% percent of households in the 7th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $9,161.

8th Congressional District:

- 47% percent of households in the 8th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $15,359.

9th Congressional District:

- 19% percent of households in the 9th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $7,541.

10th Congressional District:

- 49% percent of households in the 10th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $13,562.

11th Congressional District:

- 49% percent of households in the 11th congressional district could face a tax increase under the Republican tax plan. These households use the state and local tax (SALT) deduction for tax relief. The average SALT deduction in the district is $14,186.