The judge, Mark Pittman, was an appointee of former Republican President Donald Trump.

Pittman in a 26-page ruling wrote that the Heroes Act, the assistance program that Biden used to enact relief, did not authorize the loan forgiveness.

“We strongly believe that the Biden-Harris Student Debt Relief Plan is lawful and necessary to give borrowers and working families breathing room as they recover from the pandemic and to ensure they succeed when repayment restarts,” said U.S. Secretary of Education Miguel Cardona. “We are disappointed in the decision of the Texas court to block loan relief moving forward. Amidst efforts to block our debt relief program, we are not standing down.”

The Department of Justice has appealed to the 5th U.S. Circuit Court of Appeals.

“Despite this decision, we will never stop fighting for the millions of hardworking students and borrowers across the country,” said Cardona.

The appeal process will have to move forward before any student debt can be cancelled.

“We strongly disagree with the District Court’s ruling on our student debt relief program and the Department of Justice has filed an appeal,” said Karine Jean-Pierre, the White House Press Secretary, in a statement. “The President and this Administration are determined to help working and middle-class Americans get back on their feet, while our opponents – backed by extreme Republican special interests – sued to block millions of Americans from getting much-needed relief.”

The Biden administration has faced multiple lawsuits since announcing the plan in August. However, this is the first major setback to moving forward with the plan.

To date, more than 26 million applications have been accepted for forgiveness.

“For the 26 million borrowers who have already given the Department of Education the necessary information to be considered for debt relief – 16 million of whom have already been approved for relief – the Department will hold onto their information so it can quickly process their relief once we prevail in court,” said Jean-Pierre. “We will never stop fighting for hardworking Americans most in need – no matter how many roadblocks our opponents and special interests try to put in our way.”

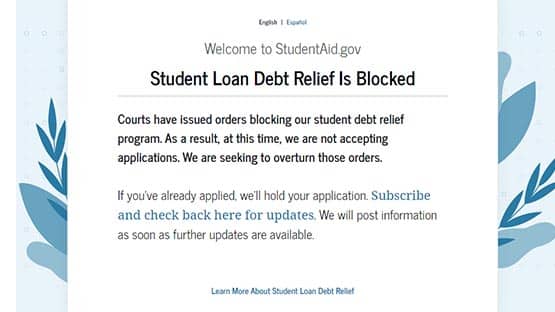

As a result of the ruling, the website set up to take information for people applying for relief is no longer accepting new applications.

A message on the page reads: “Courts have issued orders blocking our student debt relief program. As a result, at this time, we are not accepting applications. We are seeking to overturn those orders.”

It is unlikely the issue will be resolved before student loan payments are scheduled to resume on Jan. 1. If and when the court would overturn the lower court’s ruling, the Biden administration could then begin to cancel debt as outlined in the program.

The program will forgive up to $10,000 of federal student loan debt for individuals who earned less than $125,000 in 2020 or 2021, or married couples or heads of households who made less than $250,000.

If Biden’s program is allowed to move forward, individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 annually in those years could see up to $10,000 of their federal student loan debt forgiven. Pell grant recipients may be eligible for $20,000 in debt forgiveness.