Treasury released a report with new data on sources of health insurance coverage for small business owners and self-employed workers. These data show that the Affordable Care Act (ACA’s) Health Insurance Marketplaces are playing an especially crucial role in providing health coverage to entrepreneurs and other independent workers.

Prior to the Affordable Care Act, workers without employer-sponsored health insurance often lacked options for affordable coverage. Not only did high uninsured rates impede access to care and worsen financial security, but the risk of ending up without health insurance coverage prevented some individuals from striking out on their own. Experts considered “job lock,” or individuals’ need to stay in an employment situation to maintain health coverage, a significant impediment to entrepreneurship. To help address these challenges, the ACA’s Marketplaces were designed to offer portable health insurance coverage to small business owners and other independent workers, a growing segment of the economy.

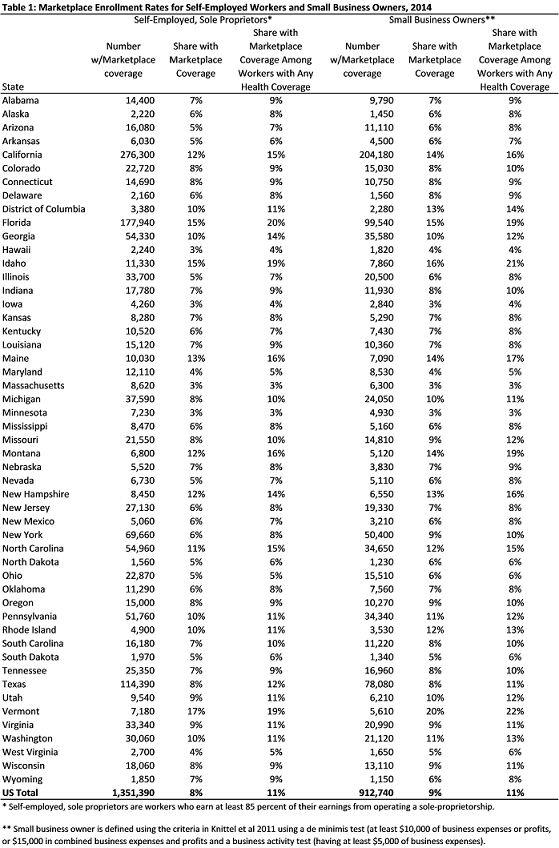

New data included in today’s Treasury Department report on alternative work arrangements show that small business owners and self-employed workers are taking advantage of the opportunity to purchase health coverage through the Marketplaces.1] In 2014, 1.4 million Marketplace consumers were self-employed, small business owners, or both, indicating that about one in five 2014 Marketplace consumers was a small business owner or self-employed. Indeed, among the 5.3 million workers who purchased Marketplace coverage for themselves (excluding their children or non-working spouses), about 28 percent were workers whose income was not primarily earned from wages paid by an employer.

In fact, small business owners and self-employed individuals were nearly three times as likely to purchase Marketplace coverage as other workers. Nearly 10 percent of small business owners and more than 10 percent of gig economy workers got coverage through the Marketplace in 2014. Among small business owners and other independent workers, those with annual incomes below $65,000 were the most likely to rely on the Marketplace for health insurance. Middle- and lower-income Americans who buy coverage through the Marketplace are eligible for tax credits to help keep coverage affordable. About 65 percent of small business owners and 69 percent of all self-employed or independent workers have incomes below $65,000.

Between 2014 and 2015, the number of people who signed up for Marketplace coverage increased by around 50 percent. And enrollment increased further in 2016, and is poised to rise again in 2017. Marketplace coverage among independent workers has almost certainly risen as well. HHS is also partnering with outside companies that support freelance workers, entrepreneurs, and start-ups to reach more independent workers with information about Marketplace coverage and financial assistance.

Geographic patterns in small business owners’ and independent workers’ health coverage

Today’s report includes detailed state-by-state data on Marketplace participation among entrepreneurs and independent workers. In all 50 states and D.C., thousands of small business owners and independent workers bought Marketplace coverage in 2014. Of note:

- The ten states with the highest share of small business owners relying on the Marketplace for coverage were Vermont, Idaho, Florida, Montana, Maine, California, New Hampshire, Washington, D.C., Rhode Island, and North Carolina.

- The 10 states with the largest number of small business owners with Marketplace coverage were California, Florida, Texas, New York, Georgia, North Carolina, Pennsylvania, Michigan, Washington, and Virginia.

To return to the page content, select the respective footnote number.

1 The Treasury report defines small business owners as Schedule C filers whose business activities (measured by expenses and gross receipts) exceed certain de minimis thresholds (a minimum of $5,000 of business expenses and either $15,000 of gross receipts or $10,000 of business expenses). Self-employed workers are defined as individuals who earn at least 85 percent of their earnings from operating a sole-proprietorship. “Gig economy workers” are those whose self-employment income derives in part or in whole from activities conducted through an online platform.

Column by Adam Looney, Deputy Assistant Secretary for Tax Analysis at the U.S. Department of Treasury and Kathryn Martin, Acting Assistant Secretary for Planning and Evaluation at HHS