Column by Chris Graham

Quentin Kidd calls it a “sleeper factor” – though the mini-revolts that we have been witnessing statewide over what have become effective tax increases that have resulted from increased local property-value reassessments this spring could reawaken from their brief slumber in time to play a key role in next week’s Republican Party primaries in several Virginia Senate districts.

“It’s all over Hampton Roads, it’s all over Northern Virginia, it’s all over the Richmond area, it’s in the Shenandoah Valley,” said Kidd, a political-science professor at Christopher Newport University.

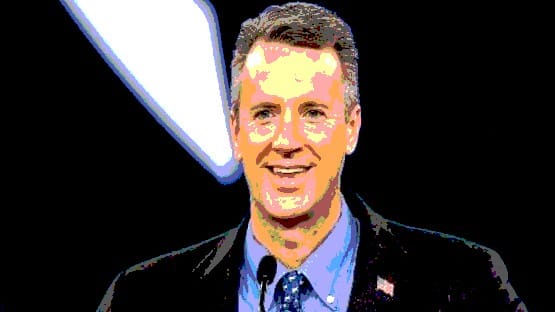

“In some of the races, like the 24th, this is exactly the kind of base that Scott Sayre needs, and these are exactly the kind of issues that he’s talking about – taxes and spending and keeping government small. You replace Waynesboro with Richmond – you let them really work themselves up in Waynesboro over property taxes, and then you immediately transfer that frustration to Richmond,” Kidd said.

Waynesboro, in the heart of the 24th Senate District, where Sayre is challenging incumbent Emmett Hanger for the Republican Party nomination, is just one of a number of localities where property reassessments have hit taxpayers in their pocketbooks. Property values are up 30 percent citywide – and while the city council in Waynesboro voted to drop the tax rate from its current 78 cents per $100 assessed value to 70 cents in the coming fiscal year, that still will translate into a de facto tax hike of 12 cents from the revenue-neutral rate of 58 cents.

“My opponent says he raised our taxes at the state level so that we would feel relief at the local level,” said Sayre, referring to Hanger’s work on tax reform at the state level that he and fellow proponents acknowledge has not been seen through to its conclusion.

“You mention 30-some percent increase there in Waynesboro – it’s the same 30-some percent increase in Staunton. And go over to Albemarle County, Greene County – these people are having taxpayer revolts, because you raise your tax at the state level with the idea of getting relief at the local level. And I ask them, Do you feel the relief? Of course not,” Sayre said.

“The plan they have is a scheme just to support more tax increases, more government, more spending – and it’s got to be reined in. And that’s what I can do – I can rein in this spending with a businessman’s approach to the budget,” Sayre said.

Hanger counters that the challenges being faced by local governments in the Commonwealth actually illustrate the need to complete the tax-reform effort that he helped initiate in Richmond.

“It’s a shared responsibility between the state and local government – and actually, that’s one of the strengths of what I have worked on in terms of my proposals for tax reform from four years ago, in that I felt very strongly, and still do, and am still working on that, that the fairer tax, the better way to raise money to support required services, is through consumption taxes, sales tax and income tax, rather than property taxes. Property taxes have become antiquated – and areas such as ours are at a tremendous disadvantage, and this creates disparities if we put too much reliance on the property tax when the state doesn’t meet its responsibilities,” Hanger said.

“That was really one of the strengths of what I had proposed four years ago – which I’m being called to task on right now by people taking things out of context. But if you look at the full package, I have proposals there that would have capped the ability of the rate of the real-estate tax to grow. I’ve also this past year introduced what’s referred to as a homestead exemption. And I’m looking for various ways of dealing with the fact that when market values increase significantly, then the resulting property taxes may go up in a way that makes middle- or lower-income individuals or individuals on fixed income unable to meet their tax obligations,” Hanger said.