The governor will include $20.8 million in the budget to facilitate removing the budget balancing gimmick, which will raise the threshold from $26 million of taxable sales to $48.5 million. Only the top 200 dealers will still be required to make AST payments of 90 percent of their previous June 2012 sales tax liability. The governor’s action substantially speeds up the process of removing the Accelerated Sales Tax.

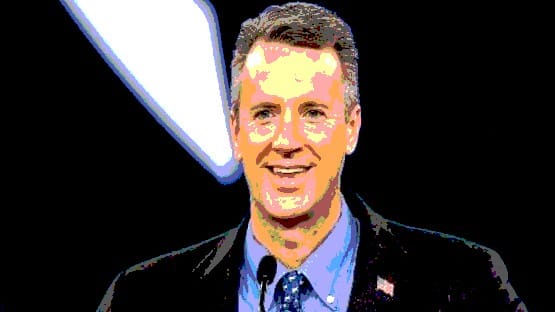

“The accelerated sales tax is bad policy and needs to be eliminated as quickly as we can,” McDonnell said. “That’s why I asked the General Assembly to begin eliminating it two years ahead of schedule in 2011 and why I am including another $20.8 million in my proposed budget amendments this year to eliminate the accelerated sales tax for half of Virginia retailers now paying it. I have always opposed the policy of playing budget games with sales tax receipts.

“The accelerated sales tax penalizes Virginia retailers and merchants and skews states revenues. When the General Assembly acts on this proposal, we will have removed the AST from 98 percent of the retailers originally required to make AST payments by 2014. We need to get this anti-business policy off our books as soon as possible and I hope the General Assembly will support this budget proposal.”

Jodi Roth, on behalf of the Virginia Retail Merchants Association, said “We applaud the governor for his commitment to raise the threshold on AST thereby reducing the number of retailers impacted by this burden.”

In fiscal year 2010, which began on July 1, 2009, at the height of the Great Recession, the General Assembly required certain merchants to pre-pay a portion of their July 2010 sales tax remittance in June. This policy change, commonly known as the accelerated sales tax payment, applied to all dealers with $1 million or more in taxable sales and/or purchases in the previous year and was equal to 90 percent of their retail sales and use tax liability paid in June of the previous year. In the 2011 session, encouraged by Governor McDonnell, the General Assembly reversed part of this policy change by raising the $1 million or more taxable sales and/or purchases threshold to a level of $5.4 million or greater in the previous year.

This change relieved 7,026 dealers from the accelerated sales tax requirement and decreased revenues by $45.7 million. Last December, Governor McDonnell asked the General Assembly to appropriate $50 million in the biennial budget to allow for the elimination of the accelerated sales tax requirement for 1,407 more retailers, and the change was incorporated into the biennial budget.