More than 8,800 businesses with at least $1 million in taxable sales have previously been required to make an additional sales and use tax payment in June. They had to pay their regular payment of sales tax collected in May, due on June 20, as well as the new accelerated payment, which is equal to 90 percent of their taxable sales for the previous June. The accelerated payment was due by the end of the month.

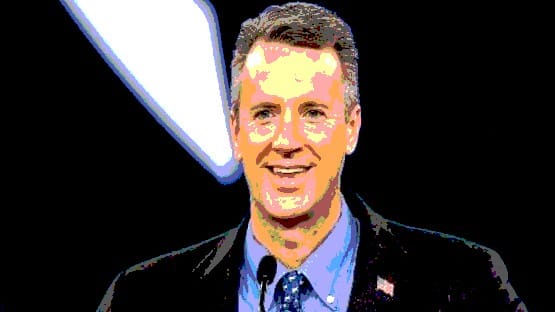

“Fast-tracking the phase-out of the accelerated sales tax program is sound fiscal policy that will help Virginia businesses grow and create jobs,” McDonnell said. “I have long said that I want to eliminate this anti-business program as soon as possible and not require any business to make this additional payment.

“We have successfully phased out the requirement on 96 percent of Virginia businesses that were mandated to participate in the program, with a goal of having the remaining 4 percent phased out by 2021. Businesses that no longer have to pay twice in June can now earn interest on those funds, purchase equipment, add inventory and create jobs here in Virginia.”

In 2011, McDonnell signed legislation approved by the General Assembly increasing the sales threshold from $1 million to $5.4 million, relieving more than 7,000 retail dealers of the additional payment requirement. Legislators agreed in 2010 to end the Accelerated Sales Tax program by June 2021 and to begin the roll-back in fiscal year 2013. The governor’s proposal moved the start of the phase-out up a year.

The Caboose Budget Bill, which adjusts Commonwealth funding for the remainder of the current biennium, put the program’s phase-out on a faster pace by raising the sales threshold to $26 million, thus reducing the number of businesses required to make the extra payment in June 2012 to 386. That’s a reduction of nearly 96 percent since 2010. The Caboose Budget Bill included a $50 million reduction in general fund revenues to account for the funds that the dealers will not have to pay in June.

The Department of Taxation has promulgated emergency guidelines to reflect the changes in how the Accelerated Sales Tax program will work. Check its website at www.tax.virginia.gov for further information.