First National Corporation reported net income of $1.8 million and earnings per share of $0.36 for the second quarter ended June 30, 2017.

For the six months ended June 30, 2017, net income increased $767 thousand, or 30%, to $3.3 million and $0.67 per share, compared to net income of $2.5 million and $0.51 per share for the same period of 2016. The increase in net income resulted primarily from an increase in net interest income and a decrease in noninterest expenses.

Select highlights for the second quarter of 2017:

- Net income increased 23%

- Return on equity of 12.79%

- Return on average assets of 0.96%

- Net interest margin increased to 3.73%

- Efficiency ratio improved to 66.71% from 71.62%

- Net interest income increased $453 thousand, or 8%

- Noninterest expenses decreased $178 thousand, or 3%

- Assets-per-employee increased to $4.6 million, up from $4.2 million at June 30, 2016

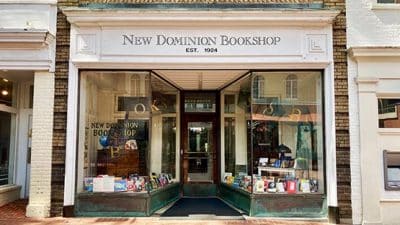

- Proposed expansion to Richmond

“Our banking company continued to reap the benefits of the low cost deposit acquisition and branch expansion from 2015 as the funds were deployed into loans in legacy and new markets,” said Scott Harvard, president and chief executive officer of First National. Harvard added, “The combination of the expansion and efficiency initiatives has generated profitable growth and outstanding financial results. During the quarter, First Bank submitted a branch application to further expand the franchise to the Westhampton neighborhood of Richmond. This expansion will begin to bring more coherence to the branch footprint, while providing an introduction into a growing deposit and loan market.”